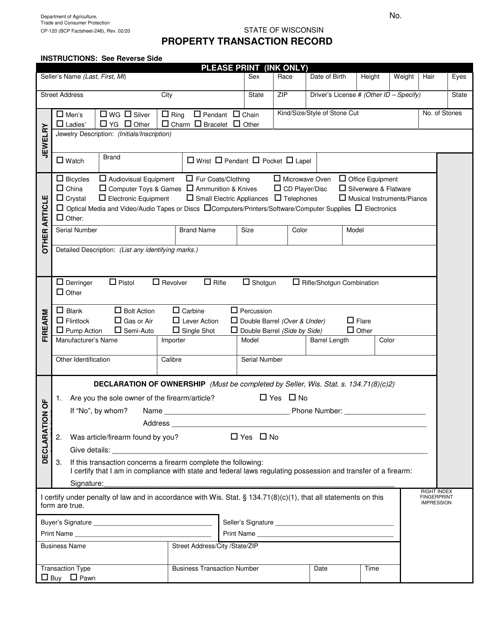

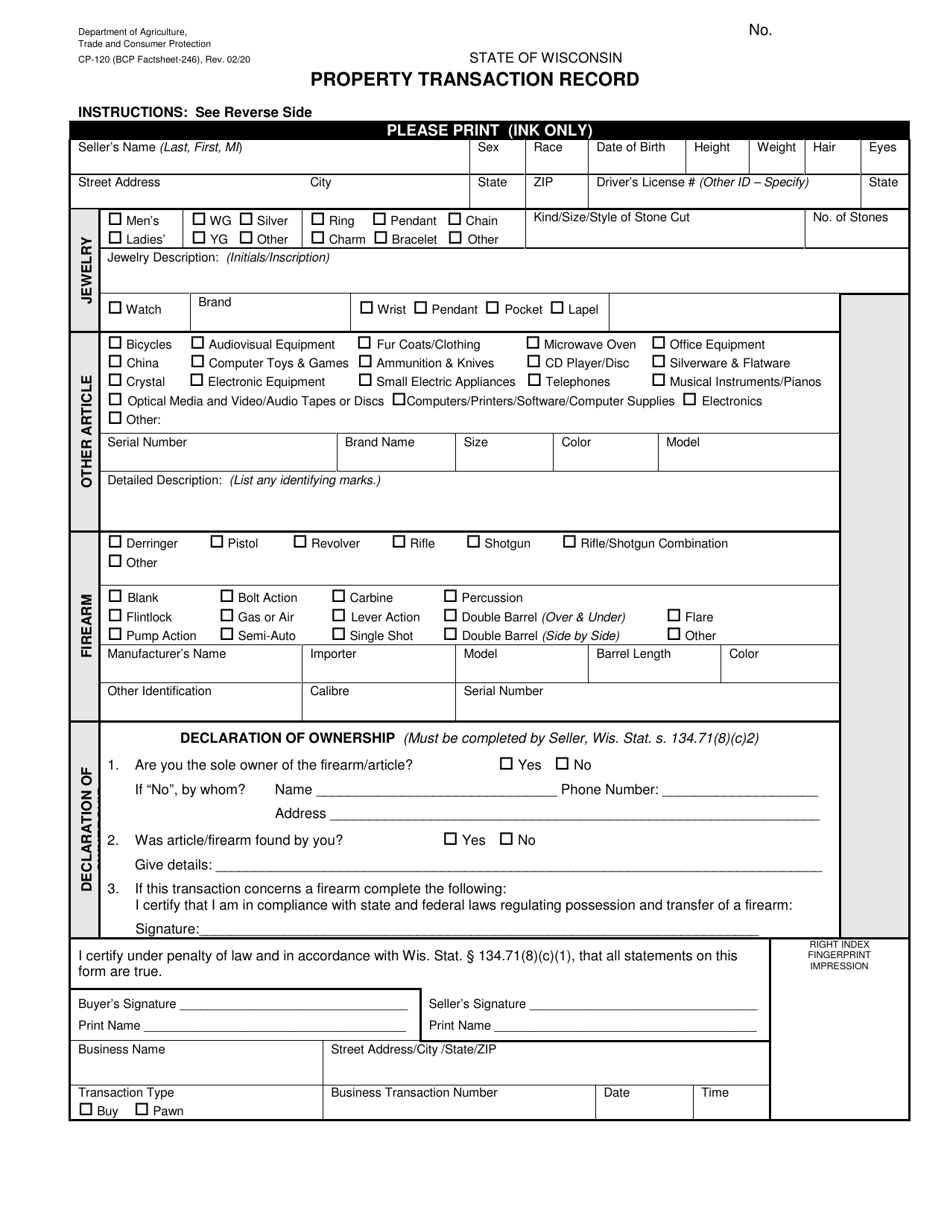

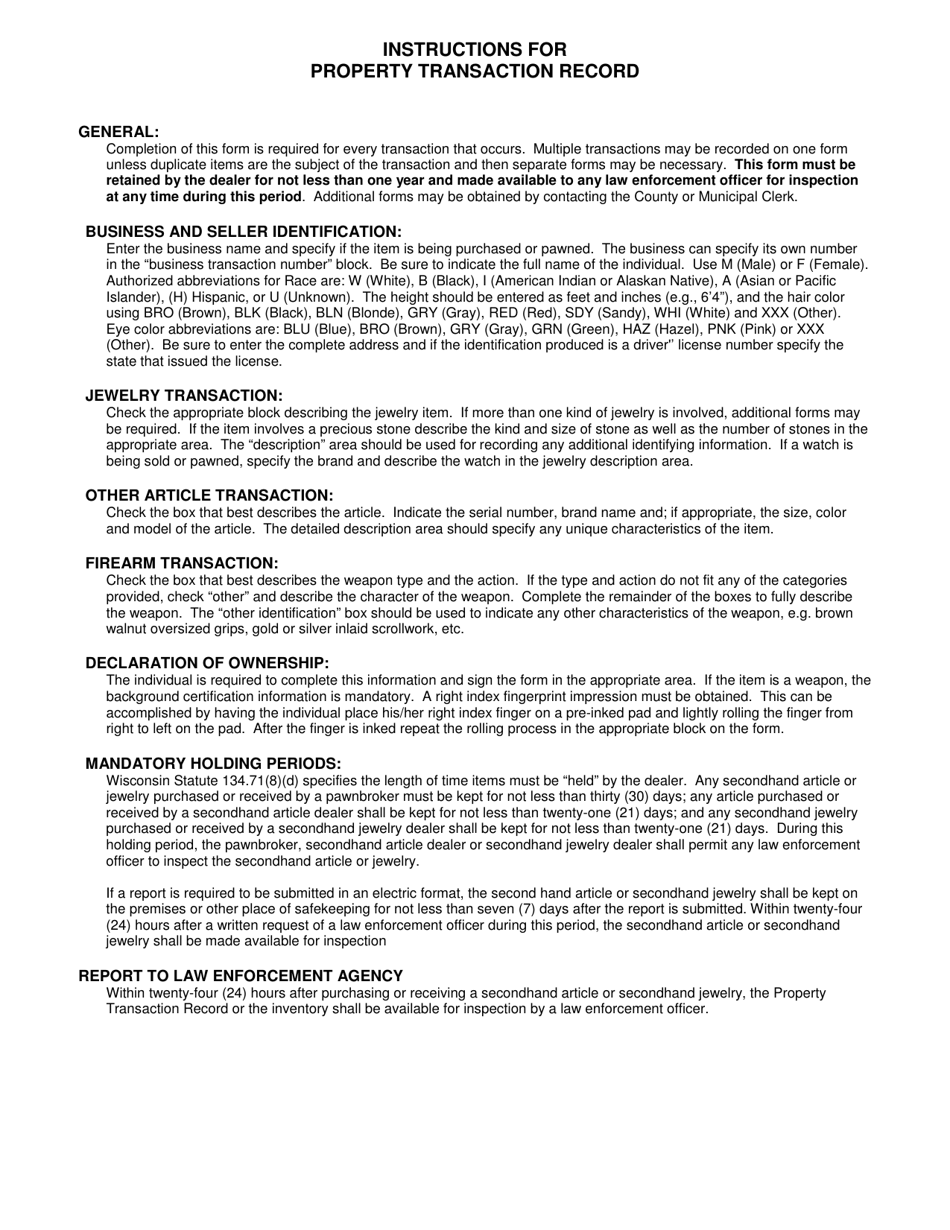

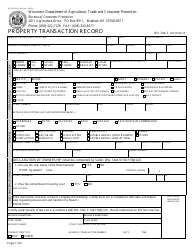

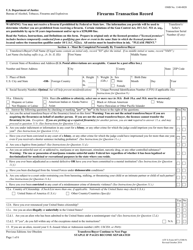

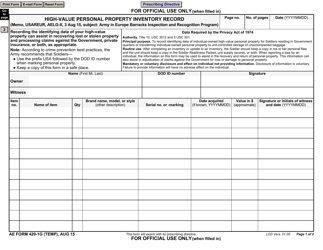

Form CP-120 Property Transaction Record - Wisconsin

What Is Form CP-120?

This is a legal form that was released by the Wisconsin Department of Agriculture, Trade and Consumer Protection - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CP-120?

A: Form CP-120 is the Property Transaction Record form used in Wisconsin.

Q: Who uses Form CP-120?

A: Form CP-120 is used by individuals and businesses involved in property transactions in Wisconsin.

Q: What is the purpose of Form CP-120?

A: Form CP-120 is used to report property transactions and provide relevant information to the Wisconsin Department of Revenue.

Q: When should Form CP-120 be filed?

A: Form CP-120 should be filed within 90 days of the property transaction.

Q: What information is required on Form CP-120?

A: Form CP-120 requires information such as property details, buyer and seller information, and transaction details.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Wisconsin Department of Agriculture, Trade and Consumer Protection;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CP-120 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Agriculture, Trade and Consumer Protection.