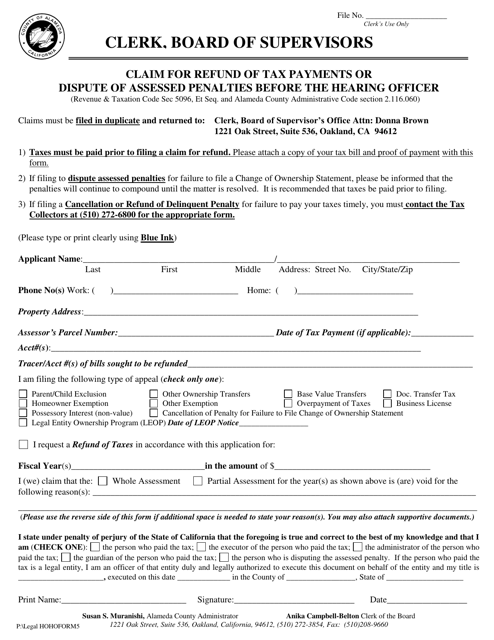

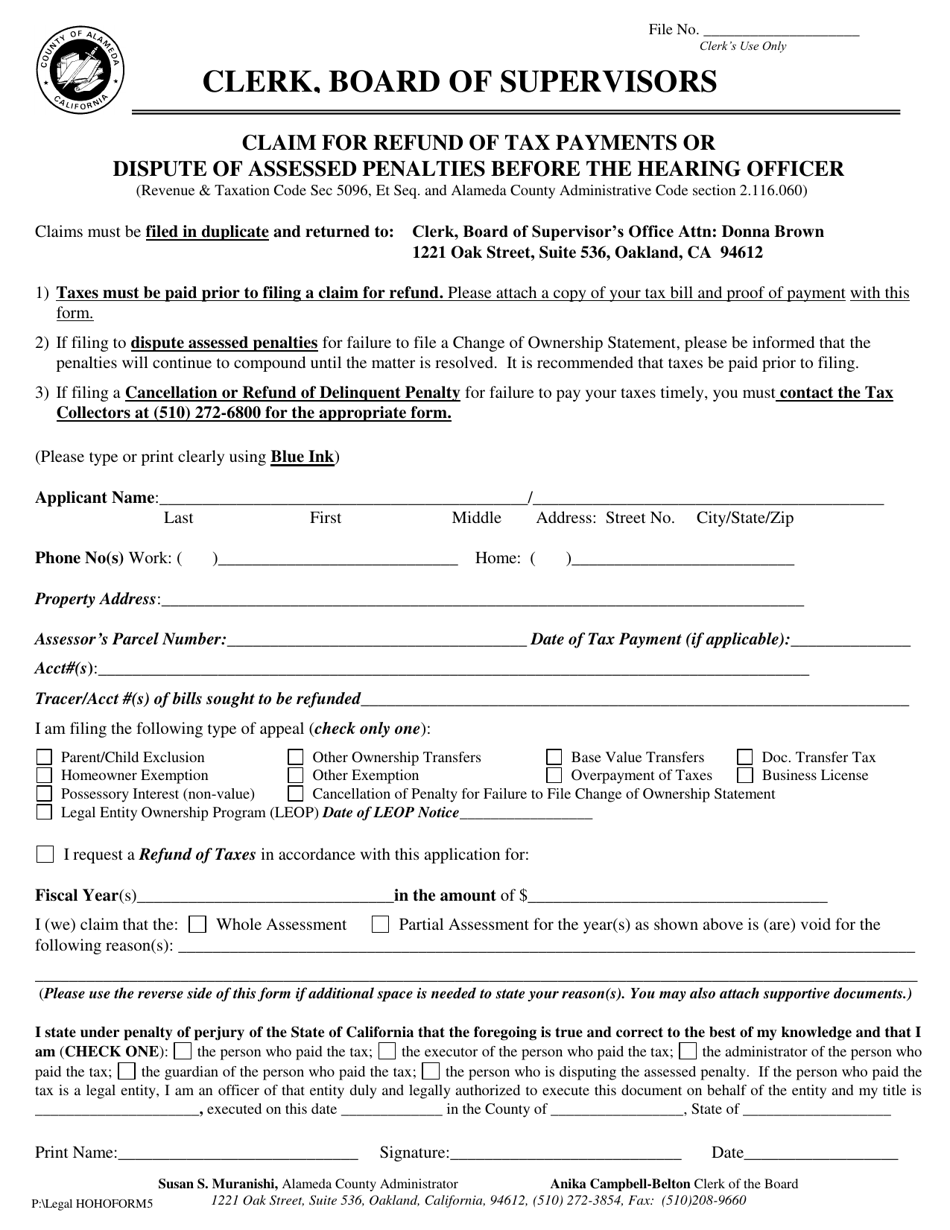

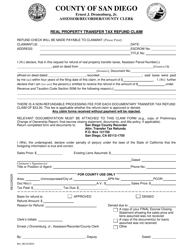

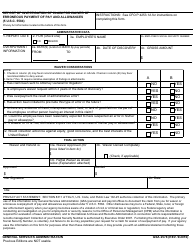

Claim for Refund of Tax Payments or Dispute of Assessed Penalties Before the Hearing Officer - County of Alameda, California

Claim for Refund of Tax Payments or Dispute of Assessed Penalties Before the Hearing Officer is a legal document that was released by the Board of Supervisors - County of Alameda, California - a government authority operating within California. The form may be used strictly within County of Alameda.

FAQ

Q: What is the claim for refund of tax payments or dispute of assessed penalties?

A: It is a process to request a refund for tax payments or dispute penalties in the County of Alameda, California.

Q: Who can file a claim for refund of tax payments or dispute of assessed penalties?

A: Any person or business who has paid taxes or received penalties in the County of Alameda, California.

Q: How can I file a claim for refund of tax payments or dispute of assessed penalties?

A: You can file a claim by completing the necessary forms and submitting them to the County of Alameda.

Q: What is the purpose of filing a claim for refund of tax payments or dispute of assessed penalties?

A: The purpose is to request a refund or dispute penalties that have been assessed by the County of Alameda.

Q: What happens after I file a claim for refund of tax payments or dispute of assessed penalties?

A: Your claim will be reviewed by the County of Alameda, and if necessary, a hearing will be scheduled before a Hearing Officer.

Q: What is the role of the Hearing Officer in a claim for refund of tax payments or dispute of assessed penalties?

A: The Hearing Officer reviews the evidence and arguments presented by both parties and makes a decision on the claim or dispute.

Q: Can I appeal the decision made by the Hearing Officer in a claim for refund of tax payments or dispute of assessed penalties?

A: Yes, you have the right to appeal the decision to the Assessment Appeals Board.

Q: How long does the process of a claim for refund of tax payments or dispute of assessed penalties take?

A: The length of the process can vary, but it typically takes several months from the filing of the claim to the final decision.

Q: Do I need legal representation to file a claim for refund of tax payments or dispute of assessed penalties?

A: You do not need legal representation, but it may be helpful to consult with a tax professional or attorney for guidance.

Q: Are there any fees associated with filing a claim for refund of tax payments or dispute of assessed penalties?

A: There may be fees associated with filing a claim, such as filing fees or administrative fees. These fees can vary.

Form Details:

- The latest edition currently provided by the Board of Supervisors - County of Alameda, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Board of Supervisors - County of Alameda, California.