Instructions for Form F-00219 Self-employment Income Report: Farm Business - Wisconsin (Hmong)

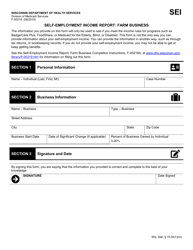

This document contains official instructions in Hmong for Form F-00219 , Self-employment Income Report: Farm Business - a form released and collected by the Wisconsin Department of Health Services. An up-to-date fillable Form F-00219 is available for download through this link.

FAQ

Q: What is Form F-00219?

A: Form F-00219 is the Self-employment Income Report specifically for Farm Business in Wisconsin. It is used to report income from self-employment in farming.

Q: Who needs to fill out Form F-00219?

A: Farmers in Wisconsin who have self-employment income from their farming business need to fill out Form F-00219.

Q: What is the purpose of Form F-00219?

A: The purpose of Form F-00219 is to report self-employment income from farm business in Wisconsin. It helps to determine eligibility for certain assistance programs and to calculate income for tax purposes.

Q: What information do I need to fill out Form F-00219?

A: You will need to provide details about your farming business, such as income earned, expenses incurred, and any other relevant financial information.

Q: Are there any deadlines for filing Form F-00219?

A: Yes, there are specific deadlines for filing Form F-00219. It is important to check with the Wisconsin Department of Health Services or your local county office to determine the exact deadline.

Q: Do I need to include supporting documents with Form F-00219?

A: Yes, you may need to include supporting documents such as invoices, receipts, and other financial records that support the information provided on the form.

Q: Who can help me if I have questions or need assistance with Form F-00219?

A: If you have questions or need assistance with Form F-00219, you can reach out to your local county office or the Wisconsin Department of Health Services for guidance.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Also available in English;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Health Services.