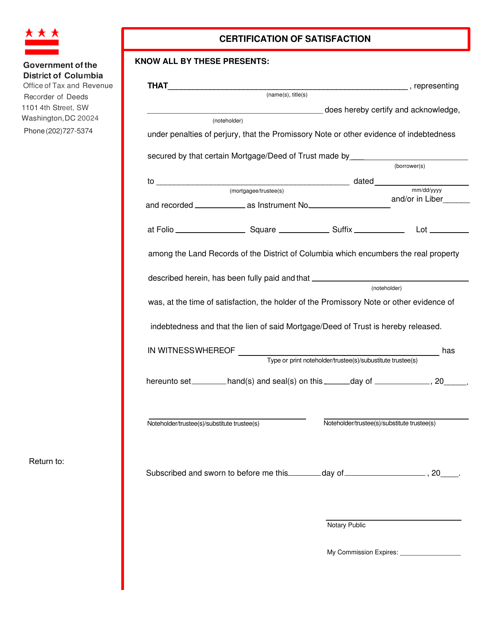

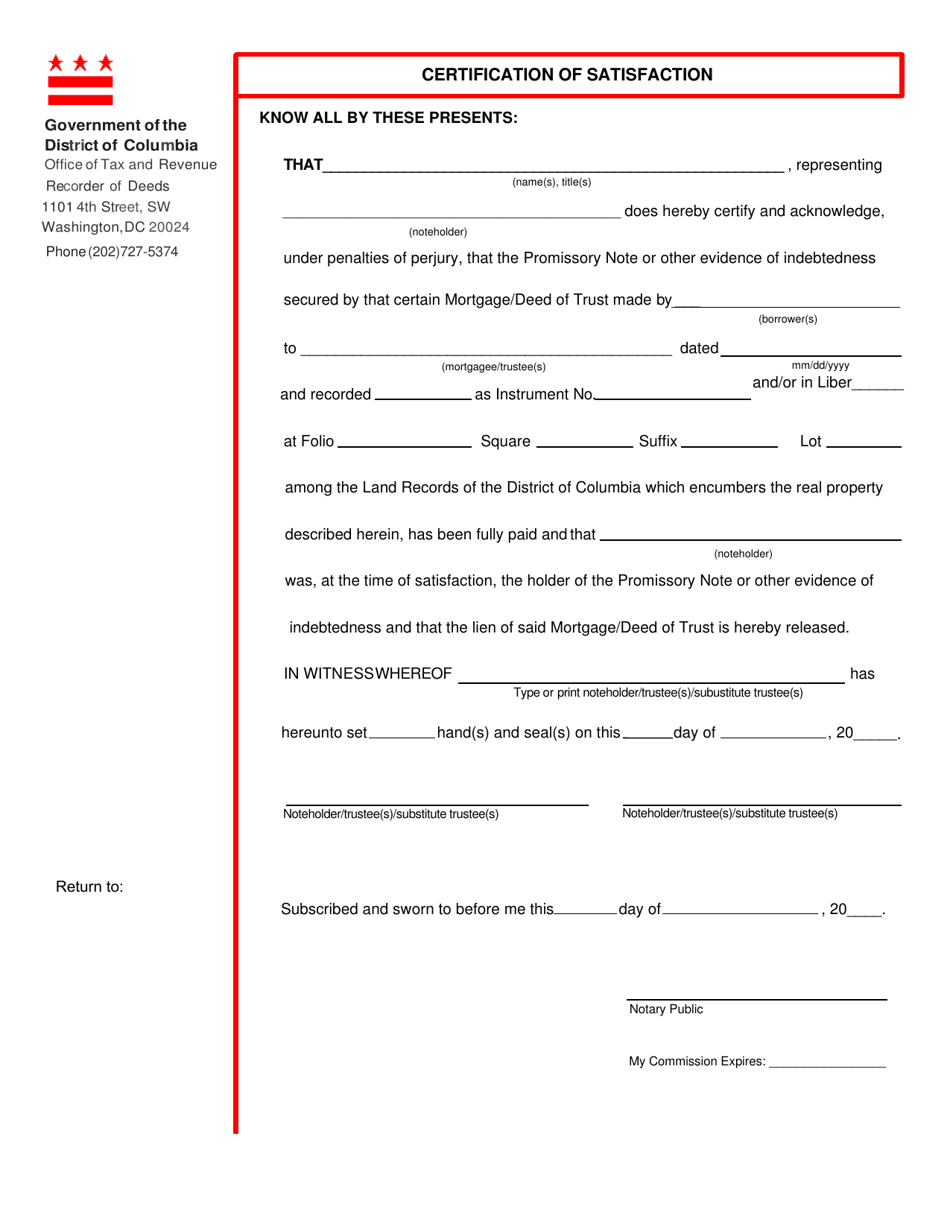

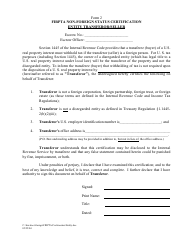

Form ROD26 Certification of Satisfaction - Washington, D.C.

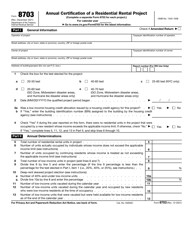

What Is Form ROD26?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ROD26?

A: Form ROD26 is a Certification of Satisfaction form.

Q: What is the purpose of Form ROD26?

A: The purpose of Form ROD26 is to certify that a judgment or lien has been satisfied.

Q: How do I fill out Form ROD26?

A: To fill out Form ROD26, you need to provide information about the judgment or lien, including the names of the parties involved, the case number, and the date of satisfaction.

Q: Are there any fees associated with filing Form ROD26?

A: There may be fees associated with filing Form ROD26. You should check with the Washington, D.C. government for the most up-to-date information.

Q: What should I do after filling out Form ROD26?

A: After filling out Form ROD26, you should submit it to the appropriate government office along with any required fees or supporting documents.

Q: Is Form ROD26 specific to Washington, D.C.?

A: Yes, Form ROD26 is specific to Washington, D.C. and cannot be used for certifications of satisfaction in other states or jurisdictions.

Q: What happens after I submit Form ROD26?

A: After you submit Form ROD26, the government office will review your application and, if everything is in order, issue a certification of satisfaction.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD26 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.