This version of the form is not currently in use and is provided for reference only. Download this version of

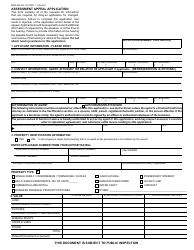

Form BOE-262-AH

for the current year.

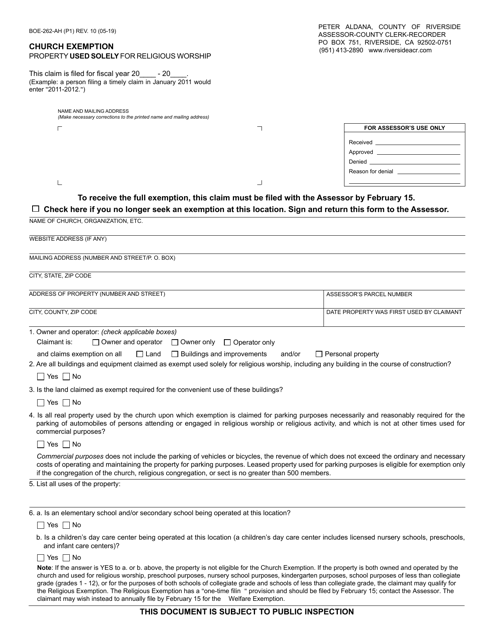

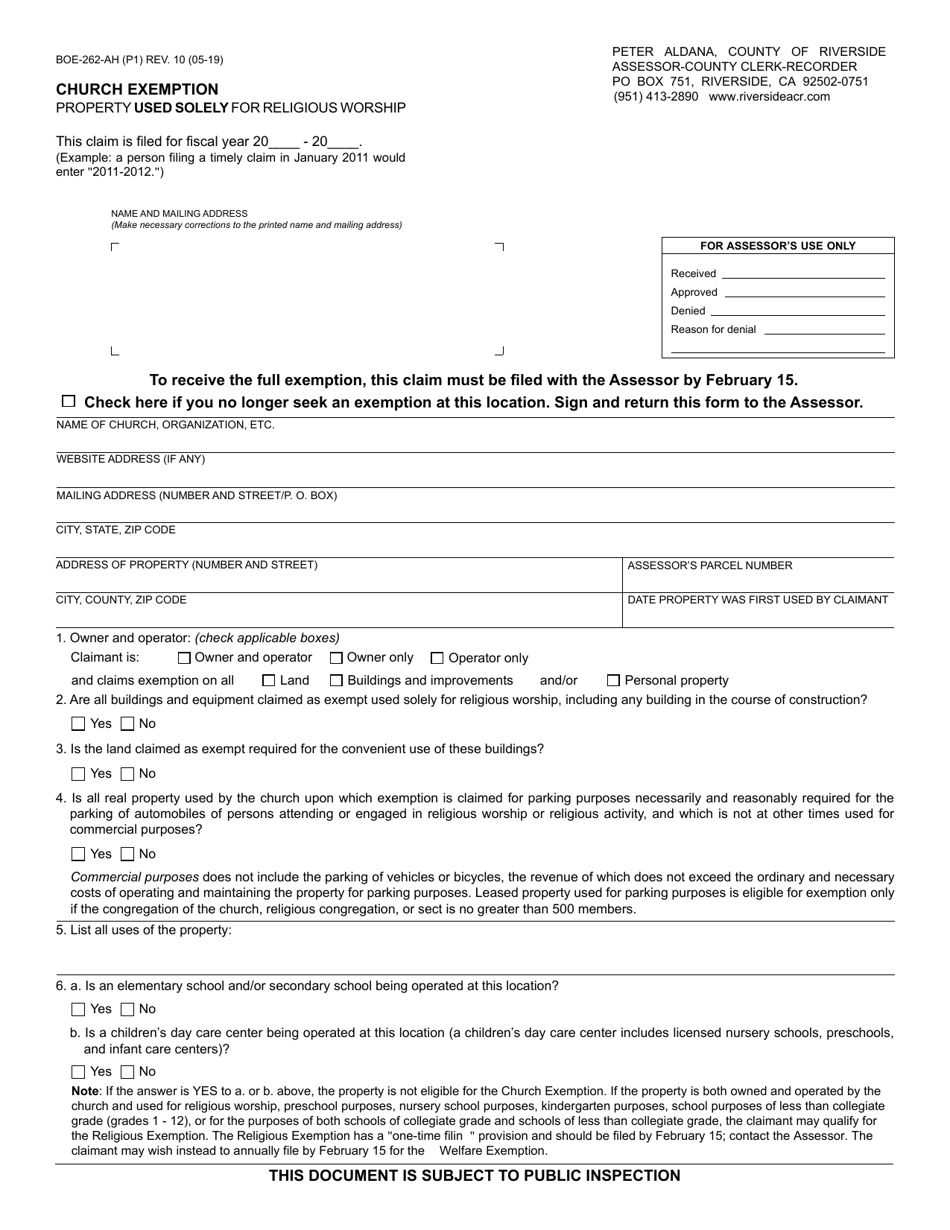

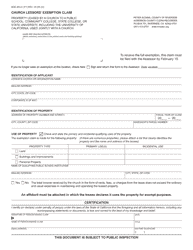

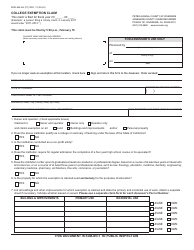

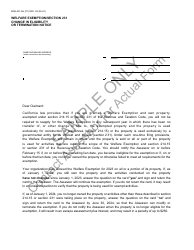

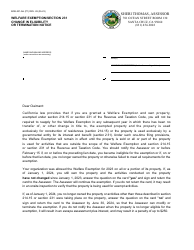

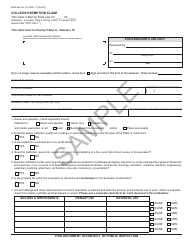

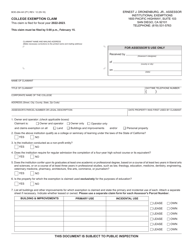

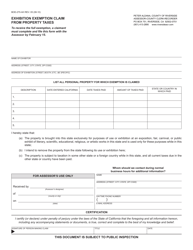

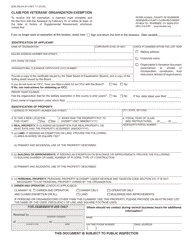

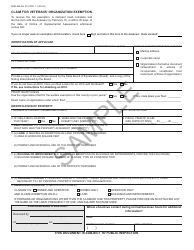

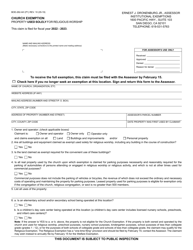

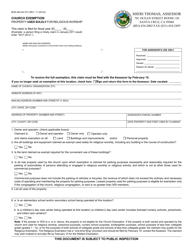

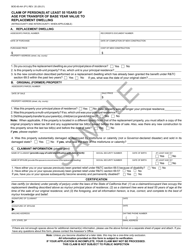

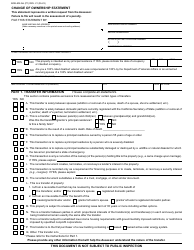

Form BOE-262-AH Church Exemption - County of Riverside, California

What Is Form BOE-262-AH?

This is a legal form that was released by the Assessor-County Clerk-Recorder - County of Riverside, California - a government authority operating within California. The form may be used strictly within County of Riverside. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-262-AH?

A: Form BOE-262-AH is an application for Church Exemption in the County of Riverside, California.

Q: What does the Form BOE-262-AH Church Exemption apply to?

A: The Form BOE-262-AH Church Exemption applies to churches seeking property tax exemption in the County of Riverside, California.

Q: Who needs to fill out the Form BOE-262-AH Church Exemption?

A: Churches in the County of Riverside, California, who are seeking property tax exemption, need to fill out the Form BOE-262-AH.

Q: Are there any fees associated with the Form BOE-262-AH Church Exemption?

A: No, there are no fees associated with filing the Form BOE-262-AH Church Exemption in Riverside County, California.

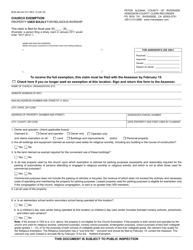

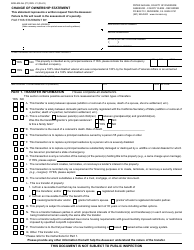

Q: What documents need to be included with the Form BOE-262-AH Church Exemption?

A: Churches need to include supporting documentation, such as articles of incorporation, bylaws, and a copy of the IRS determination letter with the Form BOE-262-AH Church Exemption.

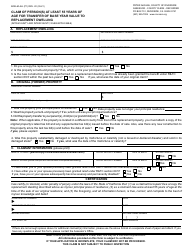

Q: When is the deadline to file the Form BOE-262-AH Church Exemption?

A: The Form BOE-262-AH Church Exemption must be filed annually with the Riverside County Assessor's Office by February 15th.

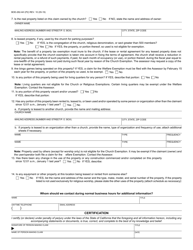

Q: What happens after submitting the Form BOE-262-AH Church Exemption?

A: After submitting the Form BOE-262-AH Church Exemption, the Riverside County Assessor's Office will review the application and make a determination for property tax exemption.

Q: Can churches still be taxed after filing the Form BOE-262-AH Church Exemption?

A: Yes, churches can still be taxed for certain types of properties or if they engage in income-generating activities that are not related to their religious purposes.

Q: How long does the property tax exemption granted through the Form BOE-262-AH Church Exemption last?

A: The property tax exemption granted through the Form BOE-262-AH Church Exemption lasts for one year and must be renewed annually.

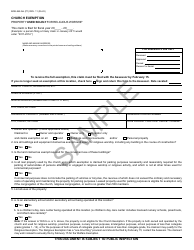

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Assessor-County Clerk-Recorder - County of Riverside, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-262-AH by clicking the link below or browse more documents and templates provided by the Assessor-County Clerk-Recorder - County of Riverside, California.