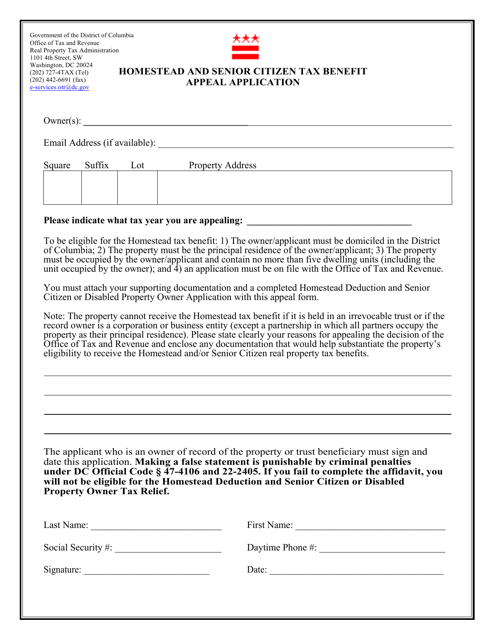

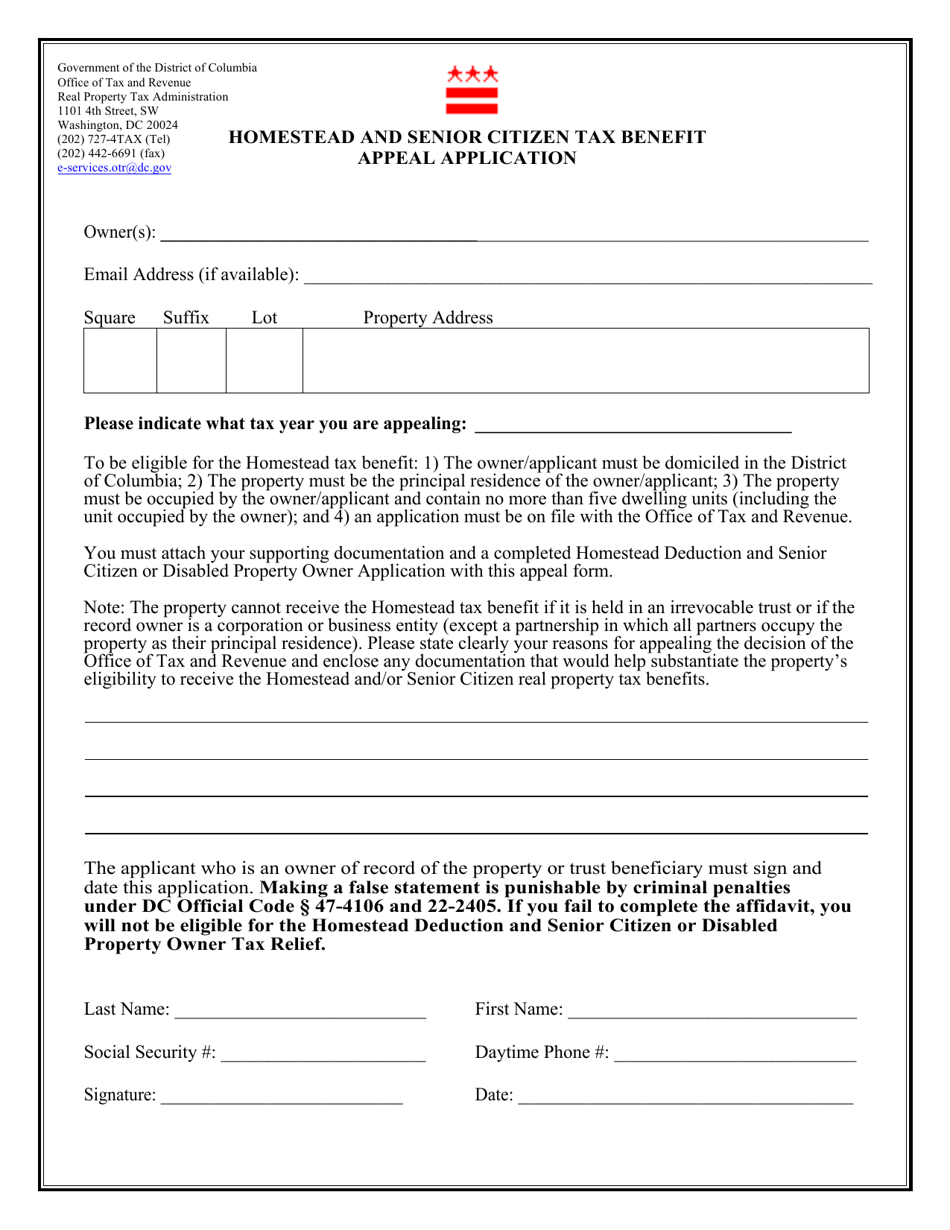

Homestead and Senior Citizen Tax Benefit Appeal Application - Washington, D.C.

Homestead and Tax Benefit Appeal Application is a legal document that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C..

FAQ

Q: What is the Homestead and Senior Citizen Tax Benefit Appeal Application?

A: It is an application for appealing the homestead and senior citizen tax benefits in Washington, D.C.

Q: Who can apply for the Homestead and Senior Citizen Tax Benefit Appeal?

A: Any resident of Washington, D.C. who wants to appeal the homestead and senior citizen tax benefits can apply.

Q: What is the purpose of the appeal?

A: The purpose of the appeal is to challenge the denial, modification, or revocation of the homestead or senior citizen tax benefits.

Q: What information is required in the application?

A: The application requires personal information, property details, and reasons for the appeal.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application. It is typically within 45 days of the denial or revocation of the tax benefits.

Q: Is there a fee for submitting the application?

A: No, there is no fee for submitting the application.

Q: What happens after submitting the application?

A: After submitting the application, it will be reviewed by the Office of Tax and Revenue, and you will be notified of the decision.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to request an administrative hearing to further appeal the decision.

Form Details:

- The latest edition currently provided by the Washington DC Office of Tax and Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.