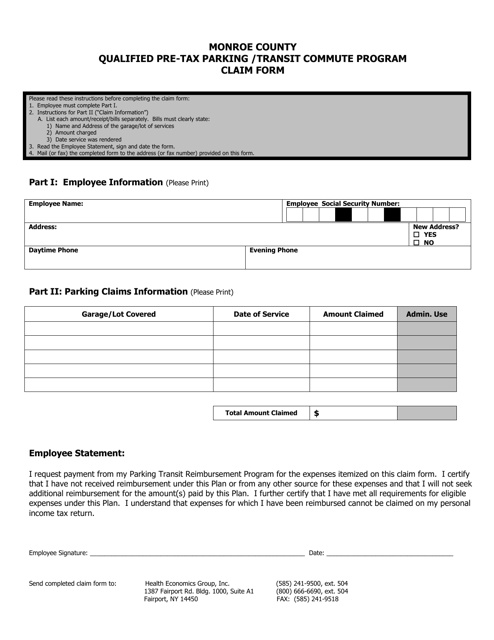

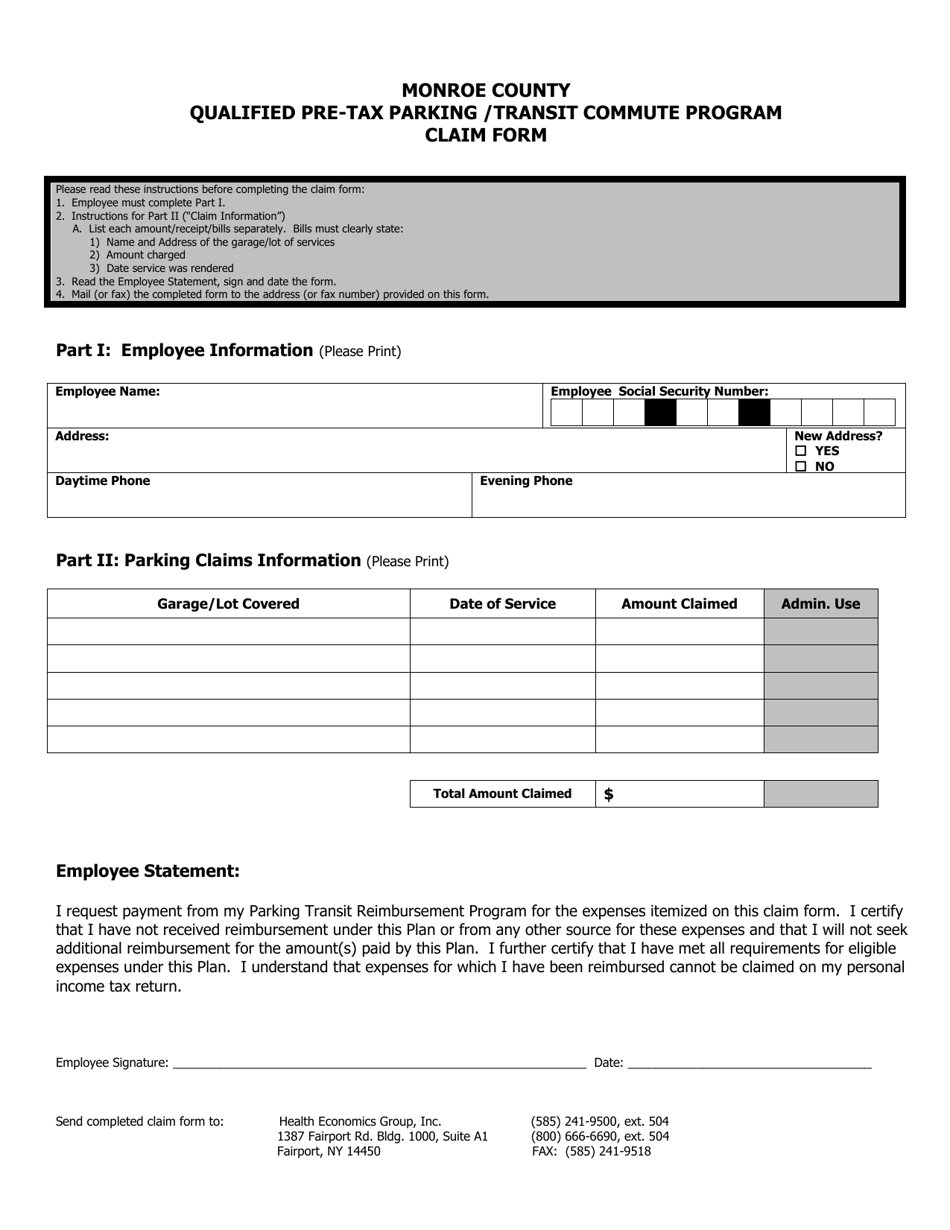

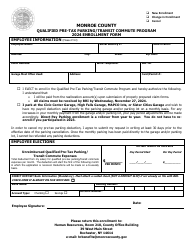

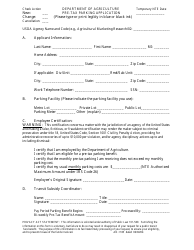

Qualified Pre-tax Parking / Transit Commute Program Claim Form - Monroe County, New York

Qualified Pre-tax Parking/Transit Commute Program Claim Form is a legal document that was released by the Department of Human Resources - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

Q: What is the Qualified Pre-tax Parking/Transit Commute Program Claim Form?

A: The Qualified Pre-tax Parking/Transit Commute Program Claim Form is a form used in Monroe County, New York to claim expenses for parking or transit commutes.

Q: What can I claim using this form?

A: You can claim expenses for parking or transit commutes using this form.

Q: Who is eligible to use this form?

A: Employees in Monroe County, New York who participate in the Qualified Pre-tax Parking/Transit Commute Program are eligible to use this form.

Q: How do I submit this form?

A: You can submit this form by following the instructions provided on the form, typically by mailing it to the designated address.

Q: Are there any specific requirements for the expenses I can claim?

A: Yes, there may be specific requirements for the expenses you can claim. Please refer to the instructions on the form for more information.

Form Details:

- The latest edition currently provided by the Department of Human Resources - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Human Resources - Monroe County, New York.