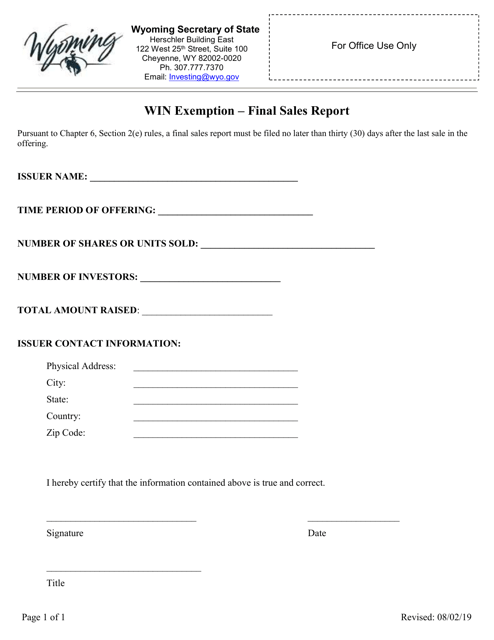

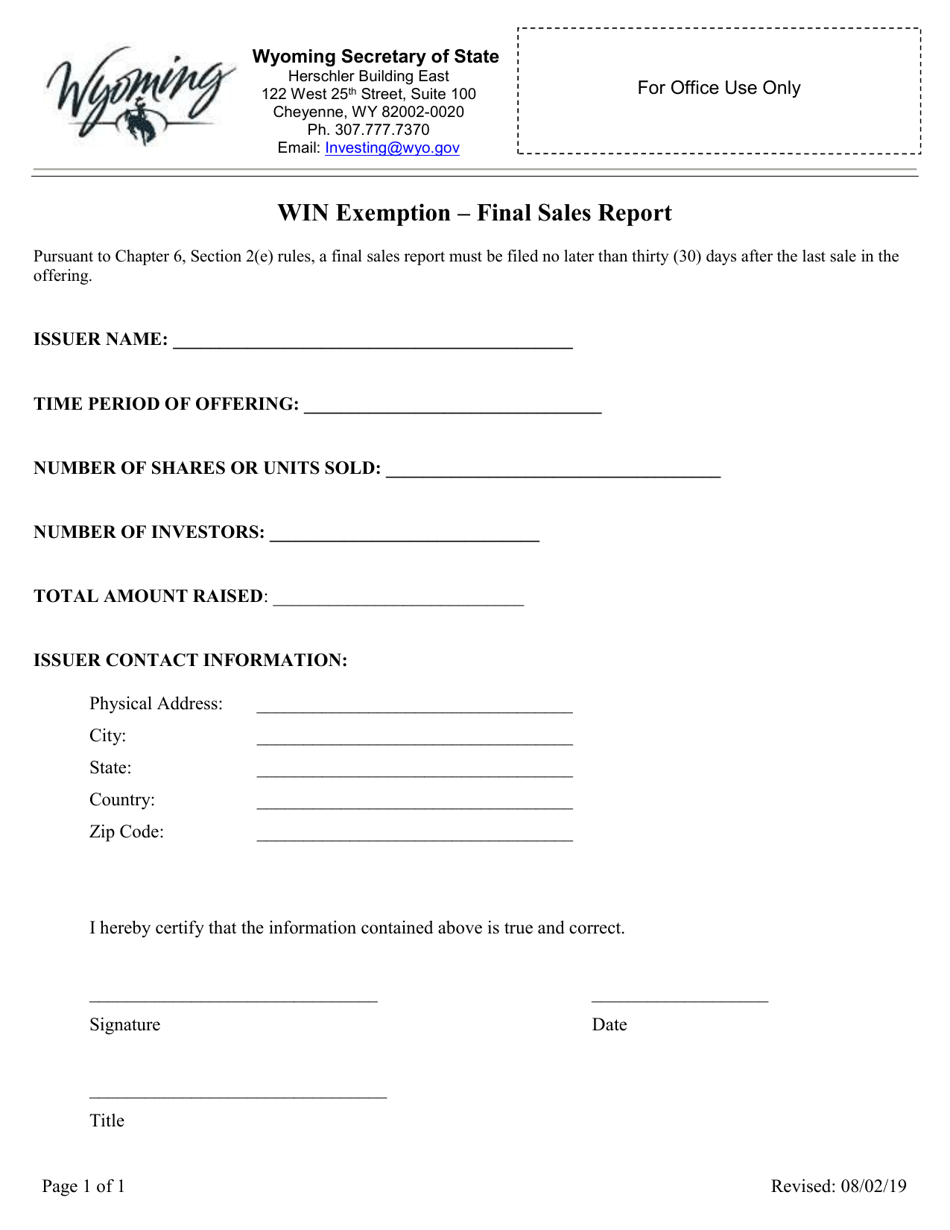

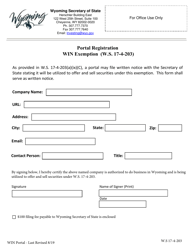

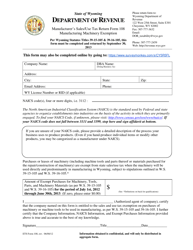

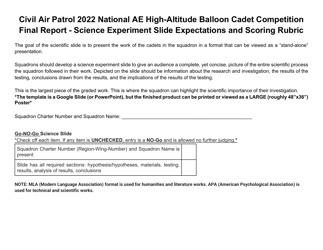

Win Exemption - Final Sales Report - Wyoming

Win Exemption - Final Sales Report is a legal document that was released by the Wyoming Secretary of State - a government authority operating within Wyoming.

FAQ

Q: What is the Win Exemption?

A: The Win Exemption is a tax exemption for sales of raw materials used in manufacturing.

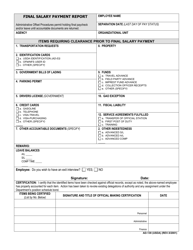

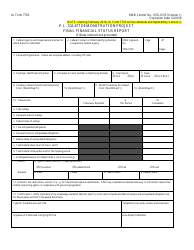

Q: What is the Final Sales Report?

A: The Final Sales Report is a report that businesses in Wyoming must file to report their sales and use tax.

Q: What is the purpose of the Final Sales Report?

A: The purpose of the Final Sales Report is to provide information on the sales and use tax that businesses have collected and remitted to the state.

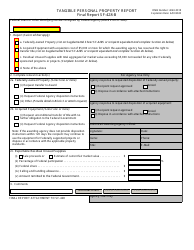

Q: Who is required to file the Final Sales Report?

A: All businesses in Wyoming that collect sales and use tax must file the Final Sales Report.

Q: When is the Final Sales Report due?

A: The Final Sales Report is due on the last day of the month following the end of the reporting period.

Q: Are there any exemptions to filing the Final Sales Report?

A: No, all businesses that collect sales and use tax in Wyoming must file the Final Sales Report.

Q: Are there any penalties for not filing the Final Sales Report?

A: Yes, businesses that fail to file the Final Sales Report may be subject to penalties and interest.

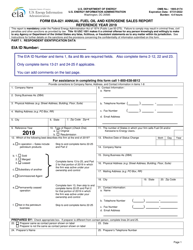

Form Details:

- Released on August 2, 2019;

- The latest edition currently provided by the Wyoming Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Secretary of State.