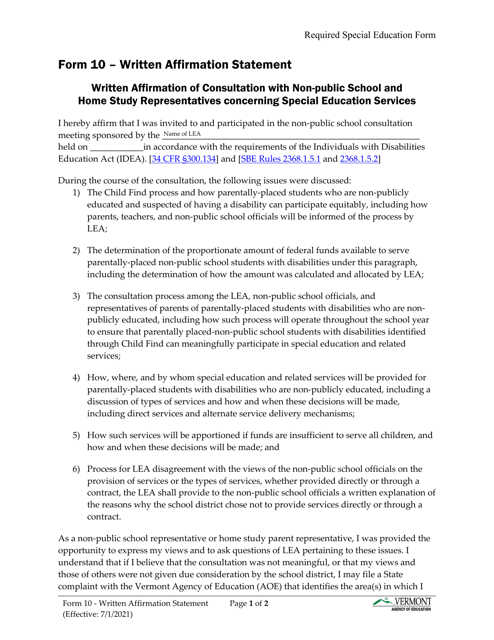

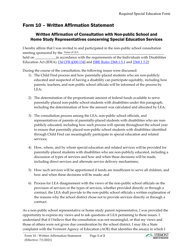

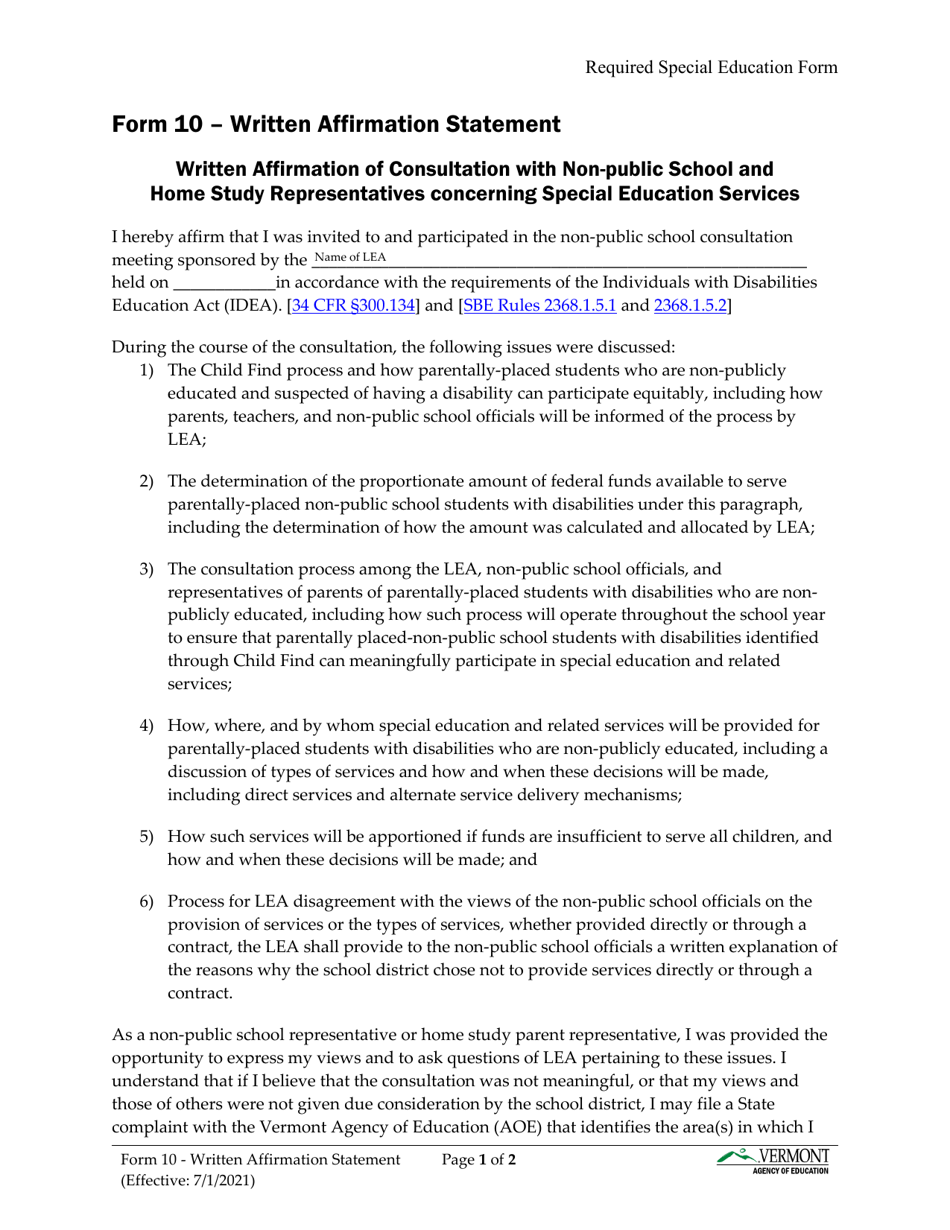

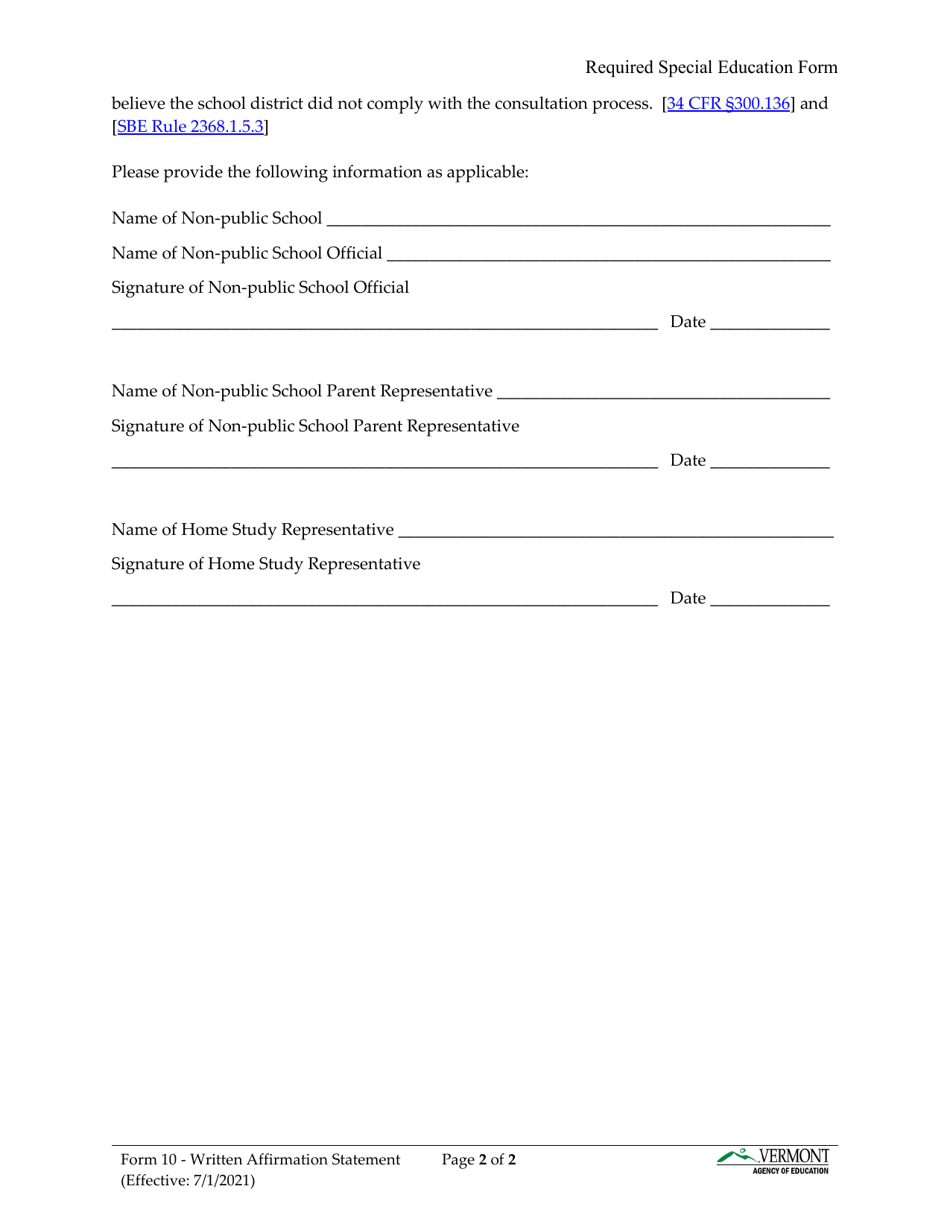

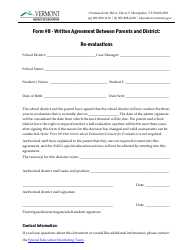

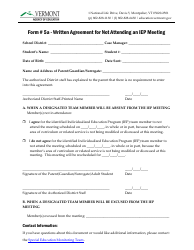

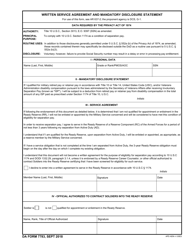

Form 10 Written Affirmation Statement - Vermont

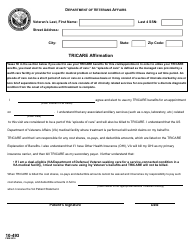

What Is Form 10?

This is a legal form that was released by the Vermont Agency of Education - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10?

A: Form 10 is a Written Affirmation Statement used in Vermont.

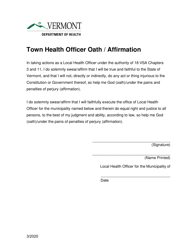

Q: Who needs to fill out Form 10?

A: Individuals or businesses who want to affirm the accuracy of information previously submitted to the Vermont Department of Taxes.

Q: What is the purpose of Form 10?

A: The purpose of Form 10 is to provide a legal affirmation that the previously submitted information is accurate and complete.

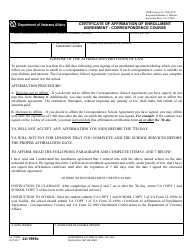

Q: Is Form 10 mandatory?

A: Form 10 is mandatory for individuals or businesses who need to affirm the accuracy of previously submitted information.

Q: What information is required on Form 10?

A: Form 10 requires basic information such as name, taxpayer identification number, and a statement affirming the accuracy of the previously submitted information.

Q: Is there a deadline for submitting Form 10?

A: The deadline for submitting Form 10 is usually specified by the Vermont Department of Taxes and may vary depending on the tax year.

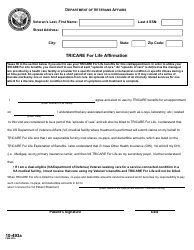

Q: What should I do if I discover an error after submitting Form 10?

A: If you discover an error after submitting Form 10, you should contact the Vermont Department of Taxes to make the necessary corrections.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Vermont Agency of Education;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10 by clicking the link below or browse more documents and templates provided by the Vermont Agency of Education.