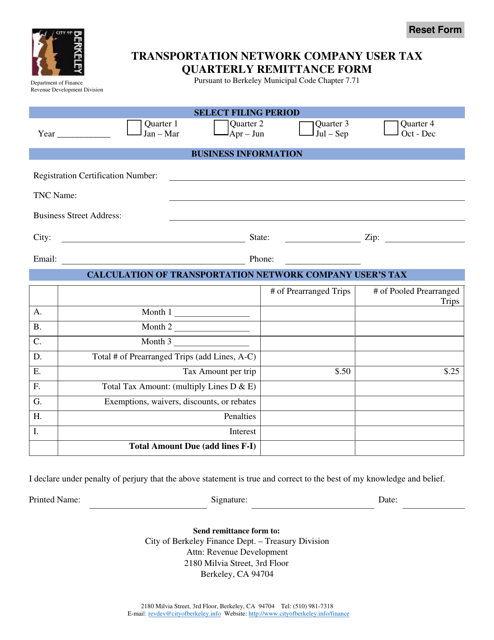

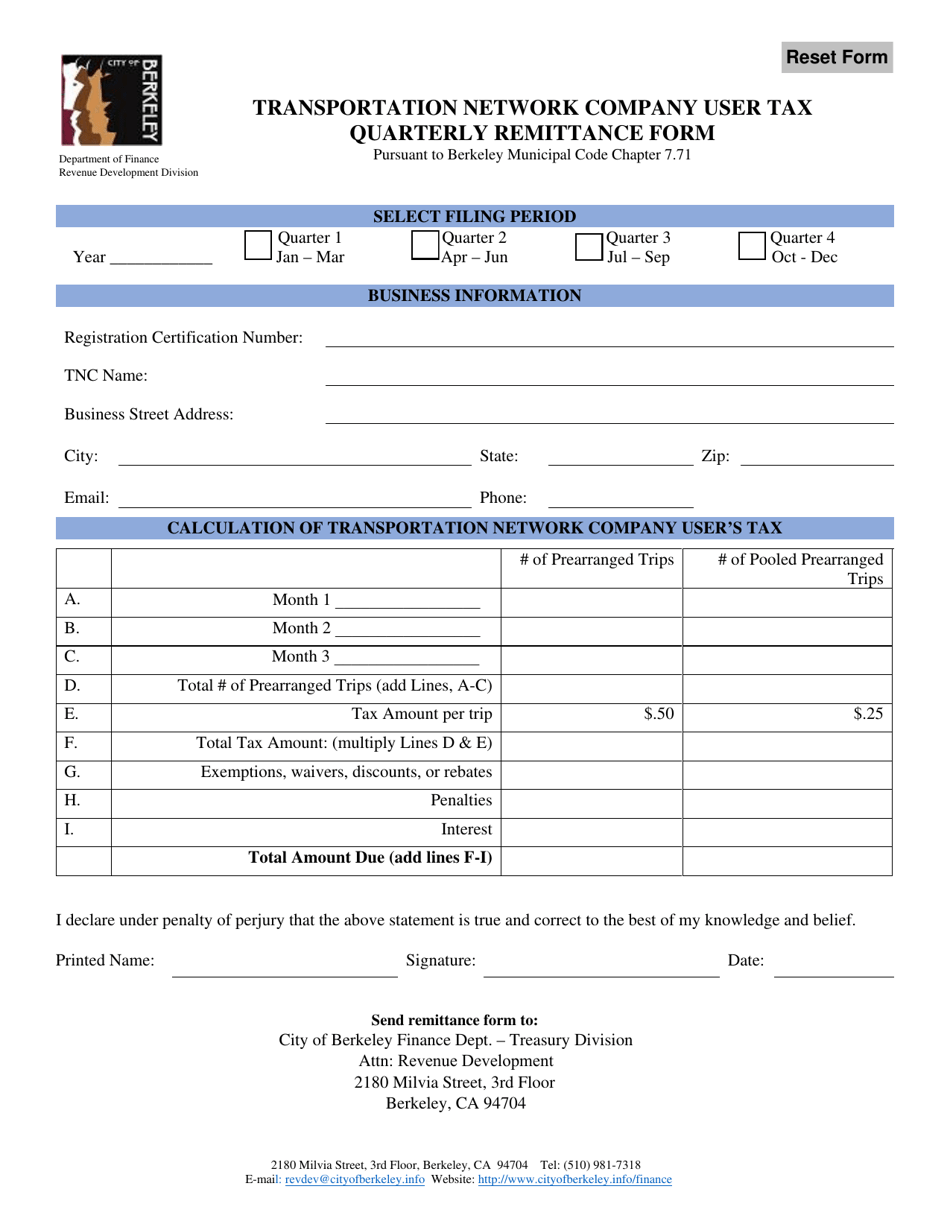

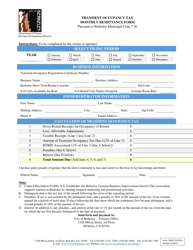

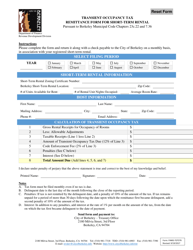

Transportation Network Company User Tax Quarterly Remittance Form - City of Berkeley, California

Transportation Network Company User Tax Quarterly Remittance Form is a legal document that was released by the Finance Department - City of Berkeley, California - a government authority operating within California. The form may be used strictly within City of Berkeley.

FAQ

Q: What is the Transportation Network Company User Tax?

A: The Transportation Network Company User Tax is a tax imposed on users of transportation network companies (e.g. Uber, Lyft) in the City of Berkeley, California.

Q: Who is responsible for paying the tax?

A: The users of transportation network companies are responsible for paying the tax.

Q: How often is the tax remittance form submitted?

A: The tax remittance form must be submitted quarterly.

Q: Is the tax applicable only to residents of Berkeley?

A: No, the tax is applicable to all users of transportation network companies in the City of Berkeley, regardless of their residency.

Form Details:

- The latest edition currently provided by the Finance Department - City of Berkeley, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Berkeley, California.