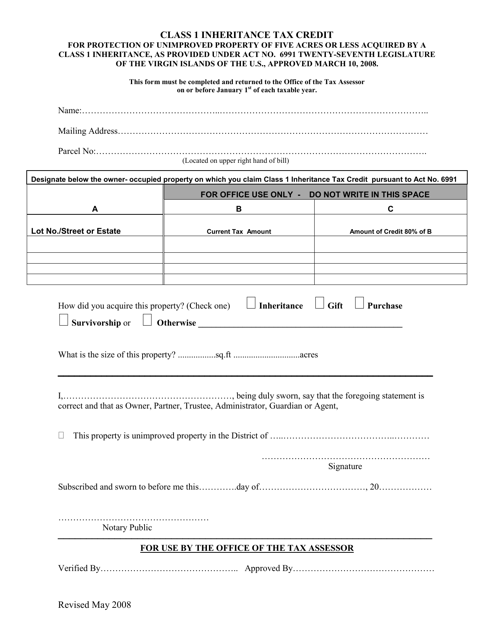

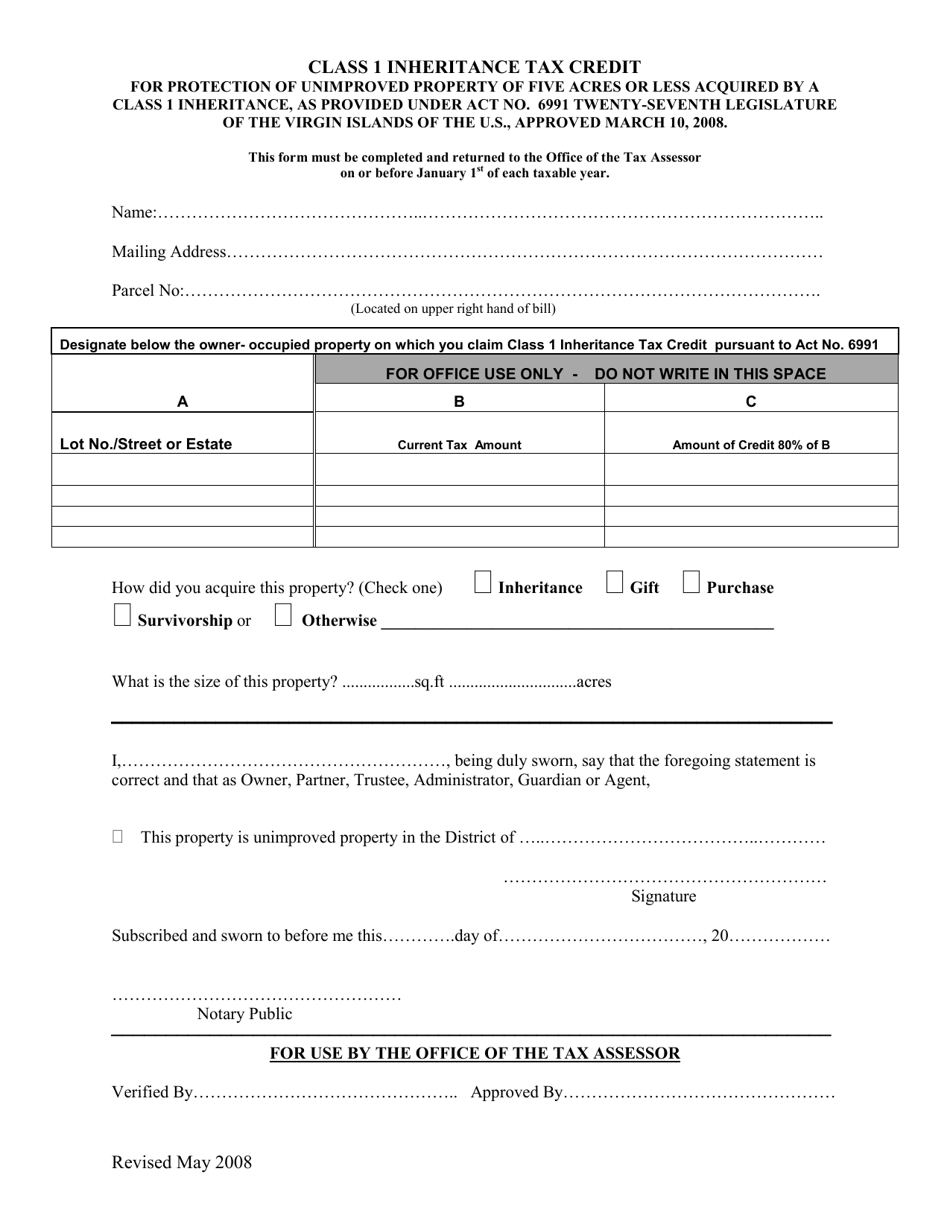

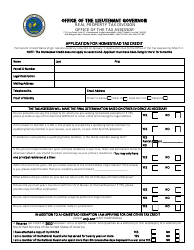

Class 1 Inheritance Tax Credit Application - Virgin Islands

Class 1 Inheritance Tax Credit Application is a legal document that was released by the Virgin Islands Office of the Lieutenant Governor - a government authority operating within Virgin Islands.

FAQ

Q: What is the Class 1 Inheritance Tax Credit Application?

A: The Class 1 Inheritance Tax Credit Application is a form required for individuals or entities who wish to claim a tax credit on inheritance taxes in the Virgin Islands.

Q: Who is eligible to apply for the Class 1 Inheritance Tax Credit?

A: Individuals or entities who have paid or will pay inheritance taxes in the Virgin Islands may be eligible to apply for the Class 1 Inheritance Tax Credit.

Q: How can I obtain the Class 1 Inheritance Tax Credit Application form?

A: You can obtain the Class 1 Inheritance Tax Credit Application form from the Virgin Islands Bureau of Internal Revenue.

Q: Are there any deadlines for submitting the Class 1 Inheritance Tax Credit Application?

A: Yes, the Class 1 Inheritance Tax Credit Application must be submitted within a certain period after the payment of inheritance taxes. It is recommended to check with the Virgin Islands Bureau of Internal Revenue for the specific deadlines.

Q: What documents are required to be submitted with the Class 1 Inheritance Tax Credit Application?

A: The Class 1 Inheritance Tax Credit Application must be accompanied by documents such as the proof of payment of inheritance taxes, the death certificate of the deceased, and any other relevant supporting documentation.

Q: What happens after I submit the Class 1 Inheritance Tax Credit Application?

A: After you submit the Class 1 Inheritance Tax Credit Application, it will be reviewed by the Virgin Islands Bureau of Internal Revenue, and if approved, you may be eligible for a tax credit on inheritance taxes.

Form Details:

- Released on May 1, 2008;

- The latest edition currently provided by the Virgin Islands Office of the Lieutenant Governor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virgin Islands Office of the Lieutenant Governor.