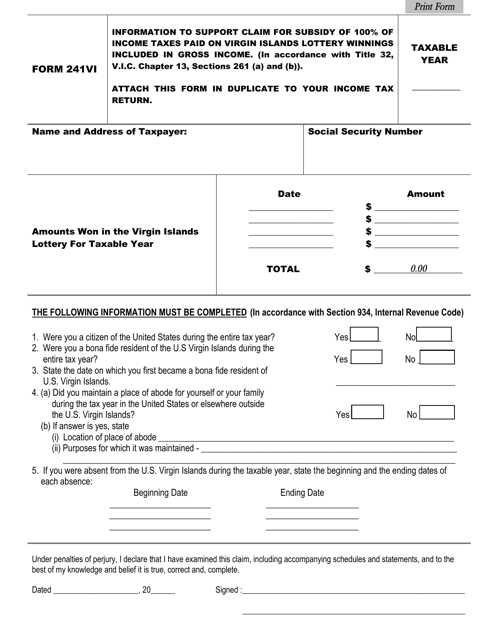

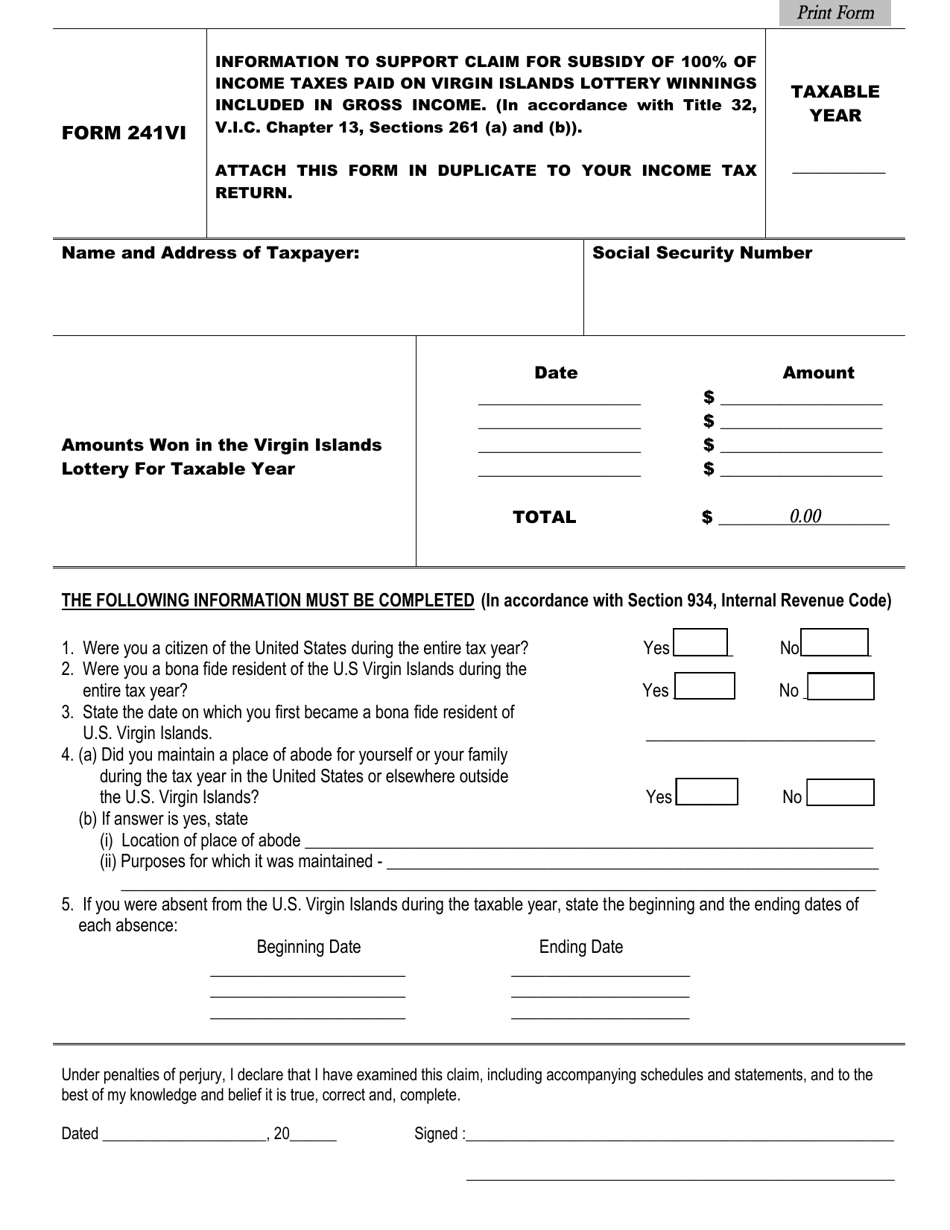

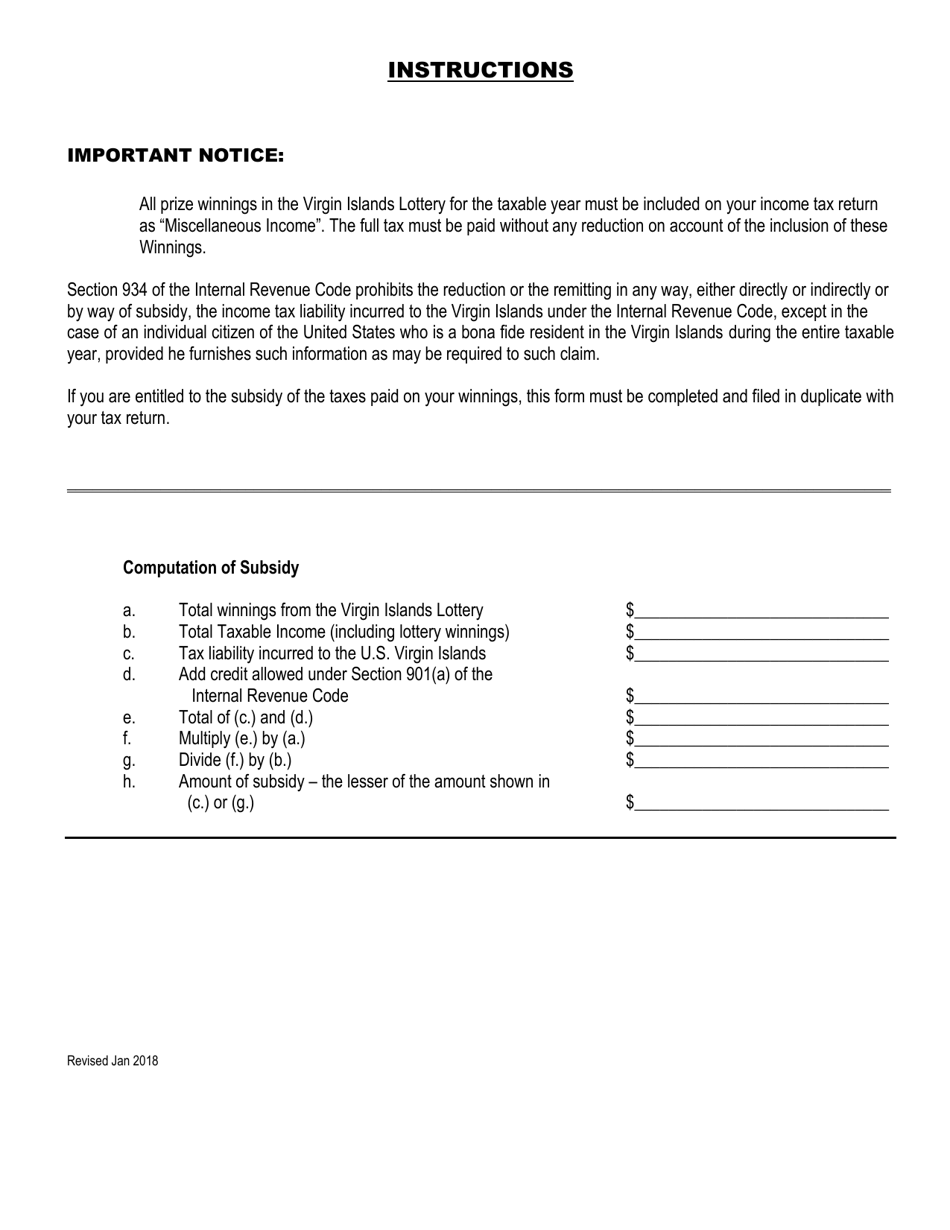

Form 241VI Lottery Subsidy - Virgin Islands

What Is Form 241VI?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 241VI?

A: Form 241VI is a lottery subsidy form specific to the Virgin Islands.

Q: What is a lottery subsidy?

A: A lottery subsidy is a payment made to provide financial assistance to the lottery winner.

Q: Who is eligible for the Form 241VI Lottery Subsidy?

A: Only residents of the Virgin Islands who have won a lottery prize are eligible for the subsidy.

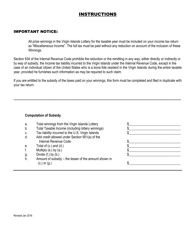

Q: How do I apply for the Form 241VI Lottery Subsidy?

A: To apply for the subsidy, you need to complete and submit Form 241VI to the appropriate government office in the Virgin Islands.

Q: What information is required on Form 241VI?

A: Form 241VI requires information about the lottery prize won, your personal details, and any supporting documents.

Q: How long does it take to process the Form 241VI Lottery Subsidy?

A: Processing times can vary, but it typically takes several weeks to review and process the subsidy application.

Q: What happens after the Form 241VI Lottery Subsidy is approved?

A: If your subsidy application is approved, you will receive the agreed-upon payment to assist with your lottery winnings.

Q: Can non-residents of the Virgin Islands apply for the subsidy?

A: No, the lottery subsidy is only available to residents of the Virgin Islands.

Q: Is there a limit to the amount of the subsidy?

A: The subsidy amount may vary depending on individual circumstances, but there may be a maximum limit determined by the government.

Q: Are lottery winnings taxable in the Virgin Islands?

A: Yes, lottery winnings are generally subject to taxation in the Virgin Islands.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 241VI by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.