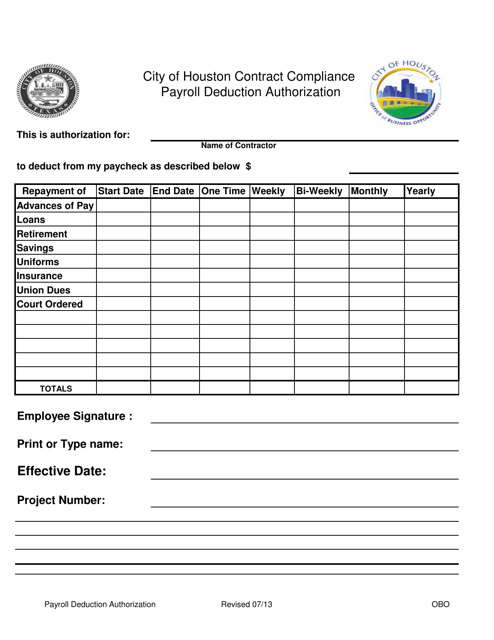

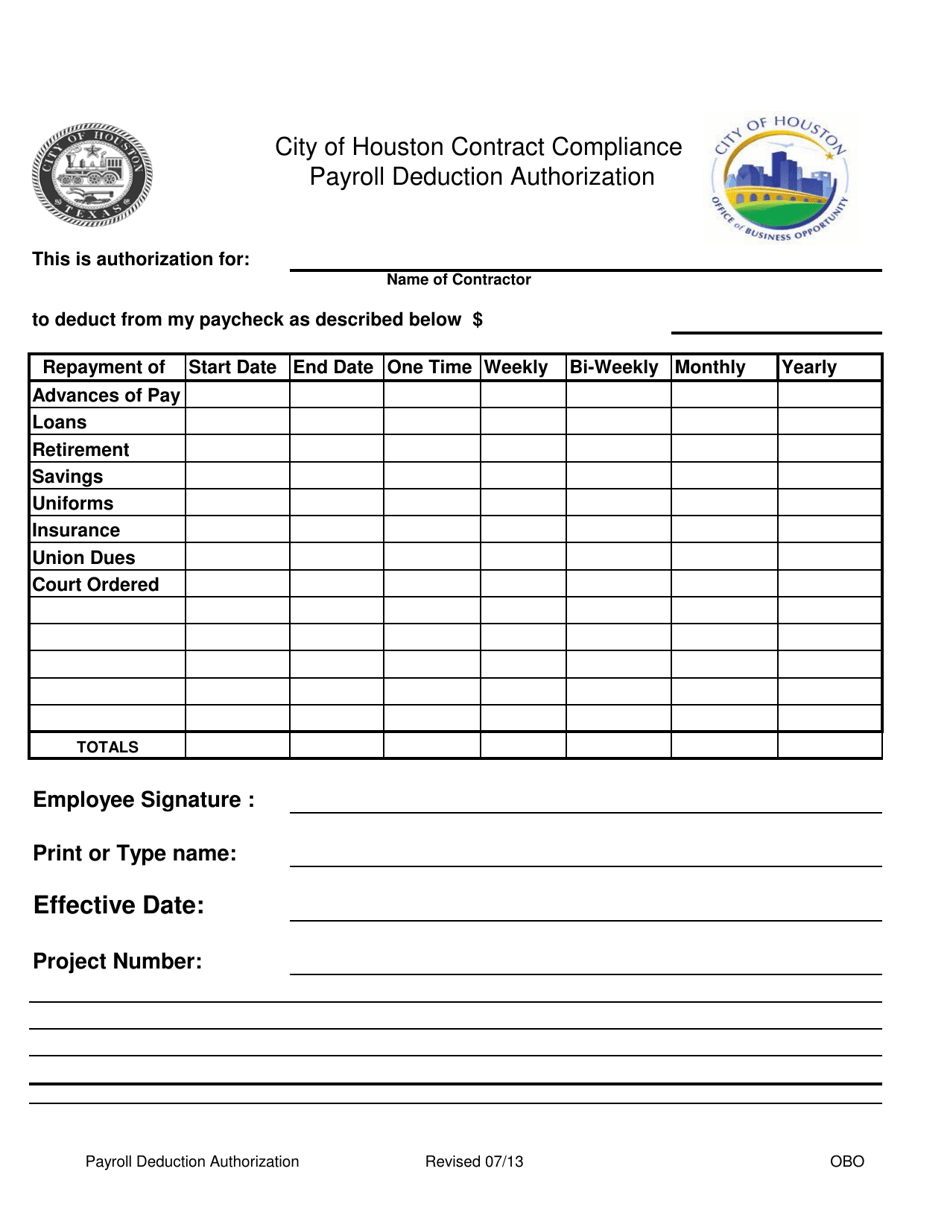

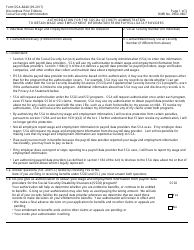

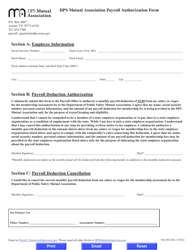

Payroll Deduction Authorization - City of Houston, Texas

Payroll Deduction Authorization is a legal document that was released by the Office of Business Opportunity - City of Houston, Texas - a government authority operating within Texas. The form may be used strictly within City of Houston.

FAQ

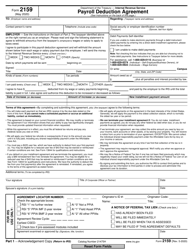

Q: What is a payroll deduction authorization?

A: A payroll deduction authorization is a form that allows an employer to deduct specific amounts from an employee's paycheck for a designated purpose.

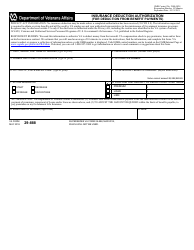

Q: Why would I need a payroll deduction authorization?

A: You would need a payroll deduction authorization if you want to authorize your employer to deduct a specific amount from your paycheck for a specific purpose, such as making a charitable donation or repaying a loan.

Q: How do I obtain a payroll deduction authorization form?

A: You can obtain a payroll deduction authorization form from your employer's human resources department or payroll department.

Q: What information is typically included in a payroll deduction authorization form?

A: A payroll deduction authorization form typically includes the employee's name, employee ID or social security number, the amount to be deducted, the purpose of the deduction, and the duration of the deduction.

Q: Is a payroll deduction authorization legally binding?

A: Yes, a payroll deduction authorization is legally binding as long as it is properly completed and executed by the employee.

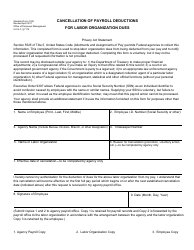

Q: Can I cancel or modify a payroll deduction authorization?

A: Yes, you can usually cancel or modify a payroll deduction authorization by notifying your employer in writing.

Q: What are some common purposes for payroll deductions?

A: Some common purposes for payroll deductions include retirement savings, healthcare benefits, union dues, and charitable donations.

Q: Is a payroll deduction authorization required by law?

A: No, a payroll deduction authorization is not required by law, but it is often used as a way to ensure employee consent and recordkeeping.

Q: Can my employer refuse to honor a payroll deduction authorization?

A: No, once a payroll deduction authorization is properly completed and executed, the employer is generally required to honor it.

Q: Can a payroll deduction authorization be used for wage garnishment?

A: No, a payroll deduction authorization is not used for wage garnishment, which is typically done through a court order or government agency.

Q: Is a payroll deduction authorization specific to the City of Houston, Texas?

A: No, a payroll deduction authorization can be used by any employer in any location, including the City of Houston, Texas.

Form Details:

- Released on July 1, 2013;

- The latest edition currently provided by the Office of Business Opportunity - City of Houston, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of Business Opportunity - City of Houston, Texas.