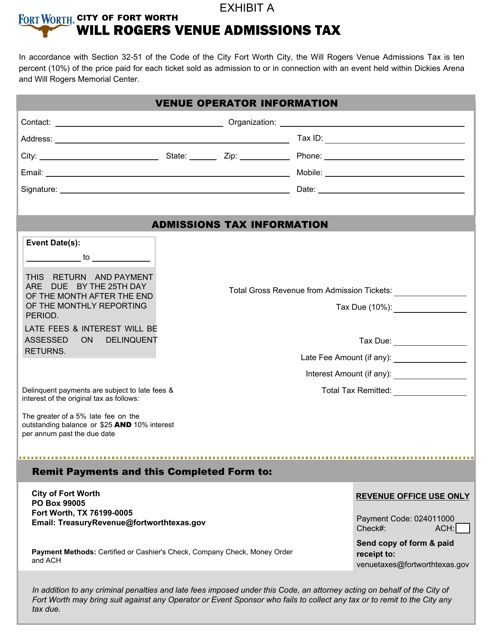

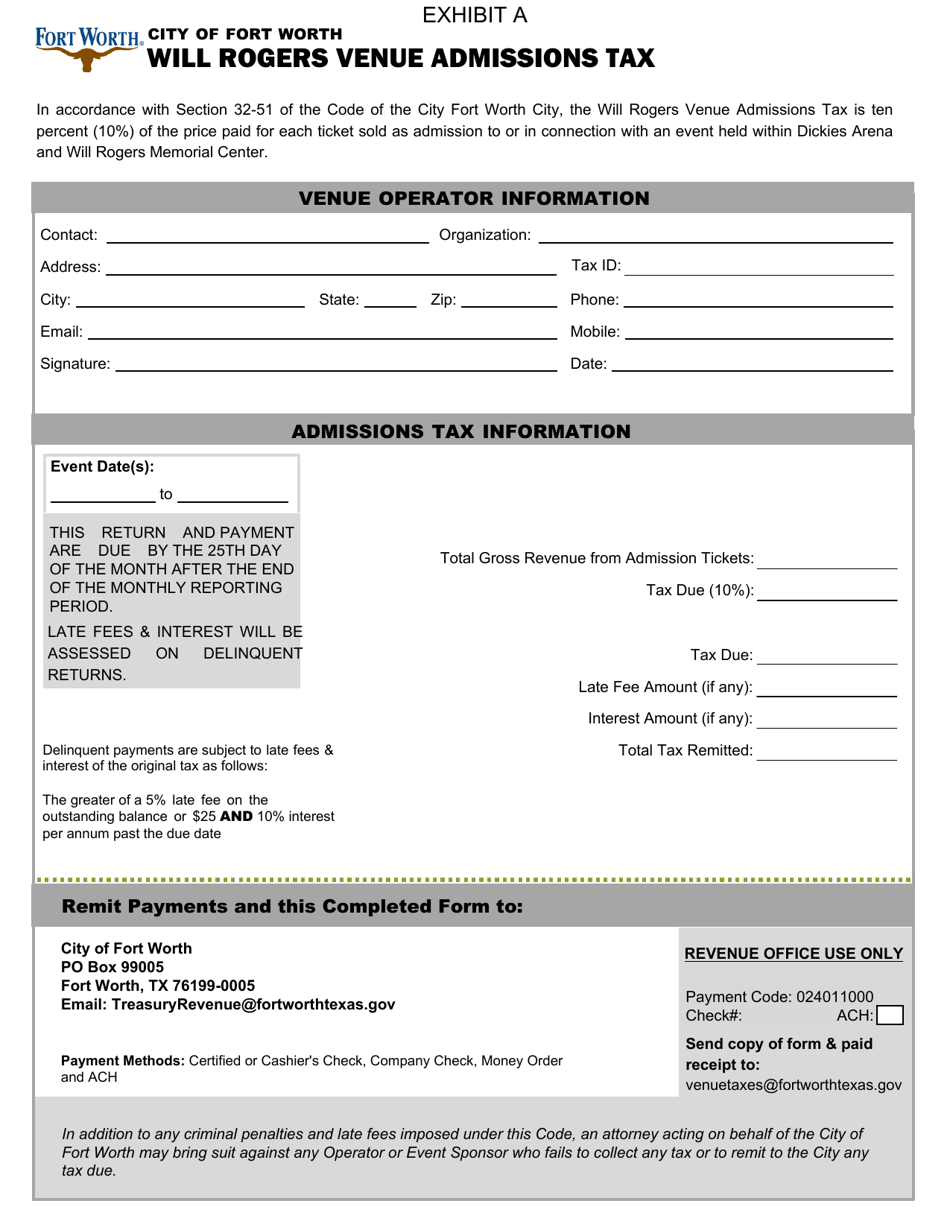

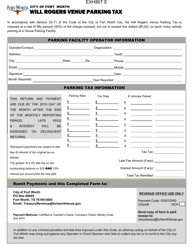

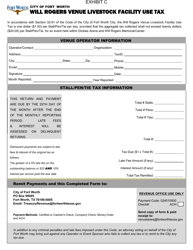

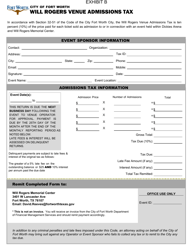

Exhibit A Will Rogers Venue Admissions Tax - City of Fort Worth, Texas

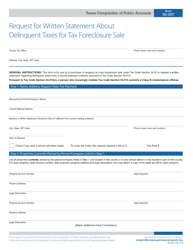

What Is Exhibit A?

This is a legal form that was released by the Public Events Department - City of Fort Worth, Texas - a government authority operating within Texas. The form may be used strictly within City of Fort Worth. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Exhibit A Will Rogers Venue Admissions Tax?

A: Exhibit A Will Rogers Venue Admissions Tax is a tax imposed by the City of Fort Worth, Texas on admissions to events at the Will Rogers Memorial Center.

Q: Why is the tax called Exhibit A Will Rogers Venue Admissions Tax?

A: The tax is called Exhibit A Will Rogers Venue Admissions Tax because it is described in Exhibit A of the Fort Worth Municipal Code and it applies specifically to admissions at the Will Rogers Memorial Center.

Q: Who is responsible for paying the Exhibit A Will Rogers Venue Admissions Tax?

A: The person or entity organizing the event and charging the admission fee is responsible for paying the tax.

Q: How much is the Exhibit A Will Rogers Venue Admissions Tax?

A: The tax rate is 10% of the total admission fee charged for each event.

Q: Are there any exemptions to the Exhibit A Will Rogers Venue Admissions Tax?

A: There are certain exemptions listed in the Fort Worth Municipal Code, such as events organized by government entities or nonprofit organizations, and events with free admission.

Q: What is the purpose of the Exhibit A Will Rogers Venue Admissions Tax?

A: The tax revenue helps fund the operations and maintenance of the Will Rogers Memorial Center and support the City of Fort Worth's cultural and recreational programs.

Q: How often is the Exhibit A Will Rogers Venue Admissions Tax collected?

A: The tax is collected on a per-event basis.

Q: Is the Exhibit A Will Rogers Venue Admissions Tax refundable?

A: No, the tax is not refundable once it has been collected.

Form Details:

- The latest edition provided by the Public Events Department - City of Fort Worth, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Exhibit A by clicking the link below or browse more documents and templates provided by the Public Events Department - City of Fort Worth, Texas.