This version of the form is not currently in use and is provided for reference only. Download this version of

Form ROD9

for the current year.

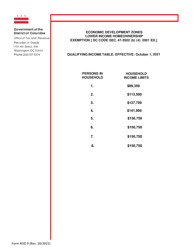

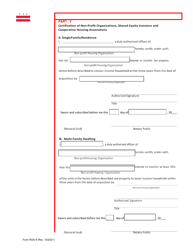

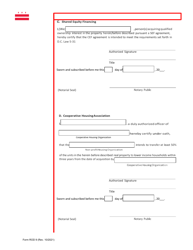

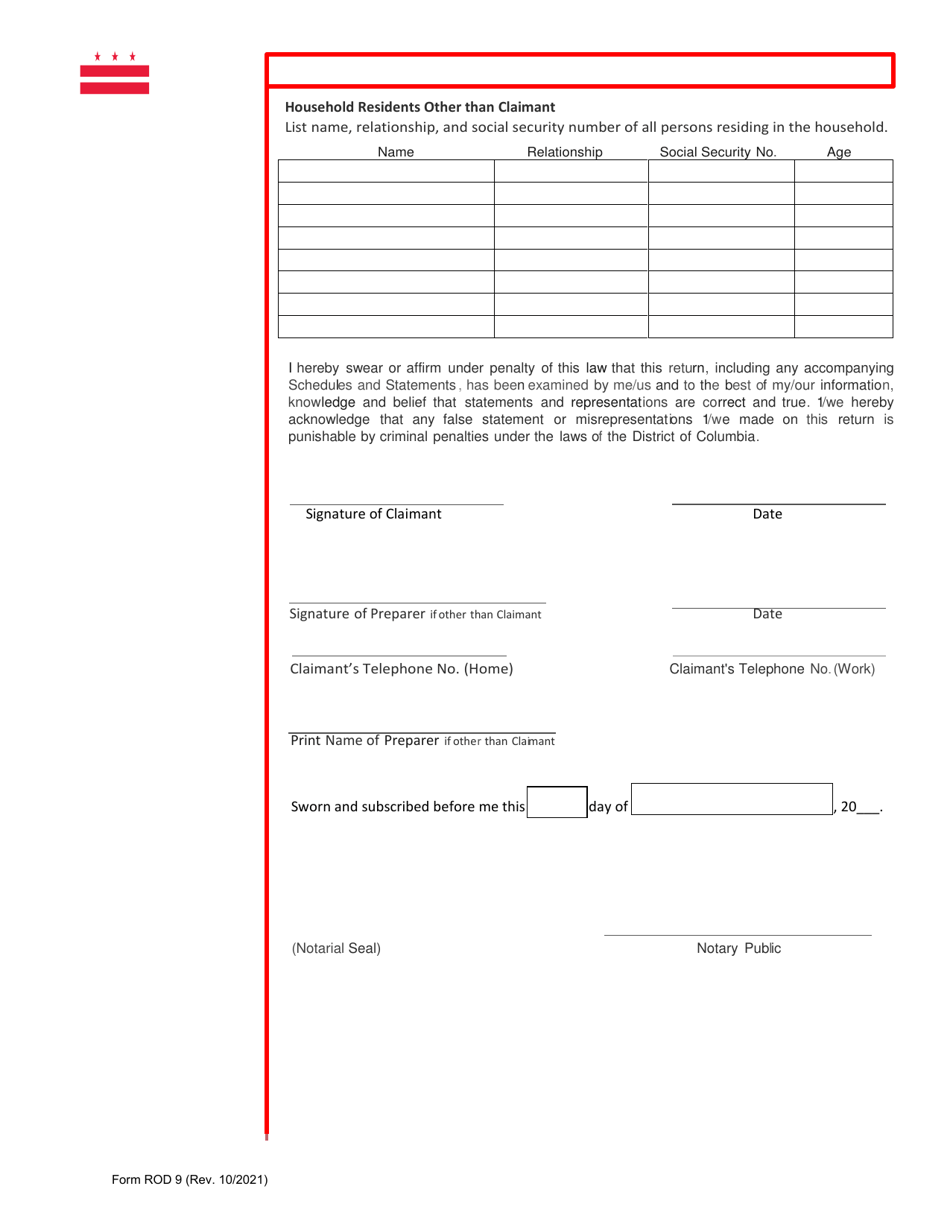

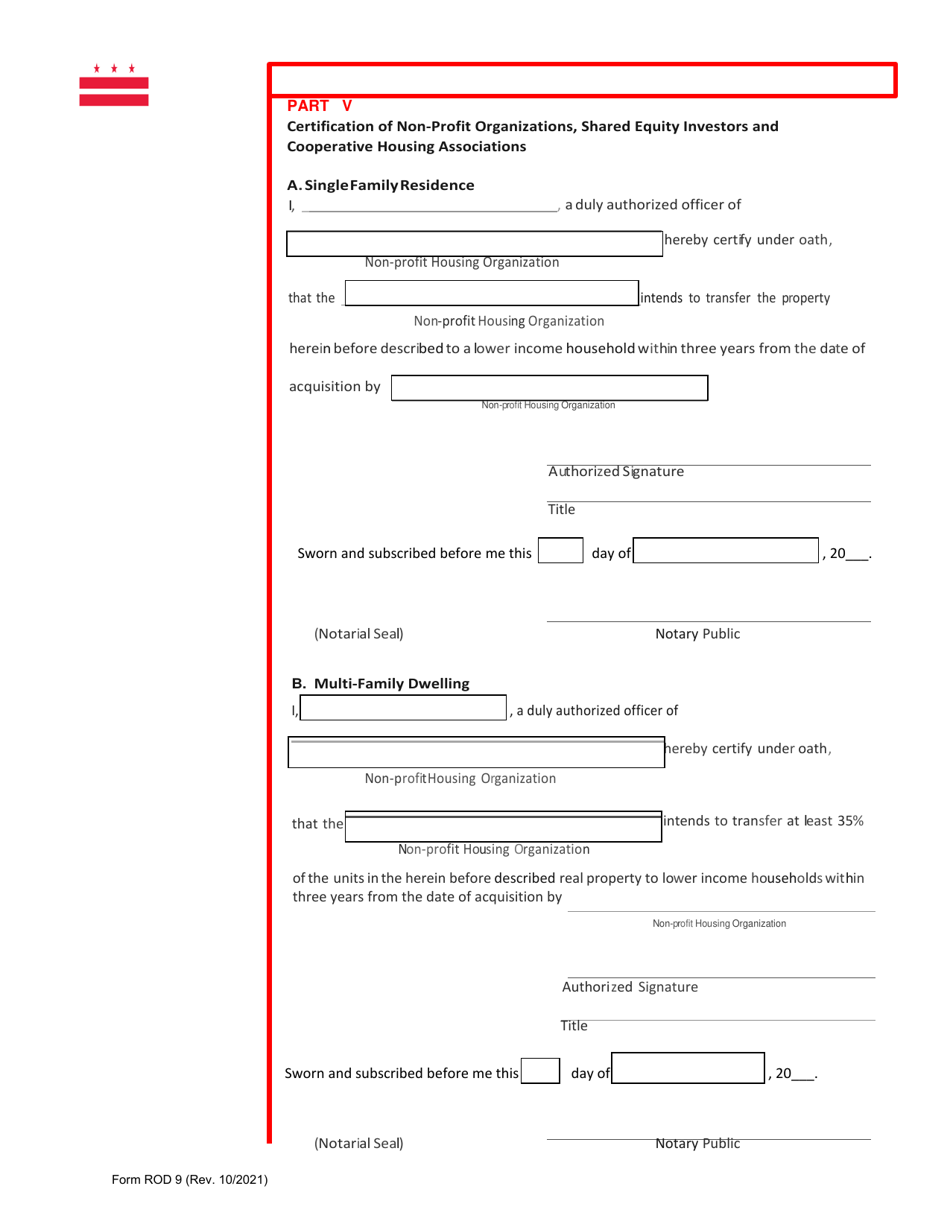

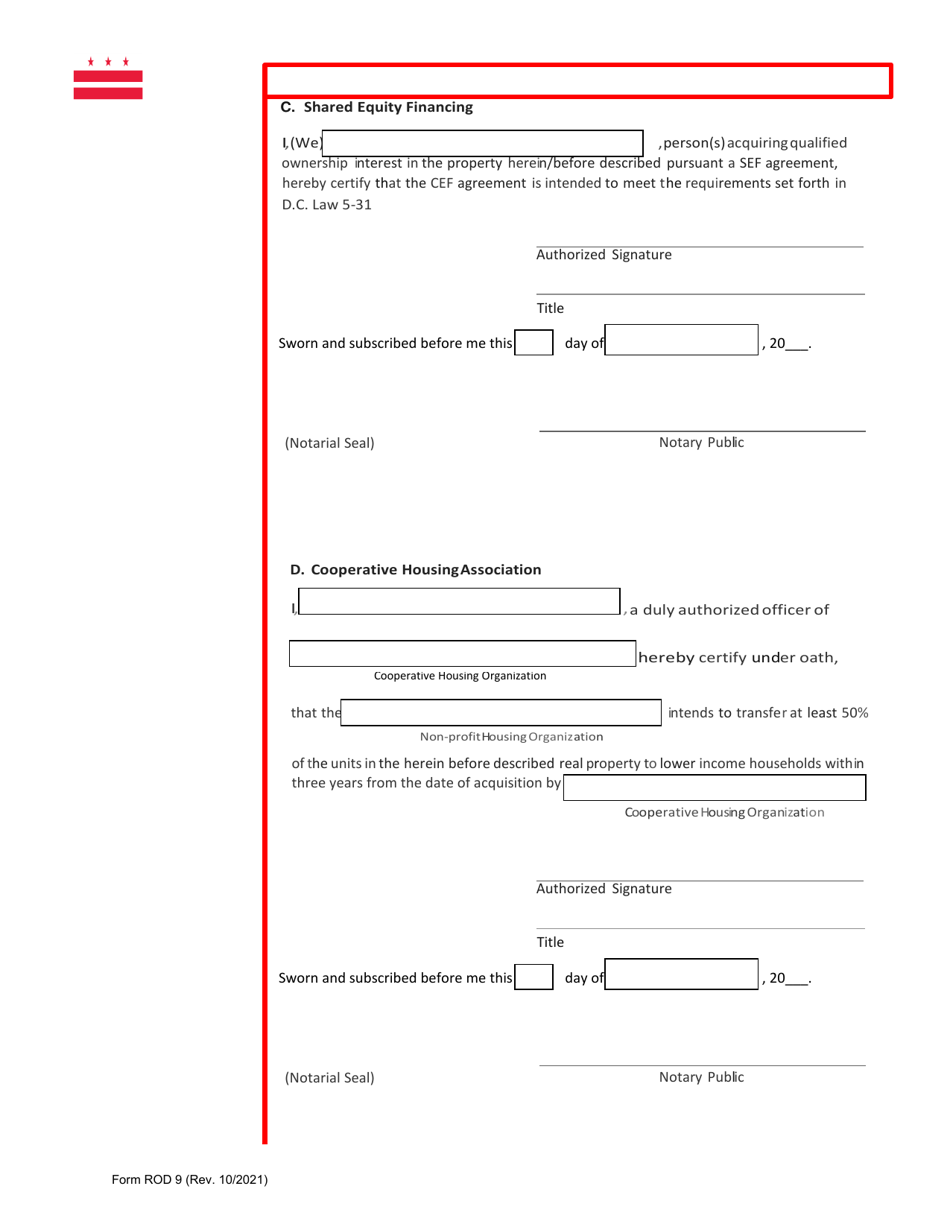

Form ROD9 Lower Income / Share Equity Homeownership Exemption Application - Washington, D.C.

What Is Form ROD9?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

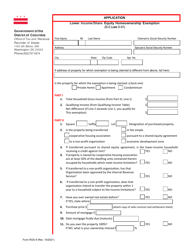

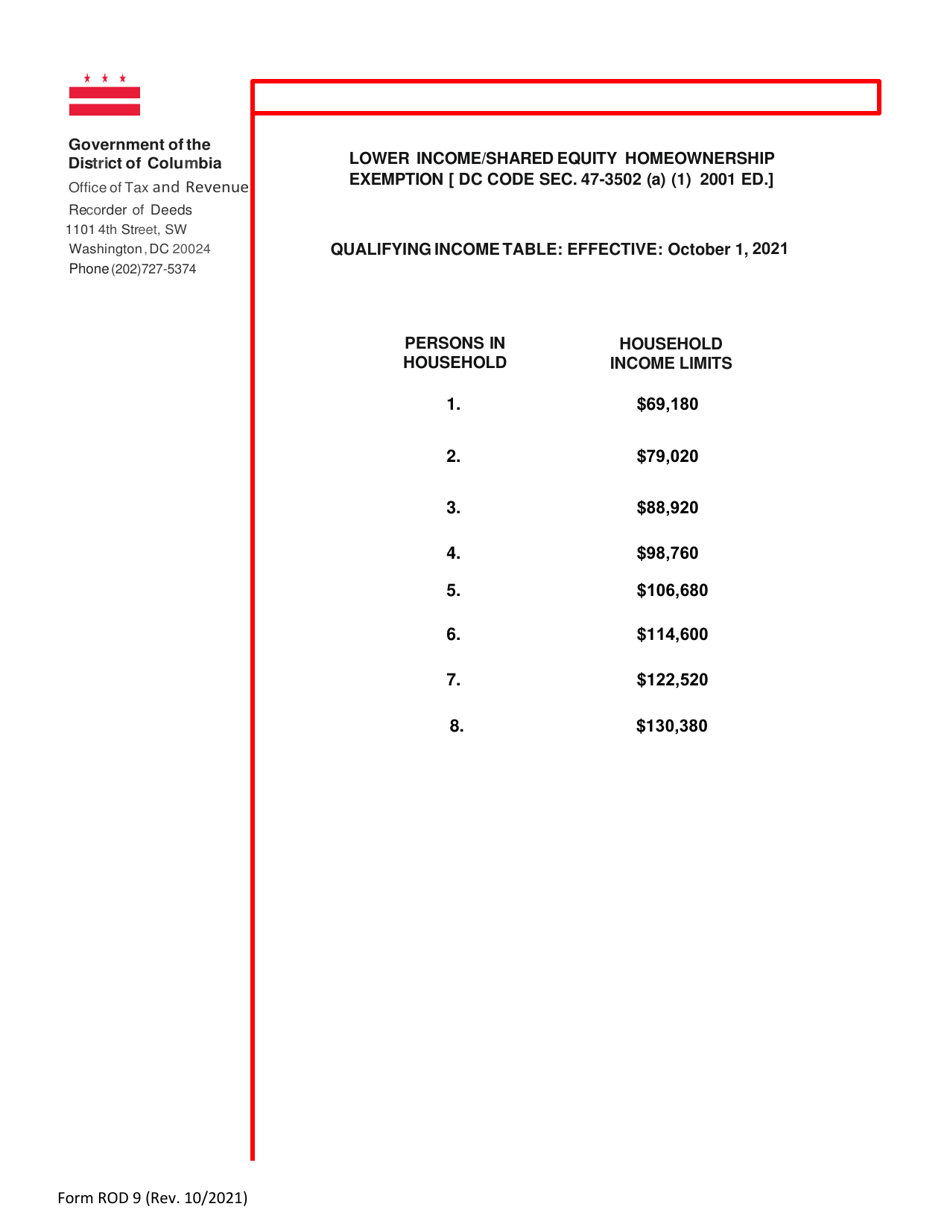

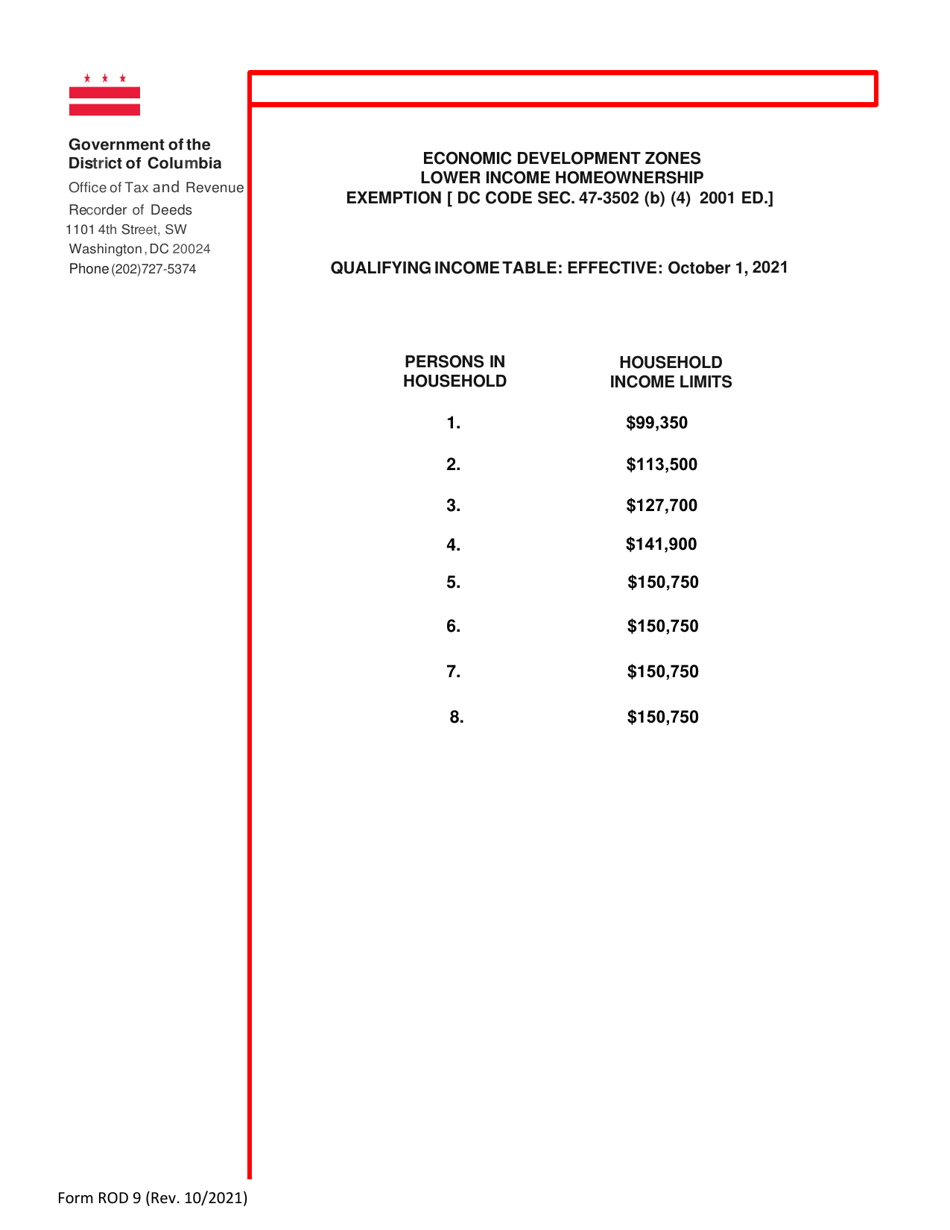

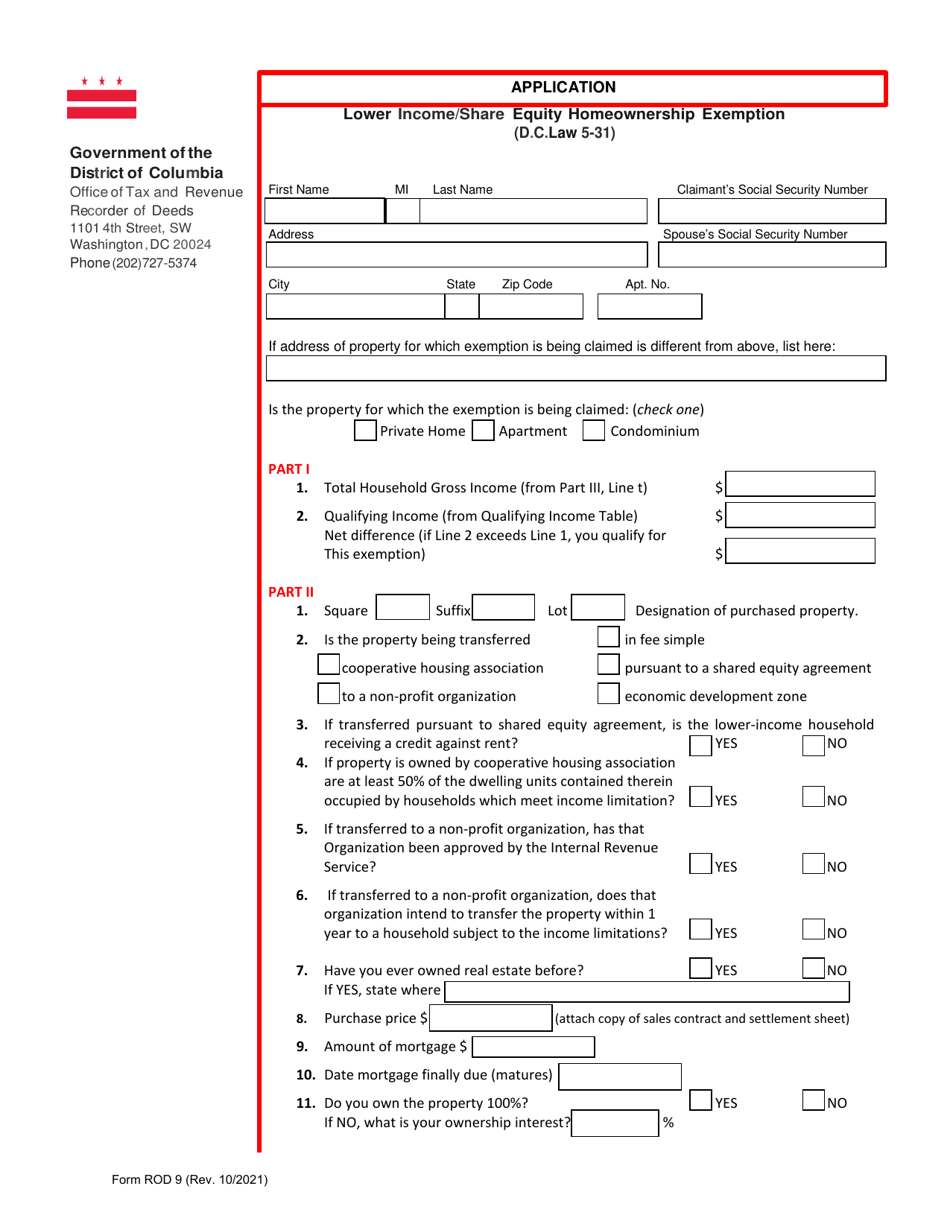

Q: What is the ROD9 Lower Income/Share Equity Homeownership Exemption Application?

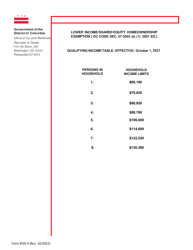

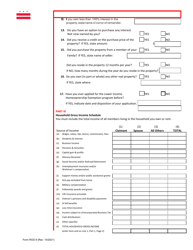

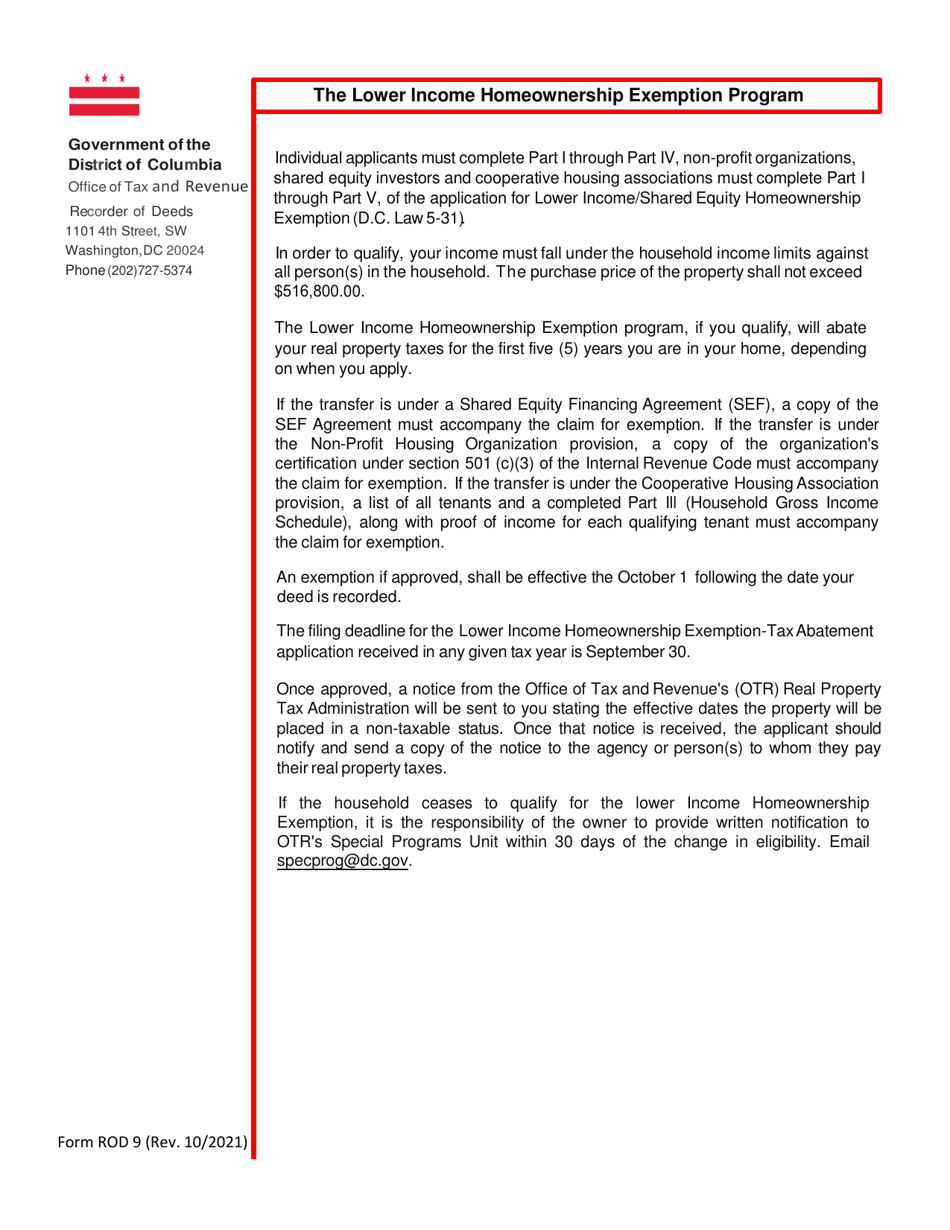

A: The ROD9 Lower Income/Share Equity Homeownership Exemption Application is a form used in Washington, D.C. to apply for a property tax exemption for lower-income or share equity homeowners.

Q: Who is eligible for the ROD9 Lower Income/Share Equity Homeownership Exemption?

A: Lower-income homeowners or share equity homeowners in Washington, D.C. are eligible for the ROD9 exemption.

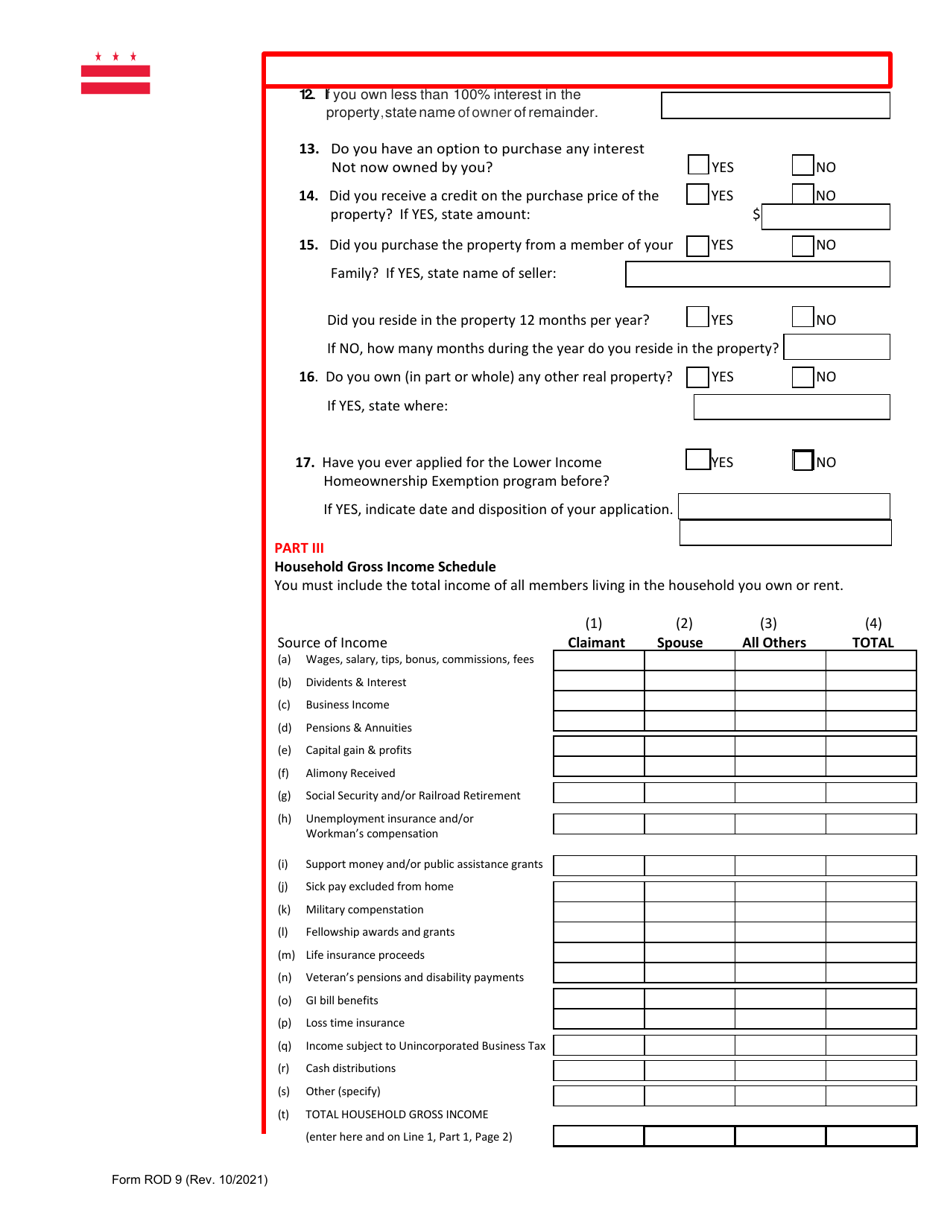

Q: How can I apply for the ROD9 Lower Income/Share Equity Homeownership Exemption?

A: You can apply for the ROD9 exemption by filling out the application form and submitting it to the appropriate government office in Washington, D.C.

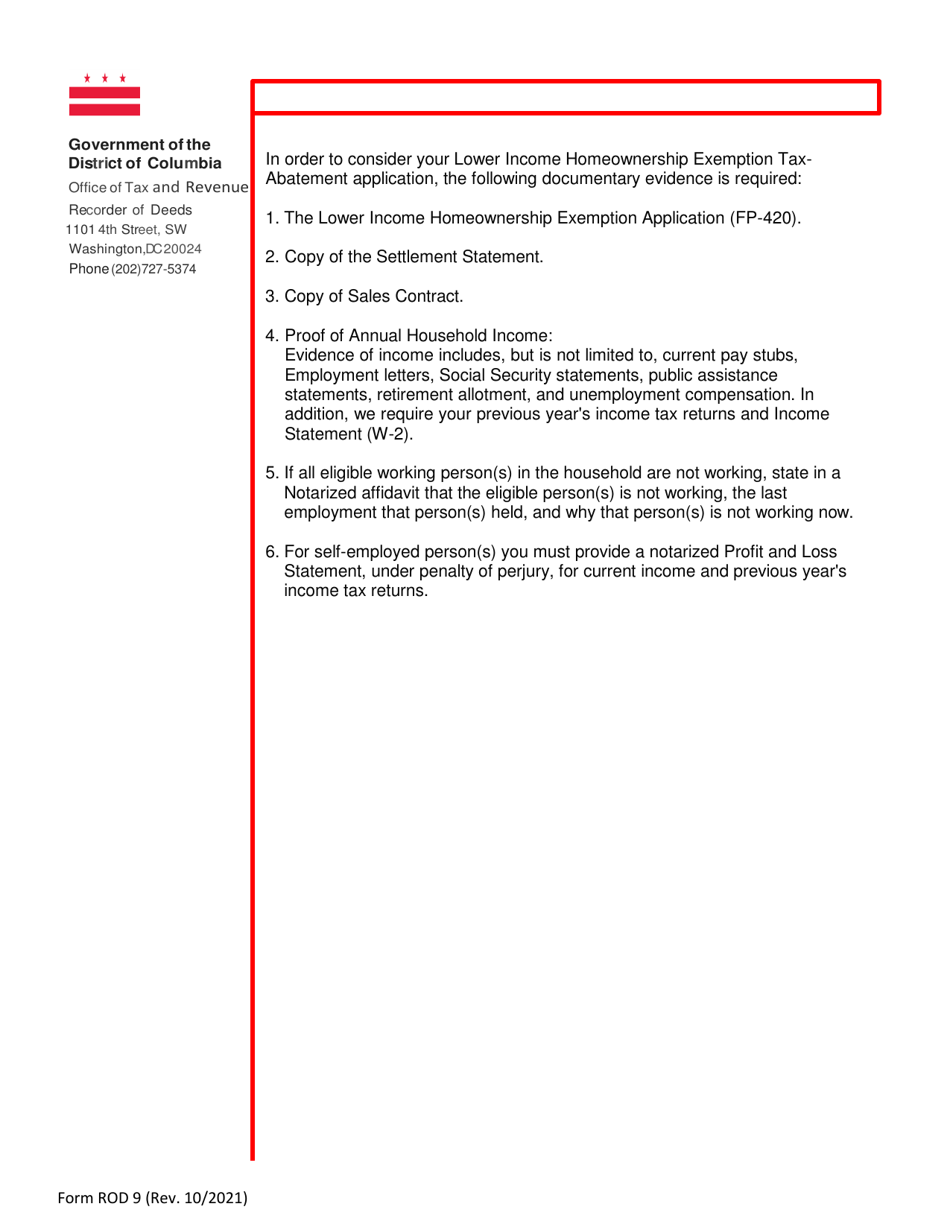

Q: What documents do I need to include with the ROD9 application?

A: You may need to include documents such as proof of income, proof of homeownership, and any other required documentation with the ROD9 application.

Q: What is the purpose of the ROD9 Lower Income/Share Equity Homeownership Exemption?

A: The purpose of the ROD9 exemption is to provide property tax relief for lower-income or share equity homeowners in Washington, D.C.

Q: Are there any deadlines for submitting the ROD9 application?

A: Yes, there are deadlines for submitting the ROD9 application. It is important to check the specific deadline for the current year.

Q: Is there a fee to apply for the ROD9 Lower Income/Share Equity Homeownership Exemption?

A: No, there is no fee to apply for the ROD9 exemption in Washington, D.C.

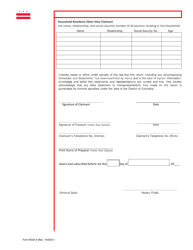

Q: What happens after I submit the ROD9 application?

A: After you submit the ROD9 application, it will be reviewed by the government office and you will be informed of the decision regarding your property tax exemption eligibility.

Q: Can I appeal if my ROD9 application is denied?

A: Yes, you can appeal if your ROD9 application is denied. There is a process to appeal the decision and provide additional information or documentation if necessary.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD9 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.