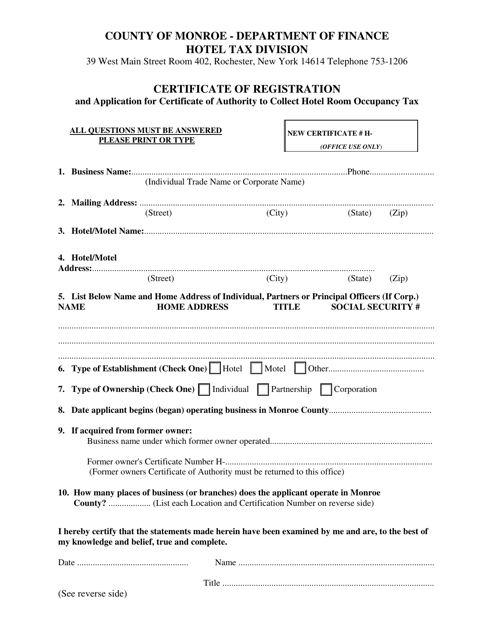

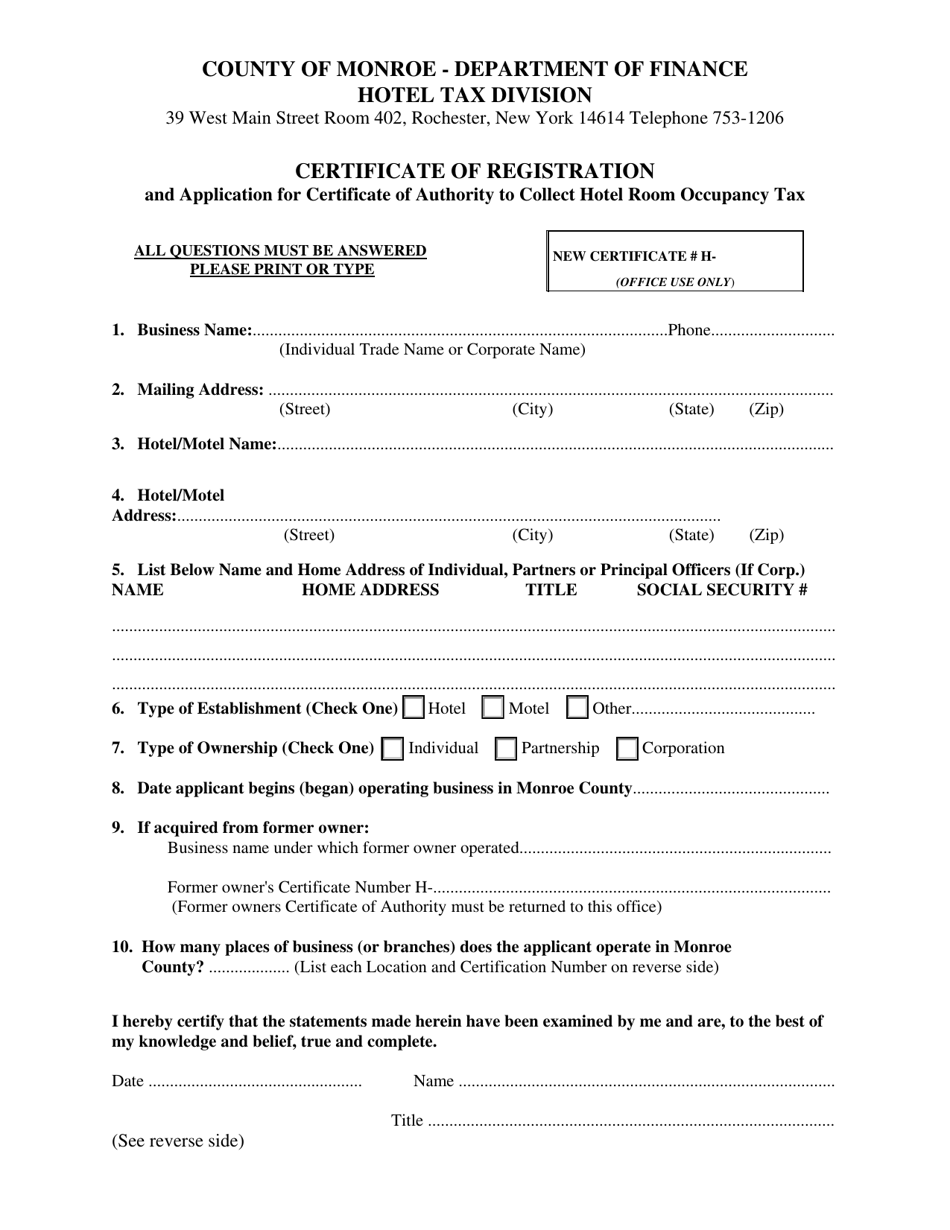

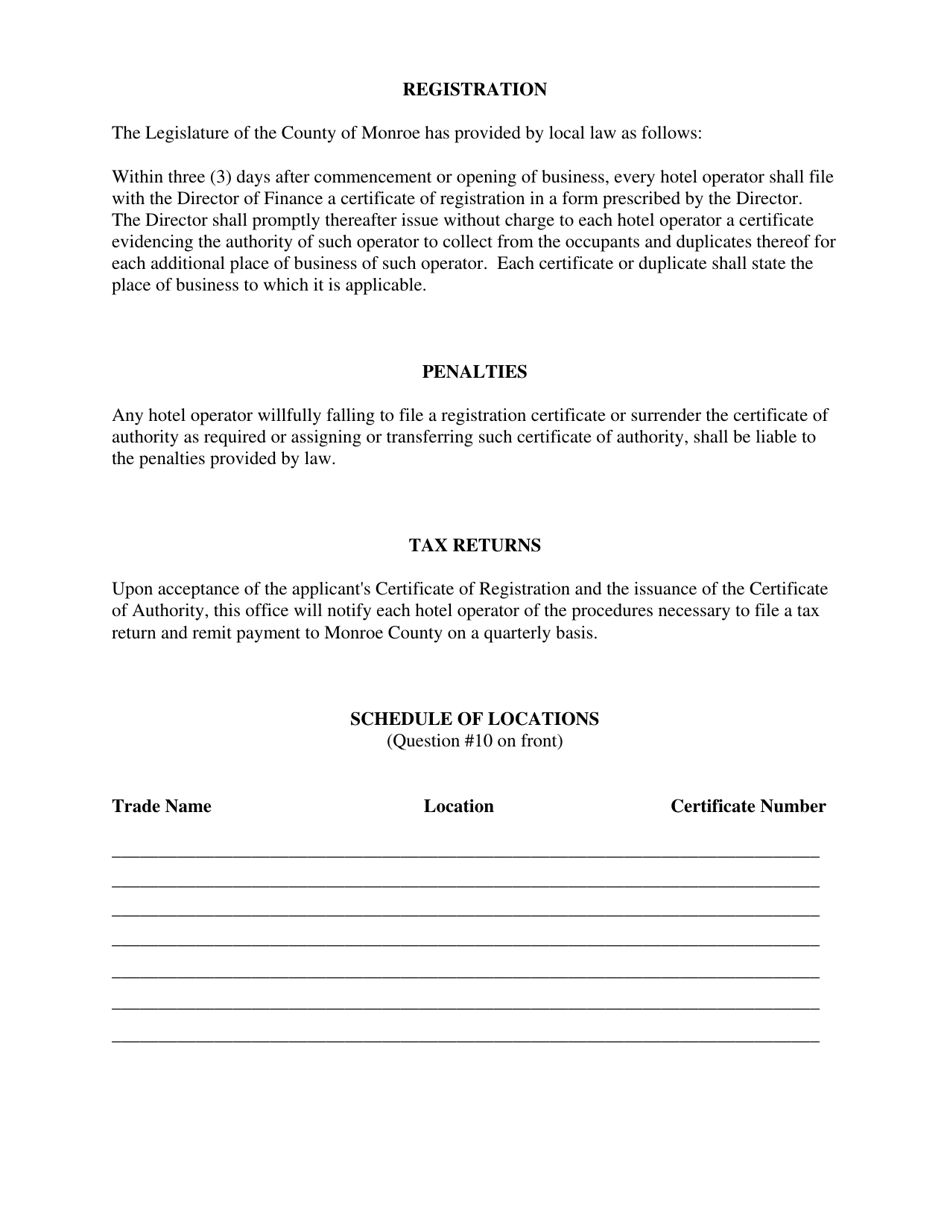

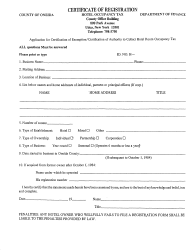

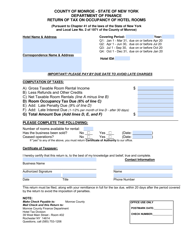

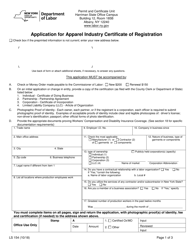

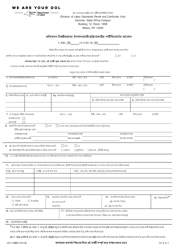

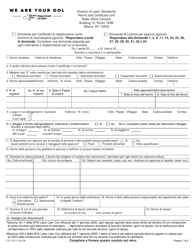

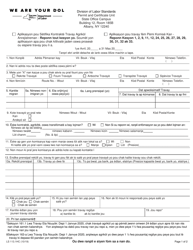

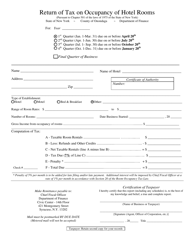

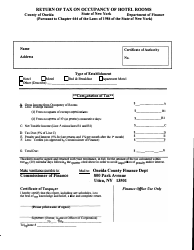

Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax - Monroe County, New York

Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax is a legal document that was released by the Department of Finance - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

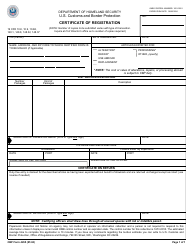

Q: What is a Certificate of Registration?

A: A Certificate of Registration is a document that certifies a business's compliance with the regulations for collecting hotel room occupancy tax.

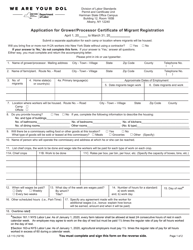

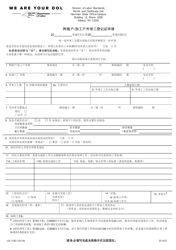

Q: What is an Application for Certificate of Authority to Collect Hotel Room Occupancy Tax?

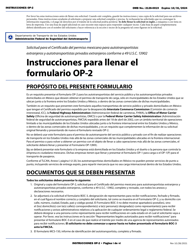

A: An Application for Certificate of Authority to Collect Hotel Room Occupancy Tax is a form that businesses must fill out to apply for authorization to collect hotel room occupancy tax in Monroe County, New York.

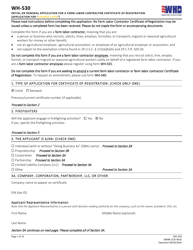

Q: Who needs to obtain a Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax?

A: Businesses that operate hotels or other types of lodging establishments in Monroe County, New York and are required to collect hotel room occupancy tax need to obtain these documents.

Q: What is the purpose of the hotel room occupancy tax?

A: The hotel room occupancy tax is a tax imposed on guests who rent hotel rooms or other types of lodging accommodations. The revenue from this tax is typically used to fund local tourism initiatives and promote economic development.

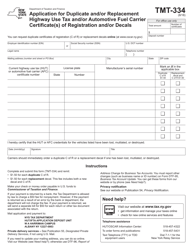

Q: How can businesses apply for a Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax?

A: Businesses can apply for these documents by filling out the appropriate forms and submitting them to the Monroe County Department of Finance - Real PropertyTax Services Division.

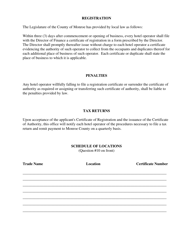

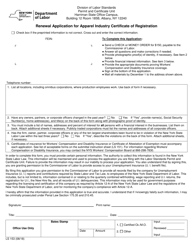

Q: Is the Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax valid indefinitely?

A: No, these documents are typically valid for a certain period of time and need to be renewed periodically. The renewal process varies and businesses should check with the Monroe County Department of Finance for more information.

Q: What are the consequences for not obtaining a Certificate of Registration and Application for Certificate of Authority to Collect Hotel Room Occupancy Tax?

A: Failure to obtain these documents can result in penalties and fines, and may also lead to legal action being taken against the business.

Form Details:

- The latest edition currently provided by the Department of Finance - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Finance - Monroe County, New York.