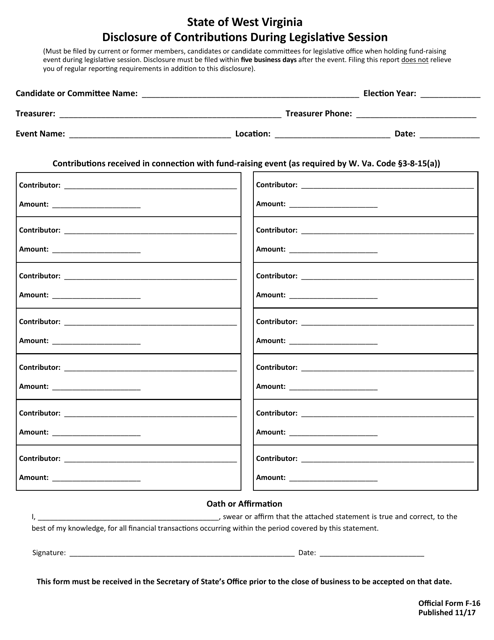

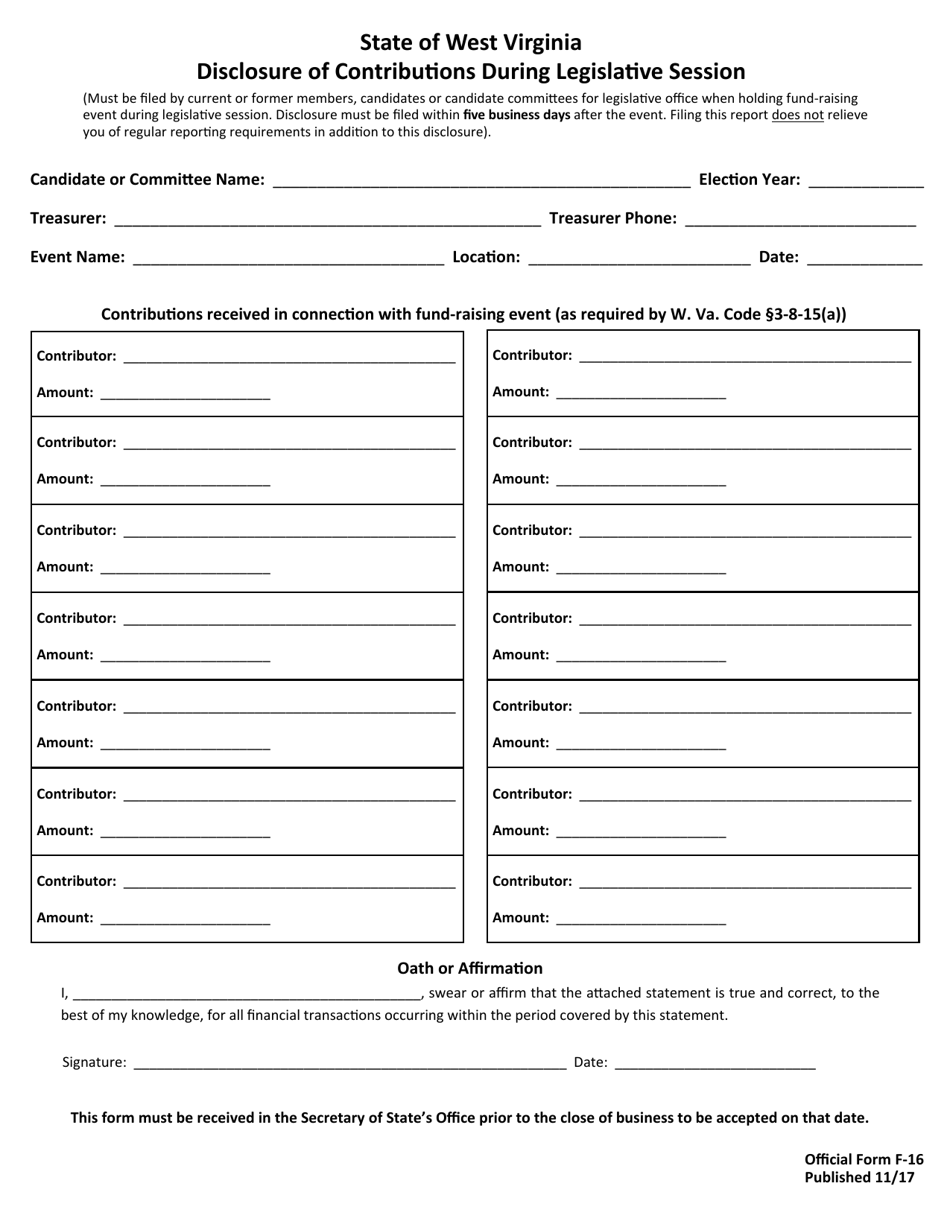

Official Form F-16 Disclosure of Contributions During Legislative Session - West Virginia

What Is Official Form F-16?

This is a legal form that was released by the West Virginia Secretary of State - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-16?

A: Form F-16 is the official disclosure form for reporting contributions made during a legislative session in West Virginia.

Q: Who is required to file Form F-16?

A: Candidates, political action committees (PACs), and other entities that make contributions during a legislative session in West Virginia are required to file Form F-16.

Q: What kind of contributions are reported on Form F-16?

A: Form F-16 is used to report contributions made during a legislative session, including monetary contributions and in-kind contributions.

Q: What is the purpose of filing Form F-16?

A: The purpose of filing Form F-16 is to provide transparency and accountability by disclosing contributions made during a legislative session in West Virginia.

Q: When is Form F-16 filed?

A: Form F-16 must be filed within 10 days after the contribution is made during a legislative session in West Virginia.

Q: Are there any penalties for not filing Form F-16?

A: Yes, failure to file Form F-16 or filing false information may result in penalties, including fines and potential criminal charges.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the West Virginia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form F-16 by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.