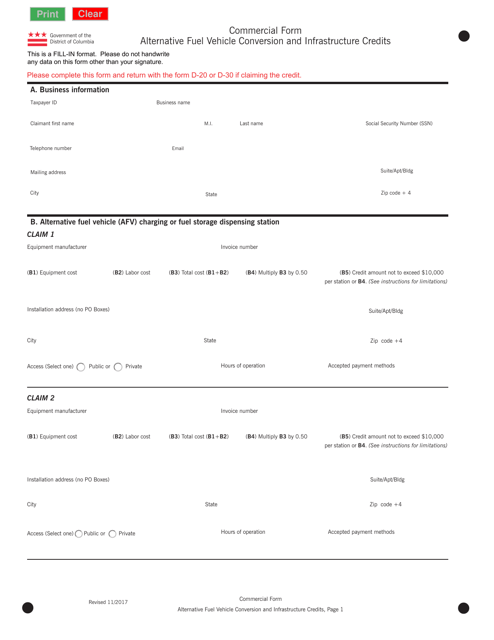

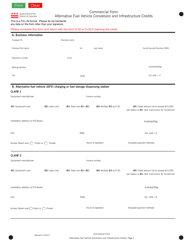

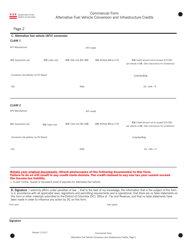

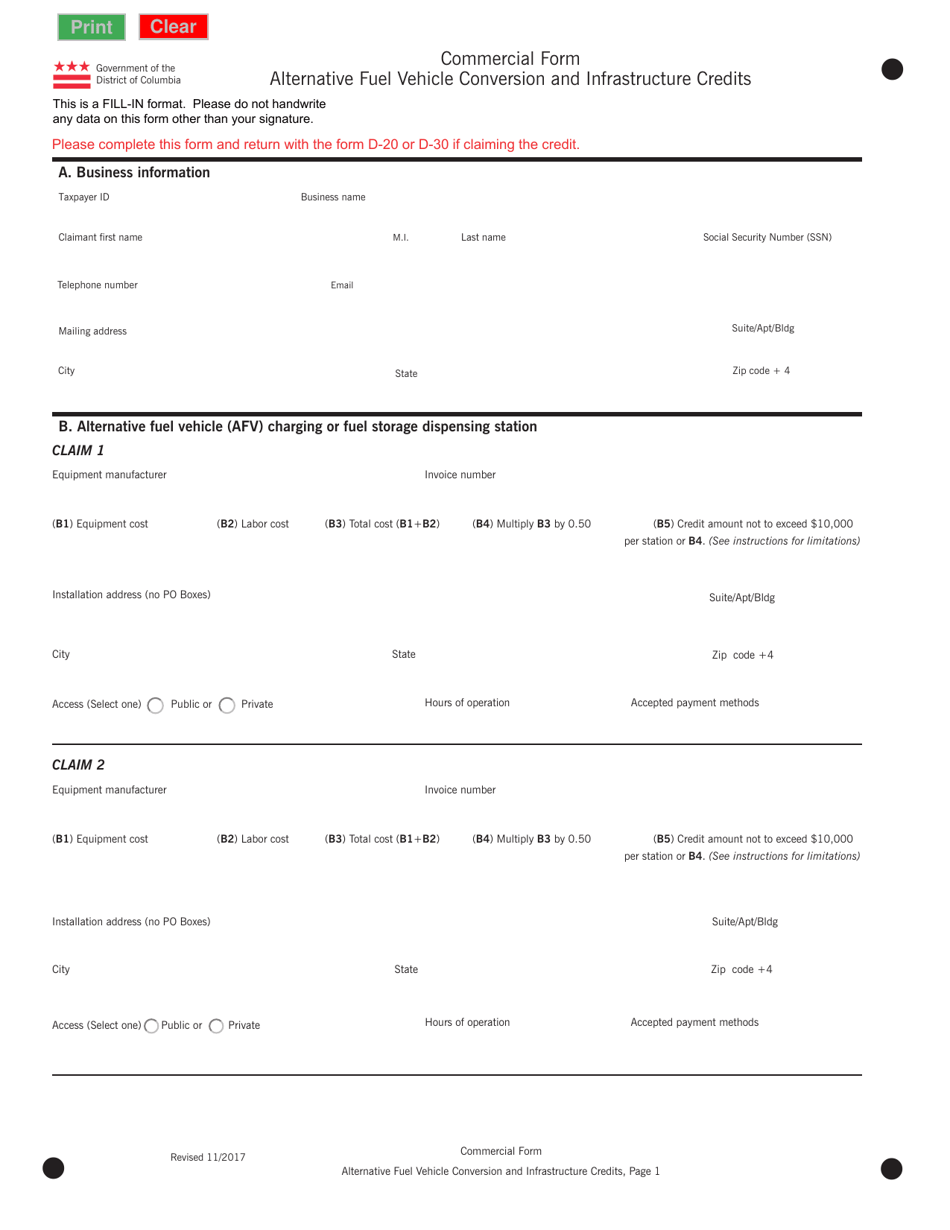

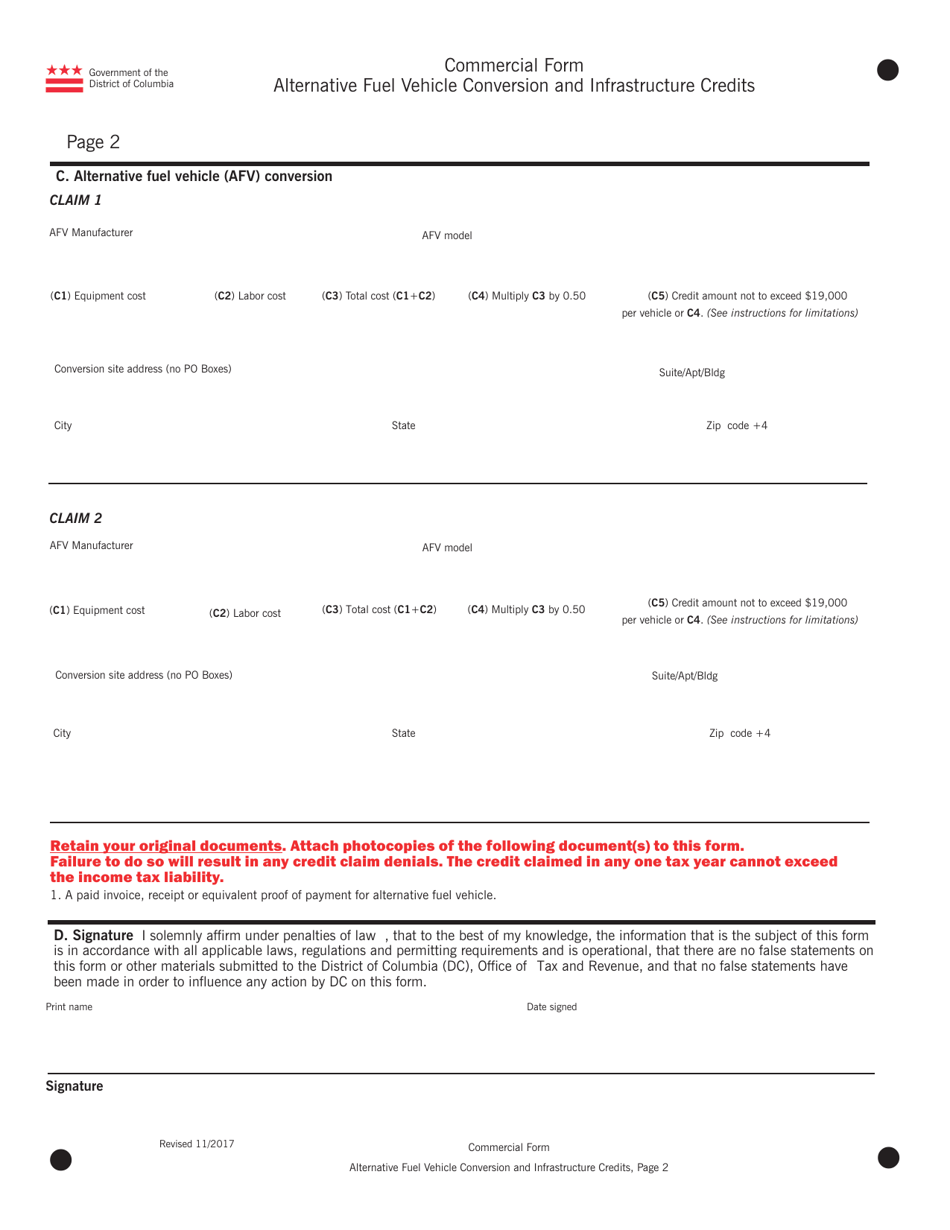

Alternative Fuel Vehicle Conversion and Infrastructure Credits - Commercial Form - Washington, D.C.

Alternative Fuel Vehicle Conversion and Infrastructure Credits - Commercial Form is a legal document that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C..

FAQ

Q: What is the Alternative Fuel Vehicle Conversion and Infrastructure Credits?

A: It is a program in Washington, D.C. that provides credits for converting vehicles to alternative fuels and building infrastructure.

Q: Who is eligible to receive the credits?

A: Commercial vehicle owners in Washington, D.C. are eligible for the credits.

Q: What types of vehicles are eligible for conversion credits?

A: Any commercial vehicle that is converted to run on alternative fuels is eligible for conversion credits.

Q: What types of infrastructure are eligible for infrastructure credits?

A: Infrastructure such as fueling stations for alternative fuels are eligible for infrastructure credits.

Q: How can I apply for these credits?

A: You can apply for the credits by submitting the required forms and documentation to the relevant authorities in Washington, D.C.

Q: Is there a deadline for applying for the credits?

A: Yes, there is a deadline for applying, which is typically specified in the program guidelines.

Form Details:

- Released on November 1, 2017;

- The latest edition currently provided by the Washington DC Office of Tax and Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.