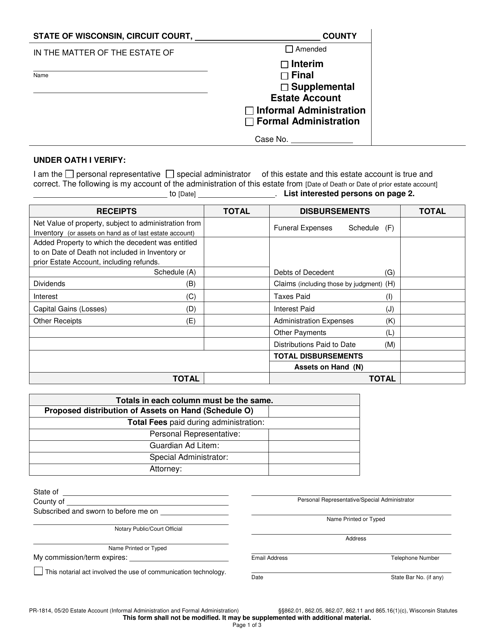

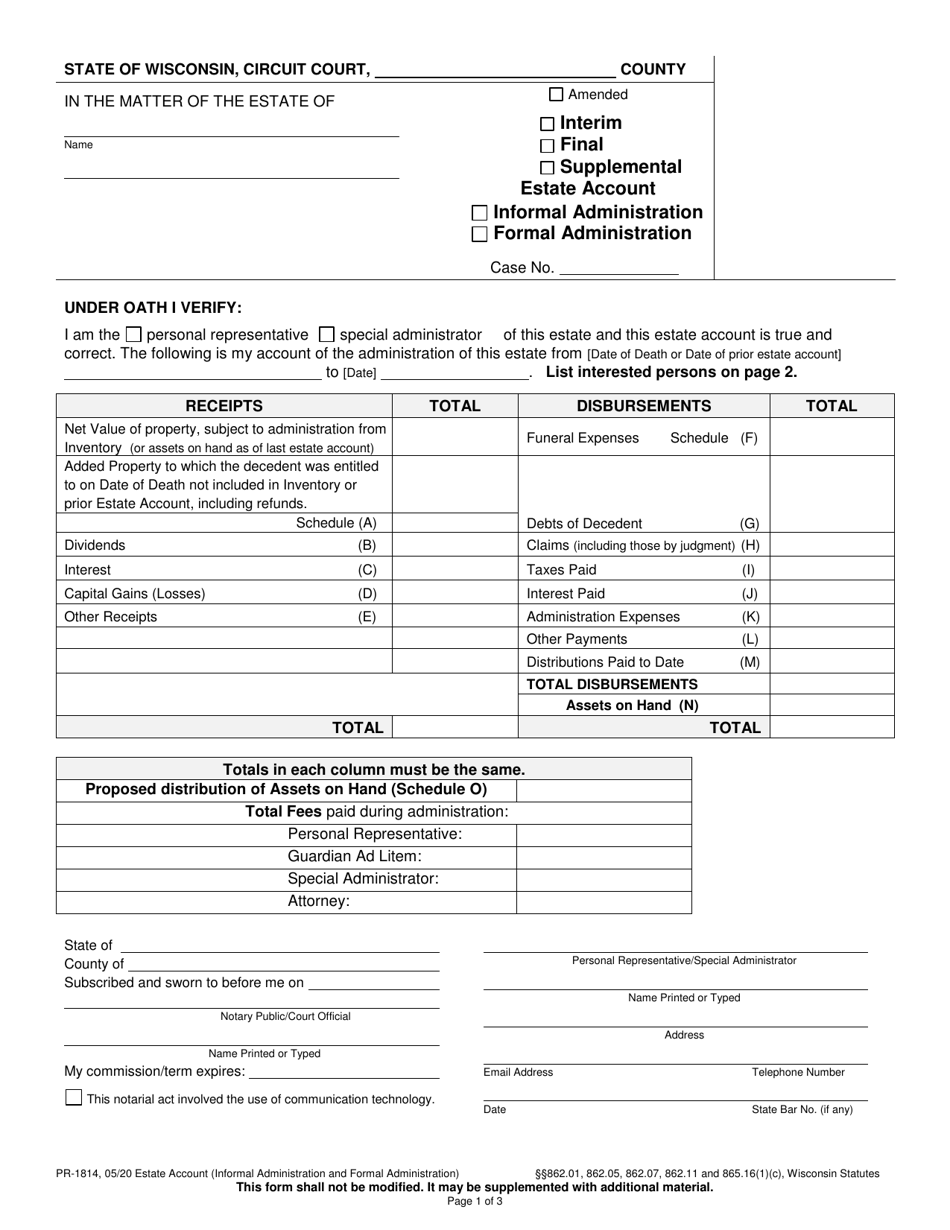

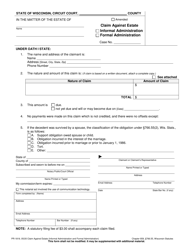

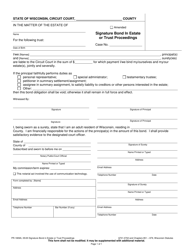

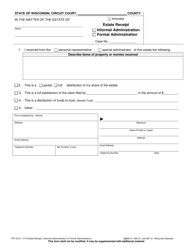

Form PR-1814 Estate Account (Informal and Formal Administration) - Wisconsin

What Is Form PR-1814?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-1814?

A: Form PR-1814 is the Estate Account form used in Wisconsin for both Informal and Formal Administration of an estate.

Q: Who needs to file Form PR-1814?

A: The personal representative of the estate (executor or administrator) needs to file Form PR-1814.

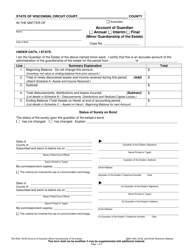

Q: What is the purpose of Form PR-1814?

A: Form PR-1814 is used to report the financial transactions related to the estate, including income, expenses, and distribution of assets.

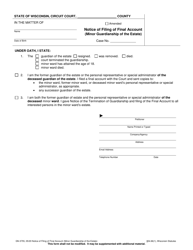

Q: Are there any filing fees for Form PR-1814?

A: Yes, there are filing fees associated with Form PR-1814. The amount can vary depending on the county where the estate is being administered.

Q: When is Form PR-1814 due?

A: Form PR-1814 is generally due within 30 days from the close of the accounting period, which is typically one year from the date of appointment of the personal representative.

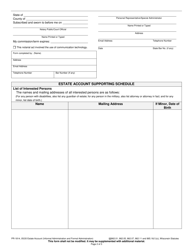

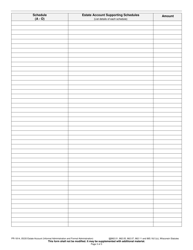

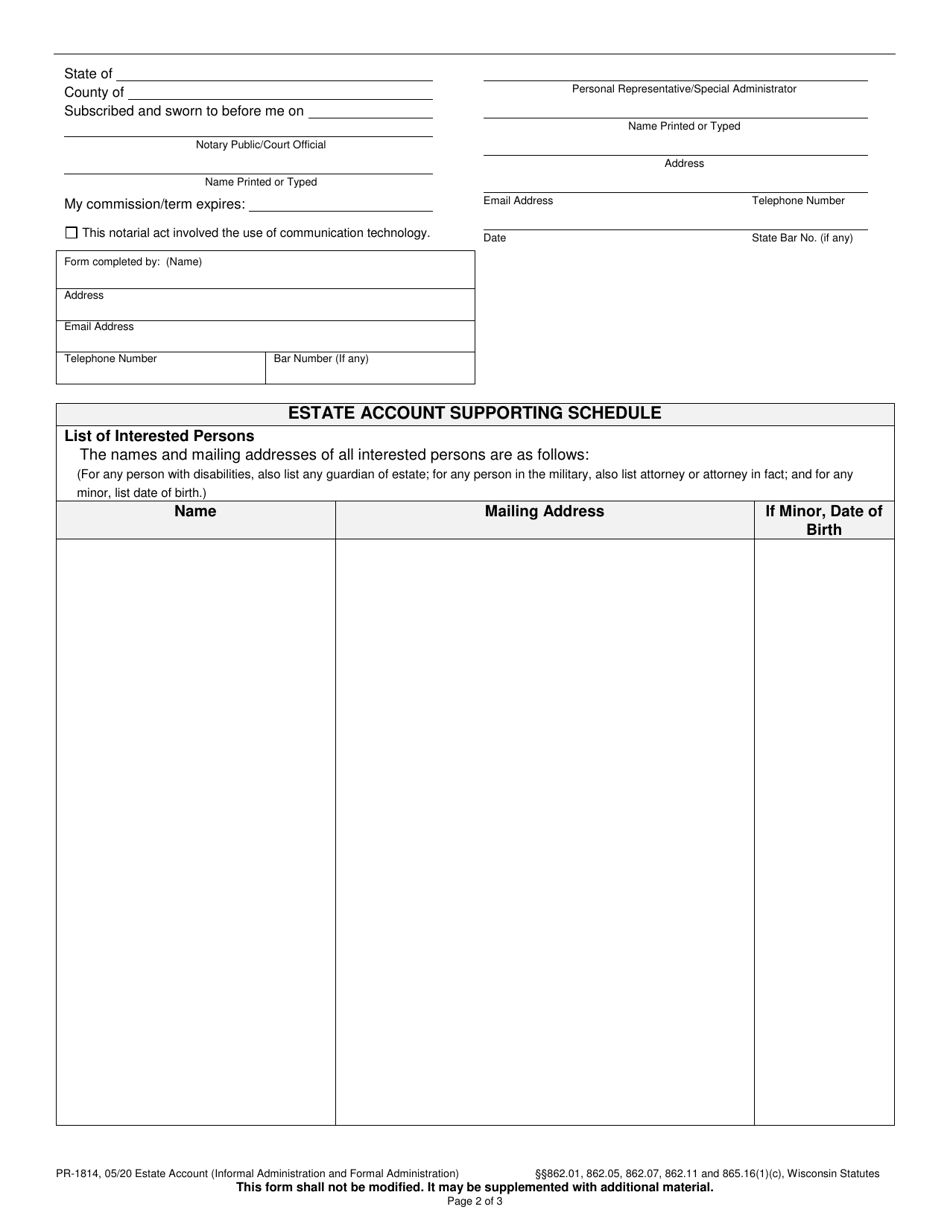

Q: What supporting documents are required with Form PR-1814?

A: Supporting documents may include bank statements, receipts, invoices, and any other relevant financial records related to the estate.

Q: Can Form PR-1814 be filed electronically?

A: Yes, in some counties, Form PR-1814 can be filed electronically. It's best to check with the probate court in the county where the estate is being administered.

Q: What happens if Form PR-1814 is not filed?

A: Failure to file Form PR-1814 can result in penalties and delays in the administration of the estate.

Q: Can I get help with filling out Form PR-1814?

A: Yes, you can seek assistance from an attorney, a certified public accountant (CPA), or a probate professional to help you fill out Form PR-1814.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-1814 by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.