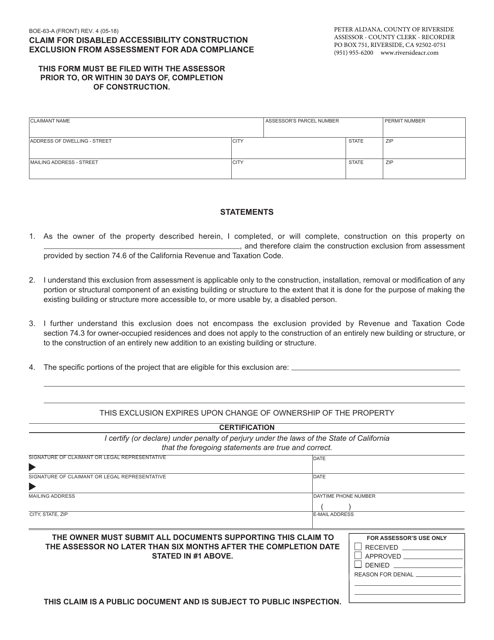

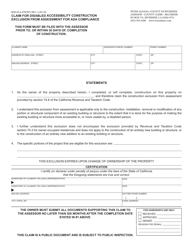

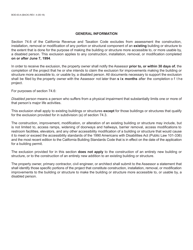

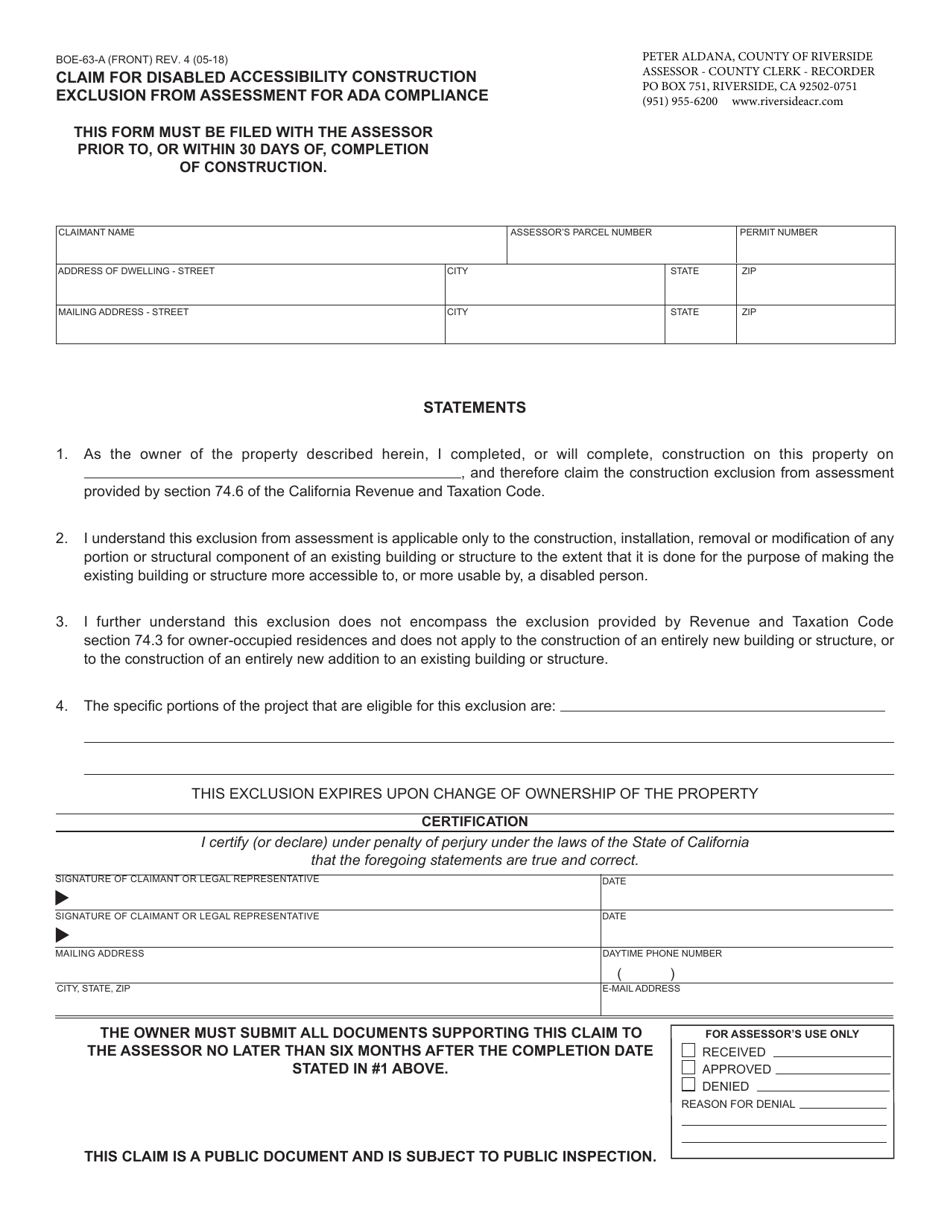

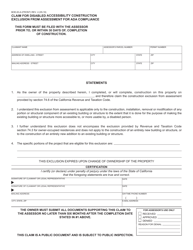

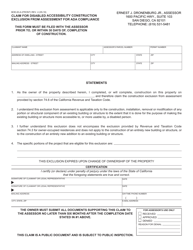

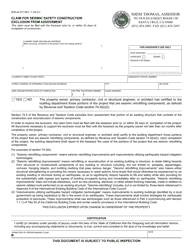

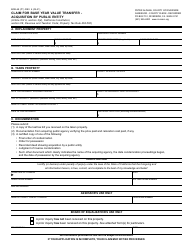

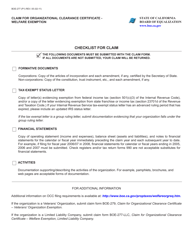

Form BOE-63-A Claim for Disabled Accessibility Construction Exclusion From Assessment for Ada Compliance - County of Riverside, California

What Is Form BOE-63-A?

This is a legal form that was released by the Assessor-County Clerk-Recorder - County of Riverside, California - a government authority operating within California. The form may be used strictly within County of Riverside. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-63-A?

A: Form BOE-63-A is a claim for disabled accessibility construction exclusion from assessment for ADA compliance in the County of Riverside, California.

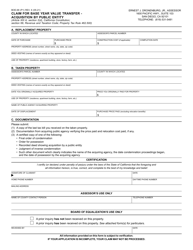

Q: What does the form claim?

A: The form claims the disabled accessibility construction exclusion from assessment for ADA (Americans with Disabilities Act) compliance.

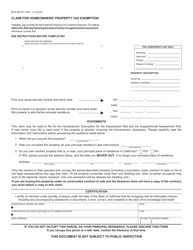

Q: Who can file Form BOE-63-A?

A: Property owners who have made eligible construction expenditures to enhance accessibility for disabled persons on their property in compliance with ADA can file Form BOE-63-A.

Q: What is the purpose of filing this form?

A: The purpose of filing Form BOE-63-A is to exclude the increased value of eligible construction expenditures from property assessment when determining property taxes.

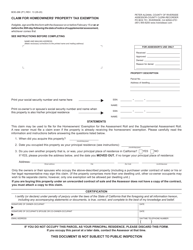

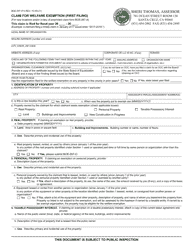

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Assessor-County Clerk-Recorder - County of Riverside, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-63-A by clicking the link below or browse more documents and templates provided by the Assessor-County Clerk-Recorder - County of Riverside, California.