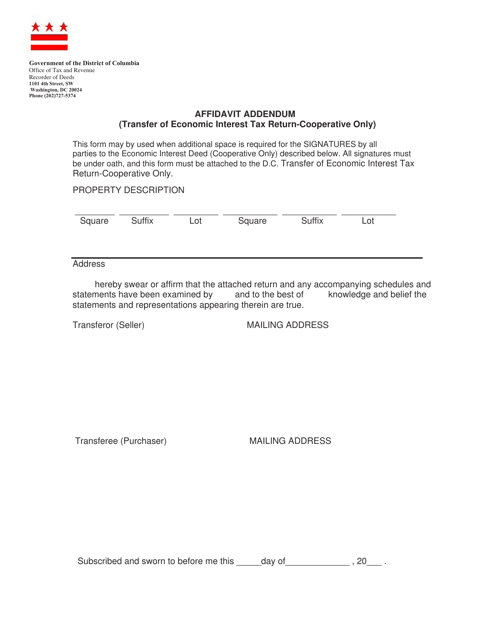

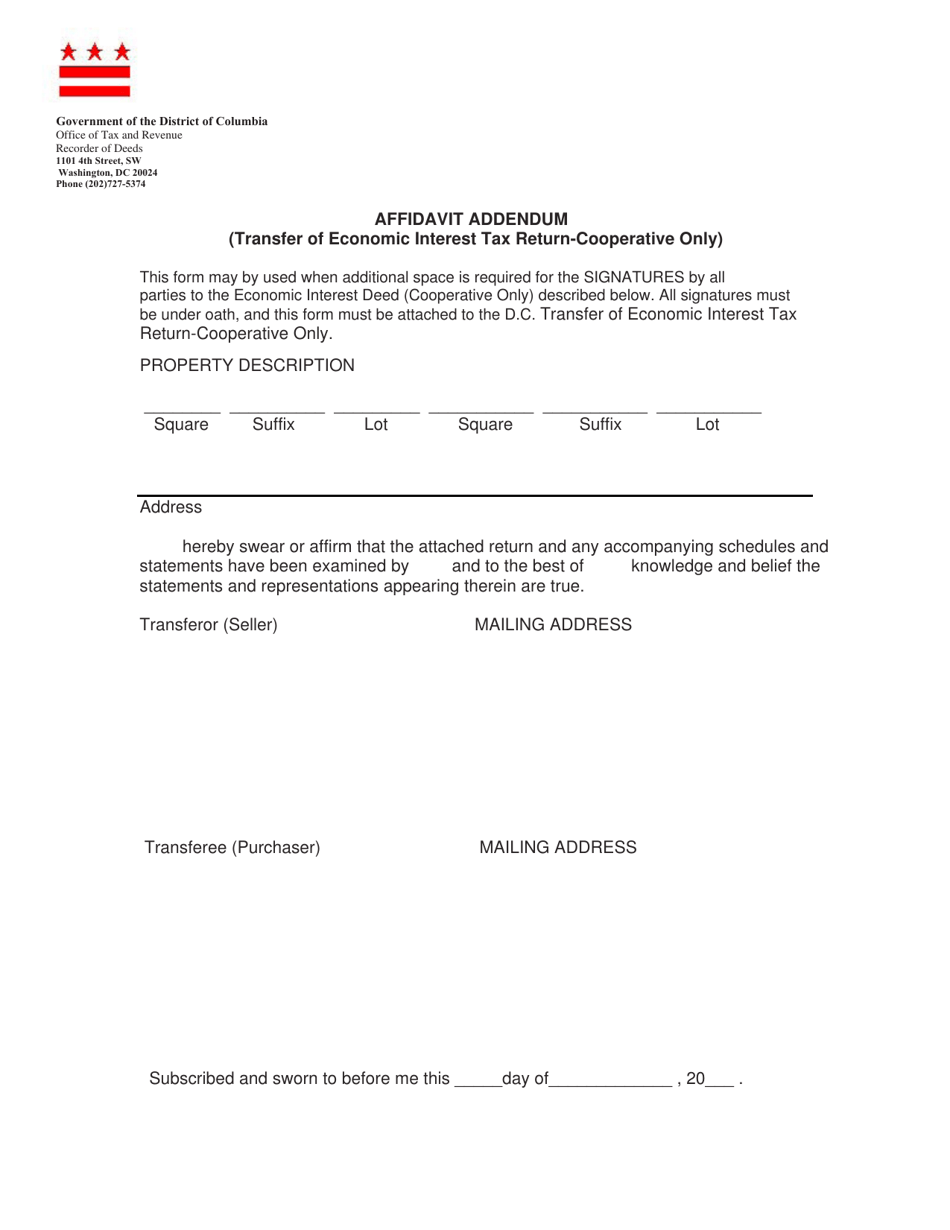

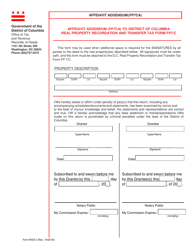

Form ROD36 Affidavit Addendum (Transfer of Economic Interest Tax Return-Cooperative Only) - Washington, D.C.

What Is Form ROD36?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a ROD36 Affidavit Addendum?

A: A ROD36 Affidavit Addendum is a document used for the transfer of economic interest in a cooperative property in Washington, D.C.

Q: Who needs to file a ROD36 Affidavit Addendum?

A: The parties involved in the transfer of economic interest in a cooperative property need to file a ROD36 Affidavit Addendum in Washington, D.C.

Q: What is the purpose of filing a ROD36 Affidavit Addendum?

A: The purpose of filing a ROD36 Affidavit Addendum is to document the transfer of economic interest in a cooperative property and comply with the tax requirements in Washington, D.C.

Q: Are there any fees associated with filing a ROD36 Affidavit Addendum?

A: Yes, there may be fees associated with filing a ROD36 Affidavit Addendum. You should contact the Washington, D.C. Office of Tax and Revenue for more information.

Q: What information is required in a ROD36 Affidavit Addendum?

A: The ROD36 Affidavit Addendum form requires information about the cooperative property, the transferor, the transferee, and the terms of the transfer.

Q: When should I file a ROD36 Affidavit Addendum?

A: A ROD36 Affidavit Addendum should be filed within 30 days of the transfer of economic interest in a cooperative property.

Q: What are the consequences of not filing a ROD36 Affidavit Addendum?

A: Failure to file a ROD36 Affidavit Addendum may result in penalties or interest charges imposed by the Washington, D.C. Office of Tax and Revenue.

Q: Can I file a ROD36 Affidavit Addendum by mail?

A: Yes, you can file a ROD36 Affidavit Addendum by mail. Send the completed form to the Washington, D.C. Office of Tax and Revenue.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ROD36 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.