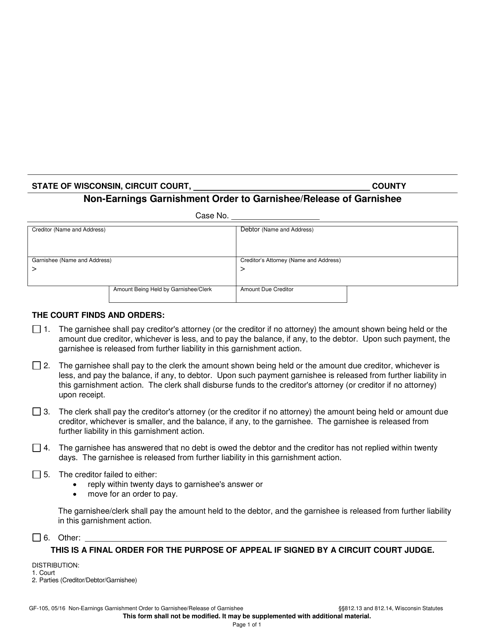

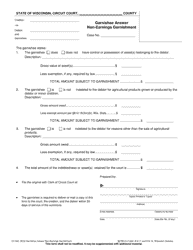

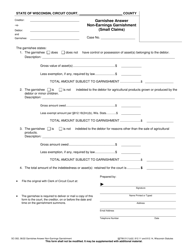

Form GF-105 Non-earnings Garnishment Order to Garnishee / Release of Garnishee - Wisconsin

What Is Form GF-105?

This is a legal form that was released by the Wisconsin Circuit Court - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GF-105?

A: Form GF-105 is a Non-earnings Garnishment Order to Garnishee/Release of Garnishee form in Wisconsin.

Q: What is a Non-earnings Garnishment Order?

A: A Non-earnings Garnishment Order is a legal document that allows a creditor to collect unpaid debts by garnishing the funds held by a third party, known as the garnishee.

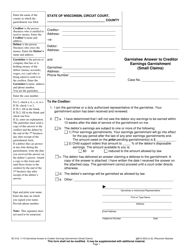

Q: Who is the garnishee?

A: The garnishee is a third party, usually a bank or employer, who is holding funds that may be used to satisfy a debt owed by the debtor.

Q: What is the purpose of Form GF-105?

A: Form GF-105 is used to request the garnishee to withhold and pay a specific amount of funds to satisfy a debt owed by the debtor.

Q: How do I use Form GF-105?

A: You need to fill out Form GF-105 with the required information about the debtor, the garnishee, and the debt. Then you must serve a copy of the form to the garnishee, who will take the necessary steps to withhold and pay the funds.

Q: Is there a fee for filing Form GF-105?

A: Yes, there is a filing fee associated with filing Form GF-105. The amount may vary depending on the county.

Q: Can I garnish non-earnings funds with Form GF-105?

A: Yes, Form GF-105 is specifically designed for non-earnings garnishments, which include funds held in a bank account or other assets that are not wages or salary.

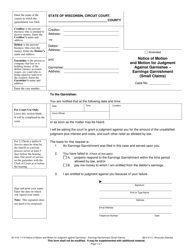

Q: What happens after Form GF-105 is filed?

A: After filing Form GF-105, the garnishee will be notified of the garnishment order and will take the necessary steps to withhold and pay the funds. The debtor will also receive notice of the garnishment.

Q: Can the debtor challenge the garnishment?

A: Yes, the debtor has the right to challenge the garnishment by filing a written objection with the court within a certain timeframe. The court will then review the objection and decide whether to modify or uphold the garnishment order.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Wisconsin Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GF-105 by clicking the link below or browse more documents and templates provided by the Wisconsin Circuit Court.