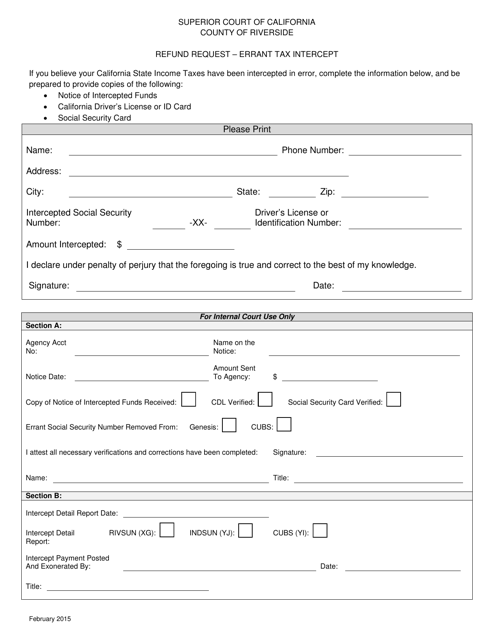

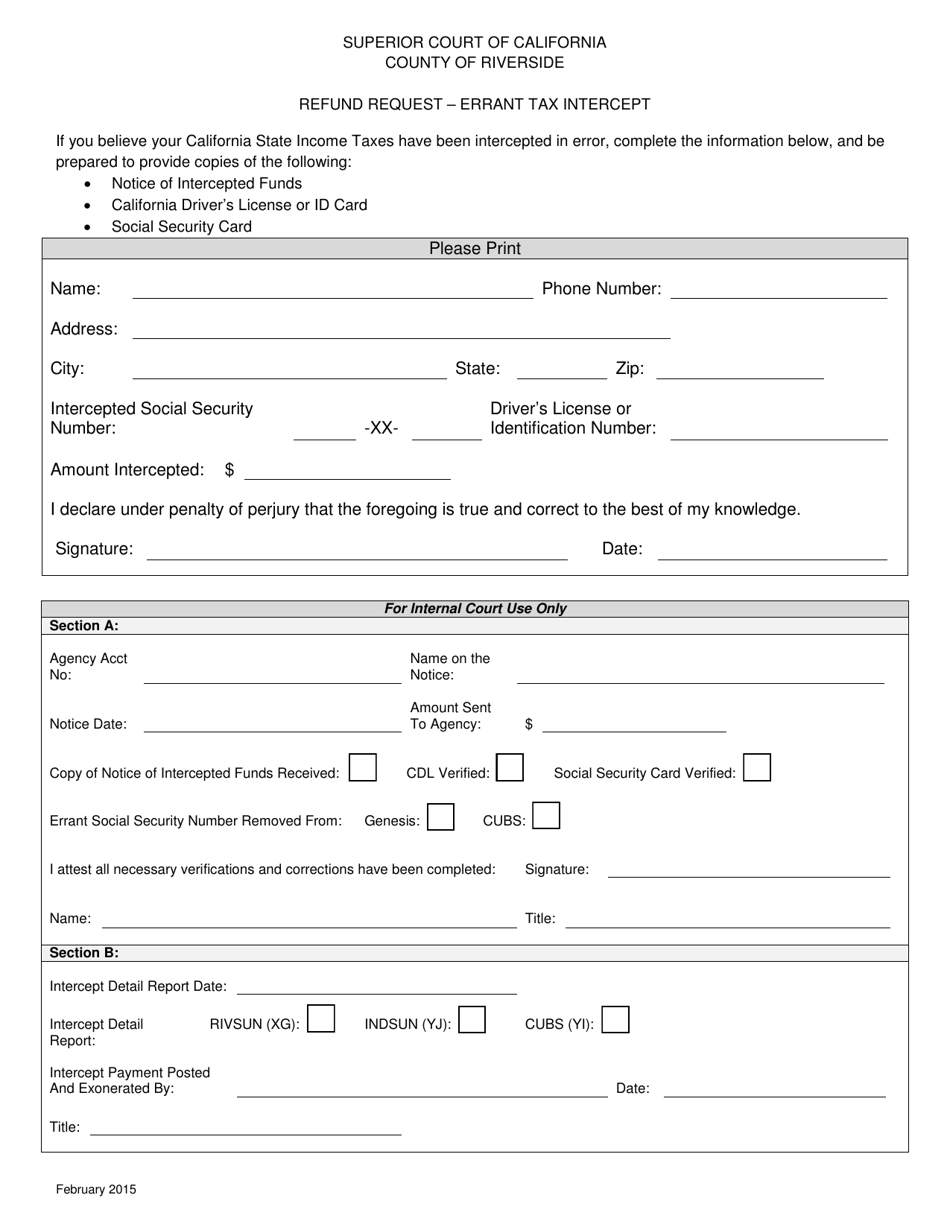

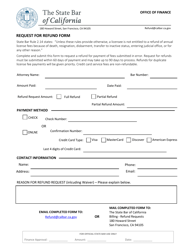

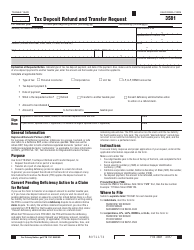

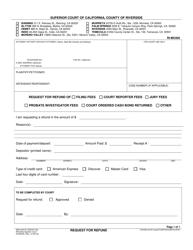

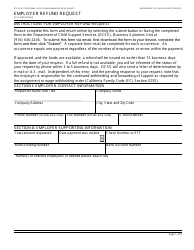

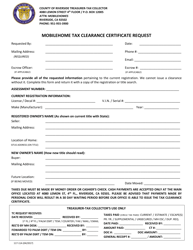

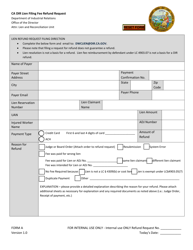

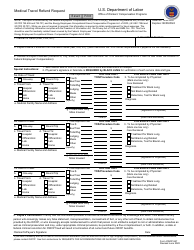

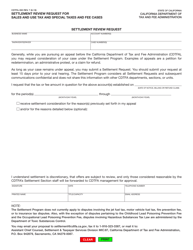

Refund Request - Errant Tax Intercept - County of Riverside, California

Refund Request - Errant Tax Intercept is a legal document that was released by the Superior Court - County of Riverside, California - a government authority operating within California. The form may be used strictly within County of Riverside.

FAQ

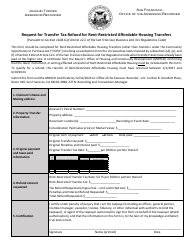

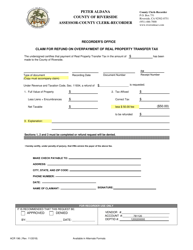

Q: What is an errant tax intercept?

A: An errant tax intercept occurs when the county of Riverside, California mistakenly intercepts and withholds a taxpayer's refund.

Q: Why would the county intercept a taxpayer's refund?

A: The county may intercept a taxpayer's refund to collect unpaid debts, such as child support or past due taxes.

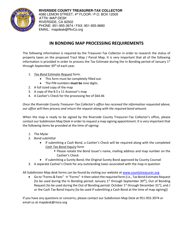

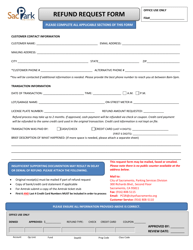

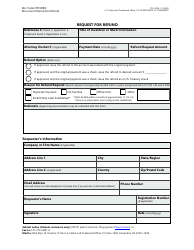

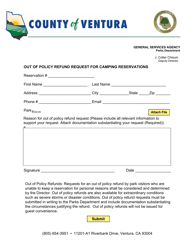

Q: How can I request a refund for an errant tax intercept?

A: To request a refund for an errant tax intercept, you should contact the county of Riverside, California and provide the necessary documentation to support your claim.

Q: What documents do I need to support my refund request?

A: You may need to provide proof that the intercepted refund was not owed to the county, such as bank statements or tax return documents.

Q: How long does it take to process a refund request?

A: The processing time for a refund request can vary. It is best to inquire with the county of Riverside, California for specific information.

Form Details:

- Released on February 1, 2015;

- The latest edition currently provided by the Superior Court - County of Riverside, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Superior Court - County of Riverside, California.