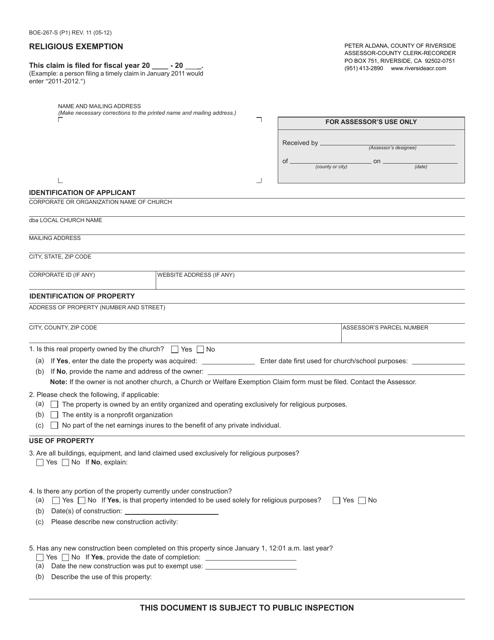

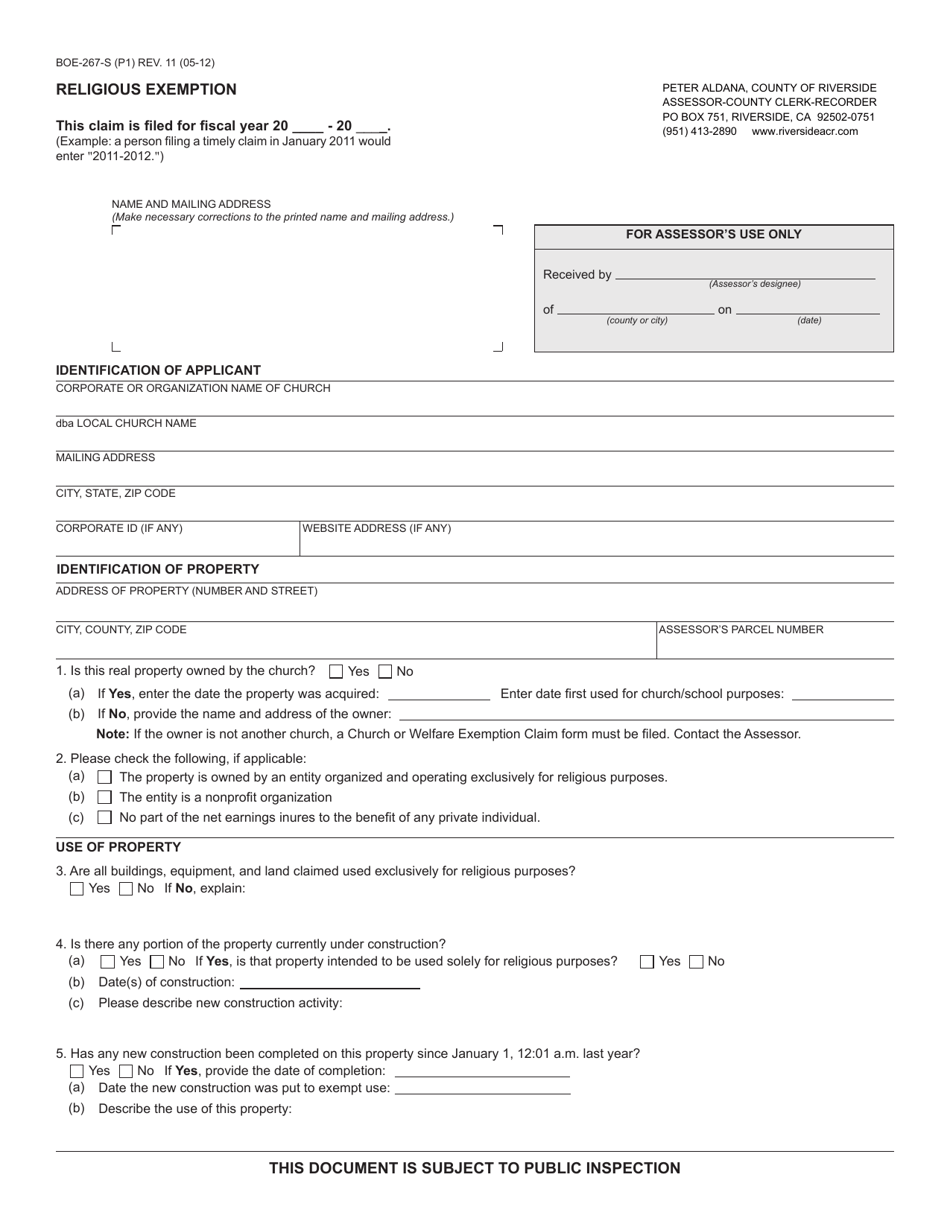

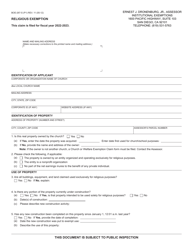

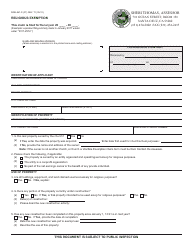

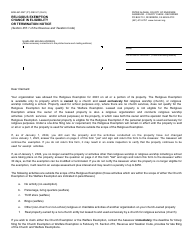

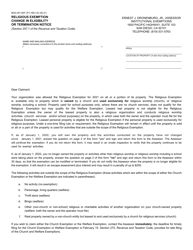

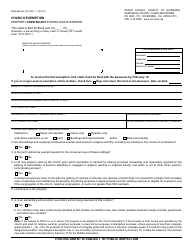

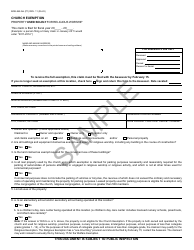

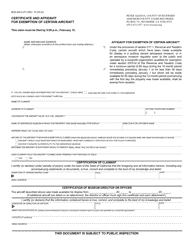

Form BOE-267-S Religious Exemption - County of Riverside, California

What Is Form BOE-267-S?

This is a legal form that was released by the Assessor-County Clerk-Recorder - County of Riverside, California - a government authority operating within California. The form may be used strictly within County of Riverside. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-267-S?

A: Form BOE-267-S is a religious exemption form for the County of Riverside, California.

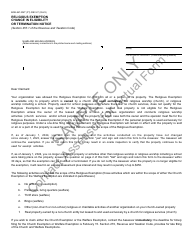

Q: What is the purpose of Form BOE-267-S?

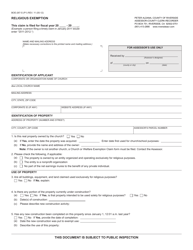

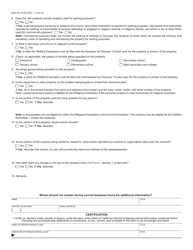

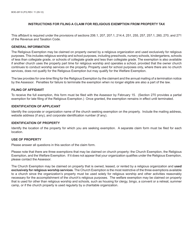

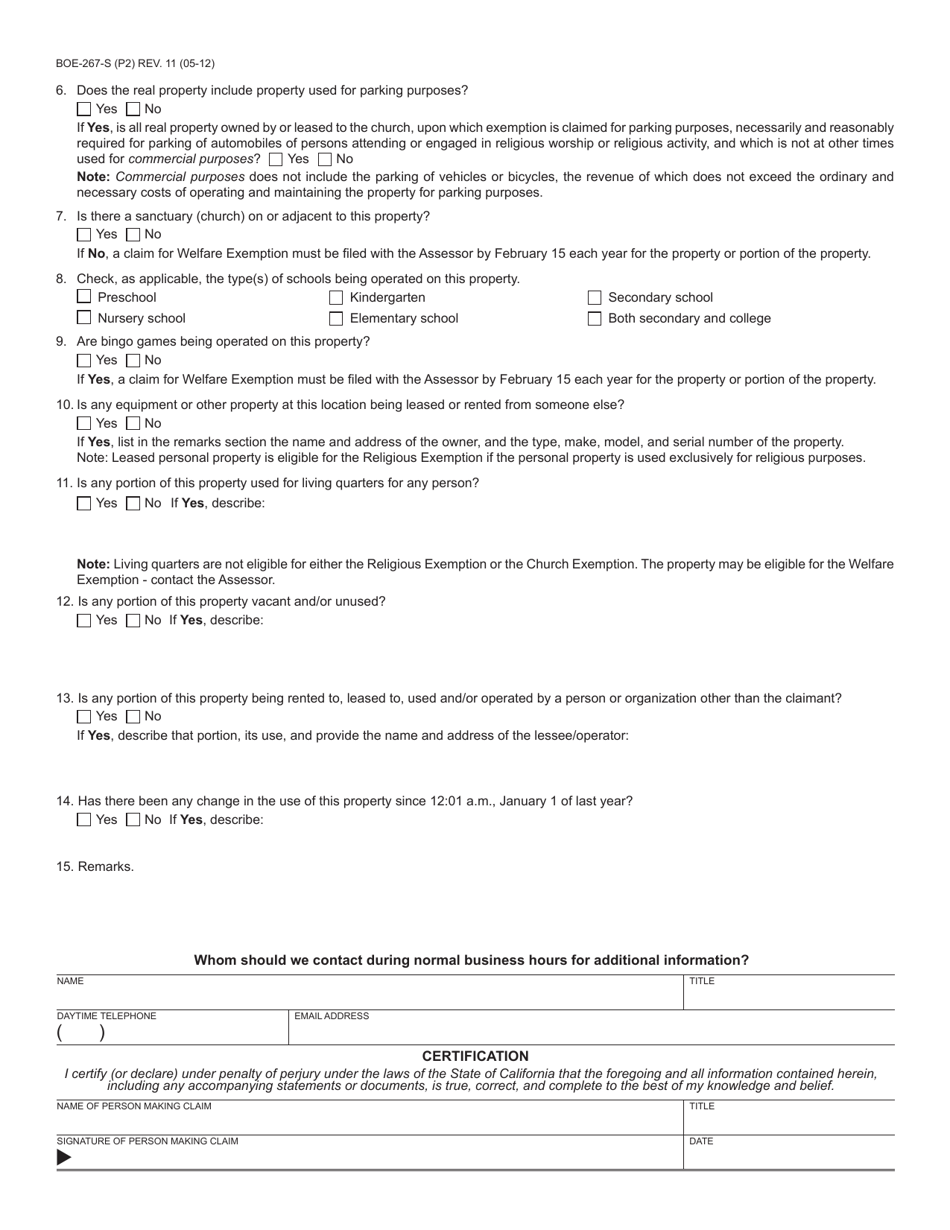

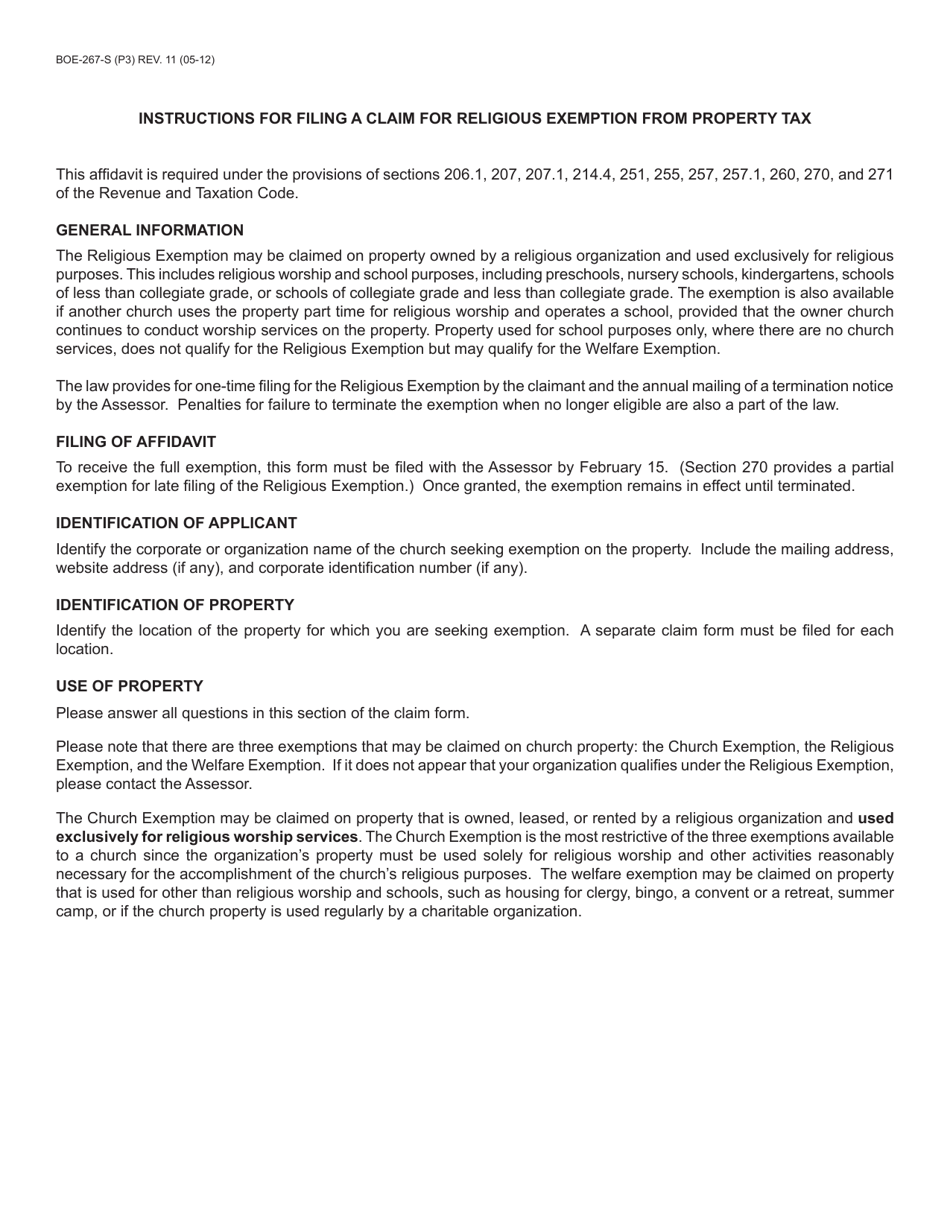

A: The purpose of Form BOE-267-S is to apply for a religious exemption from property taxes in the County of Riverside, California.

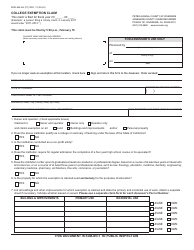

Q: Who is eligible for a religious exemption?

A: Religious organizations that meet certain criteria are eligible for a religious exemption.

Q: What criteria must be met to qualify for a religious exemption?

A: To qualify for a religious exemption, an organization must be organized and operated exclusively for religious purposes.

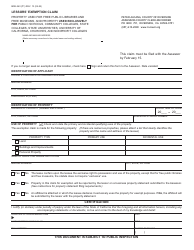

Q: Are there any deadlines for submitting Form BOE-267-S?

A: Yes, Form BOE-267-S must be filed with the County Assessor by February 15th of each year.

Q: Is there a fee for applying for a religious exemption?

A: No, there is no fee for applying for a religious exemption.

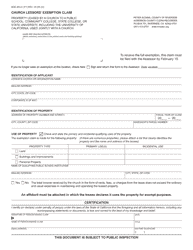

Q: What happens after I submit Form BOE-267-S?

A: After you submit Form BOE-267-S, the County Assessor will review your application and determine if you qualify for a religious exemption.

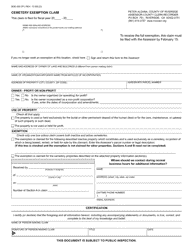

Q: How long does it take to process a religious exemption application?

A: The processing time may vary, but you should receive a determination from the County Assessor within a reasonable timeframe.

Q: What should I do if my application for a religious exemption is denied?

A: If your application is denied, you may have the option to appeal the decision or seek further clarification from the County Assessor.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Assessor-County Clerk-Recorder - County of Riverside, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-267-S by clicking the link below or browse more documents and templates provided by the Assessor-County Clerk-Recorder - County of Riverside, California.