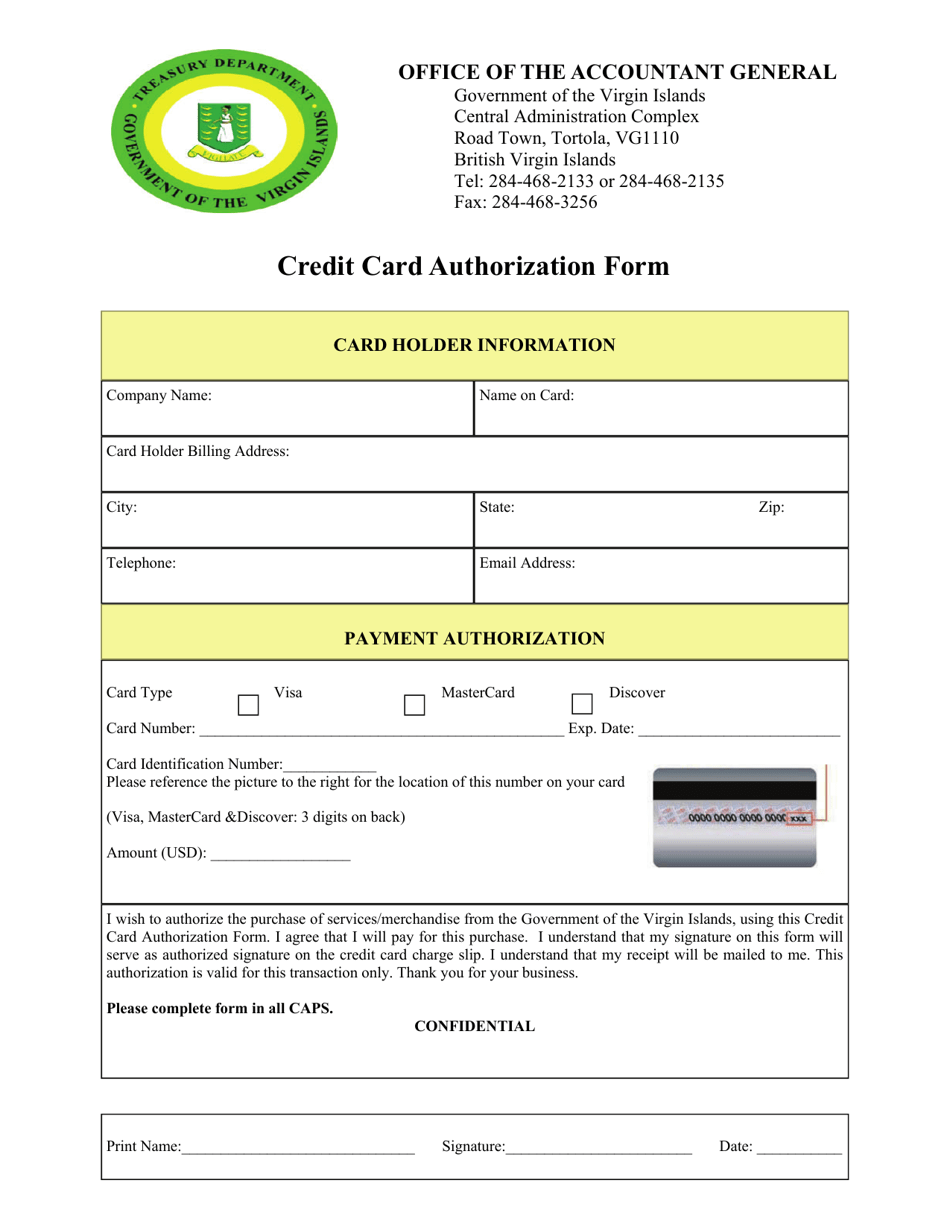

Credit Card Authorization Form - British Virgin Islands

A credit card authorization form in the British Virgin Islands is used to authorize the charging of a credit card for a specific transaction or payment. It is a legal document that allows businesses to securely obtain consent from customers to charge their credit card for goods or services provided.

FAQ

Q: What is a credit card authorization form?

A: A credit card authorization form is a document that allows a merchant to charge a customer's credit card for a specific amount.

Q: Why would I need to fill out a credit card authorization form?

A: You may need to fill out a credit card authorization form to authorize a transaction or payment, especially for situations where the merchant cannot physically swipe your card.

Q: What is the purpose of a credit card authorization form?

A: The purpose of a credit card authorization form is to protect both the merchant and the customer by ensuring that the payment is authorized, and to provide a paper trail in case of any disputes or issues with the transaction.

Q: What information is typically required on a credit card authorization form?

A: Typically, a credit card authorization form requires the cardholder's name, billing address, credit card number, expiration date, CVV code, and the amount to be charged. It may also require the cardholder's signature.

Q: Is it safe to provide my credit card information on a credit card authorization form?

A: It usually safe to provide your credit card information on a credit card authorization form, as long as you are dealing with a reputable merchant or organization. However, it's always a good idea to exercise caution and verify the legitimacy of the recipient before providing sensitive information.