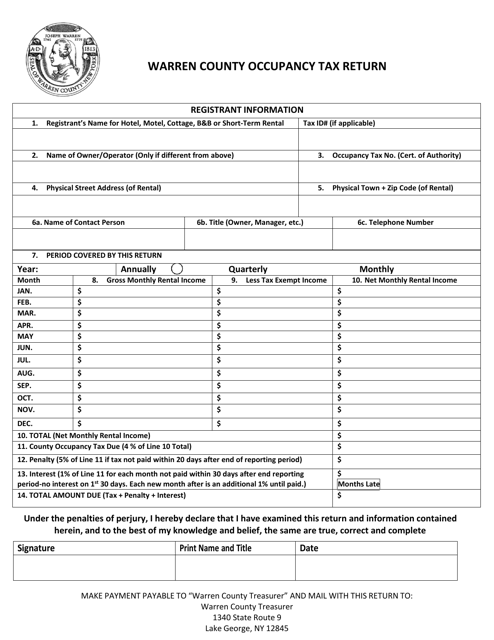

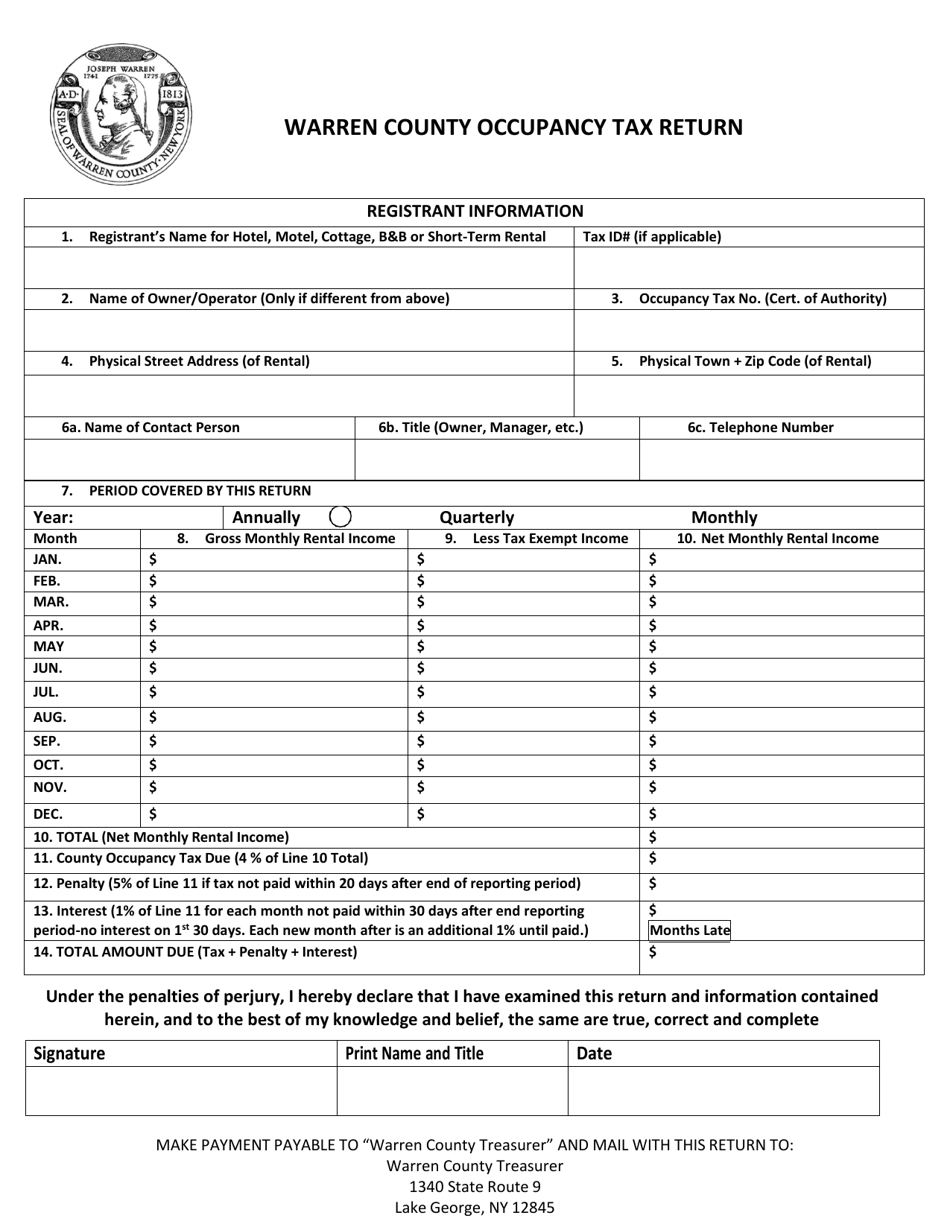

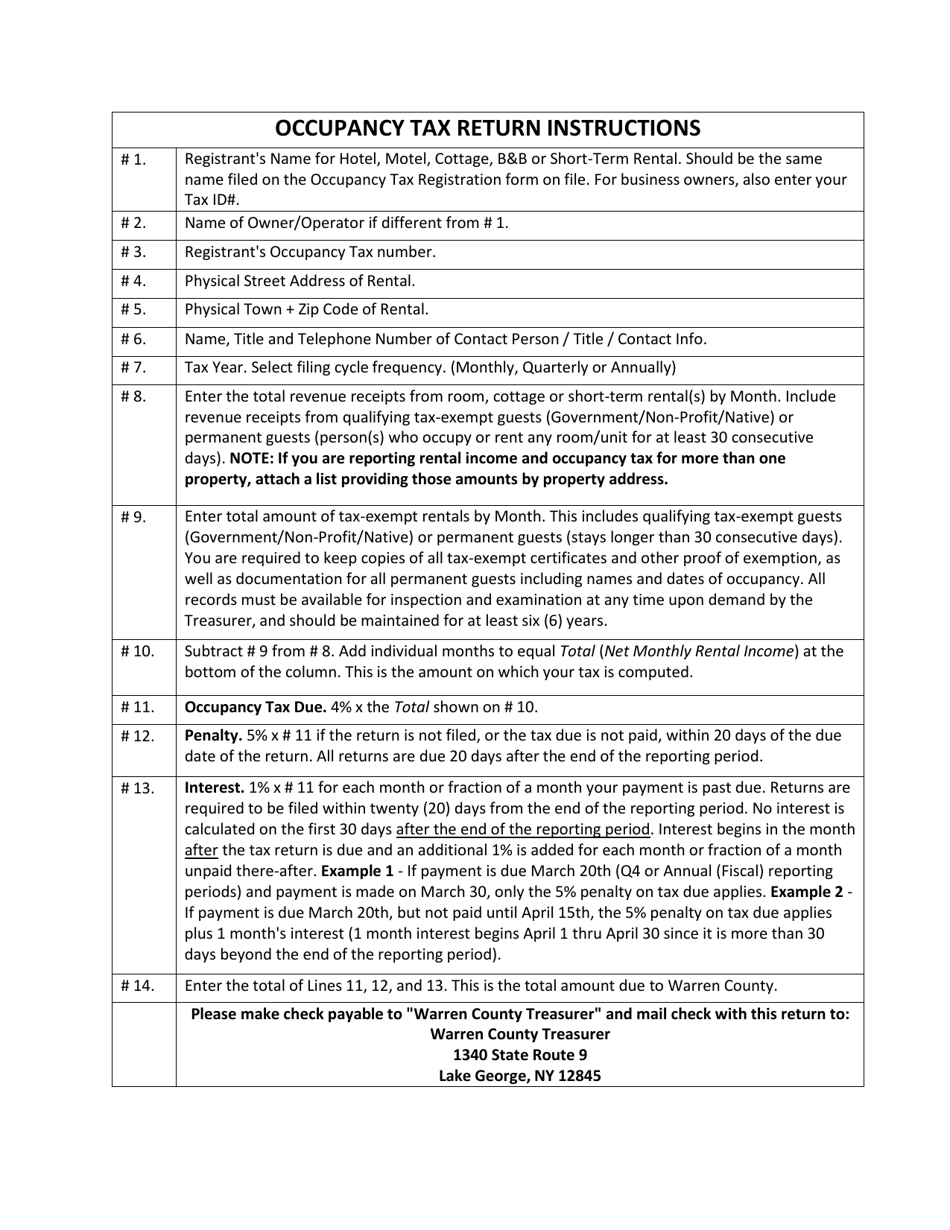

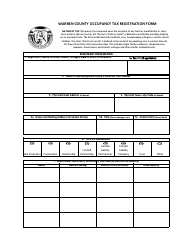

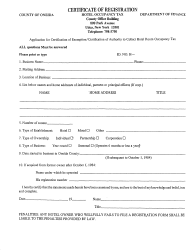

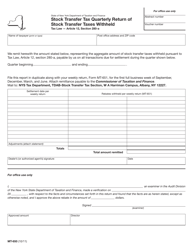

Occupancy Tax Return Form - Warren County, New York

Occupancy Tax Return Form is a legal document that was released by the County Treasurer's Office - Warren County, New York - a government authority operating within New York. The form may be used strictly within Warren County.

FAQ

Q: What is the Occupancy Tax Return Form?

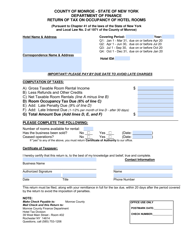

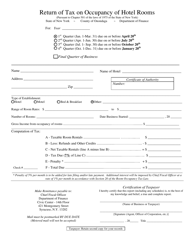

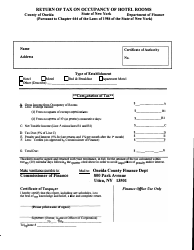

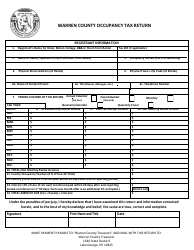

A: The Occupancy Tax Return Form is a form used to report and remit the occupancy tax collected in Warren County, New York.

Q: Who needs to file the Occupancy Tax Return Form?

A: Any person or business that operates a hotel, motel, inn, bed and breakfast, or vacation rental property in Warren County, New York and collects occupancy tax is required to file the form.

Q: When is the Occupancy Tax Return Form due?

A: The form is due on a quarterly basis, with the following due dates: February 28th (for the period of January 1st to December 31st), May 31st (for the period of January 1st to March 31st), August 31st (for the period of January 1st to June 30th), and November 30th (for the period of January 1st to September 30th).

Q: Are there any penalties for not filing the Occupancy Tax Return Form?

A: Yes, there are penalties for late filing or non-filing of the form, including interest charges and potential legal action.

Q: What information do I need to provide on the Occupancy Tax Return Form?

A: You will need to provide information such as your business name, address, contact information, occupancy tax collected, and the number of occupied nights.

Q: What is the purpose of the occupancy tax?

A: The occupancy tax is used to fund tourism promotion and economic development activities in Warren County, New York.

Q: Can I deduct the occupancy tax I paid?

A: The deductibility of the occupancy tax paid depends on your individual circumstances. It is recommended to consult with a tax professional for personalized advice regarding tax deductions.

Form Details:

- The latest edition currently provided by the County Treasurer's Office - Warren County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the County Treasurer's Office - Warren County, New York.