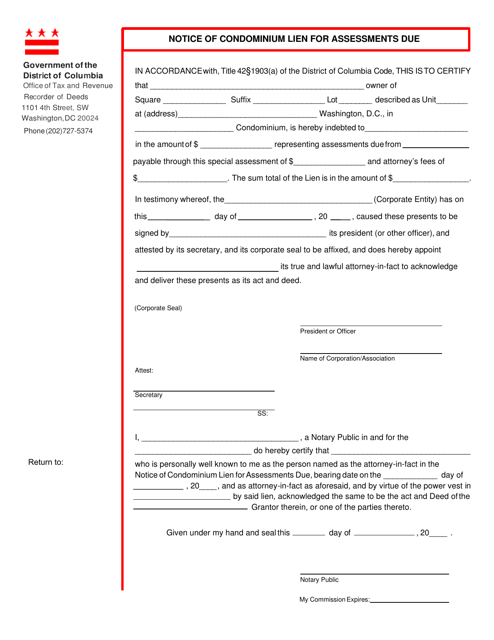

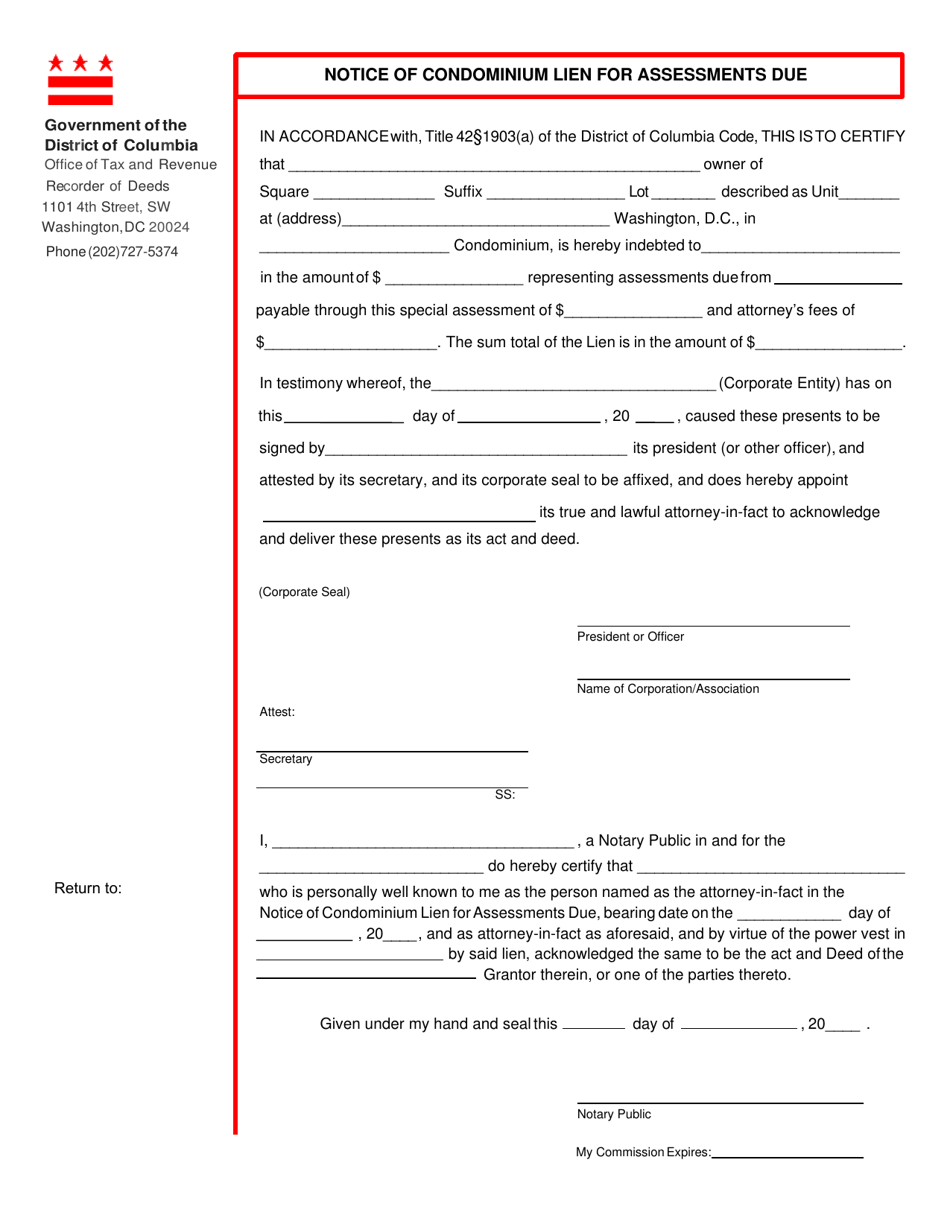

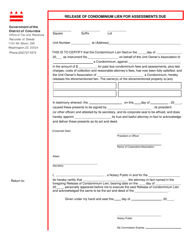

Form ROD12 Notice of Condominium Lien for Assessments Due - Washington, D.C.

What Is Form ROD12?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ROD12?

A: Form ROD12 is a Notice of Condominium Lien for Assessments Due in Washington, D.C.

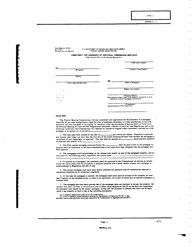

Q: When is Form ROD12 used?

A: Form ROD12 is used when a condominium owner has failed to pay their assessments and a lien needs to be placed on their property.

Q: What is a condominium lien?

A: A condominium lien is a legal claim placed on a property by the condominium association to secure unpaid assessments or fees.

Q: Who uses Form ROD12?

A: Form ROD12 is used by condominium associations in Washington, D.C.

Q: What are assessments?

A: Assessments are fees charged by the condominium association to cover the costs of maintaining and managing the common areas and amenities of the condominium.

Q: Is Form ROD12 specific to Washington, D.C.?

A: Yes, Form ROD12 is specific to Washington, D.C.

Q: Is there a deadline for filing Form ROD12?

A: Yes, there is a deadline for filing Form ROD12. It must be filed within 90 days of the due date of the assessment that is the subject of the lien.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD12 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.