This version of the form is not currently in use and is provided for reference only. Download this version of

Form HCA20-0086

for the current year.

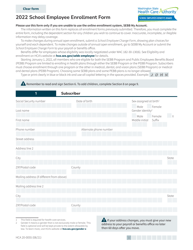

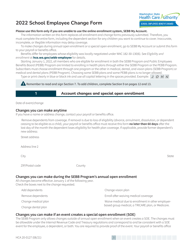

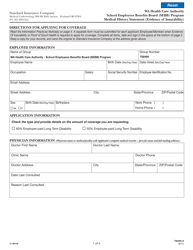

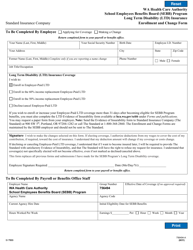

Form HCA20-0086 School Employee Authorization for Payroll Deduction to Health Savings Account - Washington

What Is Form HCA20-0086?

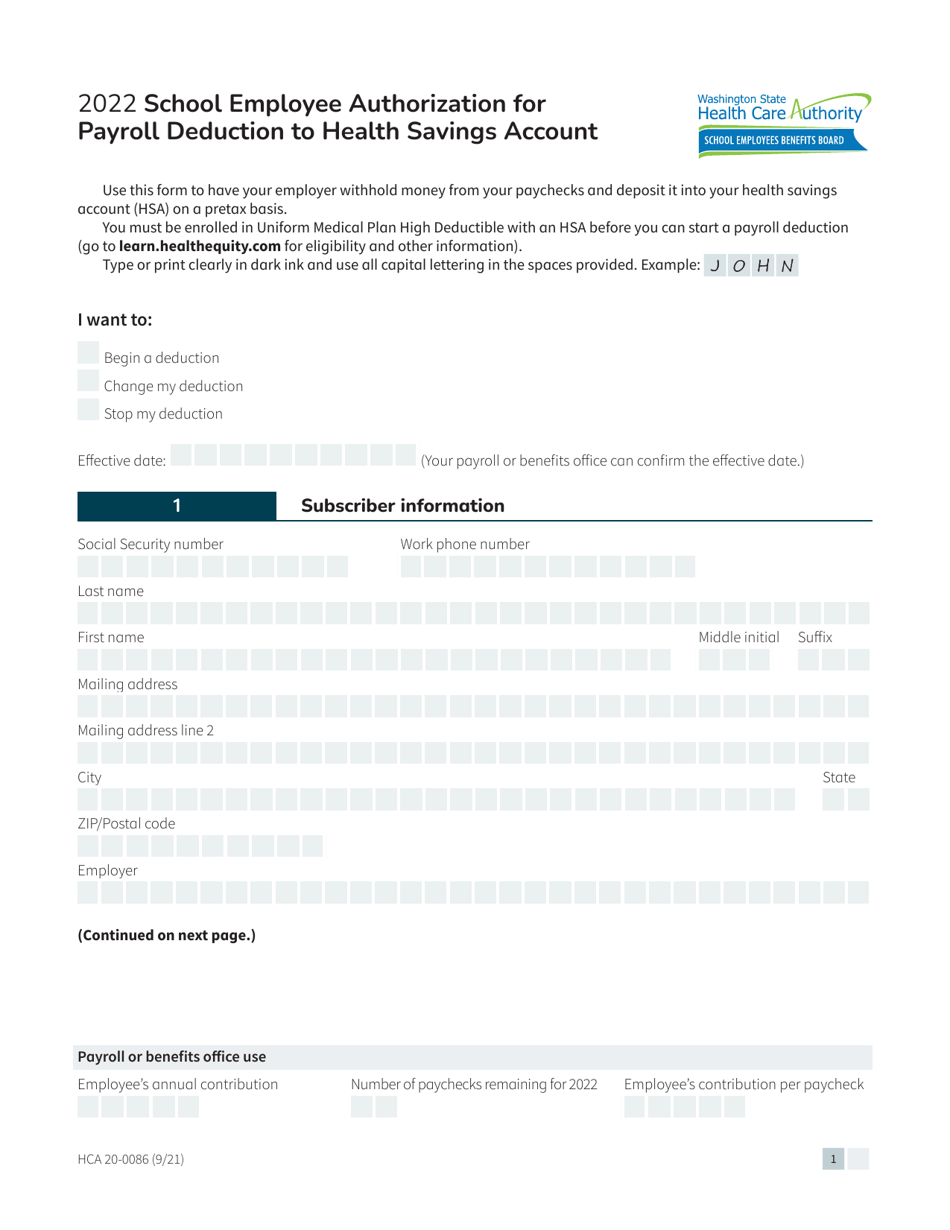

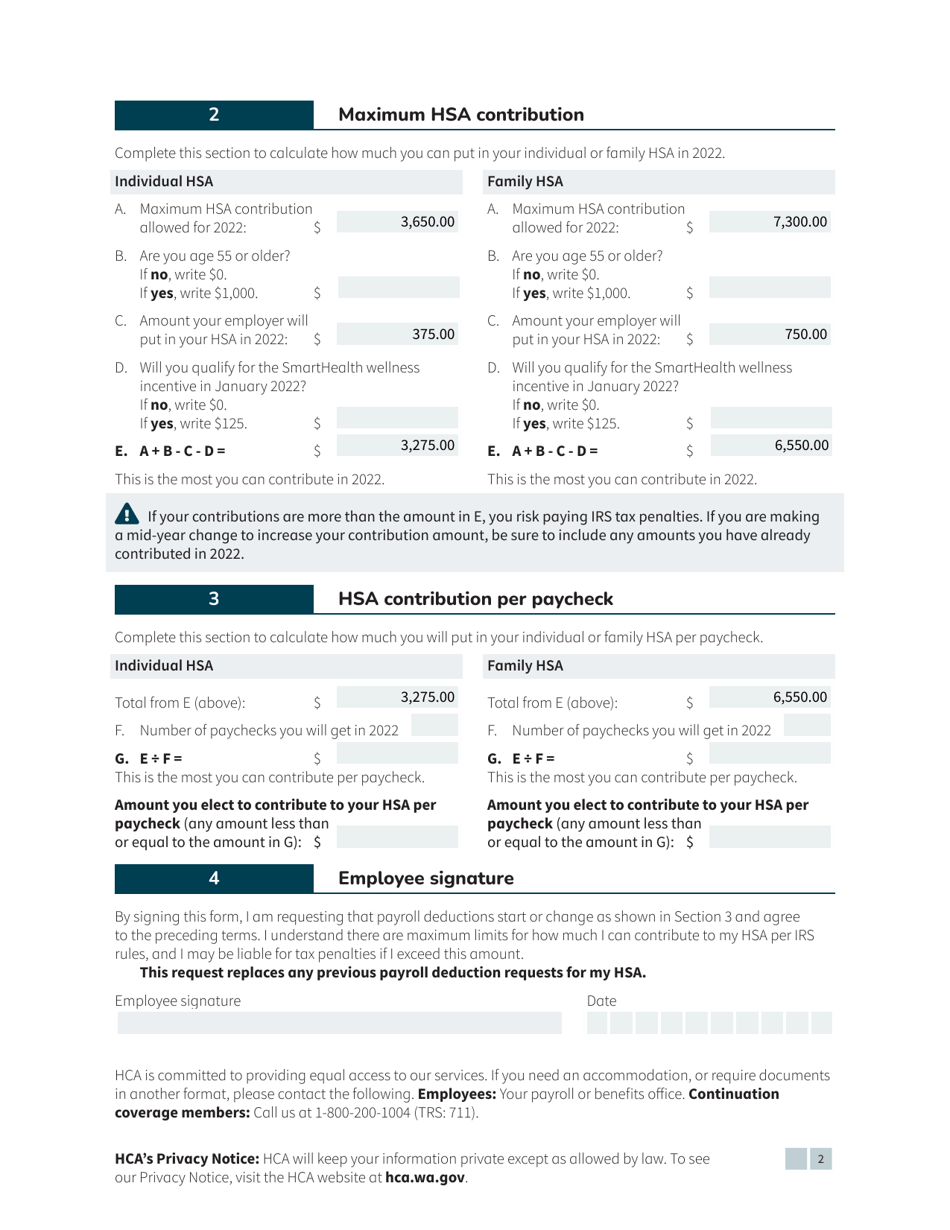

This is a legal form that was released by the Washington State Health Care Authority - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCA20-0086?

A: Form HCA20-0086 is the School Employee Authorization for Payroll Deduction to Health Savings Account.

Q: Who is this form for?

A: This form is for school employees who want to authorize payroll deductions to their Health Savings Account.

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified medical expenses.

Q: Why would a school employee want to authorize payroll deductions to their HSA?

A: Authorizing payroll deductions to a Health Savings Account (HSA) allows school employees to contribute pre-tax dollars to their HSA, which can help reduce their taxable income and provide funds for medical expenses.

Q: Is this form specific to Washington state?

A: Yes, this form is specific to Washington state.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Washington State Health Care Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCA20-0086 by clicking the link below or browse more documents and templates provided by the Washington State Health Care Authority.