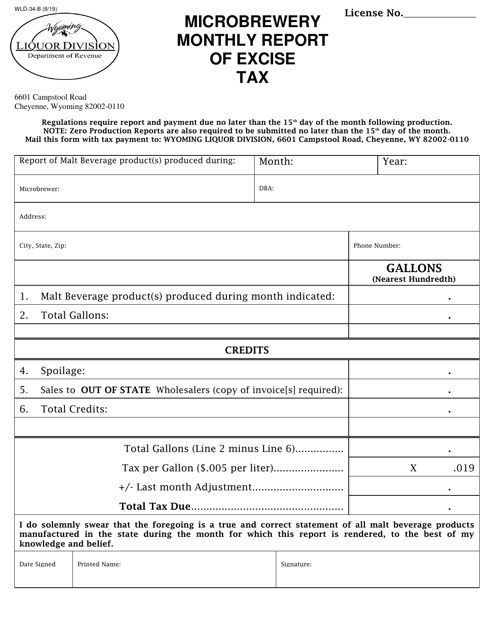

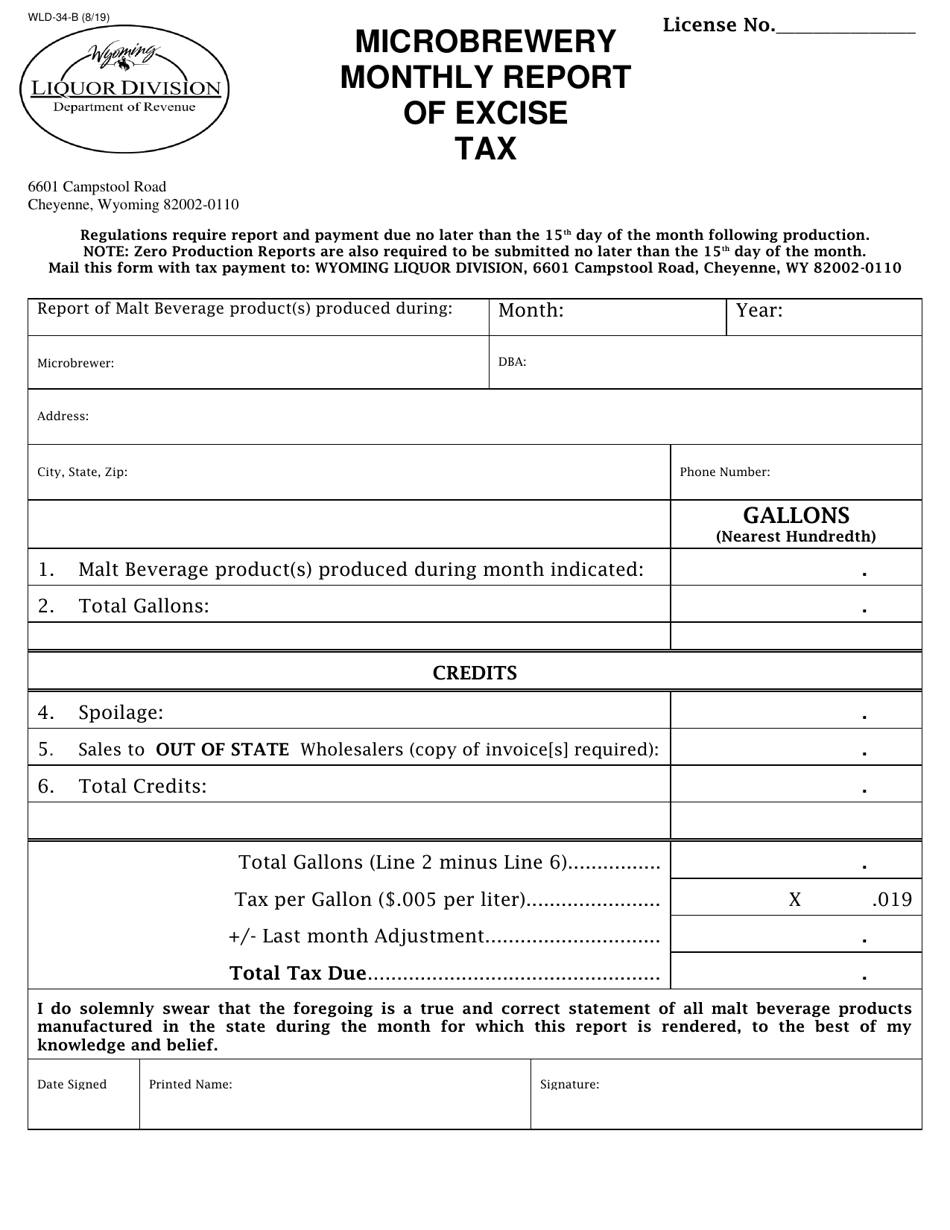

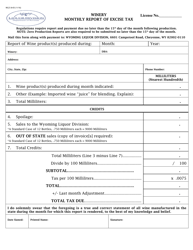

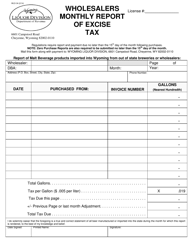

Form WLD-34-B Microbrewery Monthly Report of Excise Tax - Wyoming

What Is Form WLD-34-B?

This is a legal form that was released by the Wyoming Department of Revenue - a government authority operating within Wyoming. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WLD-34-B?

A: Form WLD-34-B is the Microbrewery Monthly Report of Excise Tax for microbreweries in Wyoming.

Q: Who needs to file Form WLD-34-B?

A: Microbreweries in Wyoming need to file Form WLD-34-B to report their excise tax.

Q: What is the purpose of Form WLD-34-B?

A: Form WLD-34-B is used to report and pay the excise tax on beer produced by microbreweries in Wyoming.

Q: When is Form WLD-34-B due?

A: Form WLD-34-B is due on the 15th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form WLD-34-B?

A: Yes, there may be penalties for late filing of Form WLD-34-B. It is important to file on time to avoid penalties.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wyoming Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WLD-34-B by clicking the link below or browse more documents and templates provided by the Wyoming Department of Revenue.