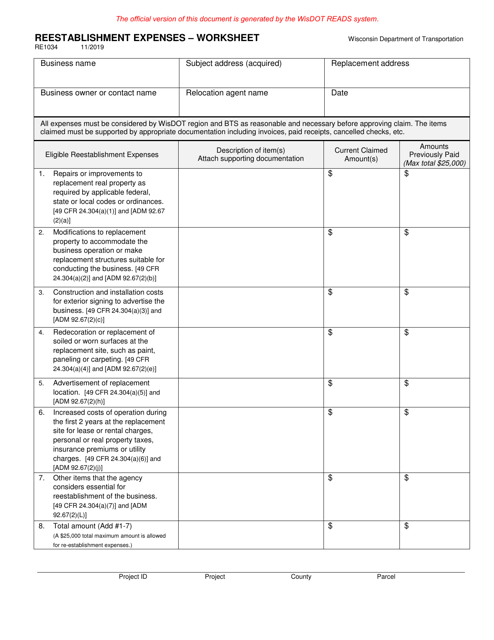

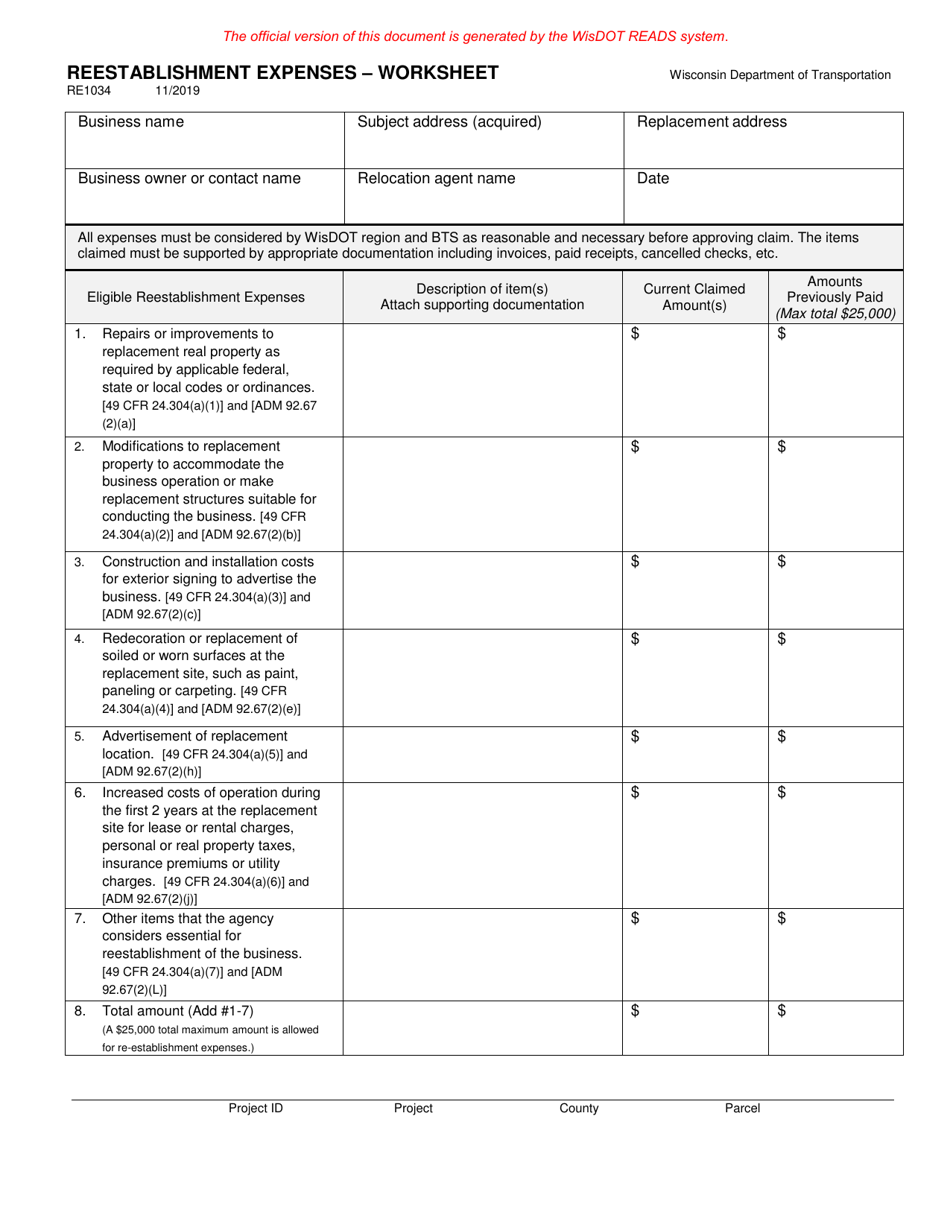

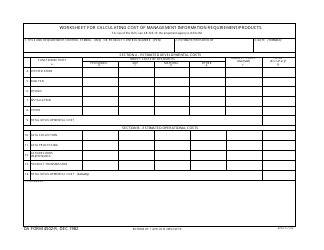

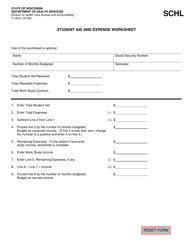

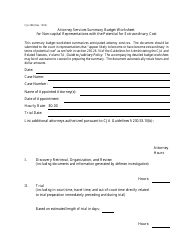

Form RE1034 Reestablishment Expenses - Worksheet - Wisconsin

What Is Form RE1034?

This is a legal form that was released by the Wisconsin Department of Transportation - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RE1034?

A: Form RE1034 is a worksheet for reporting reestablishment expenses in Wisconsin.

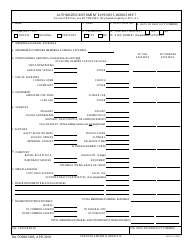

Q: What are reestablishment expenses?

A: Reestablishment expenses are costs incurred when reestablishing a business in Wisconsin.

Q: Who needs to fill out Form RE1034?

A: Businesses that have incurred reestablishment expenses in Wisconsin need to fill out this form.

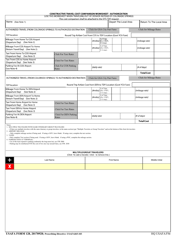

Q: How do I fill out Form RE1034?

A: Fill out the worksheet with the required information about your reestablishment expenses.

Q: When is Form RE1034 due?

A: Form RE1034 is due on or before the tax filing deadline for your business.

Q: Is there a deadline extension available for filing Form RE1034?

A: You may be able to request an extension for filing Form RE1034, but you would need to contact the Wisconsin Department of Revenue for more information.

Q: Are reestablishment expenses tax deductible?

A: Reestablishment expenses may be tax deductible, but you should consult a tax professional for specific guidance.

Q: What happens if I don't file Form RE1034?

A: Failure to file Form RE1034 may result in penalties or interest assessed by the Wisconsin Department of Revenue.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Wisconsin Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RE1034 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Transportation.