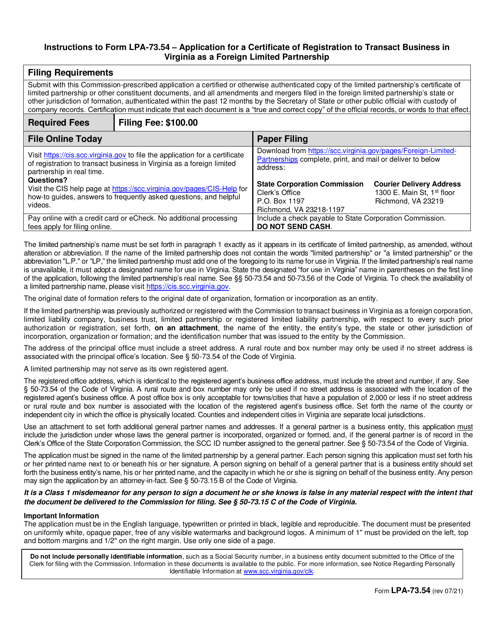

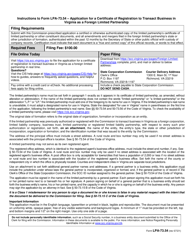

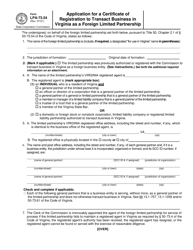

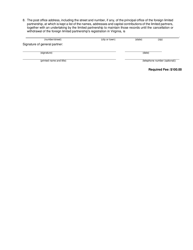

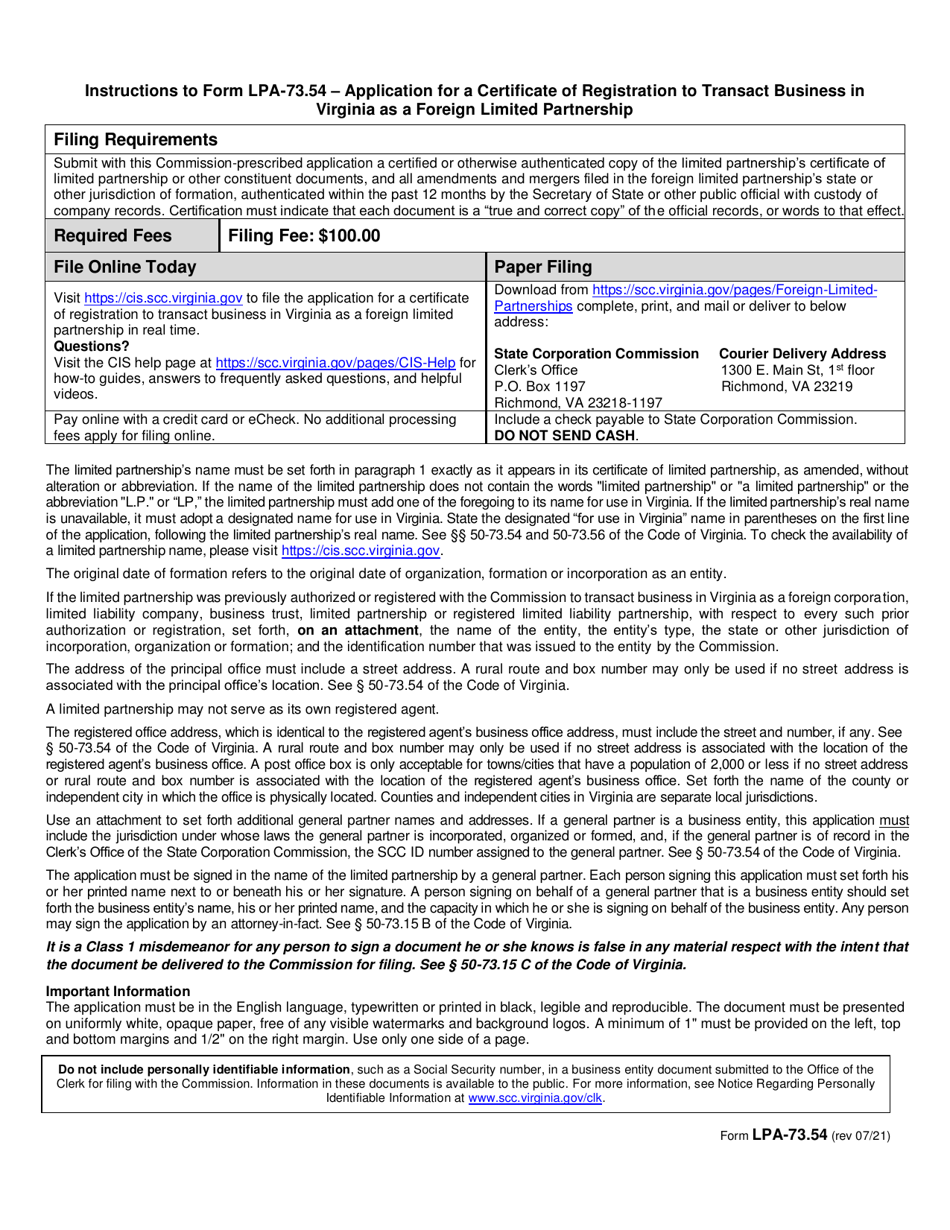

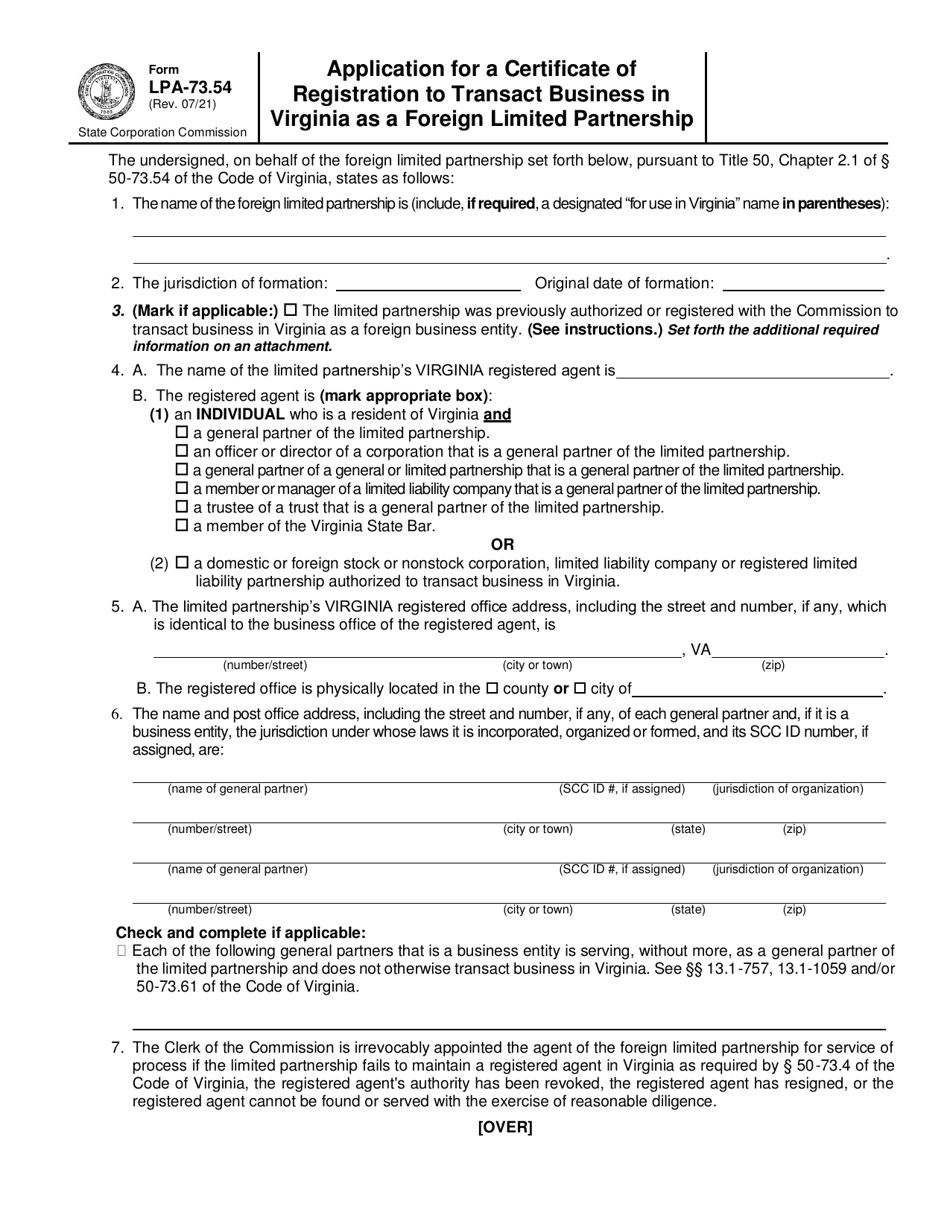

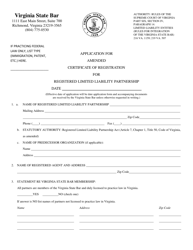

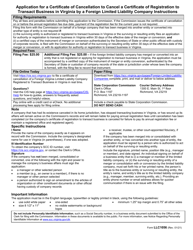

Form LPA-73.54 Application for a Certificate of Registration to Transact Business in Virginia as a Foreign Limited Partnership - Virginia

What Is Form LPA-73.54?

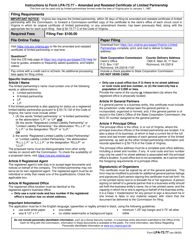

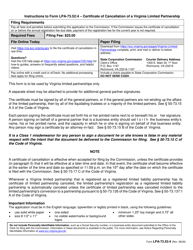

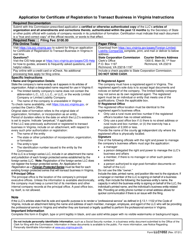

This is a legal form that was released by the Virginia State Corporation Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LPA-73.54?

A: Form LPA-73.54 is the Application for a Certificate of Registration to Transact Business in Virginia as a Foreign Limited Partnership.

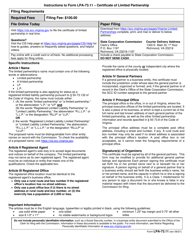

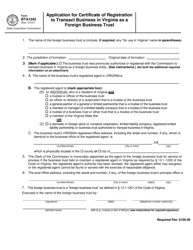

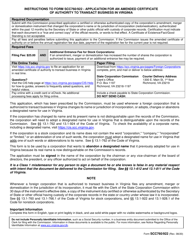

Q: What is a Foreign Limited Partnership?

A: A Foreign Limited Partnership is a partnership that is formed in another state or jurisdiction and is seeking to do business in Virginia.

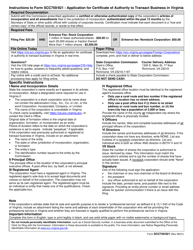

Q: Who needs to file Form LPA-73.54?

A: Any Foreign Limited Partnership that wants to transact business in Virginia needs to file Form LPA-73.54.

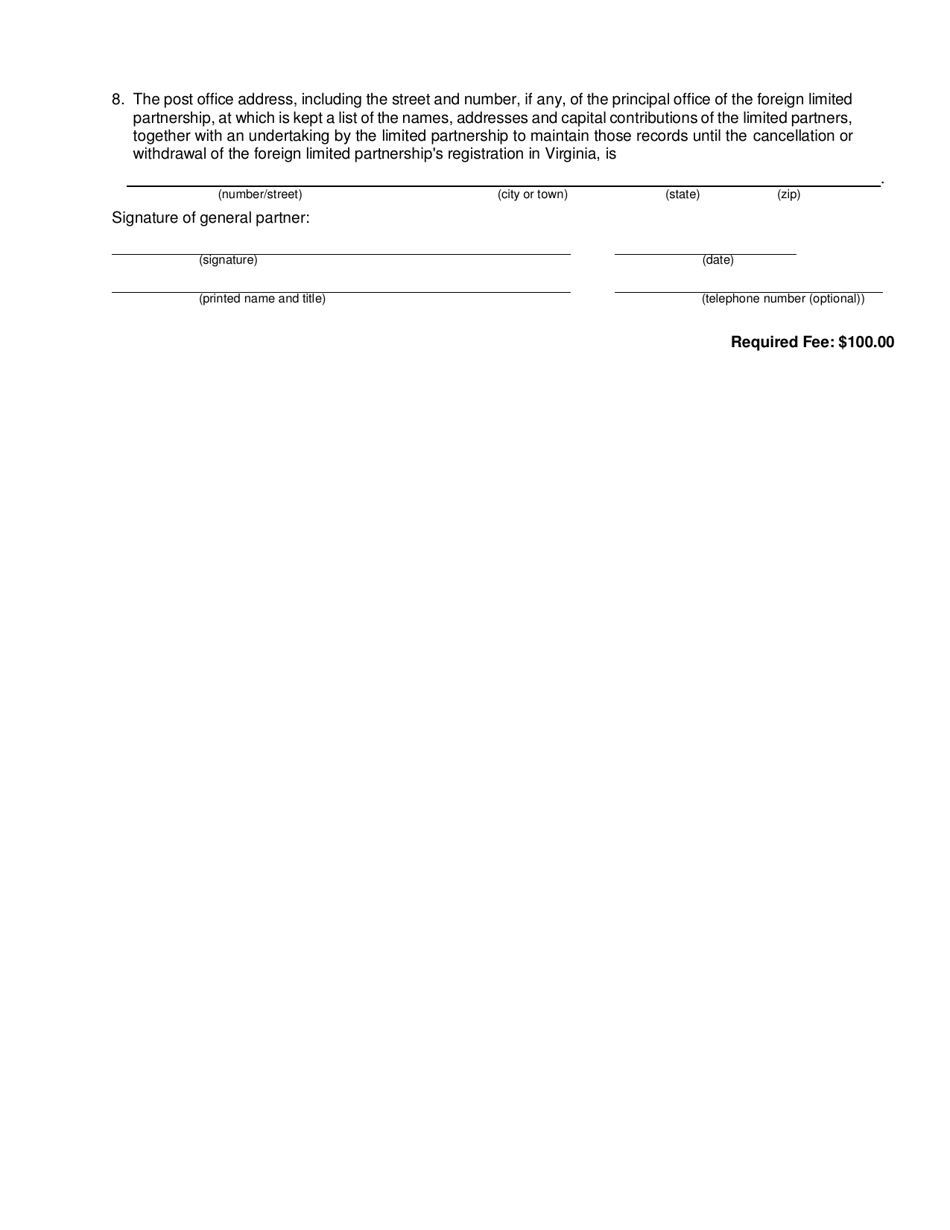

Q: What information is required on Form LPA-73.54?

A: Form LPA-73.54 requires information such as the name and address of the Foreign Limited Partnership, the state or jurisdiction of formation, and the registered agent in Virginia.

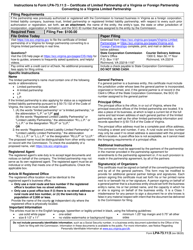

Q: What happens after I file Form LPA-73.54?

A: After you file Form LPA-73.54 and the fee is paid, the Virginia State Corporation Commission will review the application and issue a Certificate of Registration if all requirements are met.

Q: Do I need to renew my Certificate of Registration?

A: Yes, the Certificate of Registration needs to be renewed annually by filing an annual report with the Virginia State Corporation Commission.

Q: Can I transact business in Virginia before I receive my Certificate of Registration?

A: No, you cannot transact business in Virginia until you receive your Certificate of Registration.

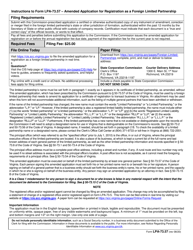

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Virginia State Corporation Commission;

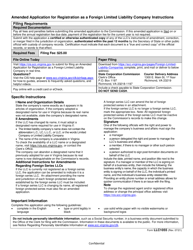

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LPA-73.54 by clicking the link below or browse more documents and templates provided by the Virginia State Corporation Commission.