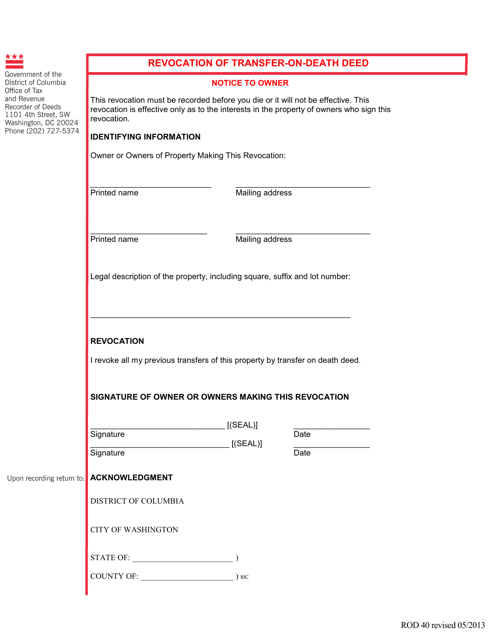

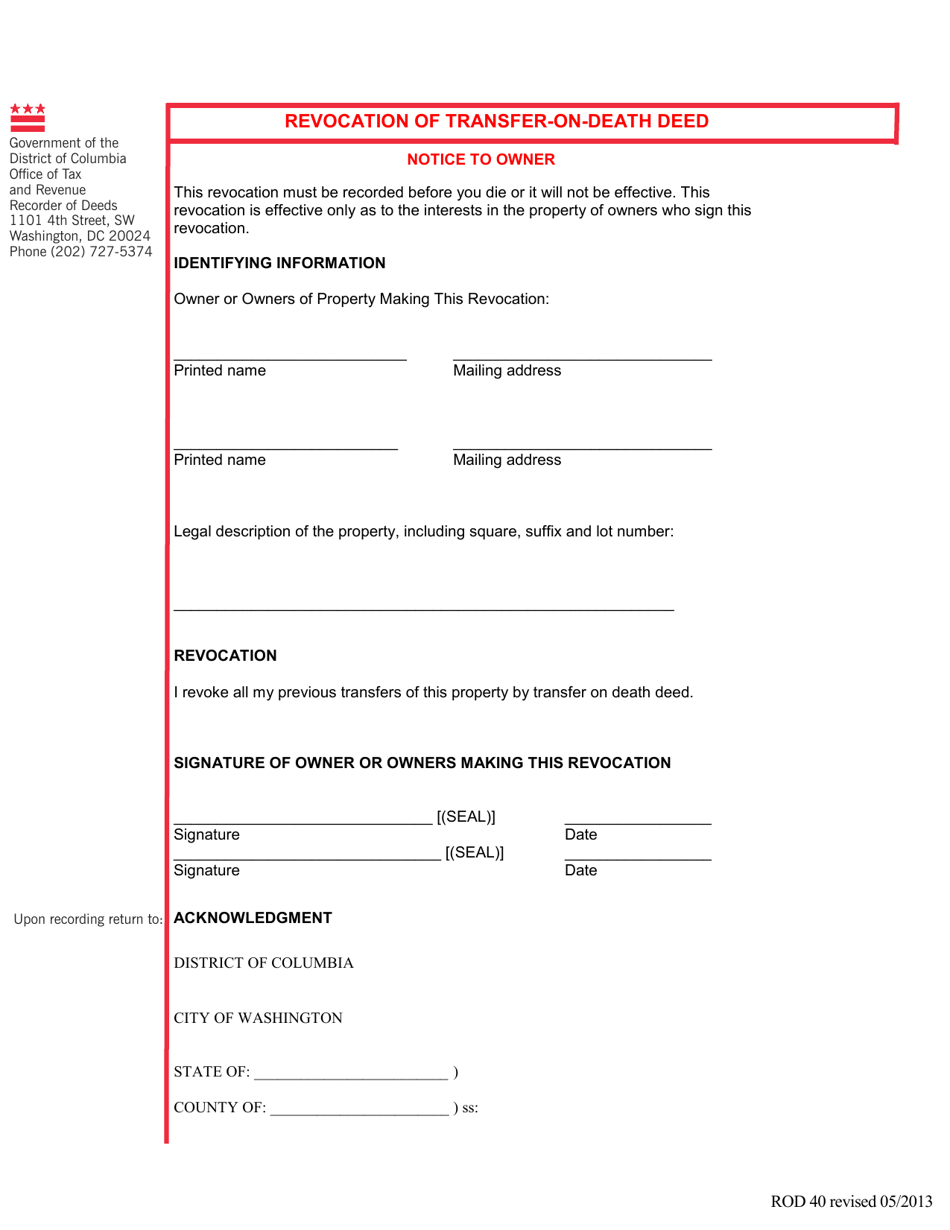

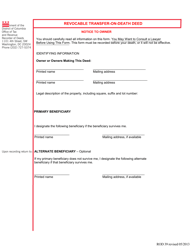

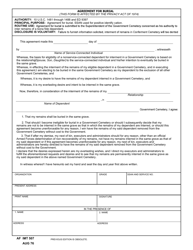

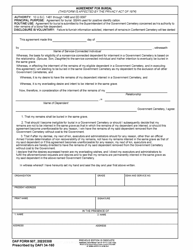

Form ROD40 Revocation of Transfer-On-Death Deed - Washington, D.C.

What Is Form ROD40?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

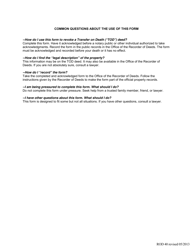

Q: What is Form ROD40?

A: Form ROD40 is the Revocation of Transfer-On-Death Deed specifically for Washington, D.C.

Q: What is a Transfer-On-Death Deed?

A: A Transfer-On-Death Deed is a legal document that allows an individual to designate who will inherit their real property upon their death, without the need for probate.

Q: What does the Revocation of Transfer-On-Death Deed do?

A: The Revocation of Transfer-On-Death Deed cancels the previous Transfer-On-Death Deed that was created.

Q: Who can use Form ROD40?

A: Form ROD40 is specifically for residents of Washington, D.C. who want to revoke a previously created Transfer-On-Death Deed.

Q: Is Form ROD40 legally binding?

A: Yes, when properly completed and executed, Form ROD40 is legally binding in Washington, D.C.

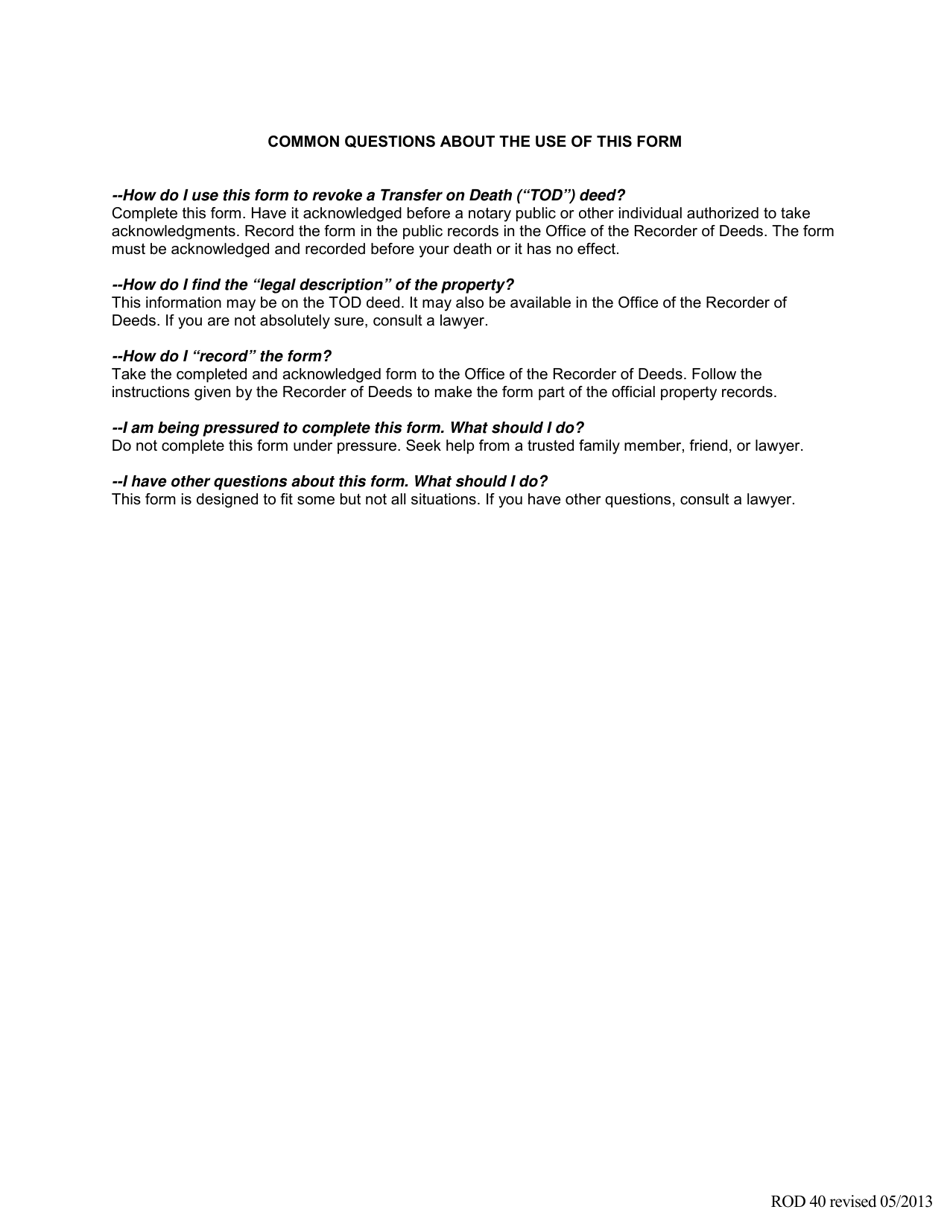

Q: Do I need a lawyer to complete Form ROD40?

A: While it is not required to have a lawyer, you may consider consulting with one to ensure the form is completed correctly and meets your specific needs.

Q: What should I do after completing Form ROD40?

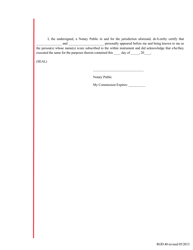

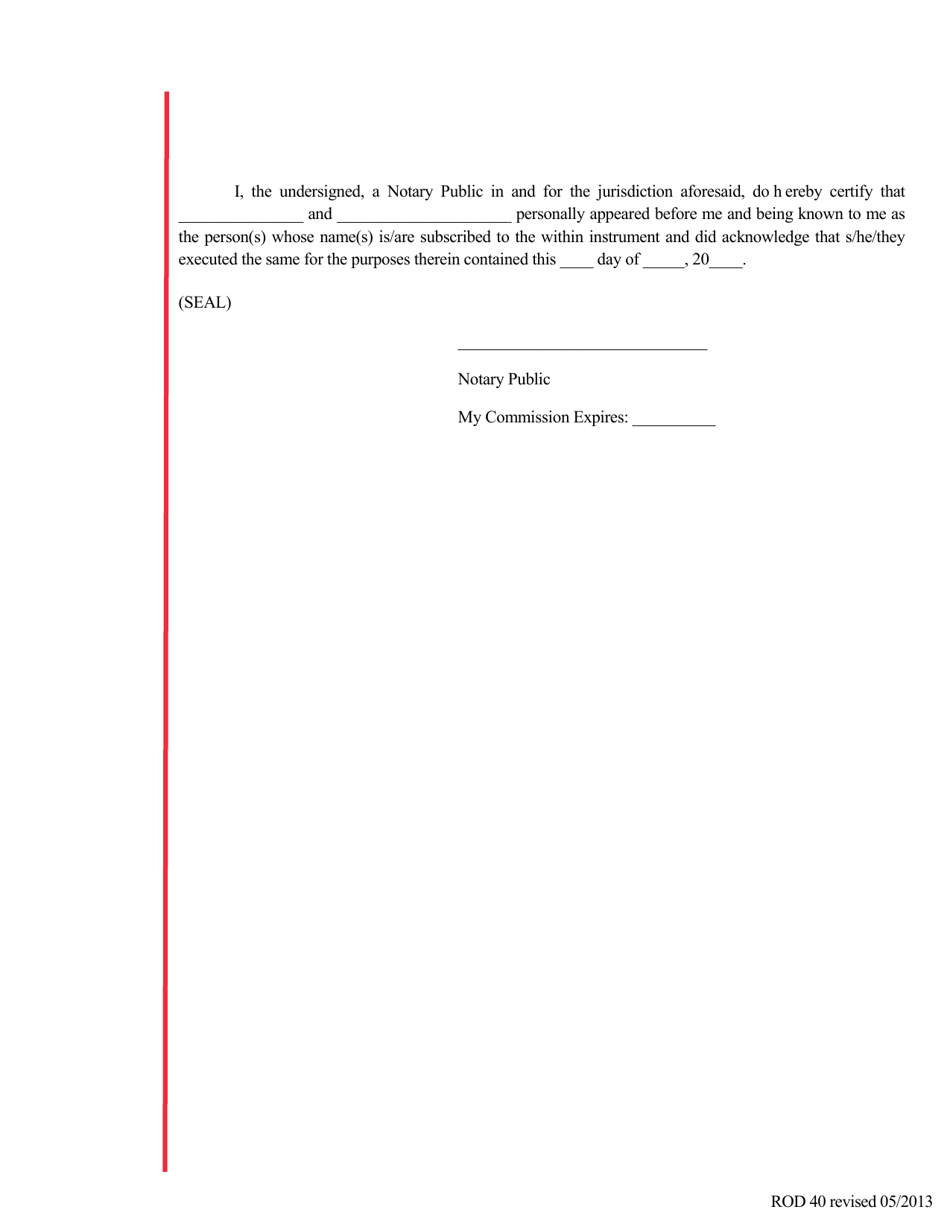

A: After completing Form ROD40, you should sign it in the presence of a notary public and file it with the District of Columbia Recorder of Deeds.

Q: Can I revoke a Transfer-On-Death Deed without using Form ROD40?

A: No, in Washington, D.C., the Revocation of Transfer-On-Death Deed must be done using Form ROD40.

Q: Is there a fee to file Form ROD40?

A: Yes, there is a fee associated with filing Form ROD40. The current fee can be obtained from the District of Columbia Recorder of Deeds.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ROD40 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.