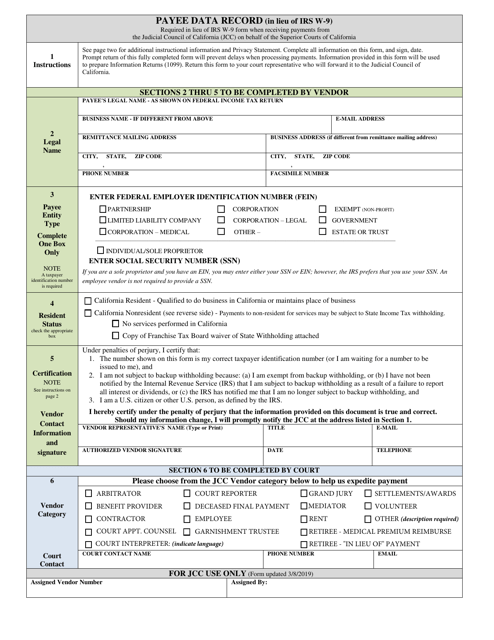

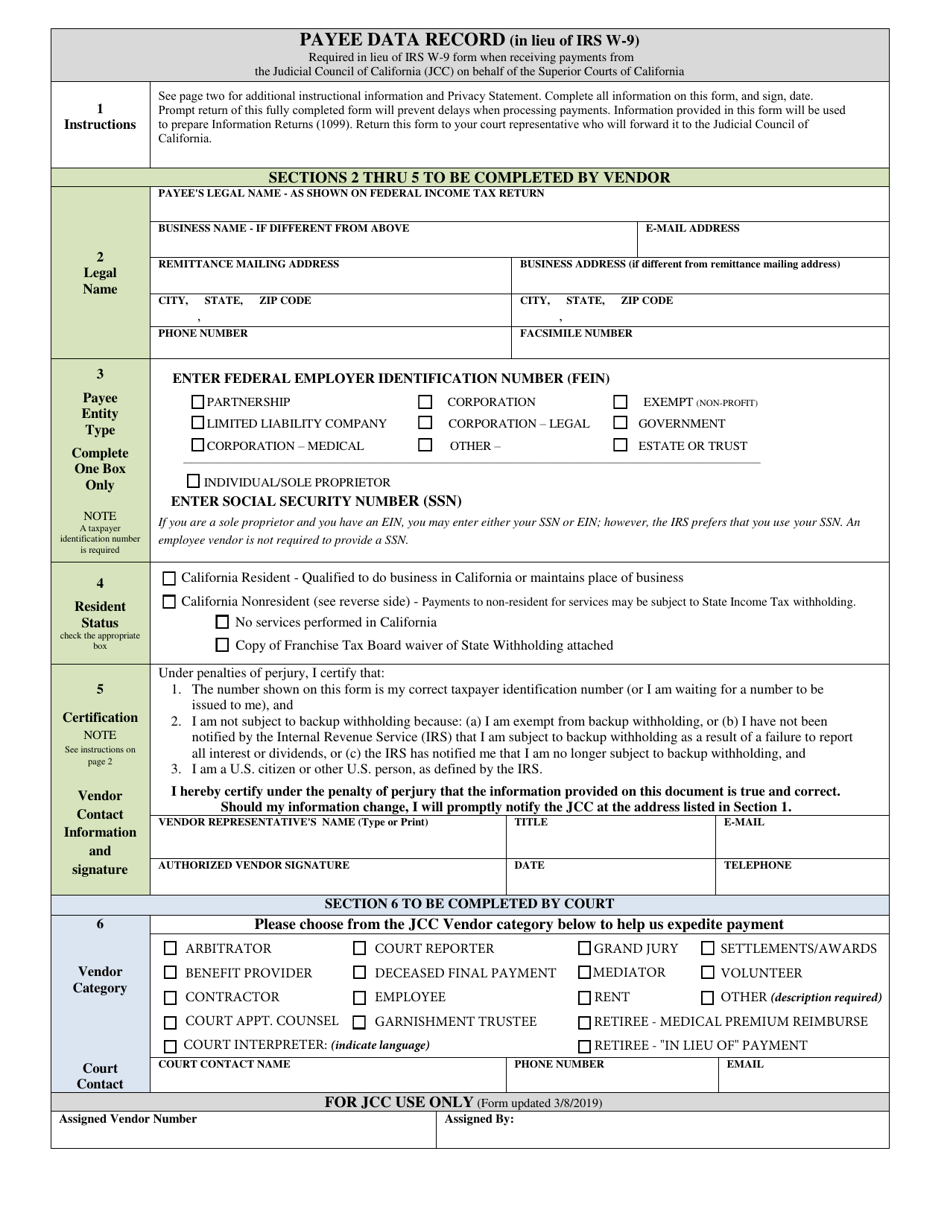

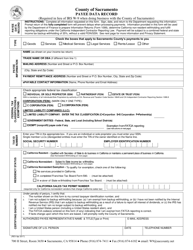

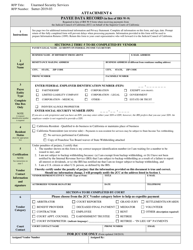

Payee Data Record (In Lieu of IRS W-9) - County of Los Angeles, California

Payee Data Record (In Lieu of IRS W-9) is a legal document that was released by the Superior Court - County of Los Angeles, California - a government authority operating within California. The form may be used strictly within County of Los Angeles.

FAQ

Q: What is the Payee Data Record?

A: The Payee Data Record is a form used by the County of Los Angeles, California.

Q: What is the purpose of the Payee Data Record?

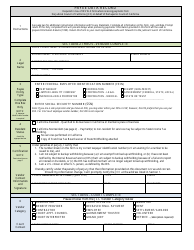

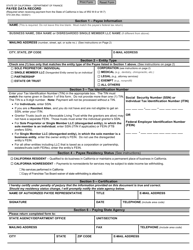

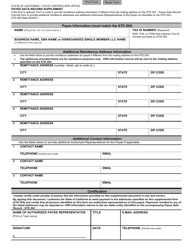

A: The purpose of the Payee Data Record is to gather information about payees for tax reporting purposes.

Q: Is the Payee Data Record required in place of IRS Form W-9?

A: Yes, the Payee Data Record is used in lieu of IRS Form W-9 for the County of Los Angeles, California.

Q: Who needs to complete the Payee Data Record?

A: Anyone who is a payee for the County of Los Angeles, California needs to complete the Payee Data Record.

Q: Is the Payee Data Record form specific to the County of Los Angeles?

A: Yes, the Payee Data Record form is specific to the County of Los Angeles, California.

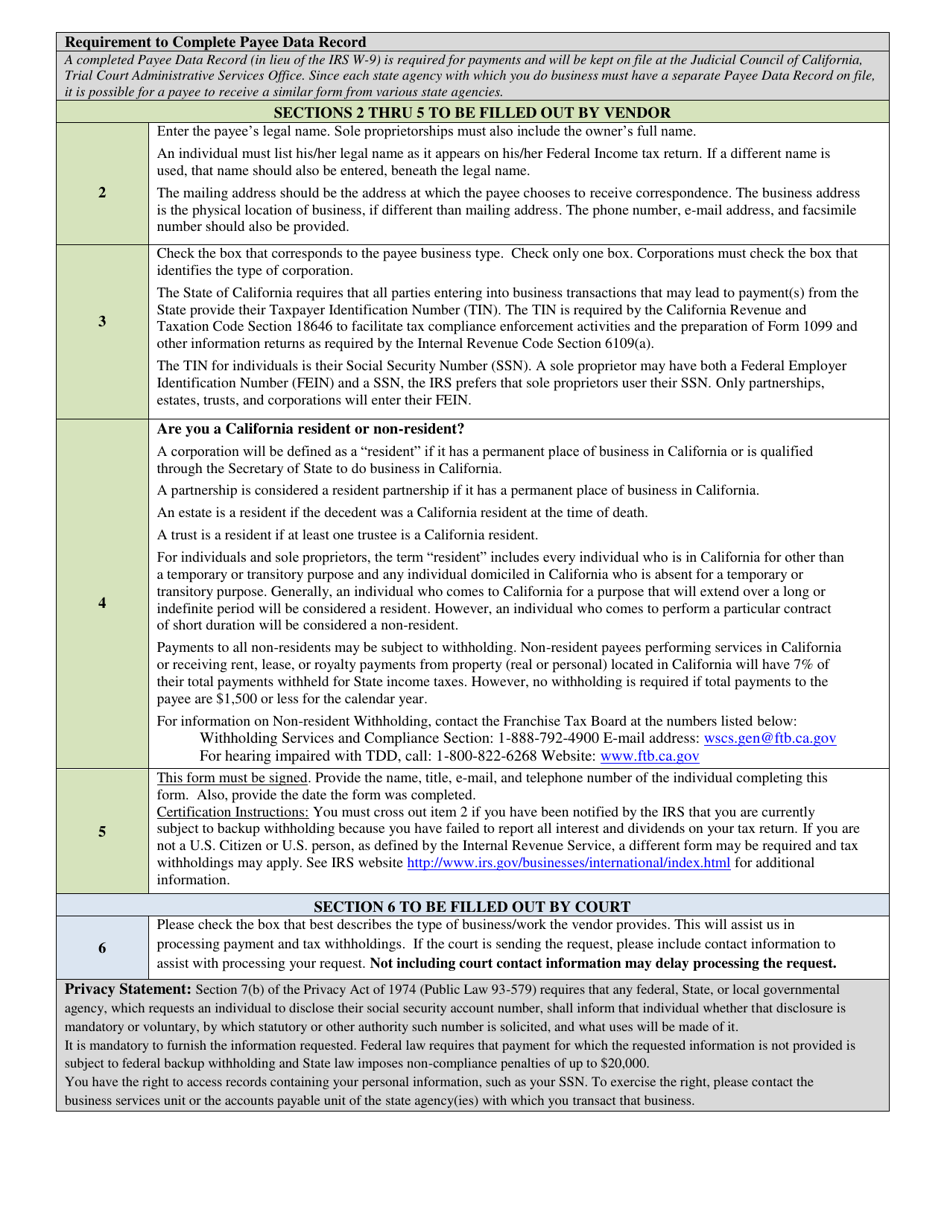

Q: What information do I need to provide on the Payee Data Record?

A: You will need to provide personal information, tax identification number, and other relevant details on the Payee Data Record.

Q: Are there any penalties for not completing the Payee Data Record?

A: Failure to complete the Payee Data Record may result in delays in payments or potential penalties from the County of Los Angeles, California.

Form Details:

- The latest edition currently provided by the Superior Court - County of Los Angeles, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Superior Court - County of Los Angeles, California.