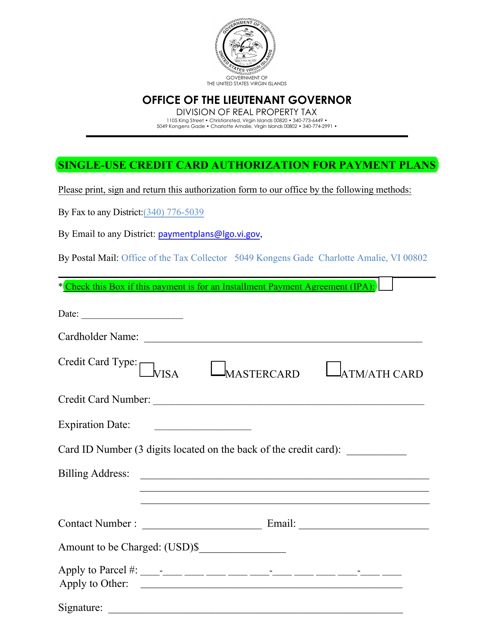

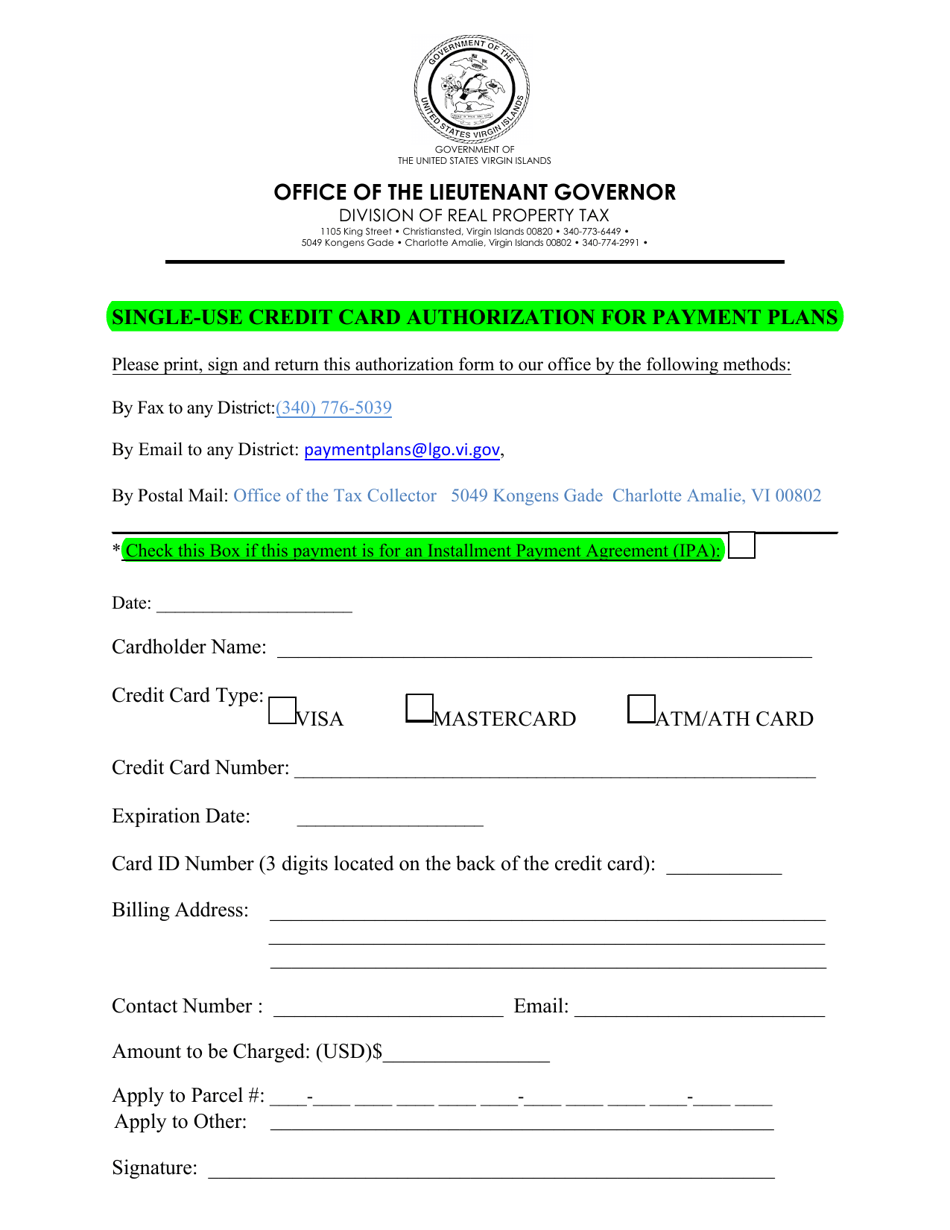

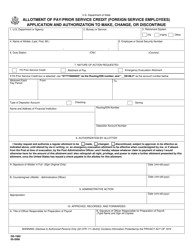

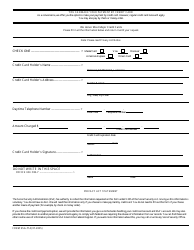

Single-Use Credit Card Authorization for Payment Plans - Virgin Islands

Single-Use Credit Card Authorization for Payment Plans is a legal document that was released by the Virgin Islands Office of the Lieutenant Governor - a government authority operating within Virgin Islands.

FAQ

Q: What is a single-use credit card authorization?

A: A single-use credit card authorization is a temporary authorization that allows a merchant to charge a credit card for a specific amount and limited time period.

Q: How does a single-use credit card authorization work?

A: When making a purchase or setting up a payment plan, the merchant may request a single-use credit card authorization. This authorization allows them to charge the card for the agreed-upon amount.

Q: Why would a merchant request a single-use credit card authorization?

A: Merchants may request a single-use credit card authorization to ensure that they are able to secure payment for the goods or services provided.

Q: What are the benefits of using a single-use credit card authorization?

A: Using a single-use credit card authorization can provide both merchants and customers with added security. The temporary authorization limits the risk of unauthorized charges and ensures that the merchant is paid for their products or services.

Q: Are there any limitations or restrictions when using a single-use credit card authorization?

A: The limitations or restrictions when using a single-use credit card authorization may vary depending on the merchant's policies. It is important to review and understand the terms and conditions before providing authorization.

Form Details:

- The latest edition currently provided by the Virgin Islands Office of the Lieutenant Governor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virgin Islands Office of the Lieutenant Governor.