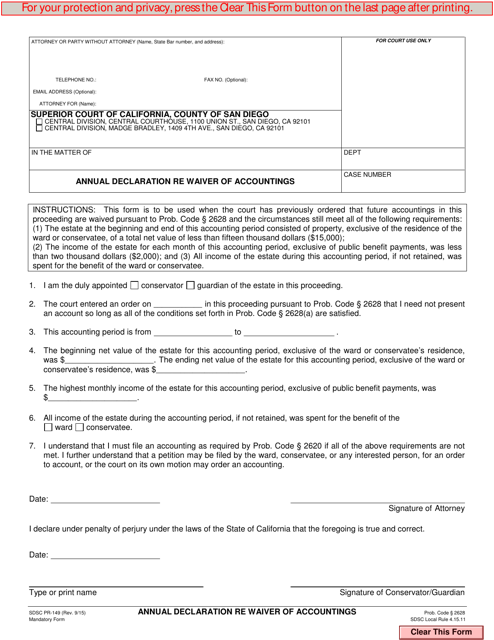

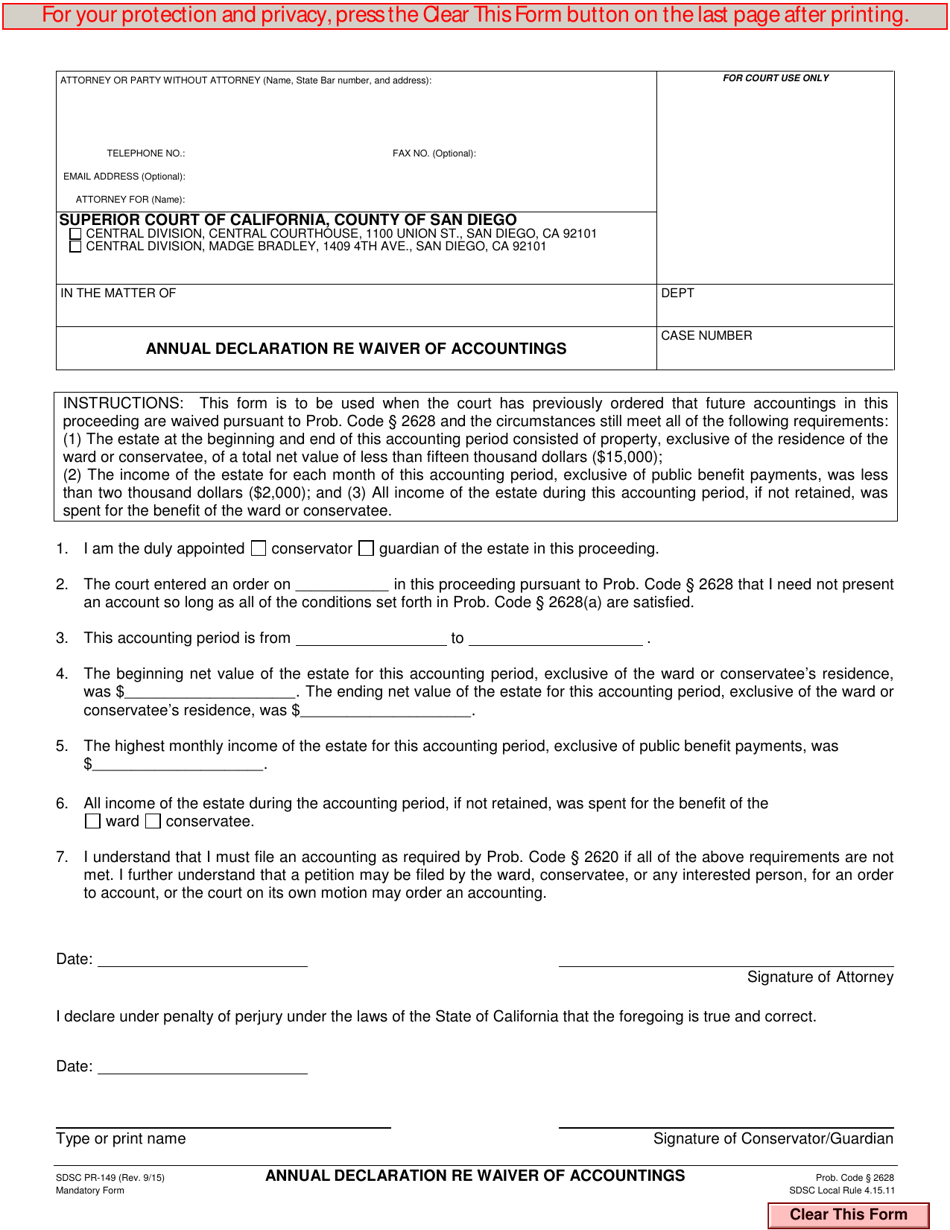

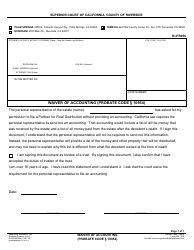

Form PR-149 Annual Declaration Re Waiver of Accountings - County of San Diego, California

What Is Form PR-149?

This is a legal form that was released by the Superior Court - County of San Diego, California - a government authority operating within California. The form may be used strictly within County of San Diego. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PR-149?

A: Form PR-149 is the Annual Declaration Re Waiver of Accountings.

Q: What is the purpose of form PR-149?

A: The purpose of form PR-149 is to waive the requirement for annual accountings in certain probate cases.

Q: Who can use form PR-149?

A: Form PR-149 can be used by personal representatives (executors or administrators) of probate estates.

Q: When should form PR-149 be filed?

A: Form PR-149 should be filed annually, within 90 days after the close of the accounting period.

Q: Is there a fee to file form PR-149?

A: Yes, there is a filing fee associated with form PR-149. Refer to the current fee schedule for the exact amount.

Q: Are there any requirements or conditions to use this form?

A: Yes, there are specific requirements and conditions that must be met to use form PR-149. Please refer to the instructions provided with the form for more details.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Superior Court - County of San Diego, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-149 by clicking the link below or browse more documents and templates provided by the Superior Court - County of San Diego, California.