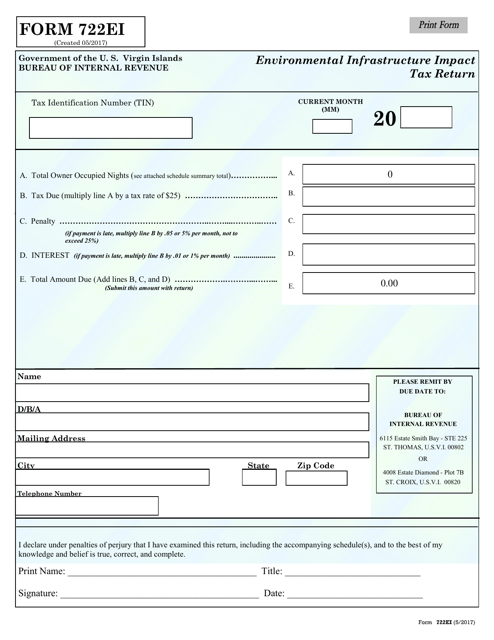

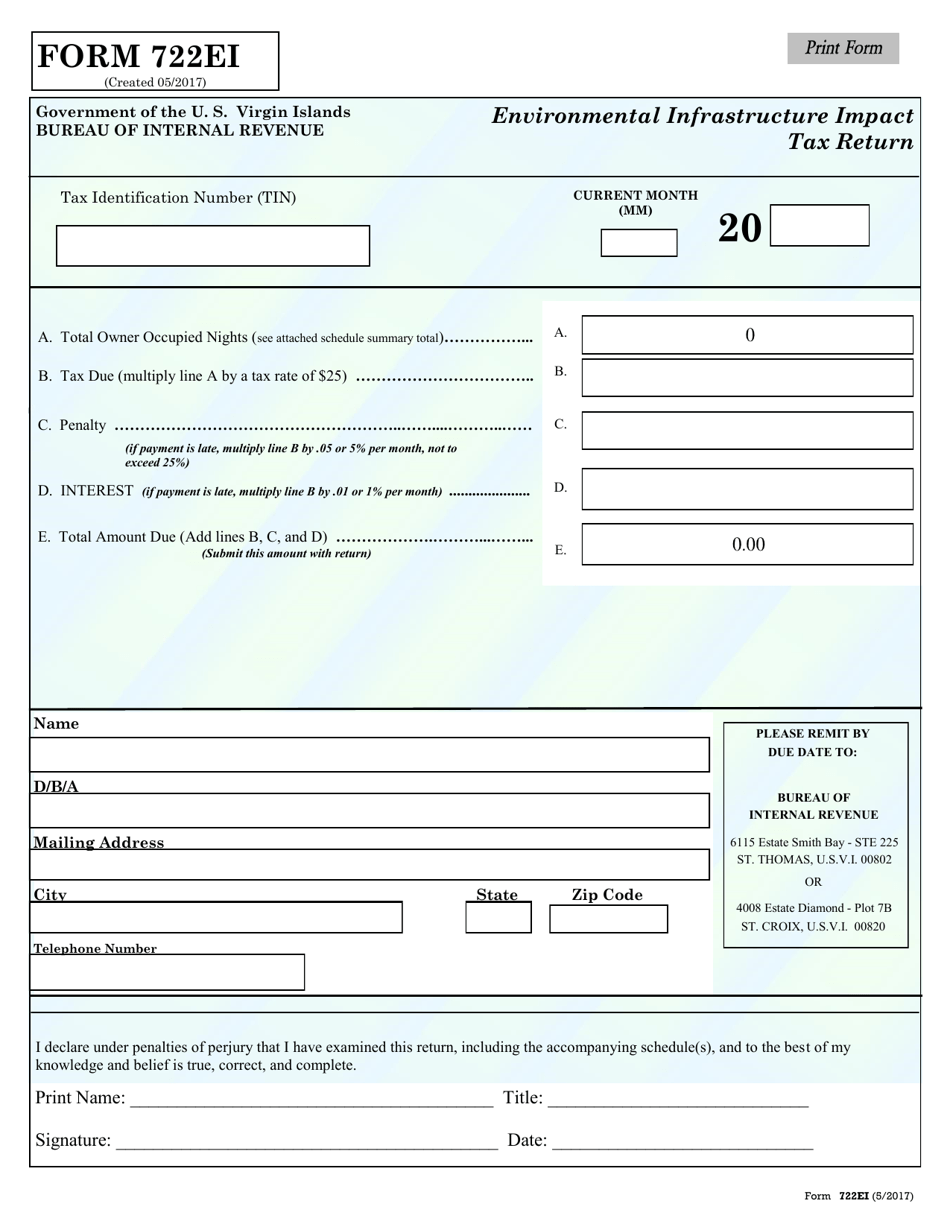

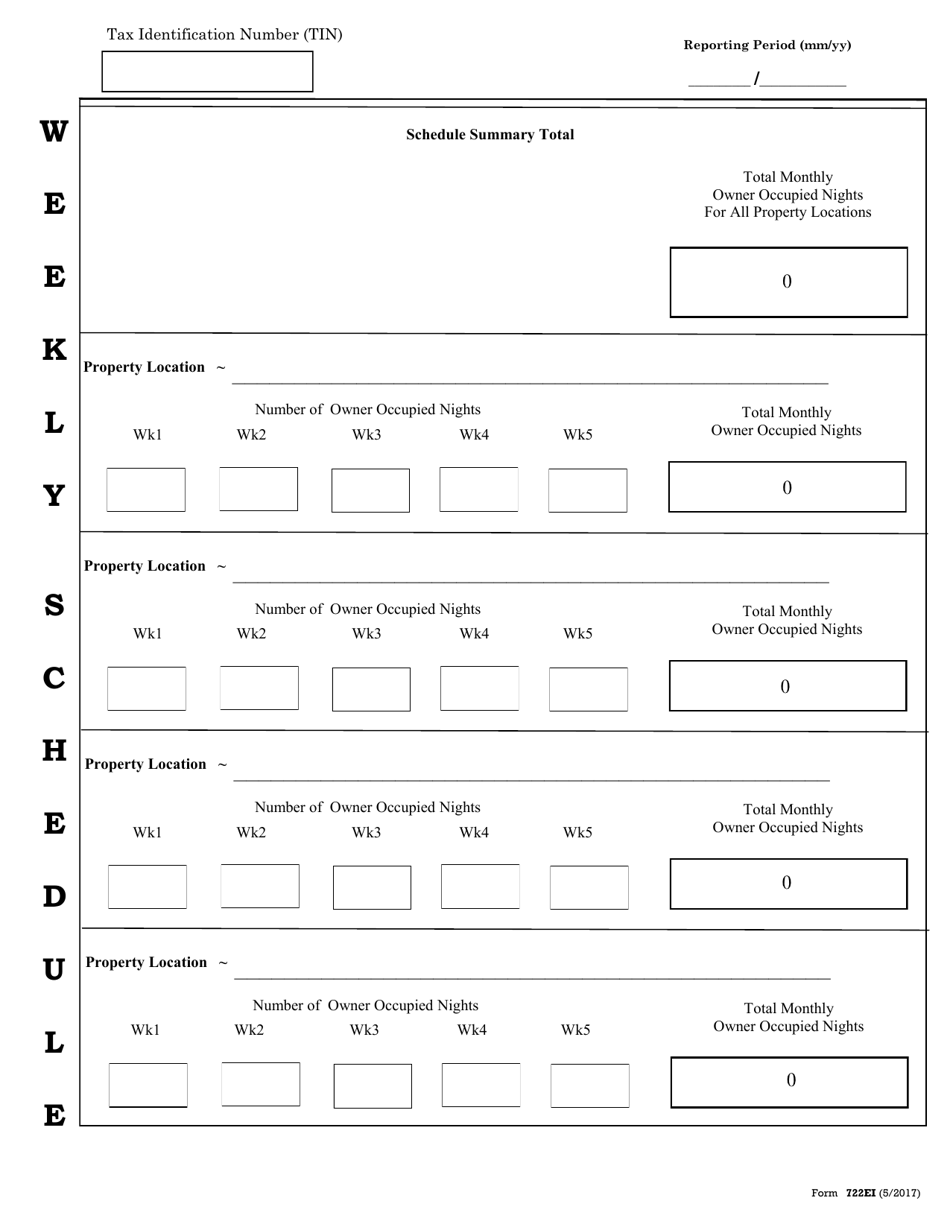

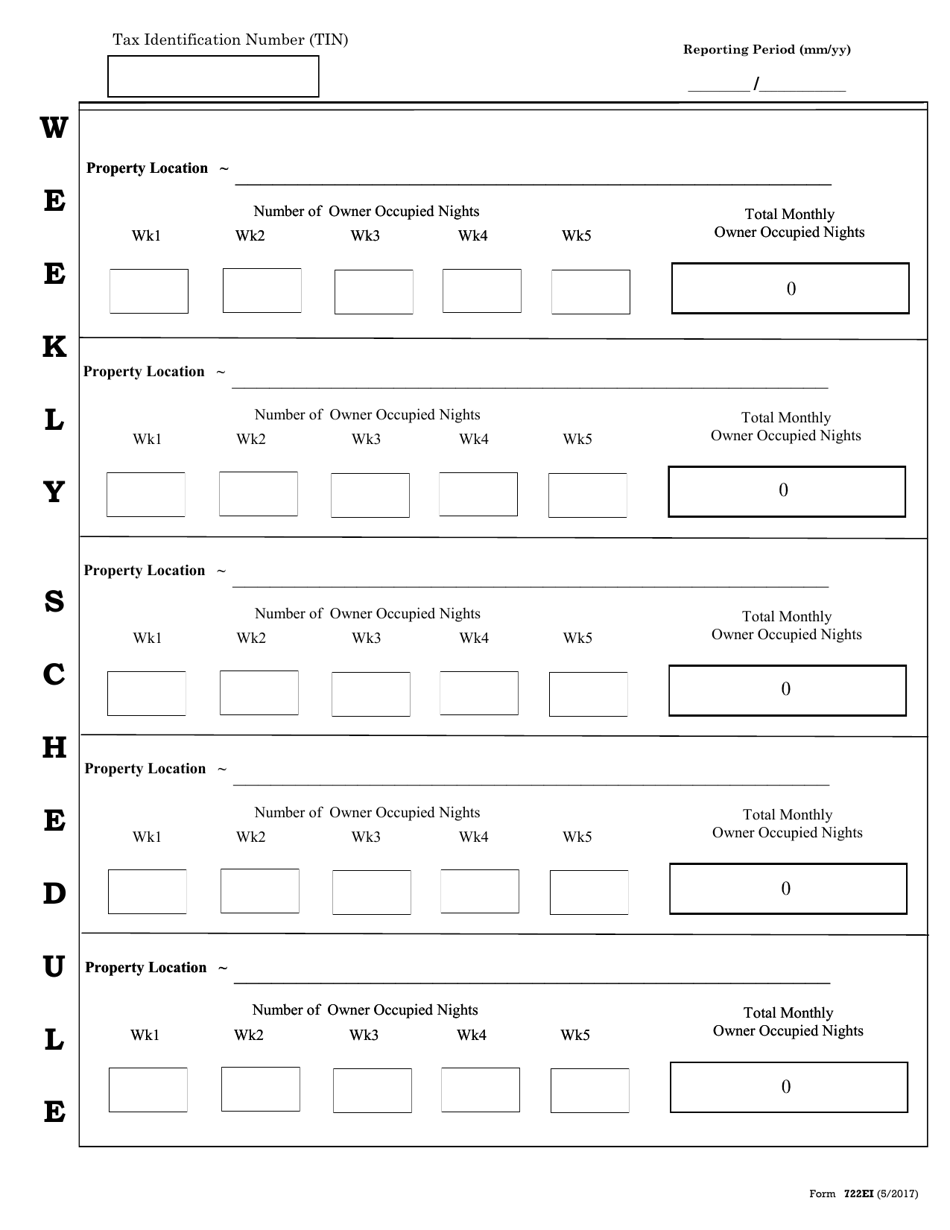

Form 722EI Environmental Infrastructure Impact Tax Return - Virgin Islands

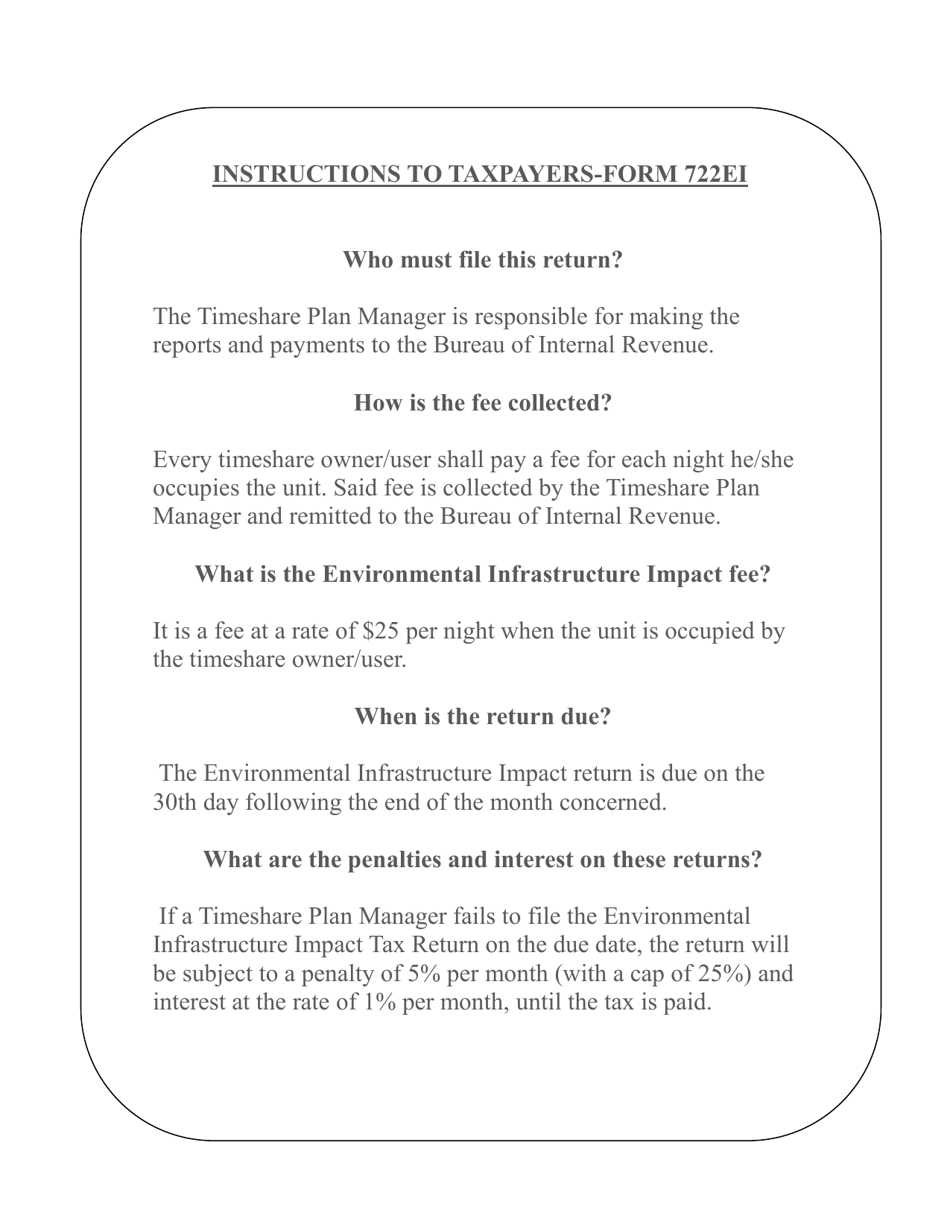

What Is Form 722EI?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 722EI?

A: Form 722EI is the Environmental Infrastructure Impact Tax Return.

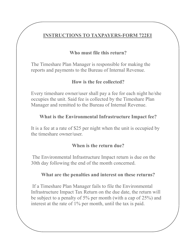

Q: Who needs to file Form 722EI?

A: Residents of the Virgin Islands who have made payments for environmental infrastructure projects.

Q: What is the purpose of Form 722EI?

A: The purpose of Form 722EI is to report and calculate the Environmental Infrastructure Impact Tax.

Q: Are there any filing deadlines for Form 722EI?

A: Yes, the filing deadline for Form 722EI is typically April 15th of each year.

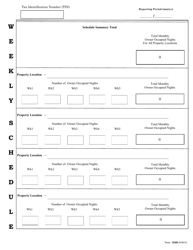

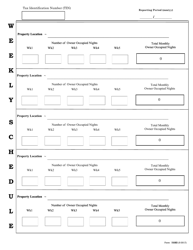

Q: Do I need to include any supporting documents with Form 722EI?

A: Yes, you may be required to attach certain supporting documents, such as receipts or invoices.

Q: Can I file Form 722EI electronically?

A: Yes, electronic filing options are available for Form 722EI.

Q: What happens if I don't file Form 722EI?

A: Failure to file Form 722EI or pay the tax may result in penalties, interest, or other enforcement actions.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 722EI by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.