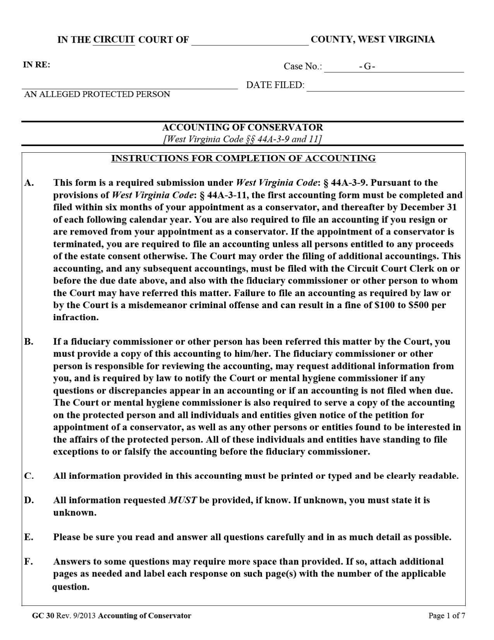

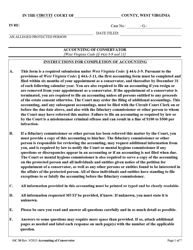

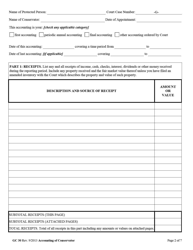

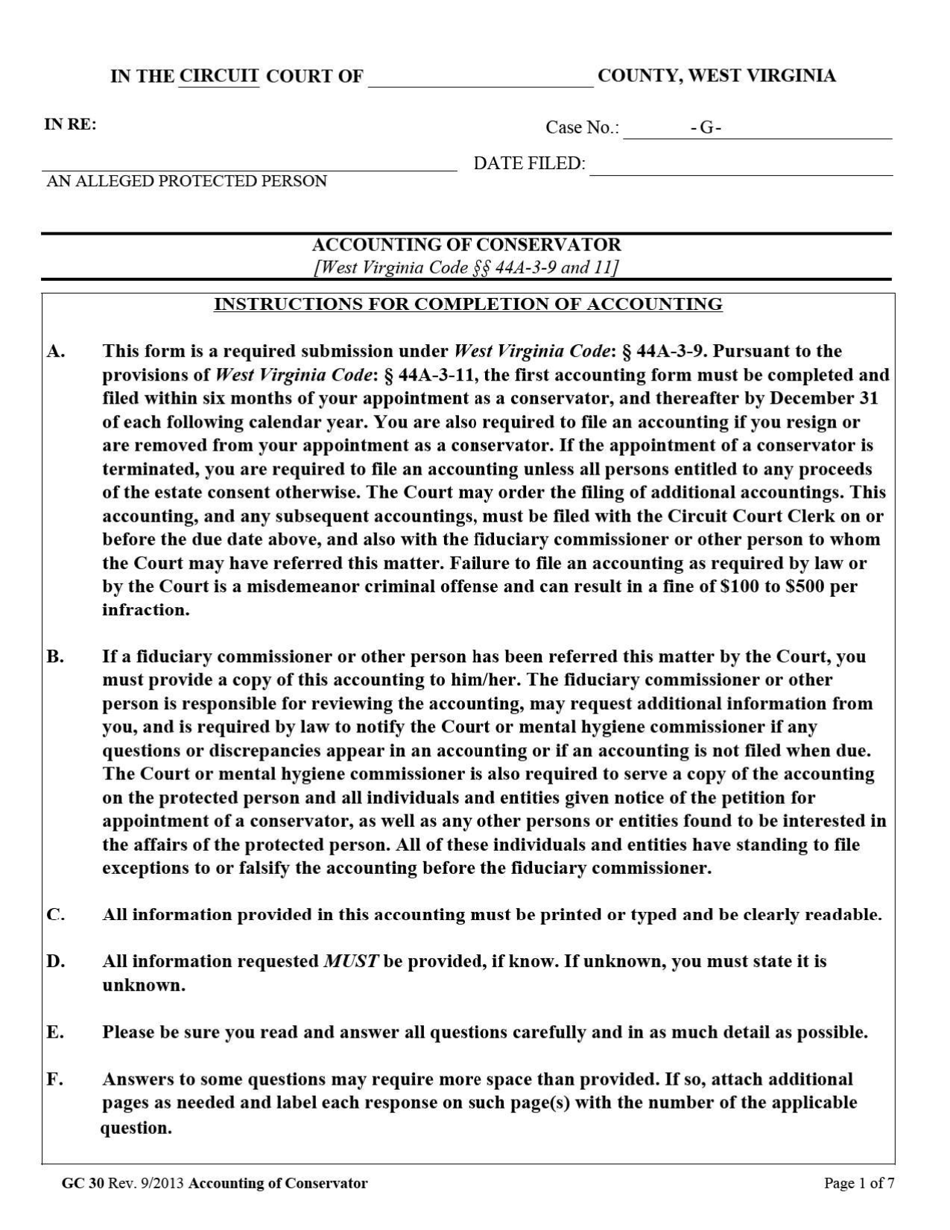

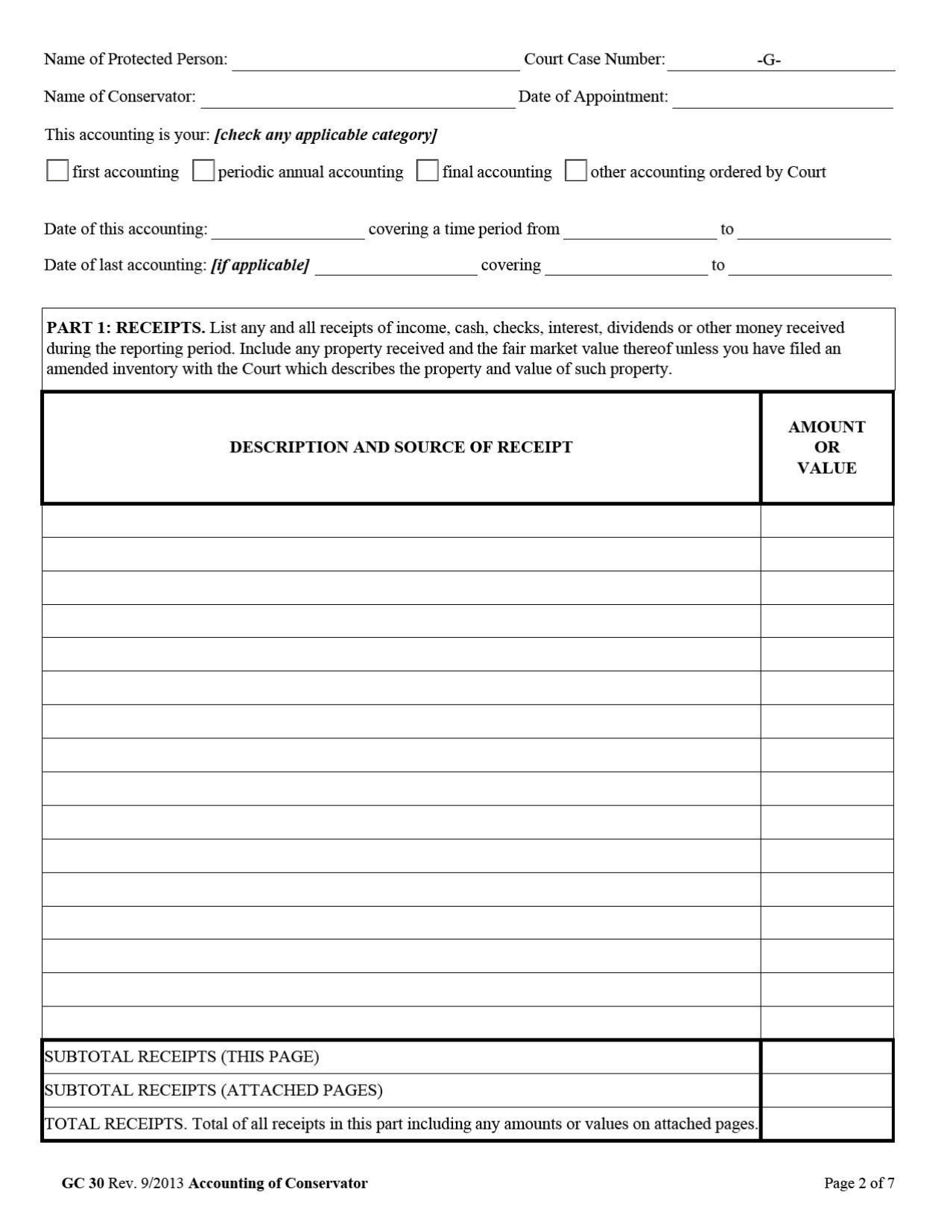

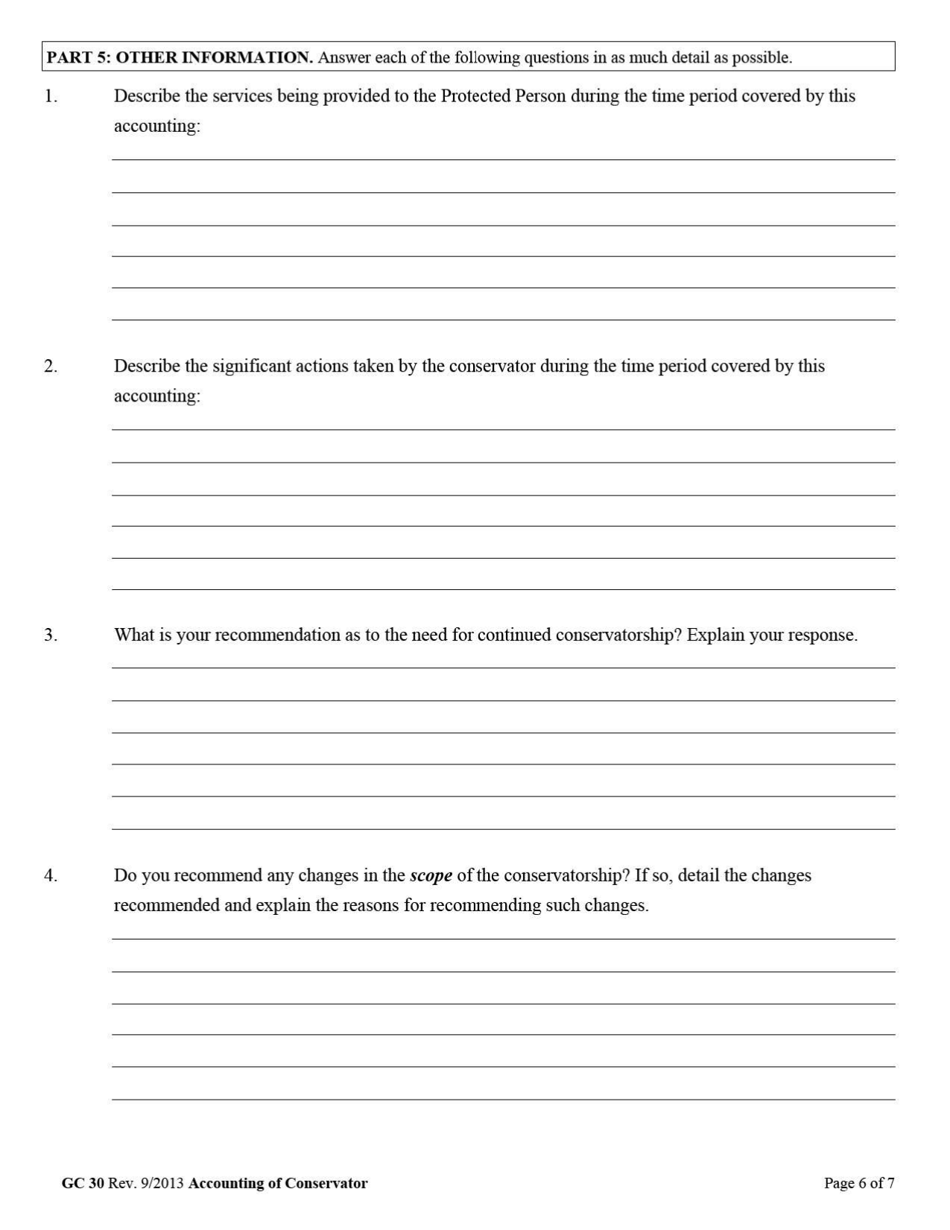

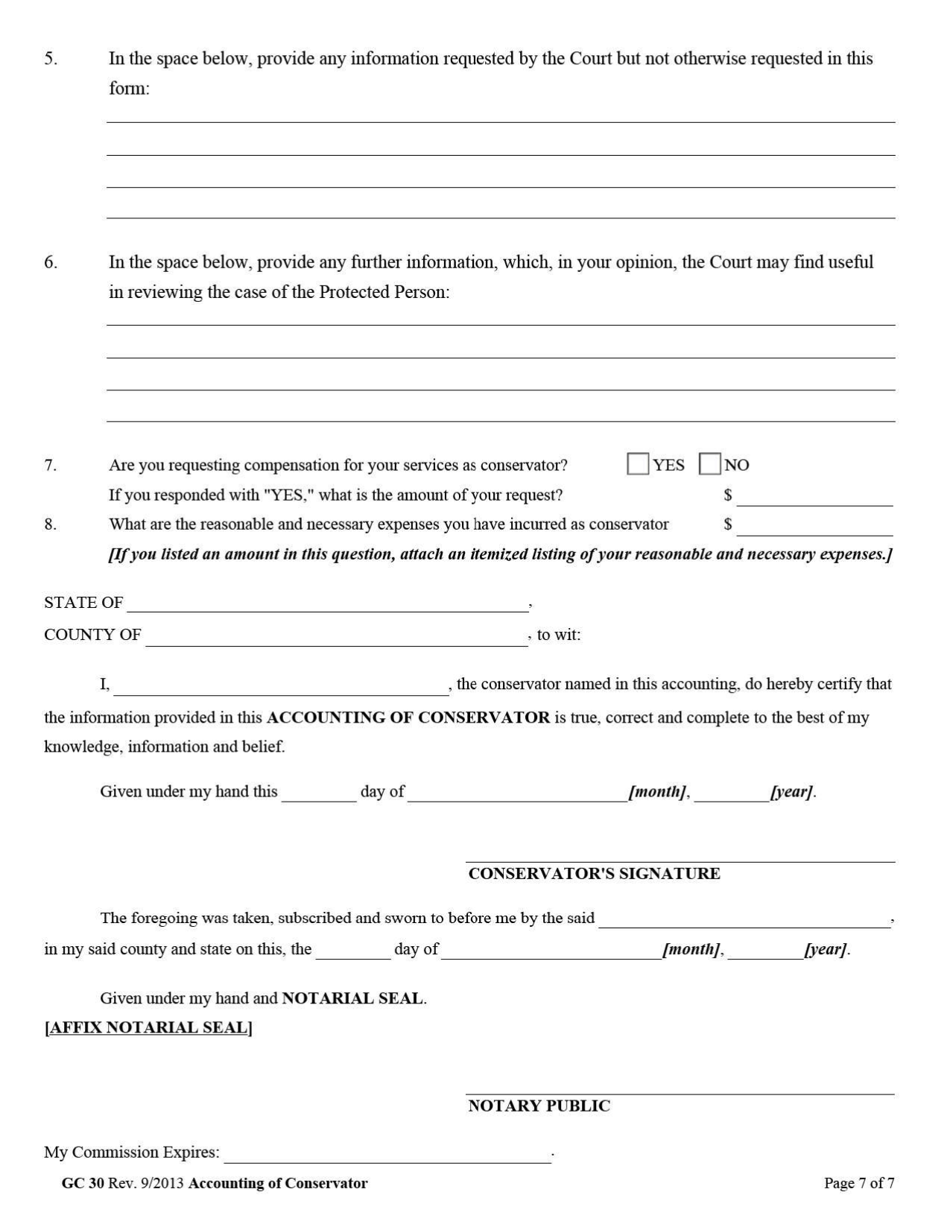

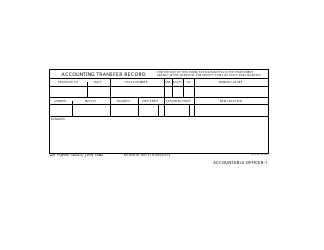

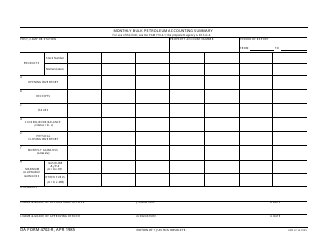

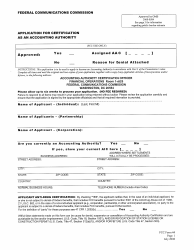

Form GC30 Accounting of Conservator - West Virginia

What Is Form GC30?

This is a legal form that was released by the West Virginia Circuit Court - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GC30?

A: Form GC30 is the Accounting of Conservator form used in West Virginia.

Q: Who needs to file Form GC30?

A: A conservator in West Virginia needs to file Form GC30.

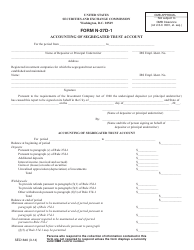

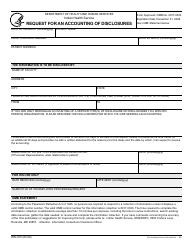

Q: What is the purpose of Form GC30?

A: Form GC30 is used to provide an accounting of the conservatorship for a minor or incapacitated adult in West Virginia.

Q: When should Form GC30 be filed?

A: Form GC30 should be filed annually, within 90 days after the end of the accounting period.

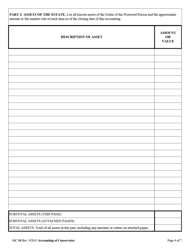

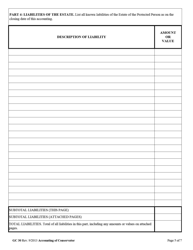

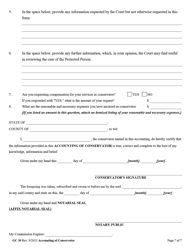

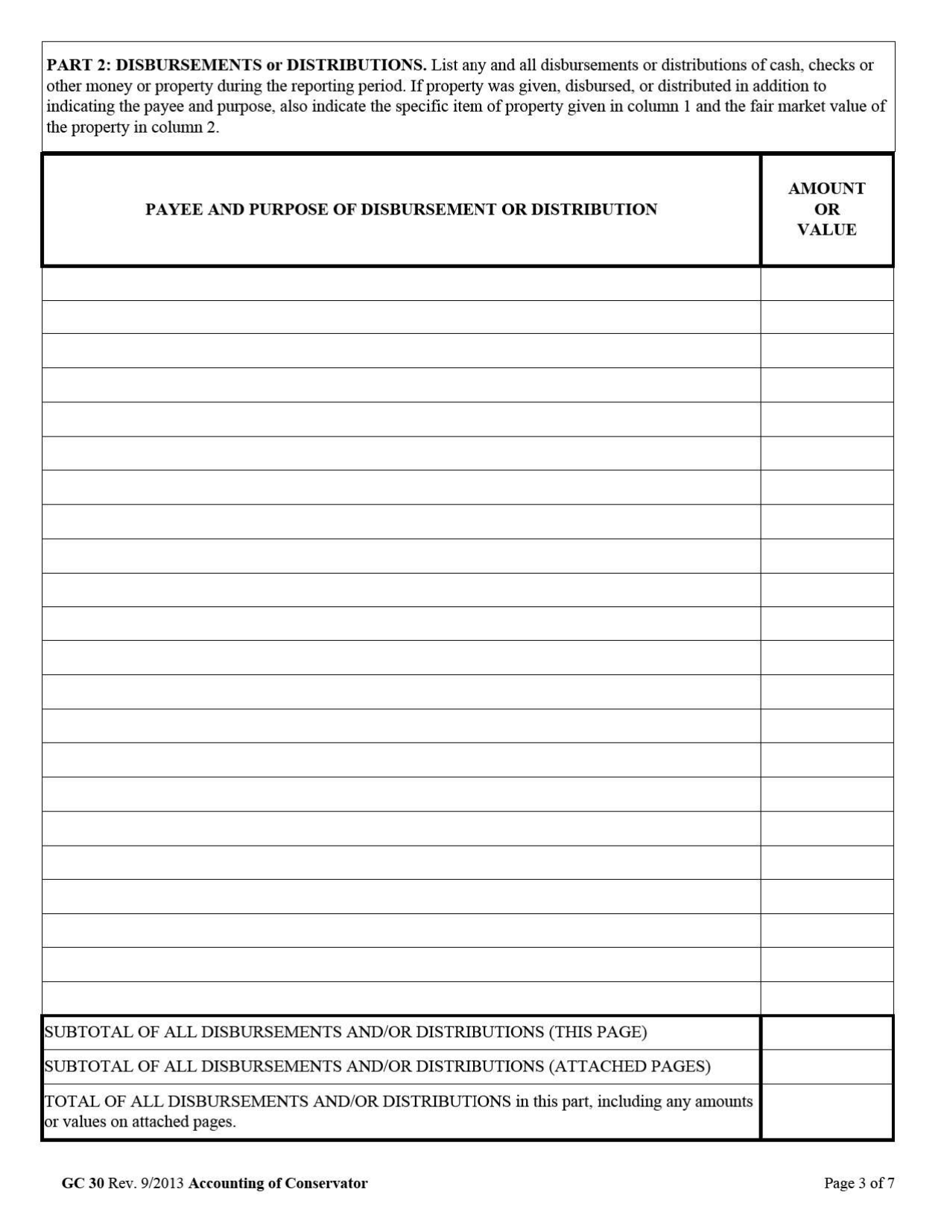

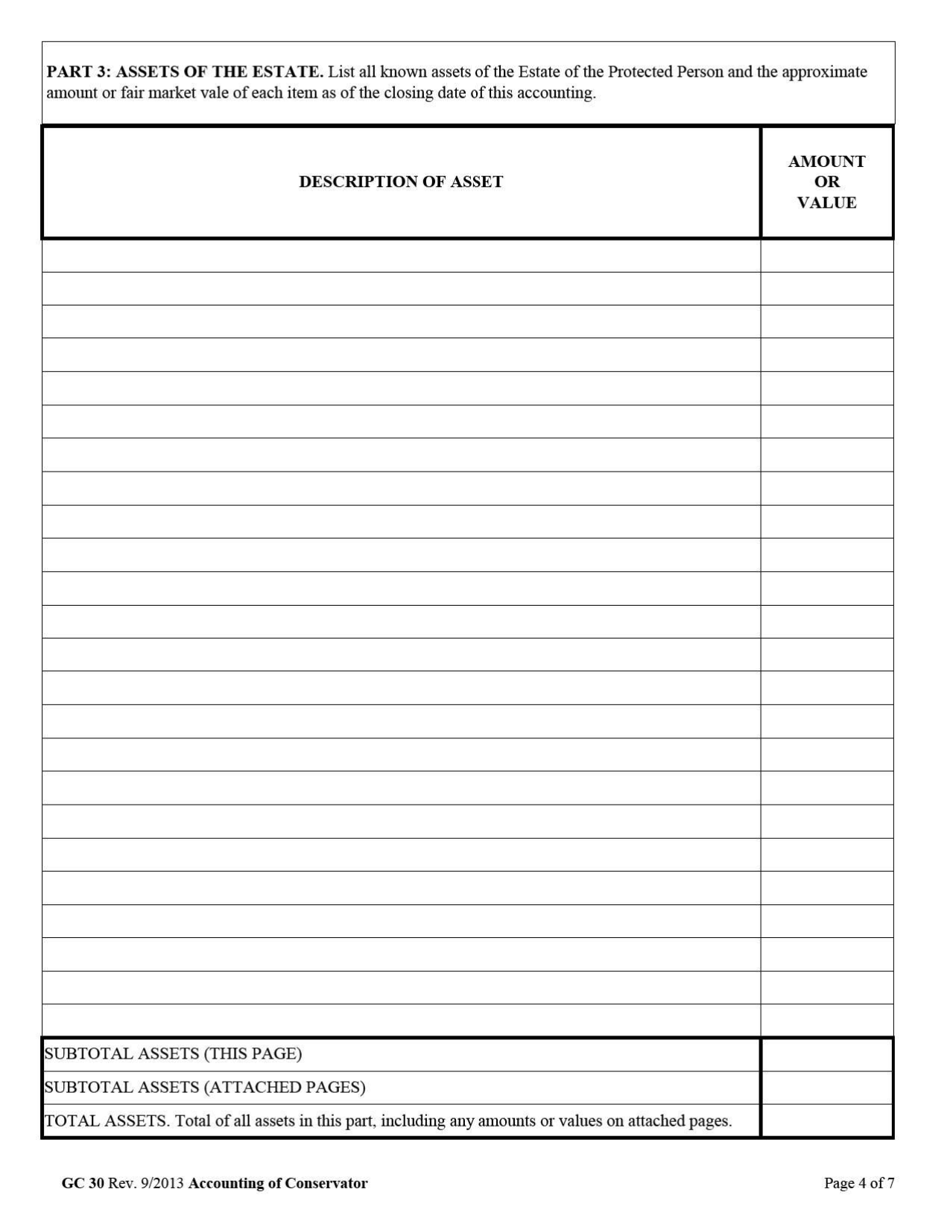

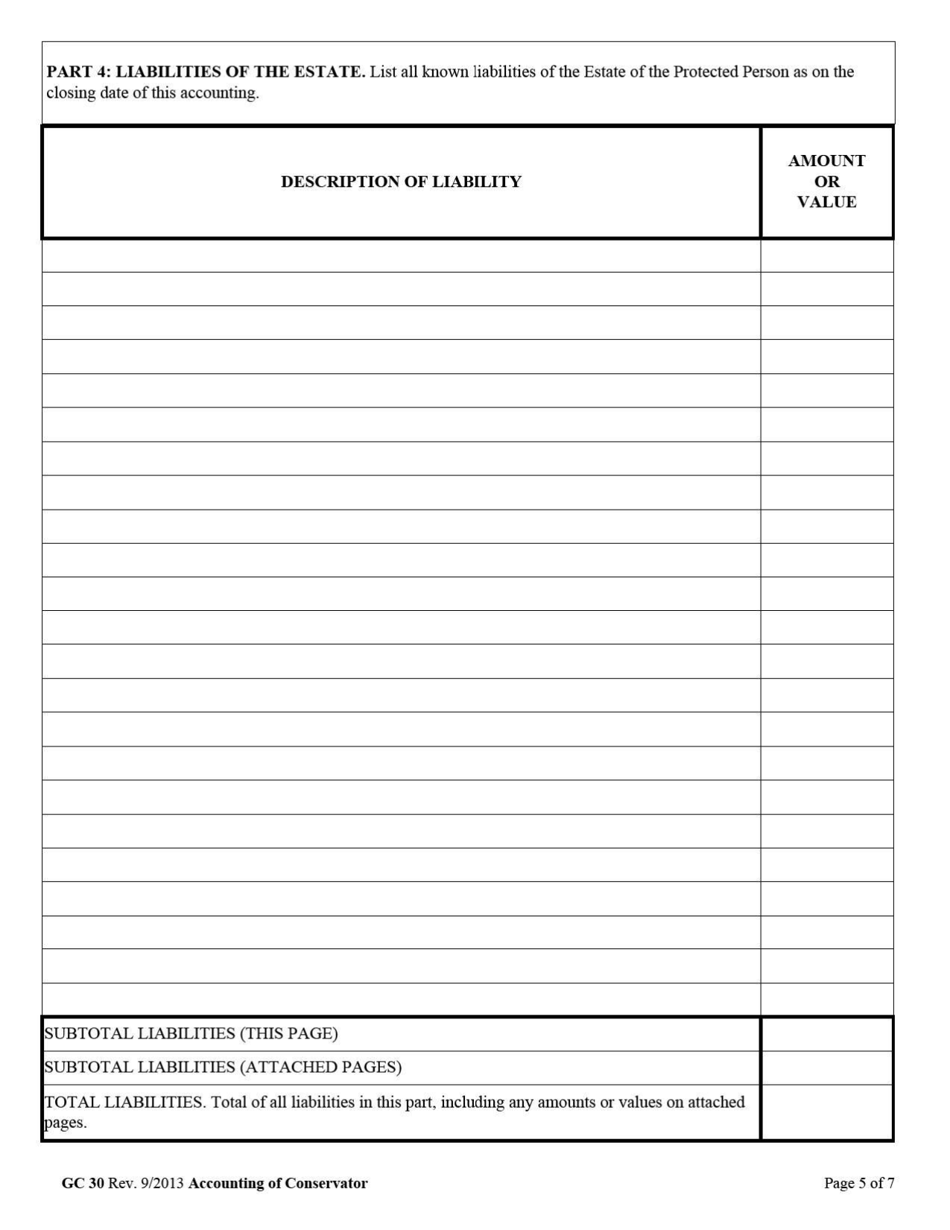

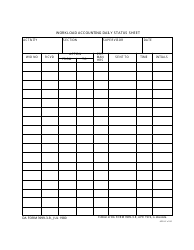

Q: What information is required on Form GC30?

A: Form GC30 requires information about the conservator, the ward, the assets and liabilities of the conservatorship, and details of all income and expenses.

Q: Are there any filing fees for Form GC30?

A: Yes, there may be filing fees associated with filing Form GC30. The fees vary by county, so it is best to check with the circuit court clerk's office.

Q: What happens after Form GC30 is filed?

A: After Form GC30 is filed, it will be reviewed by the court and a hearing may be scheduled to review the accounting.

Q: Can an attorney help with filing Form GC30?

A: Yes, it is recommended to seek the assistance of an attorney when filing Form GC30 to ensure compliance with the relevant laws and regulations.

Q: What are the consequences of not filing Form GC30?

A: Failure to file Form GC30 can result in penalties and possible removal as the conservator.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the West Virginia Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GC30 by clicking the link below or browse more documents and templates provided by the West Virginia Circuit Court.