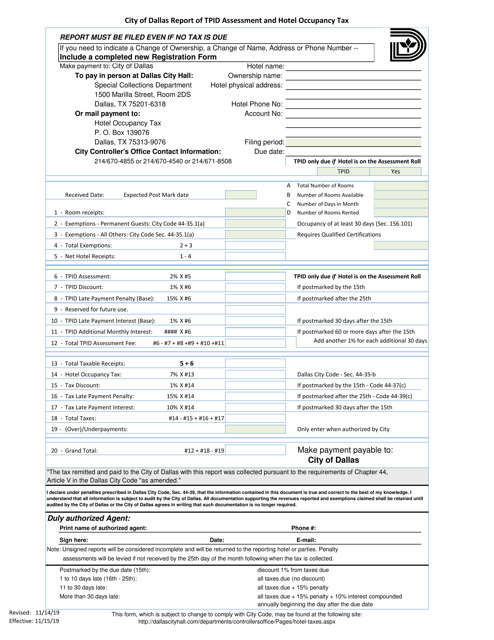

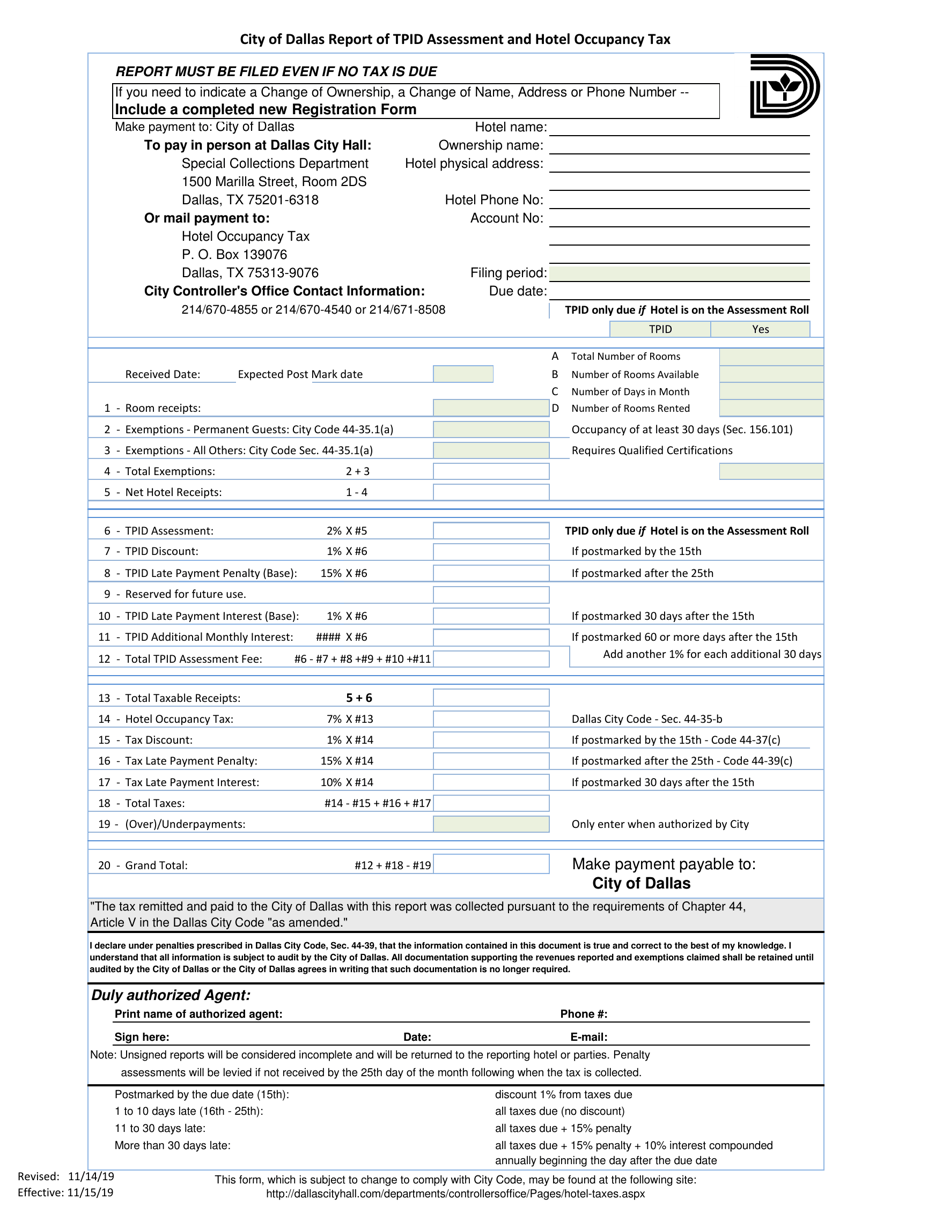

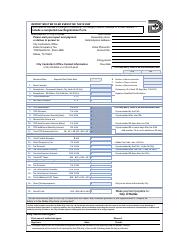

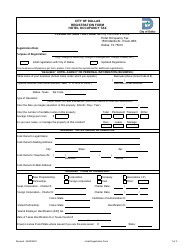

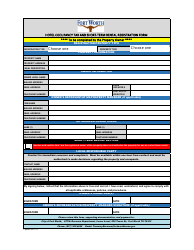

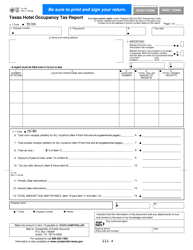

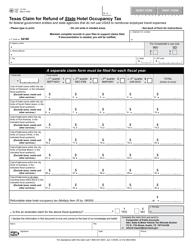

Report of Tpid Assessment and Hotel Occupancy Tax - City of Dallas, Texas

Report of Tpid Assessment and Hotel Occupancy Tax is a legal document that was released by the Controller's Office - City of Dallas, Texas - a government authority operating within Texas. The form may be used strictly within City of Dallas.

FAQ

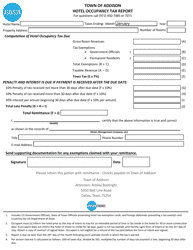

Q: What is the TPID assessment?

A: The TPID assessment is a fee imposed on certain businesses in Dallas, Texas to fund the operation of a Tourism Public Improvement District.

Q: Who is responsible for paying the TPID assessment?

A: Certain businesses located within the Tourism Public Improvement District are responsible for paying the TPID assessment.

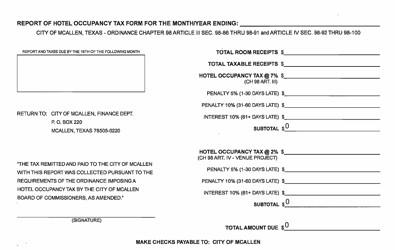

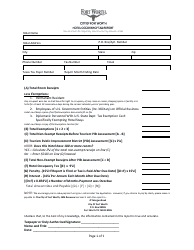

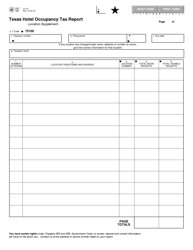

Q: What is the purpose of the Hotel Occupancy Tax?

A: The Hotel Occupancy Tax is a tax levied on hotel guests in Dallas, Texas. The revenue generated from this tax is used to support various tourism-related initiatives and projects in the city.

Q: Who is required to pay the Hotel Occupancy Tax?

A: Anyone who stays in a hotel in Dallas, Texas is required to pay the Hotel Occupancy Tax.

Q: How is the Hotel Occupancy Tax collected?

A: Hotels in Dallas, Texas collect the Hotel Occupancy Tax from their guests and remit the tax to the city's tax office.

Form Details:

- Released on November 14, 2019;

- The latest edition currently provided by the Controller's Office - City of Dallas, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Controller's Office - City of Dallas, Texas.