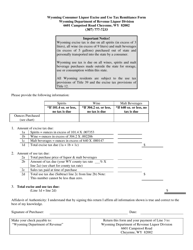

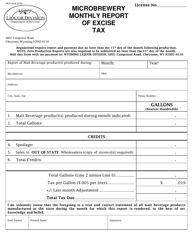

Wyoming Consumer Liquor Excise and Use Tax Remittance Form - Wyoming

Wyoming Consumer Liquor Excise and Use Tax Remittance Form is a legal document that was released by the Wyoming Department of Revenue - a government authority operating within Wyoming.

FAQ

Q: What is the Wyoming Consumer Liquor Excise and Use Tax Remittance Form?

A: The Wyoming Consumer Liquor Excise and Use Tax Remittance Form is a tax form used by liquor vendors in Wyoming to remit consumer liquor excise and use taxes to the state.

Q: Who needs to file the Wyoming Consumer Liquor Excise and Use Tax Remittance Form?

A: Liquor vendors in Wyoming who sell consumer liquor are required to file the Wyoming Consumer Liquor Excise and Use Tax Remittance Form.

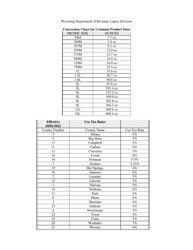

Q: What are consumer liquor excise and use taxes?

A: Consumer liquor excise and use taxes are taxes imposed on the sale or purchase of liquor meant for personal consumption in Wyoming.

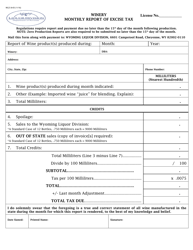

Q: How often do liquor vendors need to file the Wyoming Consumer Liquor Excise and Use Tax Remittance Form?

A: Liquor vendors in Wyoming are required to file the Wyoming Consumer Liquor Excise and Use Tax Remittance Form on a monthly basis.

Q: Are there any penalties for not filing the Wyoming Consumer Liquor Excise and Use Tax Remittance Form?

A: Yes, there can be penalties for failure to file the Wyoming Consumer Liquor Excise and Use Tax Remittance Form, including fines and potential license suspension.

Form Details:

- The latest edition currently provided by the Wyoming Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Department of Revenue.