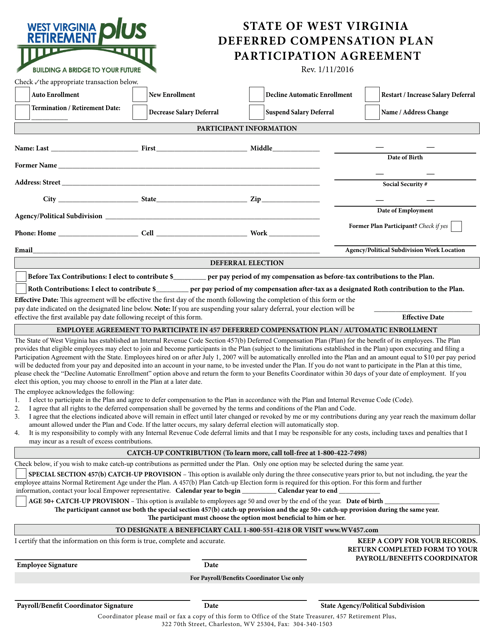

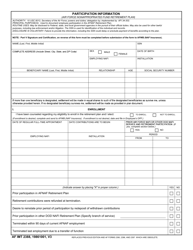

State of West Virginia Deferred Compensation Plan Participation Agreement - West Virginia

State of West Virginia Deferred Compensation Plan Participation Agreement is a legal document that was released by the West Virginia State Treasurer's Office - a government authority operating within West Virginia.

FAQ

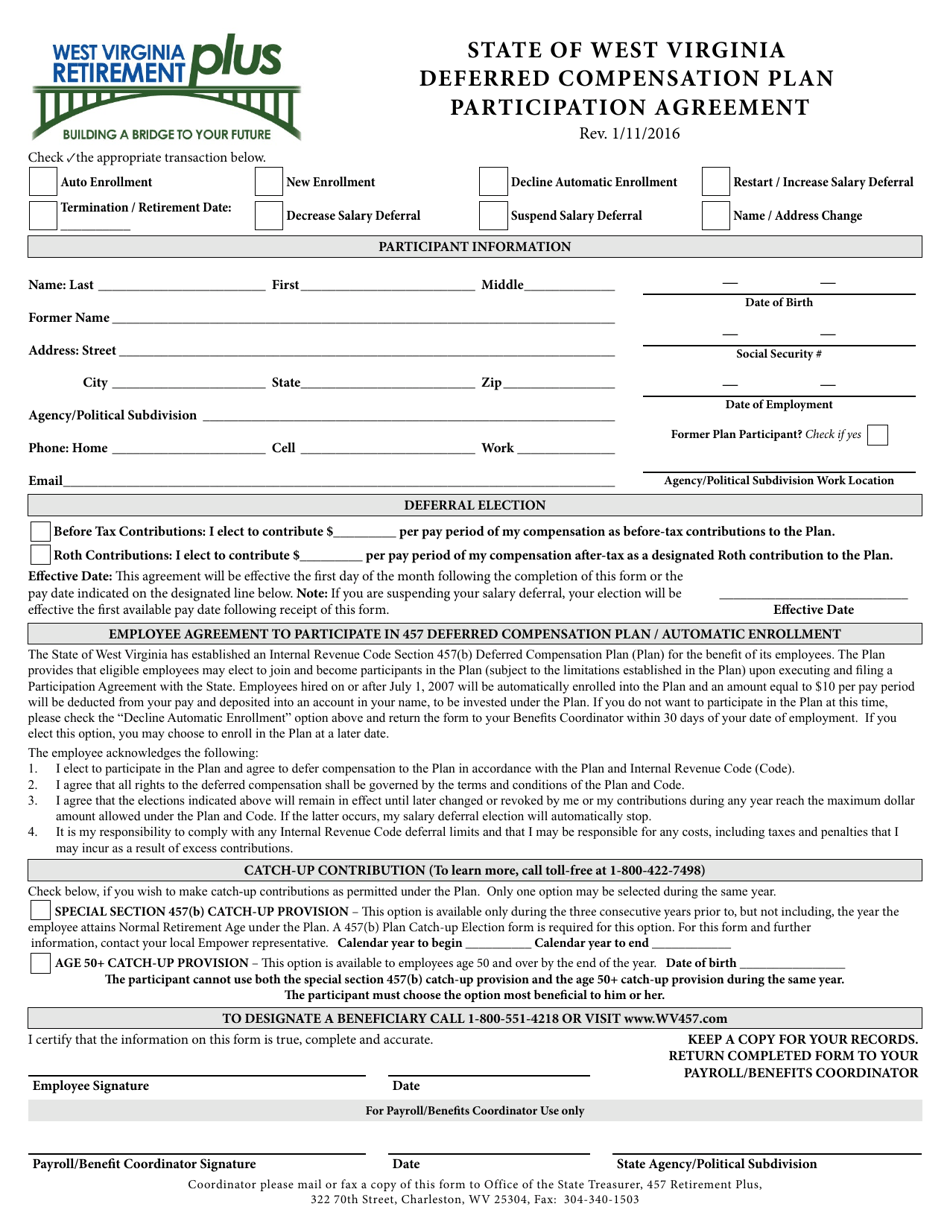

Q: What is the State of West Virginia Deferred Compensation Plan?

A: The State of West Virginia Deferred Compensation Plan is a retirement savings plan for eligible employees of the state.

Q: Who can participate in the plan?

A: Eligible employees of the State of West Virginia can participate in the plan.

Q: How does the plan work?

A: Participants can contribute a portion of their salary to the plan on a pre-tax basis, which is then invested for potential growth until retirement.

Q: What are the benefits of participating in the plan?

A: Participating in the plan allows employees to save for retirement with tax advantages and potential investment growth.

Q: How can employees enroll in the plan?

A: Employees can enroll in the plan by completing the participation agreement and submitting it to the appropriate agency.

Q: Are there any fees associated with the plan?

A: Yes, there may be administrative and investment fees associated with the plan. Details can be found in the plan's documentation.

Q: Can employees change their contribution amount?

A: Yes, employees can change their contribution amount at any time by completing a salary reduction agreement.

Q: What happens if an employee leaves the state employment?

A: If an employee leaves state employment, they may have options such as rolling over their account to another retirement plan or leaving it in the plan until retirement.

Form Details:

- Released on January 11, 2016;

- The latest edition currently provided by the West Virginia State Treasurer's Office;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia State Treasurer's Office.