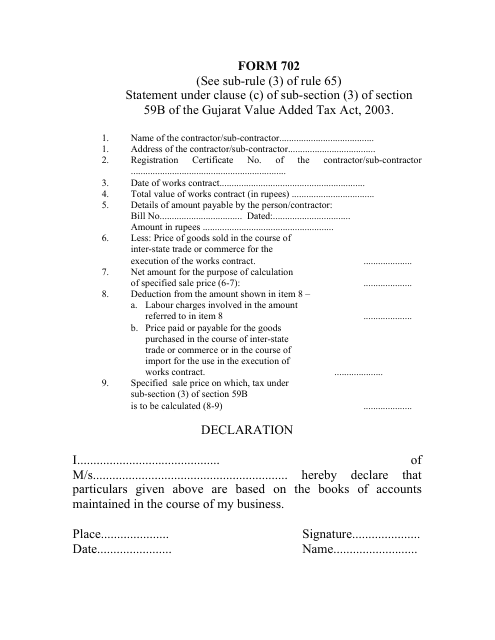

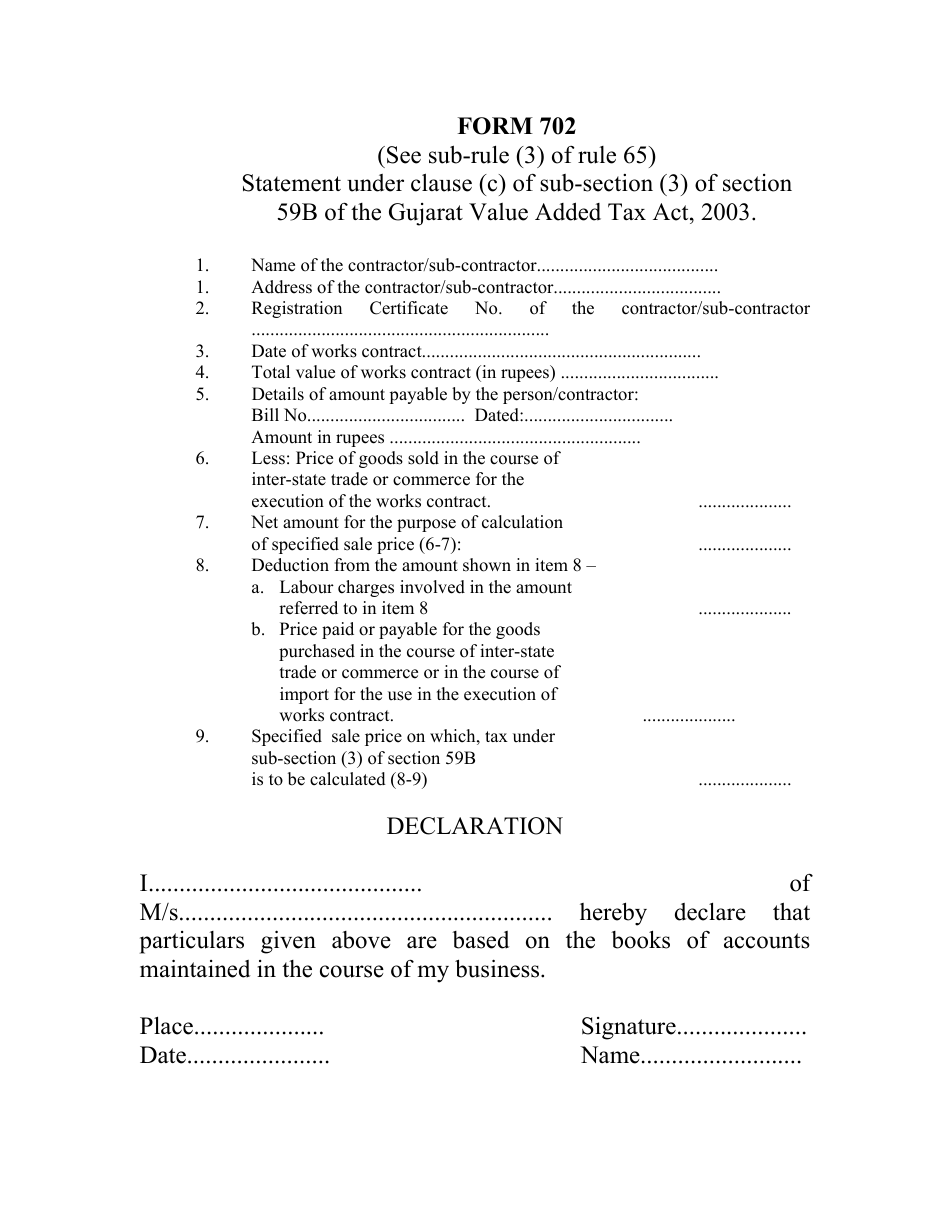

Form 702 Commercial Tax Gujarat - Gujarat, India

Form 702 Commercial Tax Gujarat is a document used in the state of Gujarat, India for the purpose of commercial tax. It is specifically used for reporting and paying taxes related to commercial activities in Gujarat. This form is typically used by businesses and traders to fulfill their tax obligations to the Gujarat state government.

The Form 702 Commercial Tax Gujarat in Gujarat, India is filed by businesses operating in Gujarat. It is a tax form used for reporting and paying commercial taxes in the state of Gujarat.

FAQ

Q: What is Form 702 Commercial Tax in Gujarat?

A: Form 702 Commercial Tax is a document used for commercial tax purposes in the state of Gujarat, India.

Q: What is the purpose of Form 702 Commercial Tax Gujarat?

A: The purpose of Form 702 Commercial Tax Gujarat is to provide details of commercial transactions and calculate the applicable tax.

Q: Who needs to fill out Form 702 Commercial Tax Gujarat?

A: Businesses engaged in commercial activities in Gujarat, India, are required to fill out Form 702 Commercial Tax Gujarat.

Q: What information is required in Form 702 Commercial Tax Gujarat?

A: Form 702 Commercial Tax Gujarat requires details of the commercial transactions, such as invoices, tax rates, and tax calculations.

Q: Is Form 702 Commercial Tax Gujarat mandatory?

A: Yes, businesses engaged in commercial activities in Gujarat, India, are required by law to fill out Form 702 Commercial Tax Gujarat.

Q: What are the penalties for non-compliance with Form 702 Commercial Tax Gujarat?

A: Non-compliance with Form 702 Commercial Tax Gujarat may attract penalties, fines, or legal actions from the authorities.

Q: Are there any deadlines for filing Form 702 Commercial Tax Gujarat?

A: Yes, businesses need to file Form 702 Commercial Tax Gujarat within the specified deadline set by the Commercial Tax Department of Gujarat.

Q: What other tax forms are commonly used in Gujarat, India?

A: Apart from Form 702 Commercial Tax, other common tax forms used in Gujarat, India include Form 403 for filing VAT returns and Form 405 for claiming input tax credit.

![Document preview: Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India](https://data.templateroller.com/pdf_docs_html/32/322/32275/form-15h-declaration-under-section-197a-1a-the-income-tax-act-1961-to-be-made-by-a-persons-not-being-a-company-or-a-firm-claiming-receipt-interest-other-than-interest-on-securities-or-income-in-respect-units-without-deduction-tax-india.png)