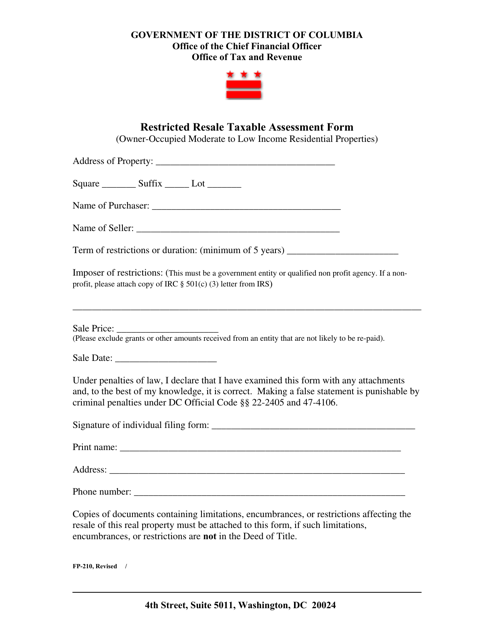

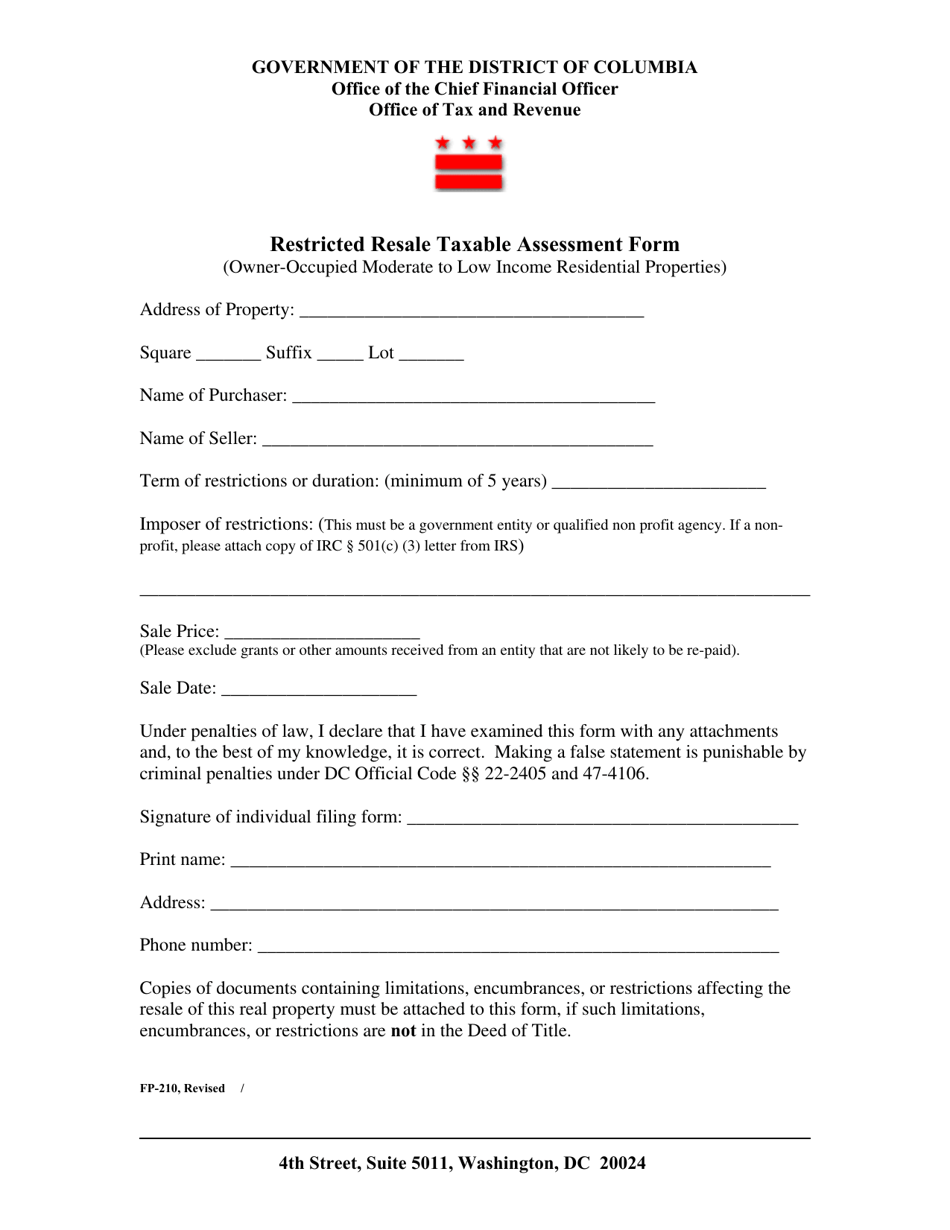

Form FP-210 Restricted Resale Taxable Assessment Form - Washington, D.C.

What Is Form FP-210?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FP-210?

A: Form FP-210 is the Restricted Resale Taxable Assessment Form used in Washington, D.C.

Q: Who uses Form FP-210?

A: Form FP-210 is used by taxpayers in Washington, D.C. who are applying for a restricted resale tax assessment.

Q: What is a restricted resale tax assessment?

A: A restricted resale tax assessment is a reduced property tax assessment for properties that are subject to certain resale restrictions.

Q: When should Form FP-210 be filed?

A: Form FP-210 should be filed within 45 days of the date of purchase or the date of settlement of the property.

Q: Are there any fees associated with filing Form FP-210?

A: No, there are no fees associated with filing Form FP-210.

Q: What happens after I file Form FP-210?

A: Once Form FP-210 is filed, the Office of Tax and Revenue will review the application and notify you of the outcome.

Q: Can I appeal the decision made on my Form FP-210 application?

A: Yes, you can appeal the decision made on your Form FP-210 application by filing a petition with the Real Property Tax Appeals Commission.

Q: Is Form FP-210 applicable only to residential properties?

A: No, Form FP-210 is applicable to both residential and commercial properties.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FP-210 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.