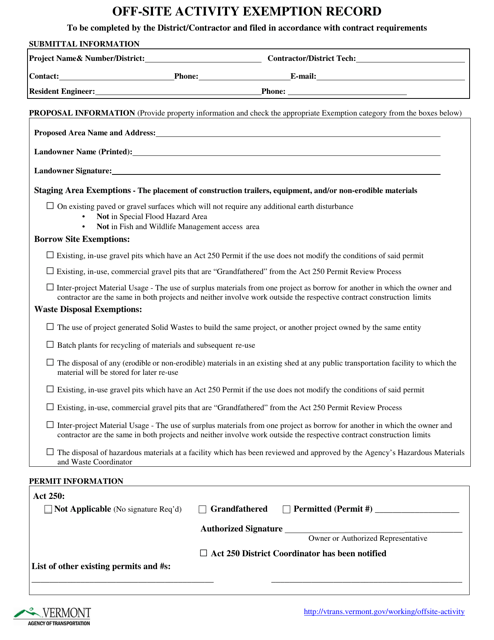

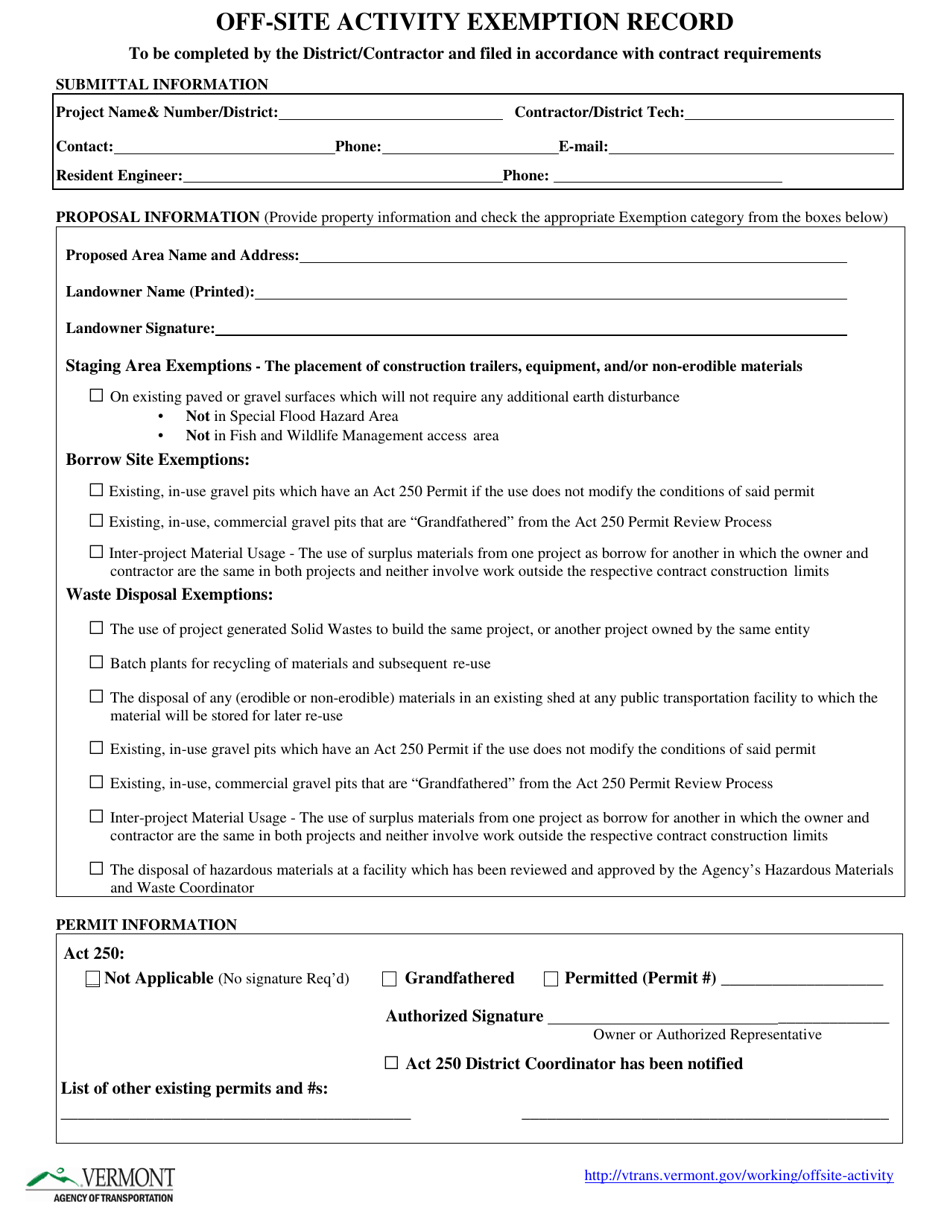

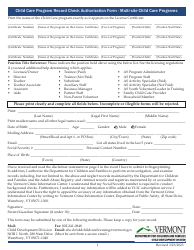

Off-Site Activity Exemption Record - Vermont

Off-Site Activity Exemption Record is a legal document that was released by the Vermont Agency of Transportation - a government authority operating within Vermont.

FAQ

Q: What is an Off-Site Activity Exemption Record in Vermont?

A: An Off-Site Activity Exemption Record is a document that allows certain businesses or organizations in Vermont to be exempt from collecting sales or use tax on items used in specific off-site activities.

Q: Which businesses or organizations can qualify for an Off-Site Activity Exemption Record in Vermont?

A: Businesses or organizations that qualify for an Off-Site Activity Exemption Record in Vermont include certain non-profit organizations, agricultural fair associations, military service organizations, and volunteer fire departments.

Q: What activities are covered under the Off-Site Activity Exemption Record in Vermont?

A: The Off-Site Activity Exemption Record in Vermont covers activities such as fundraising events, charitable activities, agricultural fairs, and emergency response services.

Q: How does an eligible business or organization obtain an Off-Site Activity Exemption Record in Vermont?

A: To obtain an Off-Site Activity Exemption Record in Vermont, eligible businesses or organizations must apply to the Vermont Department of Taxes and provide necessary documentation and information.

Q: What are the benefits of having an Off-Site Activity Exemption Record in Vermont?

A: Having an Off-Site Activity Exemption Record in Vermont allows eligible businesses or organizations to be exempt from collecting sales or use tax on items used in qualifying off-site activities, potentially reducing their operating costs.

Q: Is an Off-Site Activity Exemption Record in Vermont permanent?

A: No, an Off-Site Activity Exemption Record in Vermont is not permanent. It must be renewed annually.

Q: Are there any limitations or restrictions to the Off-Site Activity Exemption Record in Vermont?

A: Yes, there are limitations and restrictions to the Off-Site Activity Exemption Record in Vermont. The exemption does not apply to items used for personal purposes, non-qualifying activities, or items purchased from sellers who are not required to collect sales or use tax in Vermont.

Form Details:

- The latest edition currently provided by the Vermont Agency of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Agency of Transportation.