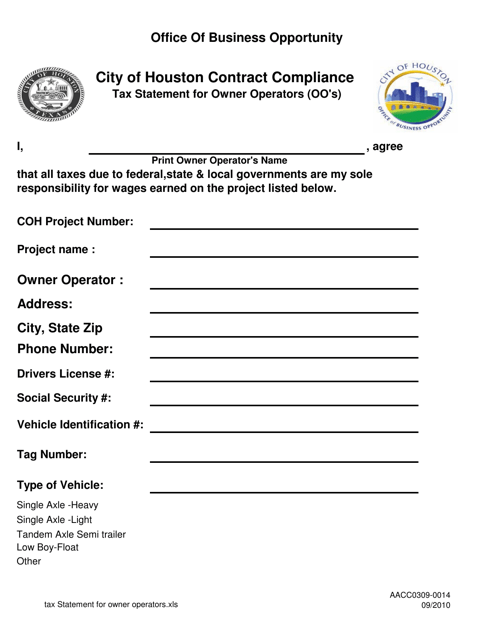

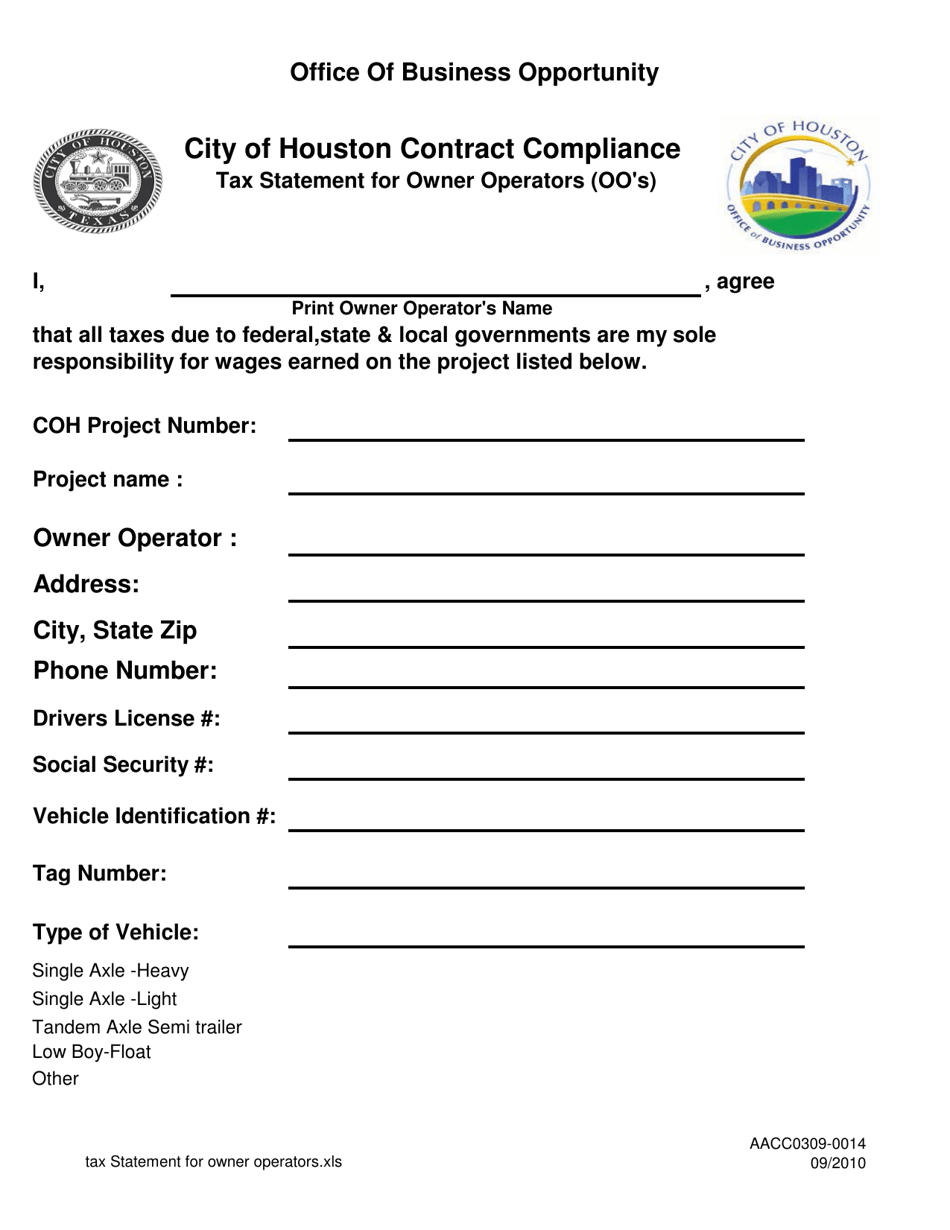

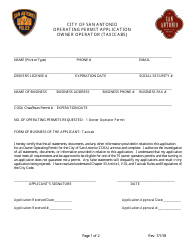

Tax Liability Statement for Owner Operators (Oo's) - City of Houston, Texas

Tax Owner Operators (Oo's) is a legal document that was released by the Office of Business Opportunity - City of Houston, Texas - a government authority operating within Texas. The form may be used strictly within City of Houston.

FAQ

Q: What is a tax liability statement?

A: A tax liability statement is a document that shows the amount of taxes owed by the taxpayer.

Q: Who is required to obtain a tax liability statement?

A: Owner Operators (Oo's) operating in the City of Houston, Texas are required to obtain a tax liability statement.

Q: Why do Owner Operators need a tax liability statement?

A: Owner Operators need a tax liability statement to accurately report and pay their taxes to the City of Houston, Texas.

Q: What information is included in a tax liability statement?

A: A tax liability statement includes details such as the amount of taxes owed, the taxpayer's identification information, and the tax period.

Q: When is the deadline to obtain a tax liability statement?

A: The deadline to obtain a tax liability statement for Owner Operators in the City of Houston, Texas may vary, so it's best to check with the tax department for specific deadlines.

Q: Is there a fee for obtaining a tax liability statement?

A: Yes, there may be a fee associated with obtaining a tax liability statement. The exact fee amount can be obtained from the City of Houston's tax department.

Form Details:

- Released on September 1, 2010;

- The latest edition currently provided by the Office of Business Opportunity - City of Houston, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of Business Opportunity - City of Houston, Texas.