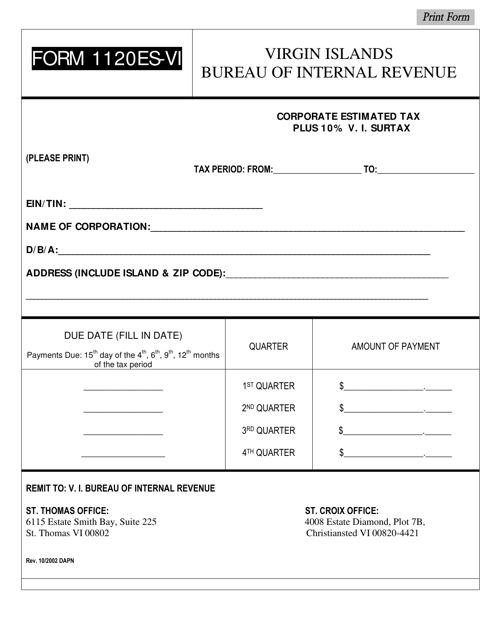

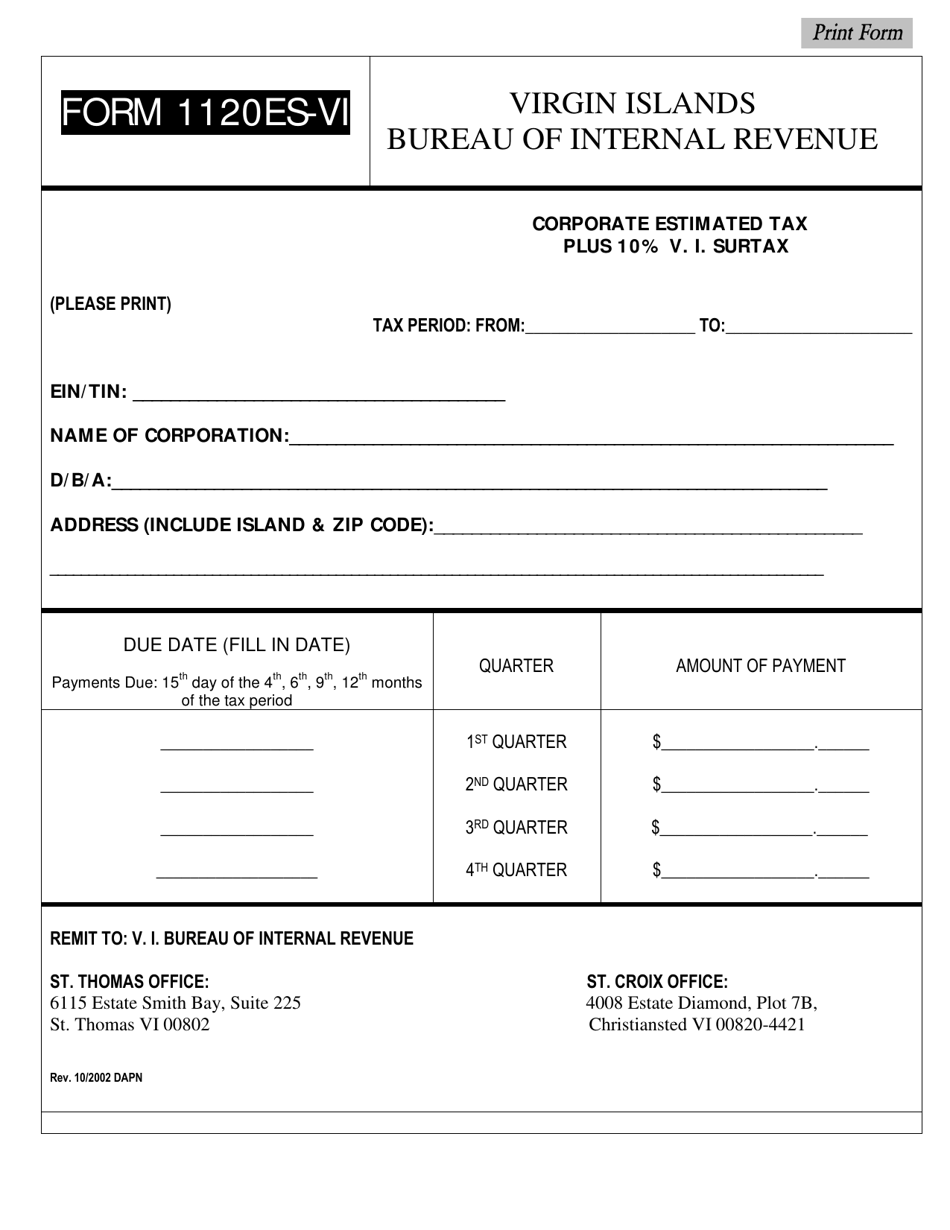

Form 1120ES-VI Corporate Estimated Tax - Virgin Islands

What Is Form 1120ES-VI?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ES-VI?

A: Form 1120ES-VI is the form used by corporations in the Virgin Islands to make estimated tax payments.

Q: Who needs to file Form 1120ES-VI?

A: Corporations in the Virgin Islands that are required to make estimated tax payments need to file Form 1120ES-VI.

Q: What are estimated tax payments?

A: Estimated tax payments are quarterly payments made by corporations to the IRS to cover their tax obligations for the year.

Q: When are estimated tax payments due?

A: Estimated tax payments for corporations are typically due on the 15th day of the 4th, 6th, 9th, and 12th months of their tax year.

Q: Are there any penalties for not making estimated tax payments?

A: Yes, there may be penalties for corporations that fail to make estimated tax payments or underpay their required amount.

Form Details:

- Released on October 1, 2002;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120ES-VI by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.