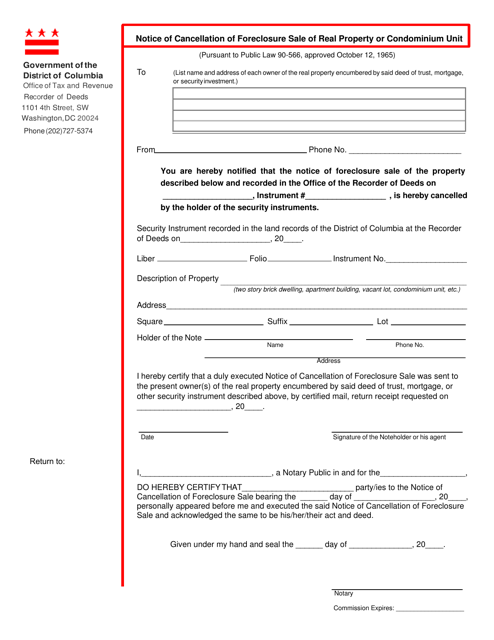

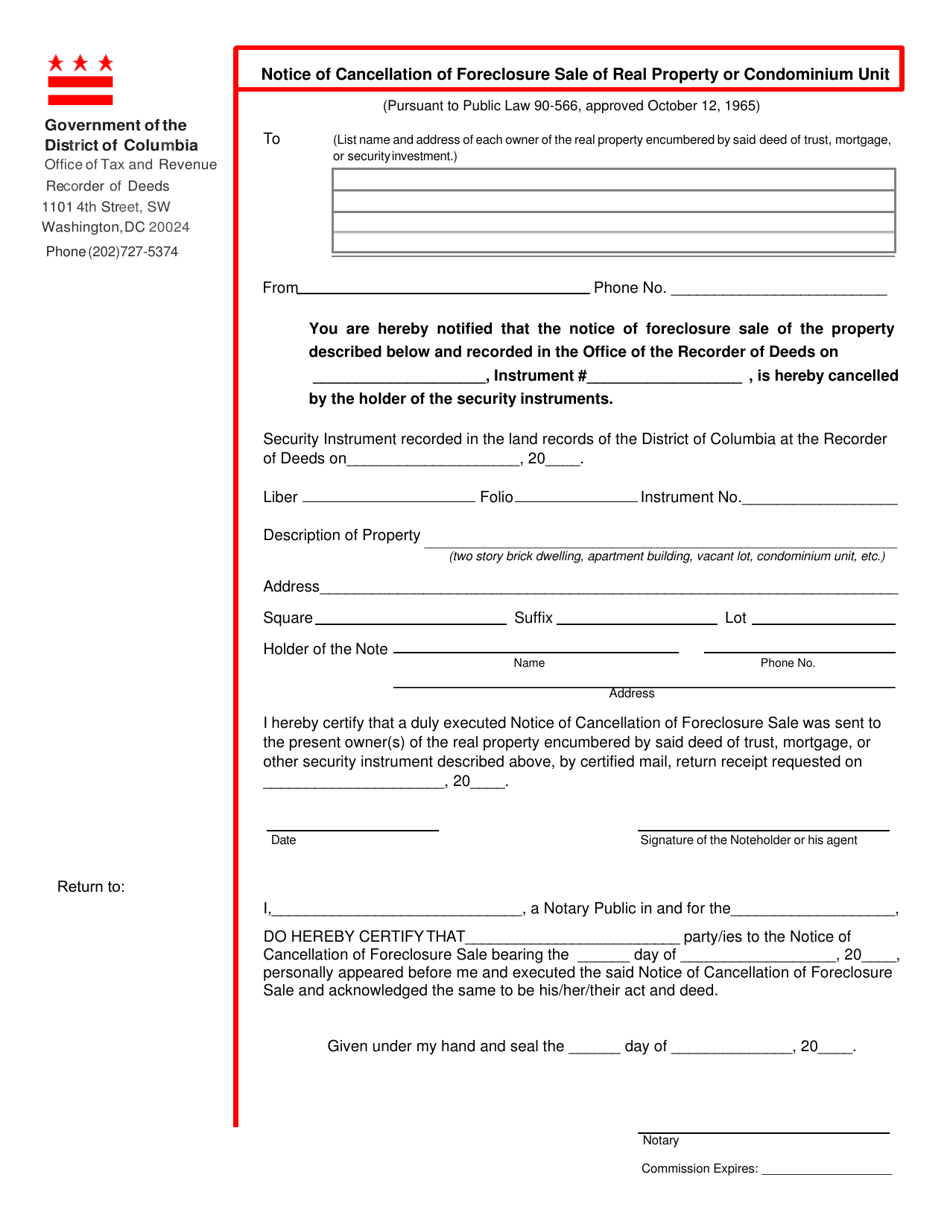

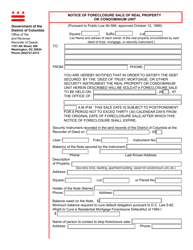

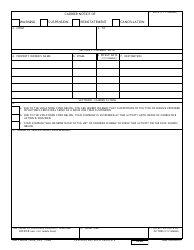

Form ROD15 Notice of Cancellation of Foreclosure Sale of Real Property or Condominium Unit - Washington, D.C.

What Is Form ROD15?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a ROD15 Notice of Cancellation of Foreclosure Sale?

A: A ROD15 Notice of Cancellation of Foreclosure Sale is a document used in Washington, D.C. to cancel a foreclosure sale of real property or condominium unit.

Q: When is a ROD15 Notice of Cancellation of Foreclosure Sale used?

A: A ROD15 Notice of Cancellation of Foreclosure Sale is used when a previously scheduled foreclosure sale needs to be canceled.

Q: Why would a foreclosure sale be canceled?

A: There are several reasons why a foreclosure sale might be canceled, such as the property owner paying off the debt, reaching a settlement agreement with the lender, or legal issues arising.

Q: Does a ROD15 Notice of Cancellation of Foreclosure Sale apply to Washington, D.C. only?

A: Yes, a ROD15 Notice of Cancellation of Foreclosure Sale is specific to Washington, D.C. and its regulations.

Q: Who is responsible for submitting the ROD15 Notice of Cancellation of Foreclosure Sale?

A: Typically, the lender or their legal representative is responsible for submitting the ROD15 Notice of Cancellation of Foreclosure Sale.

Q: What information is included in a ROD15 Notice of Cancellation of Foreclosure Sale?

A: A ROD15 Notice of Cancellation of Foreclosure Sale includes information such as the property owner's name, the foreclosure sale date, and the reason for cancellation.

Q: Is there a deadline for submitting the ROD15 Notice of Cancellation of Foreclosure Sale?

A: Yes, the ROD15 Notice of Cancellation of Foreclosure Sale must be submitted before the scheduled sale date.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD15 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.