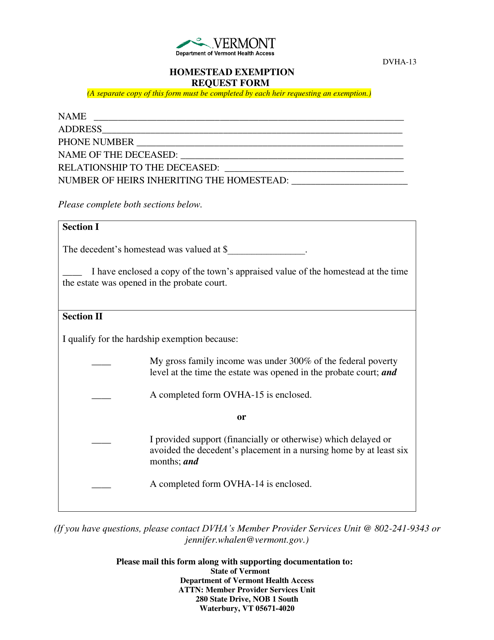

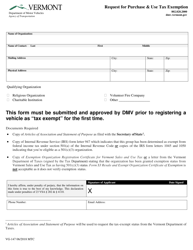

Form DVHA-13 Homestead Exemption Request Form - Vermont

What Is Form DVHA-13?

This is a legal form that was released by the Department of Vermont Health Access - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DVHA-13 Homestead Exemption Request Form?

A: The DVHA-13 Homestead Exemption Request Form is a document used in Vermont to apply for a homestead exemption on property taxes.

Q: What is a homestead exemption?

A: A homestead exemption is a reduction in property taxes for homeowners who occupy their property as their primary residence.

Q: Who is eligible for the homestead exemption?

A: To be eligible for the homestead exemption, you must own and occupy your property as your primary residence.

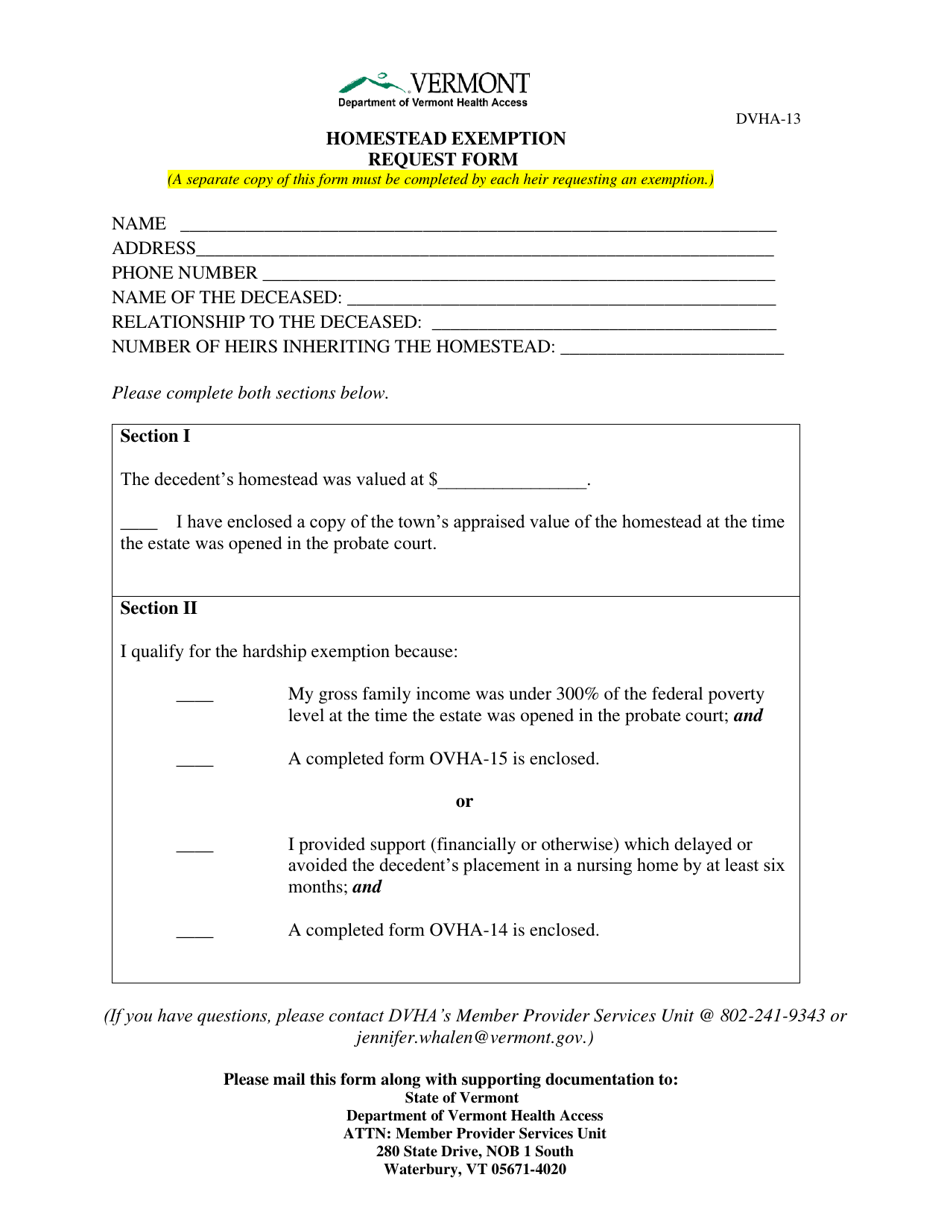

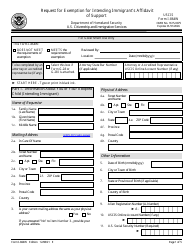

Q: How do I fill out the DVHA-13 form?

A: To fill out the DVHA-13 form, you will need to provide your property information, income information, and sign the form.

Q: When is the deadline to submit the DVHA-13 form?

A: The deadline to submit the DVHA-13 form for the homestead exemption is April 15th of each year.

Q: What are the benefits of the homestead exemption?

A: The homestead exemption can help reduce your property tax liability, making homeownership more affordable.

Q: Can I qualify for the homestead exemption if I rent out a portion of my property?

A: No, the homestead exemption is only available for properties that are owner-occupied as a primary residence.

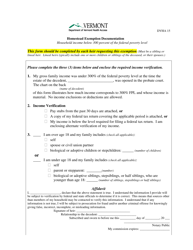

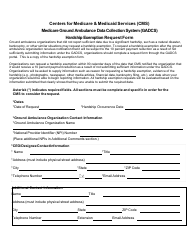

Q: What supporting documents do I need to include with the DVHA-13 form?

A: You may need to include documents such as income tax returns, proof of residency, and property ownership documents with the DVHA-13 form.

Q: Who can I contact for more information about the DVHA-13 form and the homestead exemption?

A: You can contact the Vermont Department of Taxes for more information about the DVHA-13 form and the homestead exemption.

Form Details:

- The latest edition provided by the Department of Vermont Health Access;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DVHA-13 by clicking the link below or browse more documents and templates provided by the Department of Vermont Health Access.