This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

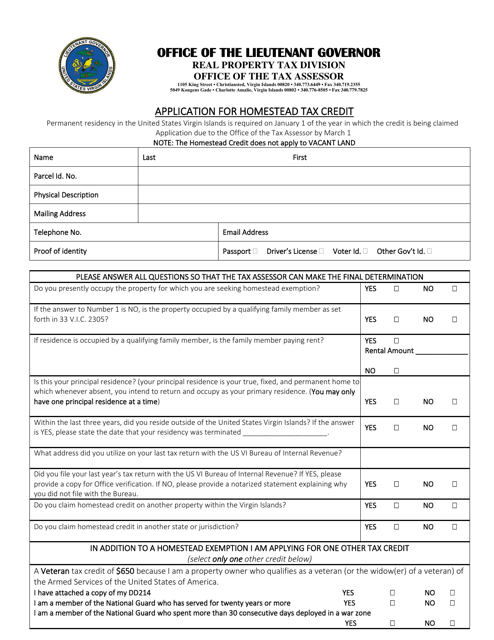

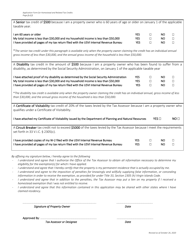

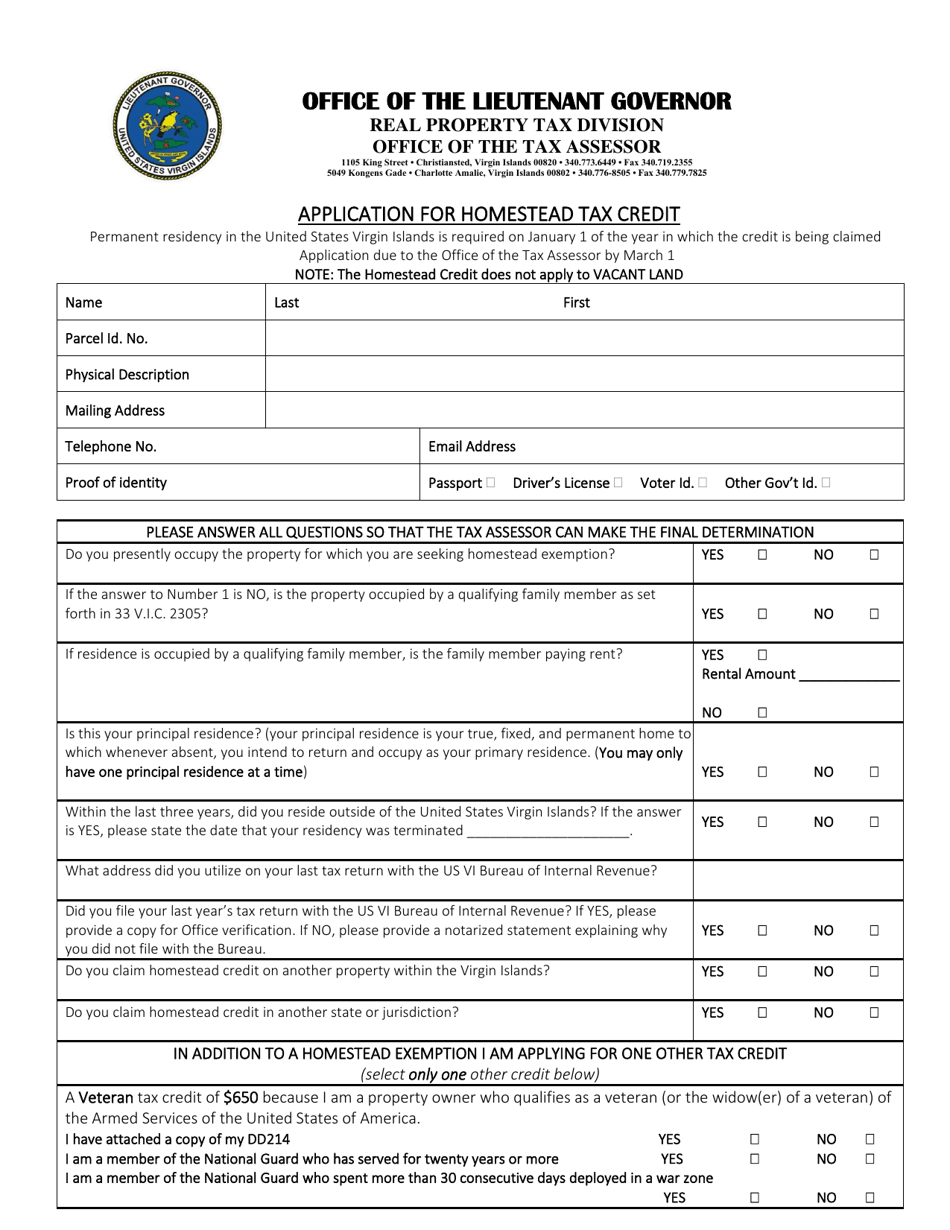

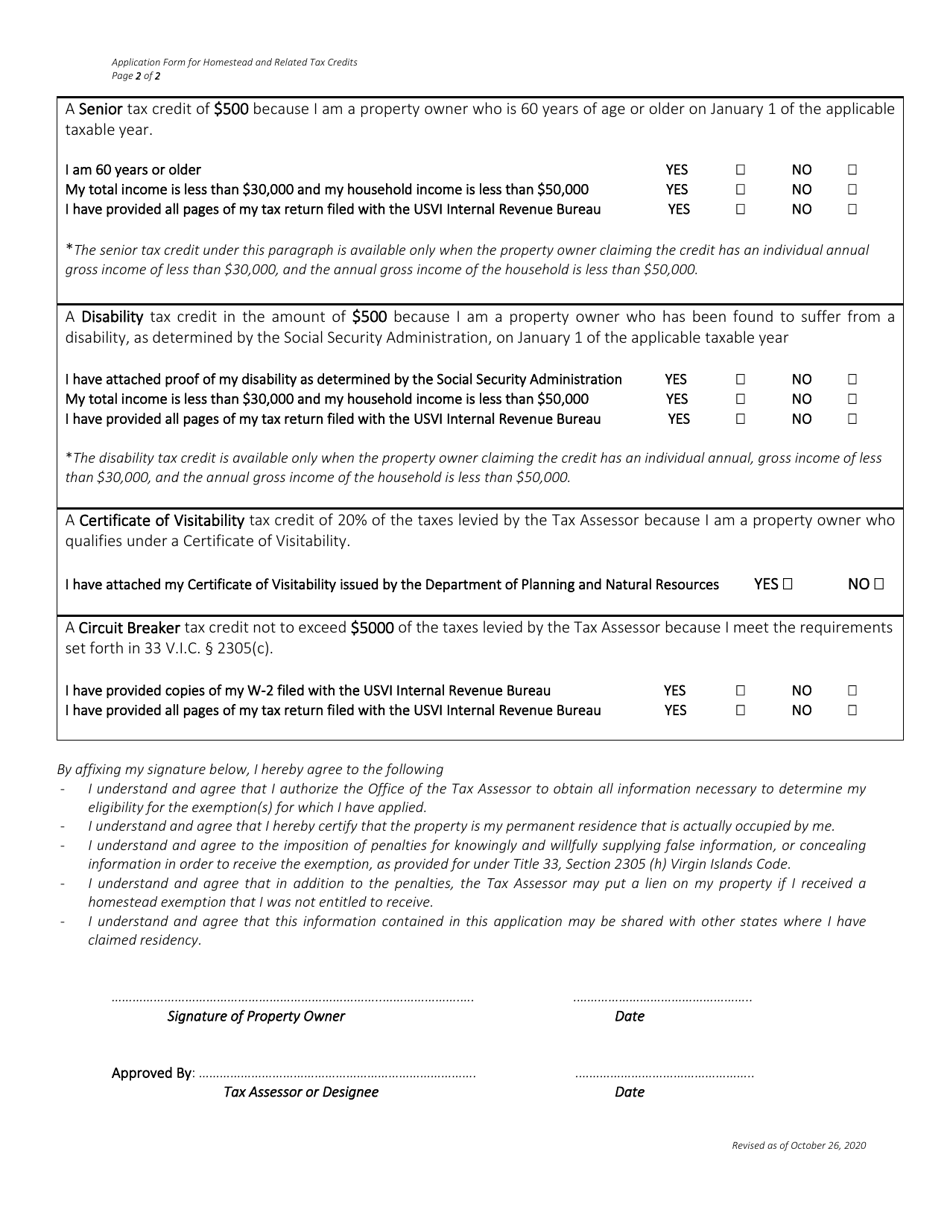

Application for Homestead Tax Credit - Virgin Islands

Application for Homestead Tax Credit is a legal document that was released by the Virgin Islands Office of the Lieutenant Governor - a government authority operating within Virgin Islands.

FAQ

Q: What is the Homestead Tax Credit in Virgin Islands?

A: The Homestead Tax Credit in Virgin Islands is a tax benefit for homeowners that can lower their property taxes.

Q: Who is eligible for the Homestead Tax Credit in Virgin Islands?

A: To be eligible for the Homestead Tax Credit in Virgin Islands, you must be the owner and resident of the property and use it as your primary residence.

Q: How can I apply for the Homestead Tax Credit in Virgin Islands?

A: To apply for the Homestead Tax Credit in Virgin Islands, you need to complete an application form and submit it to the Tax Assessor's Office.

Q: What documents do I need to include with my Homestead Tax Credit application in Virgin Islands?

A: You will typically need to provide proof of ownership, proof of residency, and other supporting documents like a property tax bill or lease agreement.

Q: When is the deadline to apply for the Homestead Tax Credit in Virgin Islands?

A: The deadline to apply for the Homestead Tax Credit in Virgin Islands varies, so it's best to check with the Tax Assessor's Office for the specific deadline.

Q: What are the benefits of the Homestead Tax Credit in Virgin Islands?

A: The Homestead Tax Credit in Virgin Islands can help reduce your property taxes, which can provide financial relief for homeowners.

Q: Can I apply for the Homestead Tax Credit if I rent out a portion of my property?

A: Typically, the Homestead Tax Credit in Virgin Islands only applies to properties that are used as a primary residence, so renting out a portion of the property may disqualify you.

Q: Is the Homestead Tax Credit in Virgin Islands available to second homeowners or vacation properties?

A: No, the Homestead Tax Credit in Virgin Islands is generally only available to homeowners who use the property as their primary residence.

Q: What happens if I sell my property after receiving the Homestead Tax Credit in Virgin Islands?

A: If you sell your property, you should notify the Tax Assessor's Office in Virgin Islands, as the Homestead Tax Credit may no longer apply.

Form Details:

- Released on October 26, 2020;

- The latest edition currently provided by the Virgin Islands Office of the Lieutenant Governor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virgin Islands Office of the Lieutenant Governor.