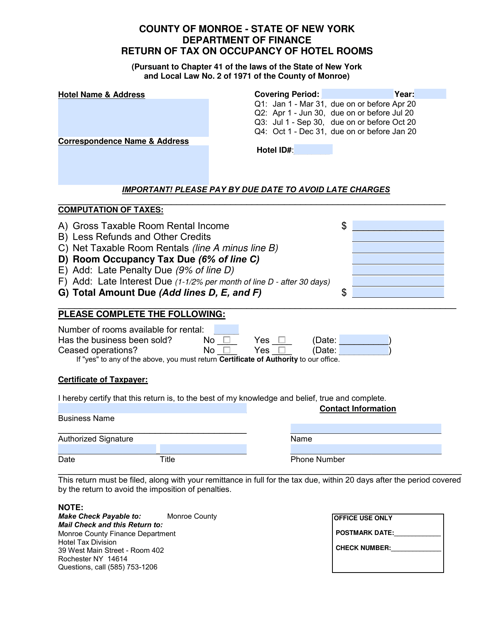

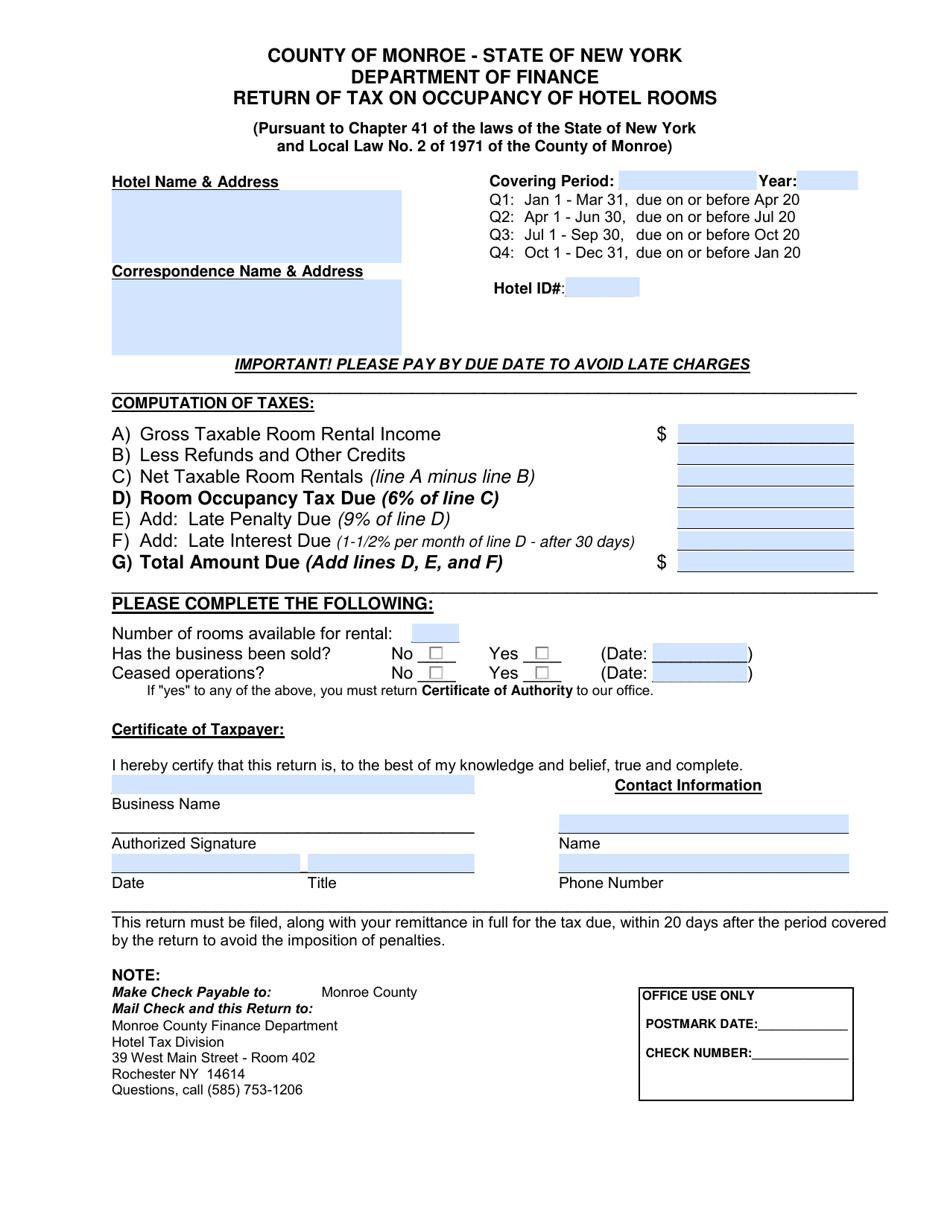

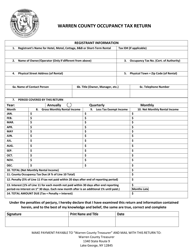

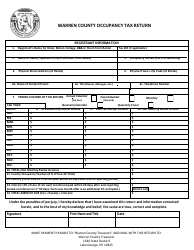

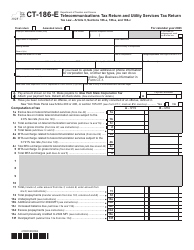

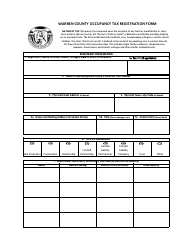

Return of Tax on Occupancy of Hotel Rooms - Monroe County, New York

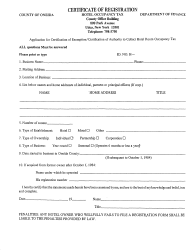

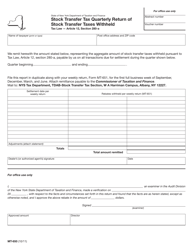

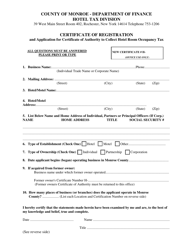

Return of Tax on Occupancy of Hotel Rooms is a legal document that was released by the Department of Finance - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

Q: What is the Return of Tax on Occupancy of Hotel Rooms?

A: The Return of Tax on Occupancy of Hotel Rooms is a tax imposed by Monroe County, New York on hotel room rentals.

Q: Who is responsible for paying the Return of Tax on Occupancy of Hotel Rooms?

A: The hotel or lodging establishment is responsible for collecting and remitting the tax to Monroe County.

Q: What is the current tax rate for the Return of Tax on Occupancy of Hotel Rooms?

A: The current tax rate is X% (please provide the specific tax rate for Monroe County, New York).

Q: How is the Return of Tax on Occupancy of Hotel Rooms used?

A: The tax revenue is typically used to support tourism promotion, arts and cultural initiatives, and local community development projects.

Q: Are there any exemptions or discounts for the Return of Tax on Occupancy of Hotel Rooms?

A: There may be certain exemptions or discounts available, such as for government employees or non-profit organizations. It is best to check with the specific requirements of Monroe County, New York.

Form Details:

- The latest edition currently provided by the Department of Finance - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Finance - Monroe County, New York.