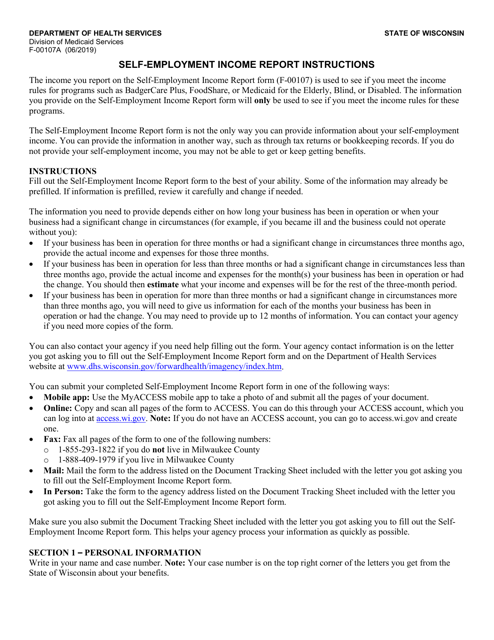

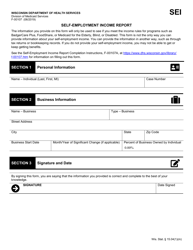

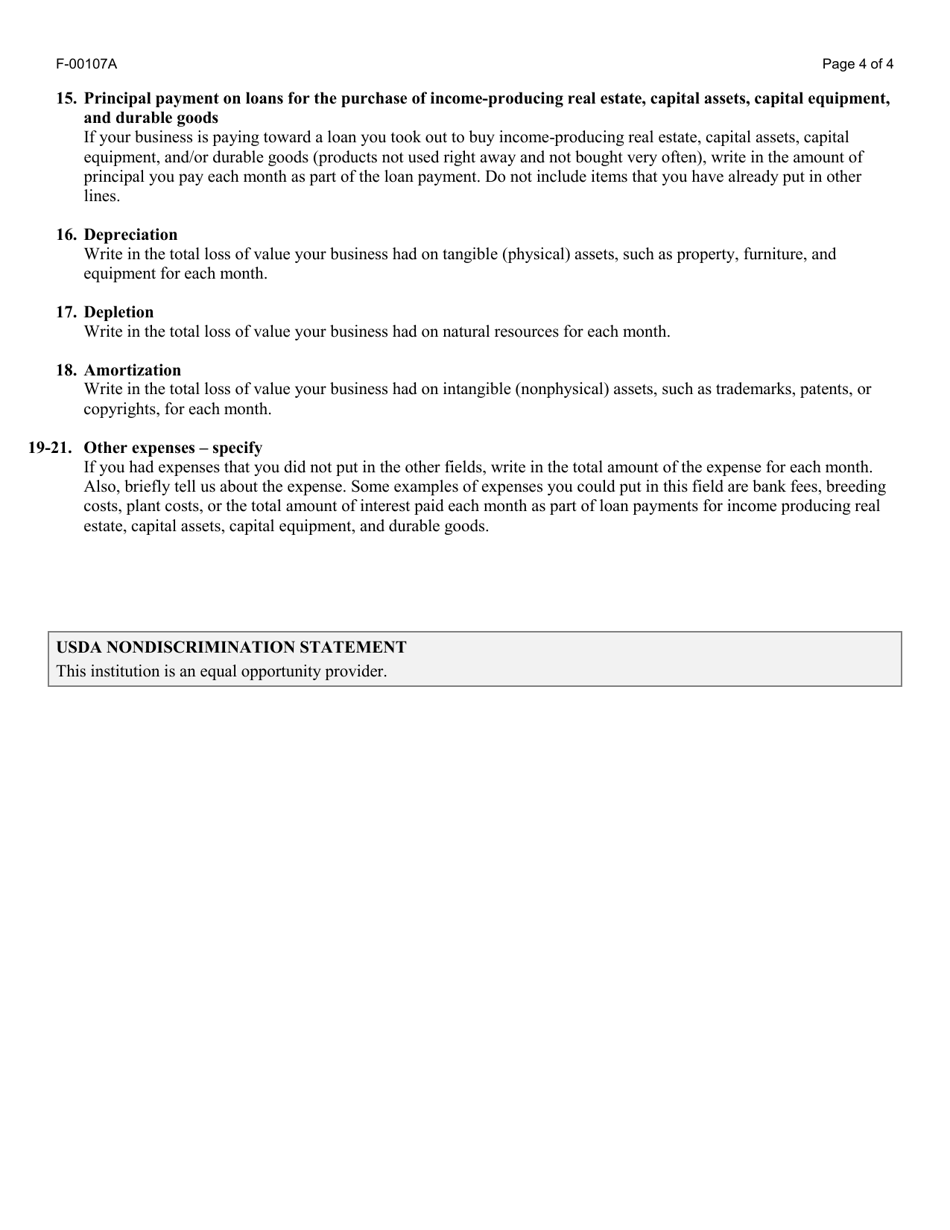

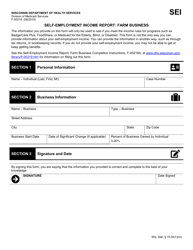

Instructions for Form F-00107 Self-employment Income Report - Wisconsin

This document contains official instructions for Form F-00107 , Self-employment Income Report - a form released and collected by the Wisconsin Department of Health Services. An up-to-date fillable Form F-00107 is available for download through this link.

FAQ

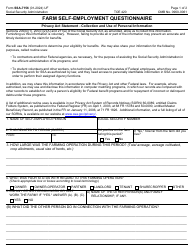

Q: What is Form F-00107?

A: Form F-00107 is the Self-employment Income Report for the state of Wisconsin.

Q: Who needs to fill out Form F-00107?

A: Self-employed individuals in Wisconsin who need to report their income.

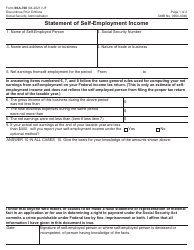

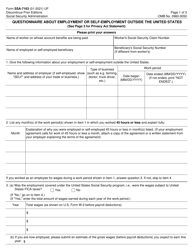

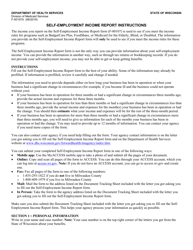

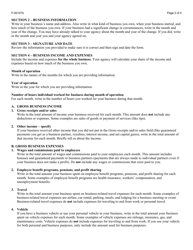

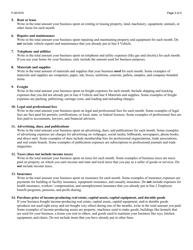

Q: What information is required on Form F-00107?

A: Form F-00107 requires the individual's personal information, details about their self-employment income, and any adjustments or deductions they may have.

Q: When is Form F-00107 due?

A: Form F-00107 is due annually by April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form F-00107?

A: Yes, there may be penalties for late filing or underreporting of income. It is important to file the form on time to avoid penalties.

Q: Are there any exemptions or deductions available on Form F-00107?

A: Yes, there may be exemptions and deductions available for self-employed individuals. It is important to review the instructions for Form F-00107 or consult a tax professional for more information.

Q: What should I do if I have questions about filling out Form F-00107?

A: If you have questions about filling out Form F-00107, you can contact the Wisconsin Department of Revenue for assistance.

Q: Can I e-file Form F-00107?

A: Currently, Form F-00107 cannot be e-filed. It must be submitted by mail or delivered in person to the Wisconsin Department of Revenue.

Q: Is Form F-00107 for individuals who have employees?

A: No, Form F-00107 is specifically for self-employed individuals and does not pertain to individuals who have employees.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

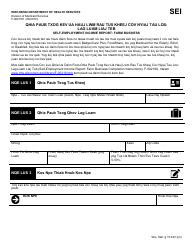

- Also available in Spanish;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Health Services.

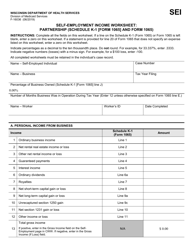

![Document preview: Form F-16035 Self-employment Income Worksheet: S Corporation (Schedule K-1 [form 1120s] and Form 1120s) - Wisconsin](https://data.templateroller.com/pdf_docs_html/2834/28349/2834988/form-f-16035-self-employment-income-worksheet-s-corporation-schedule-k-1-form-1120s-and-form-1120s-wisconsin.png)